Life-cycle funds are diversified investment funds that change their asset allocation and risk profile based on the investor's time horizon, typically targeting a specific retirement date. The primary goal of life-cycle funds is to help investors achieve long-term financial objectives while managing risk through a gradual shift from higher-risk to lower-risk assets as they approach retirement. Life-cycle funds are best suited for investors who prefer a simple, hands-off approach to retirement planning and are comfortable with predetermined asset allocation adjustments. There are three main types of life-cycle funds: target-date funds, target-risk funds, and managed payout funds. Target-date funds are designed to reach a specific level of risk by a predetermined retirement date, with the asset allocation becoming more conservative as the target date approaches. Target-risk funds maintain a consistent level of risk throughout the investment period, with investors selecting a fund based on their desired risk tolerance. Managed payout funds aim to provide investors with a steady income stream during retirement by distributing a predetermined percentage of the fund's assets each year. Asset allocation is a key component of life-cycle funds, with a focus on equity and fixed-income investments, diversification, and glide path strategies. Life-cycle funds typically invest in a mix of equity and fixed-income investments, with the allocation shifting over time to reflect the investor's changing risk tolerance and investment horizon. Life-cycle funds achieve diversification by investing in a wide range of asset classes, which can help to reduce risk and improve long-term returns. The glide path is the predetermined asset allocation path followed by a life-cycle fund, which guides the transition from a more aggressive to a more conservative investment mix as the investor approaches retirement. Evaluating life-cycle funds involves analyzing historical performance, comparing to benchmarks, and understanding factors that affect fund performance. Investors can assess a life-cycle fund's performance by reviewing its historical returns and comparing them to those of similar funds and market indices. Benchmarks, such as broad market indices, and performance metrics, like Sharpe ratios, can help investors evaluate the risk-adjusted returns of life-cycle funds. Life-cycle fund performance can be influenced by various factors, including market conditions, asset allocation decisions, and fund management strategies. Selecting the right life-cycle fund involves assessing individual risk tolerance and goals, evaluating fund management and fees, and considering various fund selection factors. It's crucial to have a comprehensive understanding of your financial situation and investment preferences to make an informed decision. Investors should consider their risk tolerance and financial objectives when choosing a life-cycle fund, as these factors will affect the fund's asset allocation and potential returns. Understanding one's investment horizon and retirement needs will help identify a suitable fund that can adapt to these requirements over time. Fund management, including the experience and track record of the fund manager, as well as fees and expenses, can impact the performance of life-cycle funds. It's essential to research the fund manager's history and compare fees among different funds to ensure you're selecting a cost-effective and well-managed option. Additional factors to consider when selecting a life-cycle fund include the fund's investment approach, its glide path design, and its underlying holdings. Investors should examine the fund's diversification strategy, the rate at which the fund adjusts its asset allocation, and the quality of the assets in the portfolio to make a well-rounded decision. Life-cycle funds have certain limitations and risks, including market risk, manager risk, and suitability concerns. Life-cycle funds are exposed to market risk and other financial risks inherent to their underlying investments, which can lead to fluctuations in the fund's value. Life-cycle funds may be subject to manager risk, as the fund's performance depends on the skill and expertise of the fund manager, and fund company risk, which relates to the stability and solvency of the fund provider. Life-cycle funds may not be suitable for all investors, as their predetermined glide paths and asset allocations may not align with individual risk tolerances, financial goals, or unique circumstances. Life-cycle funds offer a simplified investment solution for those looking to plan for retirement. These funds provide diversification and professional management, with a focus on achieving long-term financial objectives while mitigating risk through a gradual shift in asset allocation. With various types available, including target-date, target-risk, and managed payout funds, investors have the flexibility to choose a life-cycle fund that best aligns with their goals and risk tolerance. However, it's essential to recognize that life-cycle funds may not suit everyone's unique circumstances. Investors should carefully evaluate the fund's management, fees, glide path, and underlying holdings before making a decision. Additionally, it's crucial to consider other investment strategies to create a well-rounded financial plan. Life-cycle funds can play a vital role in retirement planning, but investors must remain mindful of potential limitations and risks, including market fluctuations, manager performance, and suitability concerns. By understanding the nuances of life-cycle funds and incorporating them wisely into a broader investment strategy, individuals can increase their chances of achieving a secure and comfortable retirement.What Are Life-Cycle Funds?

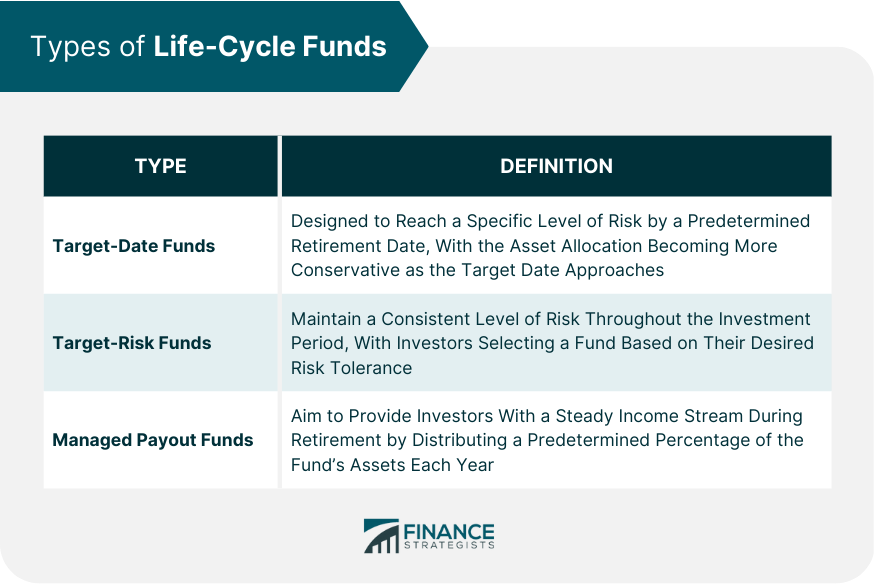

Types of Life-Cycle Funds

Target-Date Funds

Target-Risk Funds

Managed Payout Funds

Asset Allocation in Life-Cycle Funds

Equity and Fixed-Income Investments

Diversification and Risk Management

Glide Path Strategies

Performance and Evaluation of Life-Cycle Funds

Historical Performance Analysis

Benchmarks and Performance Metrics

Factors Affecting Fund Performance

Choosing a Life-Cycle Fund

Assessing Individual Risk Tolerance and Goals

Evaluating Fund Management and Fees

Fund Selection Considerations

Limitations and Risks of Life-Cycle Funds

Market Risk and Other Financial Risks

Manager Risk and Fund Company Risk

Suitability and Individualization Concerns

Bottom Line

Life-Cycle Funds FAQs

Life-cycle funds, also known as target-date funds, are a type of mutual fund that adjusts its asset allocation based on an investor's target retirement date.

Life-cycle funds start with a more aggressive asset allocation when an investor is younger and shift towards a more conservative allocation as they approach retirement age.

Life-cycle funds provide diversification, professional management, and automatic rebalancing. They are also convenient for those who want a set-it-and-forget-it investment approach.

Life-cycle funds may not be suitable for all investors since the asset allocation may not align with their specific risk tolerance or retirement goals. The fees associated with these funds may also be higher than other types of investments.

It's essential to evaluate the fund's expense ratio, asset allocation, and management style. Consider your retirement goals, risk tolerance, and investment timeline when selecting a life-cycle fund that aligns with your needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.