Held-to-Maturity securities are debt securities that a company intends and can hold until they mature. They are generally purchased for the fixed income they provide over time rather than for potential gains from price fluctuations. Investing in bonds, which are the most common type of HTM securities, involves lending money to a corporate or government entity. In return, the investor receives periodic interest payments and the return of the principal amount at maturity. The income generated by bonds is predictable, making them attractive to conservative investors. HTM securities play a crucial role in diversifying an investment portfolio. They offer a steady income stream and tend to be less risky than equities, making them a suitable choice for risk-averse investors. Investors in HTM securities typically adopt a buy-and-hold strategy. This approach means they intend to hold the security until it matures, reaping the benefits of stable interest income over the life of the investment. HTM securities provide a stable interest income, which is especially attractive in times of market volatility. The income is predictable as it's based on the fixed interest rate specified when the bond is issued. HTM securities can have significant implications on a company's financial statements. They are recorded at amortized cost on the balance sheet, and the interest income is recognized in the income statement. Bonds are essentially loans from investors to the issuer, who promises to return the face value of the bond at a specified maturity date and make periodic interest payments. Corporate bonds are issued by companies aiming to raise capital for various corporate actions such as expansion, debt repayment, or capital expenditures. Corporate bonds generally offer higher interest rates compared to government bonds because they carry a higher risk of default. Government bonds are issued by federal governments or their agencies and are typically considered safer than corporate bonds due to the backing of the government. Government bonds include treasury bonds, municipal bonds, and more. Certificates of Deposit (CDs) are time deposits offered by banks with a fixed term, typically monthly, quarterly, semi-annually, or annually. CDs have a fixed interest rate and are held until they mature, at which point the original principal and the accumulated interest is returned to the investor. They are considered low-risk investments. Treasury notes and bills are short-term securities issued by the government. They typically mature in one year or less (for treasury bills) and between one to ten years (for treasury notes). These types of securities are considered low-risk due to the backing of the government. Commercial paper is a type of unsecured, short-term debt instrument issued by corporations, typically for the financing of payroll, accounts payable, inventories, and other short-term liabilities. It's generally used by large companies with high credit ratings and is considered higher risk than government-backed securities. When a company first acquires HTM securities, they are recognized at its fair value plus any directly attributable transaction costs. After initial recognition, HTM securities are measured at amortized cost using the effective interest method. Any premium or discount at purchase is amortized over the security life. If objective evidence indicates that an HTM security is impaired, a loss is recognized in the income statement. The security is de-recognized when the contractual rights to the cash flows expire or the security is transferred. Unlike HTM securities, trading securities are bought to sell them in the short term. They are accounted for at fair value, with changes in fair value recognized in the income statement. Available-for-sale (AFS) securities are non-derivative financial assets designated as available for sale or not classified as HTM or trading securities. Unlike HTM, AFS securities can be sold before maturity. Fair Value Through Profit or Loss (FVTPL) securities are financial assets held for trading or designated upon initial recognition as at FVTPL. Unlike HTM securities, they are measured at fair value with changes in fair value recognized in the income statement. From the time of purchase, the yield or return on investment is known and does not fluctuate. This is due to the fixed interest rate provided by these securities, guaranteeing investors a stable income stream until maturity. This type of reliable return is particularly beneficial for individuals or organizations with a clear forecast of their future financial needs, enabling accurate planning and budgeting. Held-to-Maturity securities are generally considered low-risk investments. Assuming the issuer does not default, the investor's principal amount—initial investment—is returned in full upon the security's maturity. The low risk associated with these securities makes them an ideal choice for conservative investors whose primary goal is capital preservation, minimizing the likelihood of losing their initial investment. In comparison to short-term investments or money market securities, Held-to-Maturity securities can offer higher yields. The longer maturity period associated with these securities often comes with higher interest rates, translating to higher overall returns for the investor. This aspect makes Held-to-Maturity securities attractive to investors looking to maximize their long-term income. Held-to-Maturity securities provide a buffer against interest rate risk—the risk that a security's value will drop due to interest rate fluctuations. Even if market interest rates rise, thus reducing the market value of the security, the investor is insulated from this volatility as they intend to hold the security until maturity. At maturity, the full principal amount is returned, regardless of interest rate movements. Diversification is a key strategy in managing investment risks, and Held-to-Maturity securities can serve this purpose effectively. As these securities are typically low-risk and offer predictable returns, they can balance higher-risk investments within a portfolio, potentially improving the risk-reward ratio. In certain jurisdictions, the interest income generated from government Held-to-Maturity securities is exempt from local or state income taxes. This tax exemption effectively increases the net return to the investor, enhancing the attractiveness of these securities. As tax laws are complex and vary by jurisdiction, it's recommended to consult with a tax advisor to understand potential tax benefits fully. Credit risk, the risk of default by the issuer of the security, is an inherent risk in any debt-based investment. If the issuer fails to fulfill their obligations, the investor can lose a part or all of their principal amount, irrespective of the security's maturity. Although government securities generally have low credit risk, corporate Held-to-Maturity securities can bear a significant amount of it, depending on the issuer's financial health. By their very nature, Held-to-Maturity securities entail a commitment to hold them until maturity. This often means sacrificing liquidity, as these securities are not typically intended for sale before maturity. If an investor finds themselves needing to sell the security prematurely, they may be unable to recover their full initial investment, especially if market interest rates have risen since the purchase. The fixed income from these securities may not pace with inflation, especially in the case of long-term securities. Should the rate of inflation outstrip the rate of return on the security, the investor's purchasing power would gradually erode over the life of the investment. This could mean that the returns from the investment may not maintain the investor's standard of living by the time the security matures. Reinvestment risk arises when an investor has to reinvest the periodic interest income from the Held-to-Maturity security at a lower rate than the yield of the original investment. This can occur when overall market interest rates decline during the holding period. Held-to-Maturity securities play a crucial role in investment portfolios, particularly for risk-averse individuals seeking stability and capital preservation. These debt securities, including bonds, certificates of deposit, and government notes, offer predictable returns and act as a safeguard against interest rate fluctuations. By adopting a buy-and-hold strategy, investors can benefit from fixed interest income until the securities mature. The advantages of HTM securities lie in their predictable returns, capital preservation, potential for higher yields, mitigation of interest rate risk, portfolio diversification, and potential tax advantages in some jurisdictions. However, it's important to consider the disadvantages associated with HTM securities, such as credit risk, limited liquidity, inflation risk, and reinvestment risk. These factors can impact the overall performance and return on investment. By understanding the characteristics and various types of HTM securities, investors can make informed decisions that align with their risk tolerance and investment objectives.What Is Held-to-Maturity (HTM) Securities?

