Lifestyle funds are diversified investment funds that automatically adjust their asset allocation based on an investor's risk tolerance and investment horizon. These funds typically invest in a mix of stocks, bonds, and other securities, providing a one-stop solution for investors. Lifestyle funds aim to simplify the investment process for individuals who may lack the time or expertise to manage their own portfolios. They offer a convenient way to achieve diversification and risk management, allowing investors to focus on other aspects of their financial planning. The popularity of lifestyle funds has grown significantly over the years due to their ease of use and potential for delivering long-term growth. Many investors have embraced these funds as a way to reduce the complexity of their investment decisions and achieve a more balanced portfolio. Lifestyle funds can be grouped into three categories based on their risk profile. This section will discuss conservative, moderate, and aggressive lifestyle funds. Conservative lifestyle funds primarily focus on capital preservation and income generation. These funds typically allocate a higher proportion of their assets to bonds and other fixed-income securities, making them suitable for risk-averse investors or those nearing retirement. Moderate lifestyle funds strike a balance between growth and capital preservation, with a more even allocation between stocks and bonds. This type of fund may appeal to investors with a medium risk tolerance and a longer investment horizon. Aggressive lifestyle funds prioritize capital appreciation and long-term growth, with a higher allocation to stocks and other growth-oriented investments. These funds are best suited for investors with a higher risk tolerance and a longer time horizon for their investments. Lifestyle funds utilize different asset allocation strategies to achieve their investment objectives. This section will discuss fixed, dynamic, and tactical asset allocation. Fixed asset allocation involves maintaining a consistent investment mix over time, regardless of market conditions. This strategy can provide a stable, long-term framework for investors, but may not adapt to changing economic environments. Dynamic asset allocation adjusts the investment mix in response to market conditions, allowing the fund to capitalize on growth opportunities or protect against downside risk. This strategy can help improve returns and manage risk but may require more active management. Tactical asset allocation involves short-term, opportunistic adjustments to the investment mix based on market trends or specific opportunities. This strategy can enhance returns, but may also introduce additional risk and require more frequent monitoring. Evaluating the performance and risk management of lifestyle funds is crucial for investors. This section will discuss historical performance, risk evaluation, and diversification benefits. Analyzing historical performance can provide insight into how lifestyle funds have performed in different market conditions. While past performance is not indicative of future results, it can help investors understand the potential risks and rewards associated with these funds. Assessing the risk profile of a lifestyle fund is essential for aligning investment objectives with individual risk tolerance. Factors to consider include the fund's asset allocation, historical volatility, and the quality of the underlying investments. Lifestyle funds can offer diversification benefits by spreading investments across various asset classes and sectors. This can help reduce overall portfolio risk and increase the potential for more consistent returns over time. Choosing the right lifestyle fund and investment options are important steps in the investment process. This section will discuss how to select a suitable lifestyle fund, the available investment options, and the fees and expenses associated with these funds. Selecting the appropriate lifestyle fund involves assessing your risk tolerance, investment horizon, and financial goals. It is important to carefully research and compare different funds to ensure they align with your personal investment objectives. There are several ways to invest in lifestyle funds, including direct investment and through financial advisors. Direct investment may be more cost-effective, while financial advisors can provide personalized guidance and additional support for investors. Understanding the fees and expenses associated with lifestyle funds is essential for making informed investment decisions. These may include management fees, sales charges, and ongoing expenses, all of which can impact the overall performance of the fund. Lifestyle funds can be compared to other investment options such as target-date funds, traditional mutual funds, and exchange-traded funds (ETFs). This section will explore these comparisons. Target-date funds adjust their asset allocation over time based on a specific retirement date, while lifestyle funds focus on an investor's risk tolerance. Both options offer diversification and simplicity, but target-date funds may be more suitable for investors with a defined retirement timeline. Traditional mutual funds offer a wide range of investment strategies and styles but often require more active portfolio management. Lifestyle funds provide a more streamlined approach, which may be more appealing for investors seeking a simpler investment solution. ETFs offer intraday trading and lower expense ratios compared to lifestyle funds. However, lifestyle funds provide a more hands-off approach to investing and may be better suited for investors looking for a comprehensive, long-term investment solution. Despite their popularity, lifestyle funds face certain challenges and criticisms. This section will discuss limitations in risk management, inefficiencies in asset allocation, and potential conflicts of interest. Lifestyle funds may not fully address an individual investor's specific risk tolerance or changing circumstances, as they are based on broad categories. Investors should consider their unique needs and preferences when selecting a lifestyle fund. Some critics argue that lifestyle funds can be less efficient in their asset allocation compared to more actively managed investments. This may result in missed opportunities or underperformance in certain market conditions. Conflicts of interest can arise when fund managers have financial incentives to include specific investments within a lifestyle fund. This could lead to suboptimal investment decisions and negatively impact the overall performance of the fund. The future of lifestyle funds will be shaped by trends in the investment industry, technological advancements, and potential changes in fund offerings. This section will explore these factors. The investment industry continues to evolve, with a growing focus on personalized investment solutions, sustainable investing, and digital innovations. These trends may lead to the development of new lifestyle fund offerings and enhancements to existing products. Technological advancements, such as artificial intelligence and big data analytics, are transforming the investment landscape. These innovations may improve the efficiency of asset allocation strategies and risk management in lifestyle funds, providing enhanced investment solutions for investors. As the investment industry continues to evolve, lifestyle funds may adapt to meet changing investor needs and preferences. This could include the introduction of new fund categories, more personalized investment options, or additional features such as environmental, social, and governance (ESG) considerations. Lifestyle funds provide a simplified investment solution for investors seeking diversification and risk management without the need for active portfolio management. These funds offer a range of risk profiles and asset allocation strategies, making them an attractive option for investors with varying goals and risk tolerances. Lifestyle funds play a significant role in personal finance, as they can help investors achieve long-term financial goals and maintain a well-balanced portfolio. By selecting the appropriate lifestyle fund, investors can benefit from professional management and diversification, allowing them to focus on other aspects of their financial planning. Investing in lifestyle funds can be a convenient and effective way to manage a diverse investment portfolio. However, it is important to carefully research and evaluate different funds to ensure they align with individual investment objectives, risk tolerance, and financial goals. As the investment industry and technology continue to evolve, lifestyle funds may offer even more tailored and efficient investment solutions in the future.What Are Lifestyle Funds?

