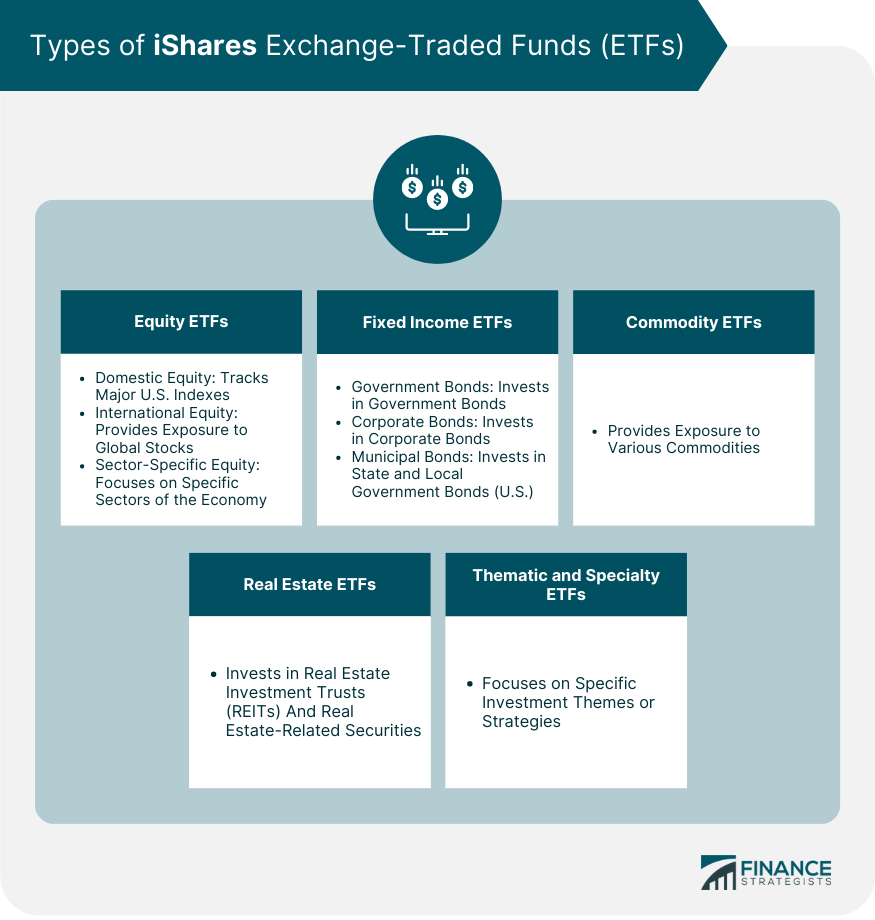

iShares is a family of exchange-traded funds (ETFs) managed by BlackRock, one of the world's largest asset managers. ETFs are investment funds traded on stock exchanges, much like individual stocks. They hold assets such as stocks, bonds, or commodities and aim to track the performance of specific indexes. iShares was launched in 2000 and has since become a global leader in the ETF industry, offering a wide range of funds to cater to various investment goals and strategies. The primary purpose of iShares ETFs is to provide investors with a simple, cost-effective way to achieve diversification in their investment portfolios. By tracking specific indexes, iShares ETFs allow investors to gain exposure to a broad range of asset classes, sectors, and geographical regions. They function much like mutual funds but offer the added benefits of being traded like stocks, providing investors with greater flexibility and liquidity. Domestic equity ETFs focus on stocks from a specific country. iShares offers a variety of domestic equity ETFs that track major U.S. indexes, such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ-100. International equity ETFs provide exposure to stocks from various countries around the world. iShares offers ETFs that track global indexes, as well as those focused on specific regions or countries, allowing investors to diversify their portfolios geographically. Sector-specific equity ETFs focus on specific sectors of the economy, such as technology, healthcare, or financials. iShares offers a range of these ETFs, enabling investors to target their investments towards sectors they believe will outperform. Government bond ETFs invest in bonds issued by governments. iShares offers ETFs that track U.S. Treasury bonds of various maturities, as well as those that invest in foreign government bonds. Corporate bond ETFs invest in bonds issued by corporations. iShares offers a variety of these ETFs, ranging from those that invest in high-quality, investment-grade bonds to those that focus on higher-yielding, lower-rated bonds. Municipal bond ETFs invest in bonds issued by state and local governments in the U.S. iShares offers several of these ETFs, which can provide tax advantages for certain investors. Commodity ETFs provide exposure to various commodities, such as gold, silver, oil, or agricultural products. iShares offers several commodity ETFs, allowing investors to hedge against inflation or take advantage of price movements in specific commodities. Real estate ETFs invest in real estate investment trusts (REITs) and other real estate-related securities. iShares offers several real estate ETFs, providing investors with a way to gain exposure to the real estate market without the need to directly own properties. Thematic and specialty ETFs focus on specific investment themes or strategies. iShares offers a range of these ETFs, including those that focus on environmental, social, and governance (ESG) criteria, clean energy, artificial intelligence, and more. Investing in iShares ETFs can be done through most online brokerage accounts. Investors can buy and sell shares of iShares ETFs just like they would with individual stocks. iShares ETFs can also be included in various retirement accounts, such as individual retirement accounts (IRAs) and 401(k) plans. This can provide a way for investors to grow their retirement savings on a tax-deferred or tax-free basis. Investors can also purchase iShares ETFs directly through BlackRock. This