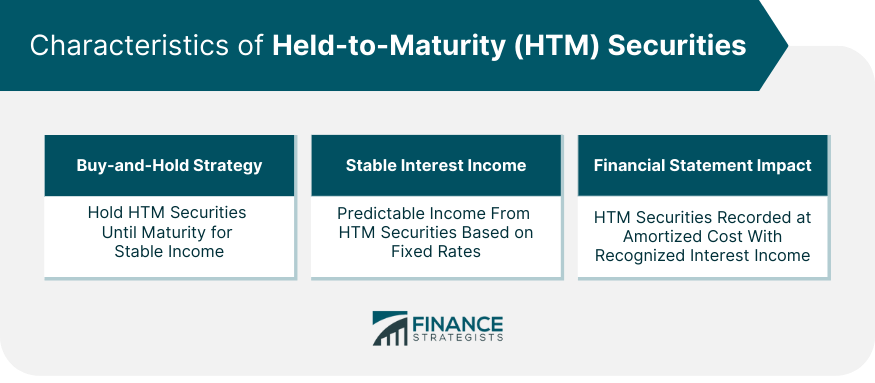

Characteristics of HTM Securities

Buy-and-Hold Strategy

Stable Interest Income

Implications on Financial Statements

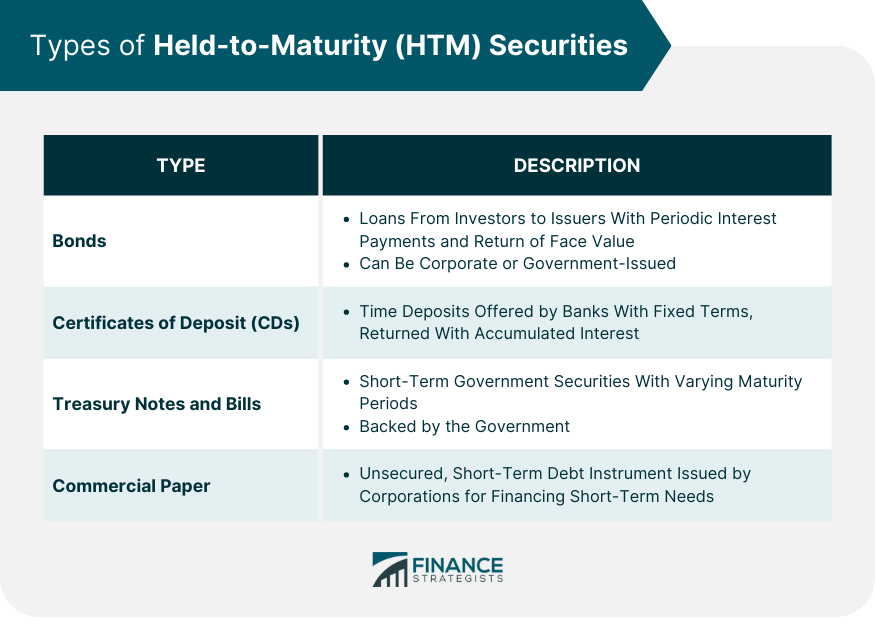

Types of Held-to-Maturity Securities

Bonds

Certificates of Deposit

Treasury Notes and Bills

Commercial Paper

Accounting for HTM Securities

Initial Recognition and Measurement

Subsequent Measurement and Amortization

Impairment and De-recognition

HTM Securities vs Other Types of Securities

Trading Securities

Available-for-Sale Securities

Fair Value Through Profit or Loss Securities

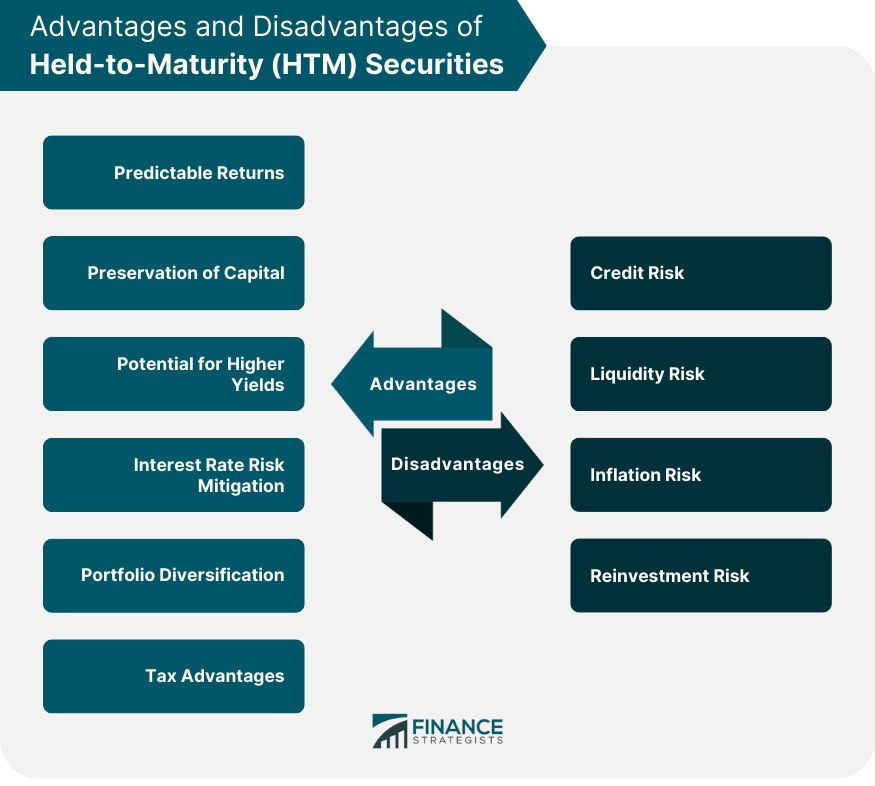

Advantages of Held-to-Maturity Securities

Predictable Returns

Preservation of Capital

Potential for Higher Yields

Interest Rate Risk Mitigation

Portfolio Diversification

Tax Advantages

Disadvantages of Held-to-Maturity Securities

Credit Risk

Liquidity Risk

Inflation Risk

Reinvestment Risk

Conclusion

Held-to-Maturity (HTM) Securities FAQs

HTM securities are debt securities, such as bonds or certificates of deposit, that a company or investor intends to hold until they mature. They are purchased for the fixed income they provide over time rather than for potential gains from price fluctuations.

Unlike trading securities or available-for-sale securities, HTM securities are not bought for short-term selling or speculative purposes. HTM securities are accounted for at amortized cost and provide stable interest income, while other types of securities may be valued at fair market value and subject to fluctuations.

Investing in HTM securities offers predictable returns and capital preservation. The fixed interest rates associated with these securities provide stable income, making them attractive to conservative investors. They also serve as a hedge against interest rate risk and can contribute to portfolio diversification.

The primary risks associated with HTM securities include credit risk, where the issuer may default, and liquidity risk, as these securities are intended to be held until maturity and may not be easily sold before that time. Additionally, inflation risk and reinvestment risk can affect the overall return on investment.

In certain jurisdictions, the interest income generated from government-held HTM securities may be exempt from local or state income taxes. However, tax laws are complex and vary by jurisdiction, so it is recommended to consult with a tax advisor to understand the specific tax benefits applicable to HTM securities in a particular region.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.