Types of Lifestyle Funds

Conservative Lifestyle Funds

Moderate Lifestyle Funds

Aggressive Lifestyle Funds

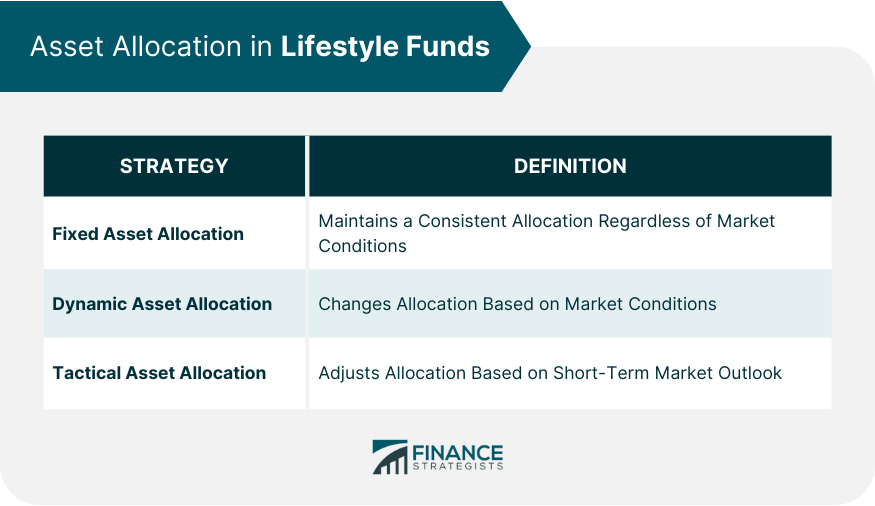

Asset Allocation Strategies in Lifestyle Funds

Fixed Asset Allocation

Dynamic Asset Allocation

Tactical Asset Allocation

Performance and Risk Management of Lifestyle Funds

Historical Performance of Lifestyle Funds

Evaluating Risk in Lifestyle Funds

Diversification Benefits

Selecting and Investing in Lifestyle Funds

Choosing the Right Lifestyle Fund for Your Needs

Investment Options

Fees and Expenses in Lifestyle Funds

Comparing Lifestyle Funds to Other Investment Options

Lifestyle Funds vs Target-Date Funds

Lifestyle Funds vs Traditional Mutual Funds

Lifestyle Funds vs Exchange-Traded Funds

Challenges and Criticisms of Lifestyle Funds

Limitations in Risk Management

Inefficiencies in Asset Allocation

Potential Conflicts of Interest

Future of Lifestyle Funds

Trends in the Investment Industry

Technological Advancements

Potential Changes in Lifestyle Fund Offerings

Conclusion

Lifestyle Funds FAQs

Lifestyle funds are a type of mutual fund that automatically adjusts the asset allocation mix based on a target date or retirement age, offering a diversified investment portfolio that aligns with an investor's risk tolerance and investment goals.

Lifestyle funds work by automatically adjusting the asset allocation mix, shifting from more aggressive investments to more conservative ones as the target date approaches. The idea is to provide investors with a portfolio that becomes less risky as they get closer to their target retirement date.

Lifestyle funds provide investors with a diversified portfolio that adjusts automatically over time, reducing the need for constant monitoring and rebalancing. They also help to mitigate risk by gradually shifting to more conservative investments as the target date approaches.

Lifestyle funds are suitable for investors with long-term investment goals, such as retirement savings. However, investors should carefully consider their investment objectives, risk tolerance, and time horizon before investing in lifestyle funds.

One potential drawback of lifestyle funds is the lack of customization. Investors cannot adjust the asset allocation mix beyond what is offered by the fund. Additionally, lifestyle funds may have higher expense ratios compared to other types of mutual funds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.