can be a convenient option for investors who want to manage all of their investments through a single platform. Dollar-cost averaging involves investing a fixed amount of money in a particular investment at regular intervals, regardless of the investment's price. This strategy can be an effective way to invest in iShares ETFs, as it allows investors to spread their purchases over time, potentially reducing the impact of short-term price fluctuations. One of the primary benefits of investing in iShares ETFs is the ability to achieve diversification. Because each ETF holds a broad range of securities, investors can spread their risk across many different assets, reducing the potential impact of any single investment's poor performance. iShares ETFs are known for their cost efficiency. They typically have lower expense ratios compared to mutual funds, making them an attractive option for cost-conscious investors. Additionally, because they track indexes, they often have lower turnover rates, which can result in lower transaction costs. ETFs, including those offered by iShares, are structured in a way that allows investors to manage their capital gains. The unique creation and redemption process of ETFs often results in lower capital gains distributions, making them more tax-efficient than traditional mutual funds. iShares ETFs are traded on exchanges just like individual stocks, providing investors with the ability to buy and sell shares throughout the trading day at market prices. This liquidity can be beneficial for investors who need to make quick investment decisions. iShares offers a wide range of ETFs that provide exposure to various markets, sectors, and asset classes. This allows investors to tailor their portfolios to their specific investment goals, risk tolerance, and market outlook. Market risk, also known as systematic risk, is the risk that the value of an ETF will decrease due to changes in the overall market. For example, a downturn in the economy could negatively affect all stocks, leading to a decrease in the value of equity ETFs. Liquidity risk refers to the possibility that an investor may not be able to buy or sell an ETF quickly enough due to a lack of buyers or sellers in the market. While iShares ETFs are generally highly liquid, certain niche or specialized ETFs may have lower trading volumes, which could increase liquidity risk. Currency risk is relevant for international ETFs that invest in assets denominated in foreign currencies. Changes in exchange rates can affect the value of these ETFs. For example, if the U.S. dollar strengthens against a foreign currency, an ETF holding assets in that currency could decrease in value. Interest rate risk is a significant concern for fixed-income ETFs. When interest rates rise, the prices of existing bonds fall, which can lead to a decrease in the value of bond ETFs. Conversely, when interest rates fall, bond prices rise, which can increase the value of bond ETFs. Counterparty risk, also known as credit risk, is the risk that a party involved in a transaction, such as a bank or other financial institution, will default on its contractual obligations. This risk is particularly relevant for ETFs that use derivatives or engage in securities lending. The performance of iShares ETFs is often evaluated by comparing their returns to those of their benchmark indexes. A benchmark index is a standard against which the performance of an ETF is measured. For example, an ETF that tracks the S&P 500 would use that index as its benchmark. The expense ratio of an ETF is a measure of its total costs, expressed as a percentage of its assets. It includes management fees, administrative costs, and other expenses. iShares ETFs are known for their competitive expense ratios, which can contribute to their overall performance. Tracking error is a measure of how closely an ETF follows its benchmark index. A lower tracking error indicates that the ETF is more accurately replicating the performance of its index. iShares ETFs typically have low tracking errors, reflecting their efficient management. Many iShares ETFs pay dividends to their shareholders, which can contribute to their total returns. The dividend yield of an ETF is the annual dividend payment divided by the ETF's price. Higher dividend yields can be attractive to income-focused investors. iShares incorporates Environmental, Social, and Governance (ESG) criteria into many of its ETFs. These criteria consider a company's environmental impact, social responsibility, and corporate governance practices. iShares' ESG-focused ETFs offer investors the opportunity to align their investments with their values. iShares offers a range of ESG-focused ETFs that track indexes composed of companies with strong ESG practices. These ETFs span various asset classes and sectors, allowing investors to incorporate ESG considerations into different parts of their portfolios. Impact investing seeks to generate positive social or environmental impacts alongside financial returns. iShares offers several ETFs that support impact investing, such as those focused on clean energy, gender diversity, and sustainable agriculture. iShares ETFs can be used in various asset allocation strategies, which involve dividing a portfolio among different asset classes to balance risk and return. For example, an investor might use a mix of iShares equity, bond, and commodity ETFs to achieve a desired asset allocation. Rebalancing involves adjusting the proportions of different assets in a portfolio to maintain a desired asset allocation. iShares ETFs, with their broad market exposure and liquidity, can be useful tools for rebalancing a portfolio. iShares ETFs can also play a role in risk management. For example, an investor concerned about market volatility might use iShares bond or commodity ETFs to help stabilize their portfolio. Similarly, an investor concerned about inflation might use iShares TIPS (Treasury Inflation-Protected Securities) ETFs to hedge against rising prices. iShares, managed by BlackRock, offers a diverse range of ETFs. They provide cost-effective diversification, tracking various indexes and asset classes. Equity ETFs focus on domestic and international stocks, while sector-specific ETFs target specific sectors. Fixed-income ETFs cover government, corporate, and municipal bonds. Commodity ETFs offer exposure to various commodities, and real estate ETFs invest in REITs. Thematic and specialty ETFs cater to specific investment themes. iShares ETFs provide benefits such as diversification, cost efficiency, tax efficiency, liquidity, and access to various markets. Risks include market risk, liquidity risk, currency risk, interest rate risk, and counterparty risk. Performance is evaluated through benchmark comparisons, expense ratios, tracking error, and dividend yields. iShares also incorporate ESG criteria and offers impact investing options. iShares ETFs are useful in portfolio construction for asset allocation, rebalancing, and risk management strategies.What Are iShares?

Types of iShares ETFs

Equity ETFs

Domestic Equity

International Equity

Sector-Specific Equity

Fixed Income ETFs

Government Bonds

Corporate Bonds

Municipal Bonds

Commodity ETFs

Real Estate ETFs

Thematic and Specialty ETFs

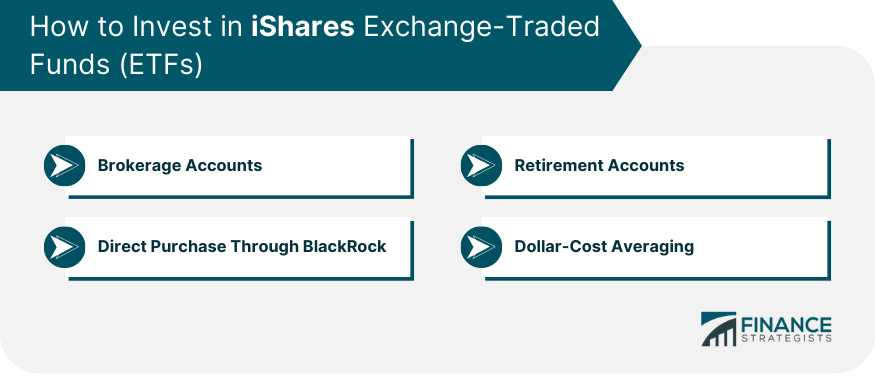

How to Invest in iShares ETFs

Brokerage Accounts

Retirement Accounts

Direct Purchase Through BlackRock

Dollar-Cost Averaging

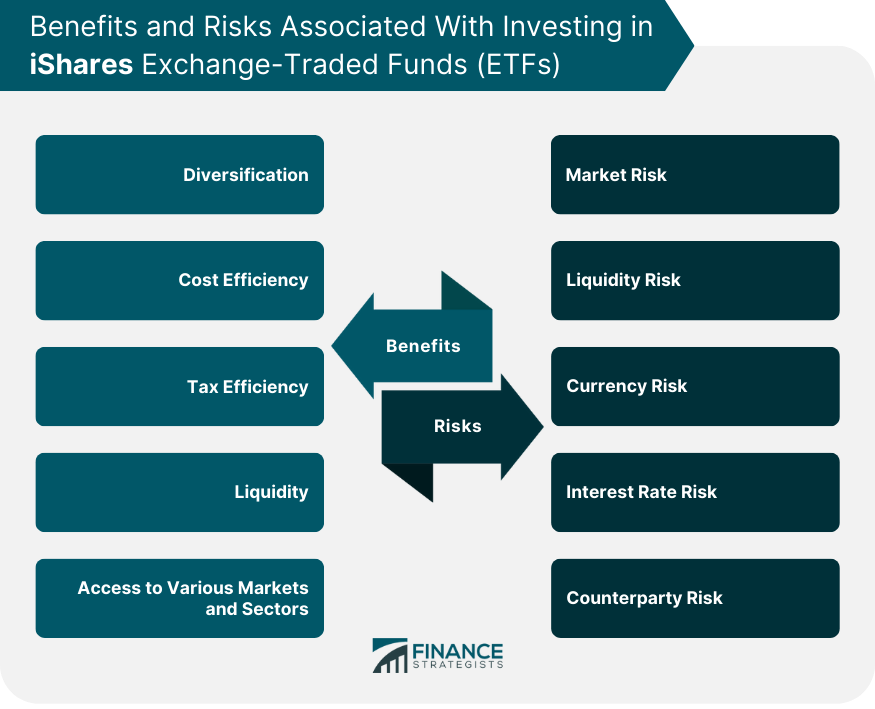

Benefits of Investing in iShares ETFs

Diversification

Cost Efficiency

Tax Efficiency

Liquidity

Access to Various Markets and Sectors

Risks Associated With iShares ETFs

Market Risk

Liquidity Risk

Currency Risk

Interest Rate Risk

Counterparty Risk

Performance and Evaluation of iShares ETFs

Benchmark Comparisons

Expense Ratios

Tracking Error

Dividend Yields

iShares and Sustainable Investing

Environmental, Social, and Governance (ESG) Criteria

iShares ESG-Focused ETFs

Impact Investing

iShares ETFs in Portfolio Construction

Asset Allocation Strategies

Rebalancing

Risk Management

Final Thoughts

iShares FAQs

iShares is a family of exchange-traded funds (ETFs) that are managed by BlackRock, one of the world's largest asset managers. These ETFs are designed to track specific indexes, providing investors with a cost-effective way to achieve diversification in their investment portfolios.

iShares offers a wide range of ETFs to cater to various investment goals and strategies. These include equity ETFs (domestic, international, and sector-specific), fixed income ETFs (government, corporate, and municipal bonds), commodity ETFs, real estate ETFs, and thematic and specialty ETFs.

Investing in iShares ETFs offers numerous benefits, including diversification, cost efficiency, tax efficiency, liquidity, and access to various markets and sectors. These benefits can enhance portfolio performance and help investors achieve their investment goals.

Like all investments, iShares ETFs come with certain risks, including market risk, liquidity risk, currency risk, interest rate risk, and counterparty risk. It's important for investors to understand these risks and consider them in the context of their overall investment strategy and risk tolerance.

You can invest in iShares ETFs through most online brokerage accounts, retirement accounts, or directly through BlackRock. It's also possible to use strategies like dollar-cost averaging to spread your investments over time and potentially reduce the impact of short-term price fluctuations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.