Mid-cap funds are mutual funds that invest in companies with a market capitalization between $2 billion and $10 billion. These companies are typically larger than small-cap companies but smaller than large-cap companies. Mid-cap funds offer investors exposure to companies that have growth potential and are not as widely covered as large-cap companies. They are often considered to be a sweet spot between growth and value investing. One of the key benefits of mid-cap funds is their potential for higher returns compared to large-cap funds. While large-cap companies are typically more stable and have lower growth potential, mid-cap companies are often in a stage of rapid growth, which can lead to higher returns over the long term. Additionally, mid-cap funds can provide diversification benefits by investing in a broad range of companies across different sectors. Some examples of mid-cap funds include the Vanguard Mid-Cap Index Fund, the T. Rowe Price Mid-Cap Growth Fund, and the iShares Russell Mid-Cap ETF. One of the primary advantages of investing in mid-cap funds is their potential for high growth. Mid-cap companies are often in a stage of rapid growth, which can lead to higher returns over the long term. As these companies continue to grow and mature, their share prices can rise, resulting in higher returns for investors. Additionally, mid-cap companies may be more nimble and able to adapt to changes in the market, allowing them to capitalize on new opportunities and generate higher returns. Another advantage of investing in mid-cap funds is their diversification benefits. Mid-cap funds typically invest in a broad range of companies across different sectors, which can help reduce the risk of losses due to market fluctuations. By investing in a diversified portfolio of mid-cap stocks, investors can potentially generate higher returns while also minimizing their overall risk. Many mid-cap companies are not as widely covered as large-cap companies, which can create opportunities for investors. While large-cap companies may be well-known and already fully valued by the market, mid-cap companies may have higher growth potential and be undervalued by the market. By investing in mid-cap funds, investors can gain exposure to lesser-known companies that have high growth potential and may be overlooked by other investors. While small-cap funds offer high growth potential, they are also associated with higher risk. Small-cap companies are often in the early stages of growth and may be more vulnerable to economic downturns and market fluctuations. Mid-cap companies, on the other hand, are often more established and have a track record of success, which can help mitigate some of the risk associated with investing in smaller companies. One of the primary risks associated with investing in mid-cap funds is market volatility. Mid-cap companies can be more sensitive to market fluctuations than large-cap companies, which can lead to higher levels of volatility. During periods of market downturns or economic uncertainty, mid-cap funds may experience greater losses than large-cap funds. Another risk associated with mid-cap funds is liquidity risk. Mid-cap stocks may not be as widely traded as large-cap stocks, which can make it more difficult for investors to buy and sell shares quickly. This lack of liquidity can result in wider bid-ask spreads, which can increase transaction costs for investors. In extreme market conditions, investors may find it challenging to sell their shares of mid-cap funds at fair market value, potentially resulting in losses. Mid-cap funds typically have higher fees than large-cap funds due to the additional research required to identify undervalued mid-cap companies. While higher fees can be justified if the fund is delivering higher returns, it is essential for investors to carefully evaluate the fees associated with a mid-cap fund before investing. The fund manager's expertise is one of the most critical factors to consider when choosing a mid-cap fund. The fund manager's knowledge of the market, investment strategy, and management style can significantly impact the fund's performance. It is essential to research the fund manager's track record and experience before investing. Another critical factor to consider is the fund's investment strategy. Mid-cap funds can have different investment strategies, such as growth-oriented or value-oriented. It is essential to evaluate the fund's investment strategy and determine if it aligns with your investment goals and risk tolerance. The fund's historical performance is an essential consideration when choosing a mid-cap fund. It is important to evaluate the fund's performance over multiple market cycles to determine if it has consistently delivered strong returns. The fund's expense ratio is an important consideration when evaluating mid-cap funds. The expense ratio includes the fees associated with managing the fund, including the fund manager's salary and research costs. It is essential to compare the expense ratios of different mid-cap funds to ensure you are investing in a fund with reasonable fees. The fund's risk profile is another critical factor to consider when choosing a mid-cap fund. It is important to evaluate the fund's risk profile and determine if it aligns with your risk tolerance. Some mid-cap funds may be riskier than others due to their investment strategy or sector focus. Mid-cap funds can provide investors with exposure to companies with high growth potential while also offering diversification benefits. However, they also come with risks, including market volatility, liquidity risk, and higher fees. When choosing a mid-cap fund, it is essential to consider factors such as the fund manager's expertise, investment strategy, historical performance, expense ratio, and risk profile. By carefully evaluating these factors, investors can make informed decisions and potentially generate higher returns over the long term. In conclusion, mid-cap funds can be an excellent addition to a diversified investment portfolio. They offer exposure to companies with high growth potential while also providing diversification benefits. However, it is crucial to carefully evaluate the risks and benefits of investing in mid-cap funds and consider factors such as the fund manager's expertise, investment strategy, historical performance, expense ratio, and risk profile. By doing so, investors can make informed decisions and potentially achieve higher returns over the long term.Definition of Mid-Cap Funds

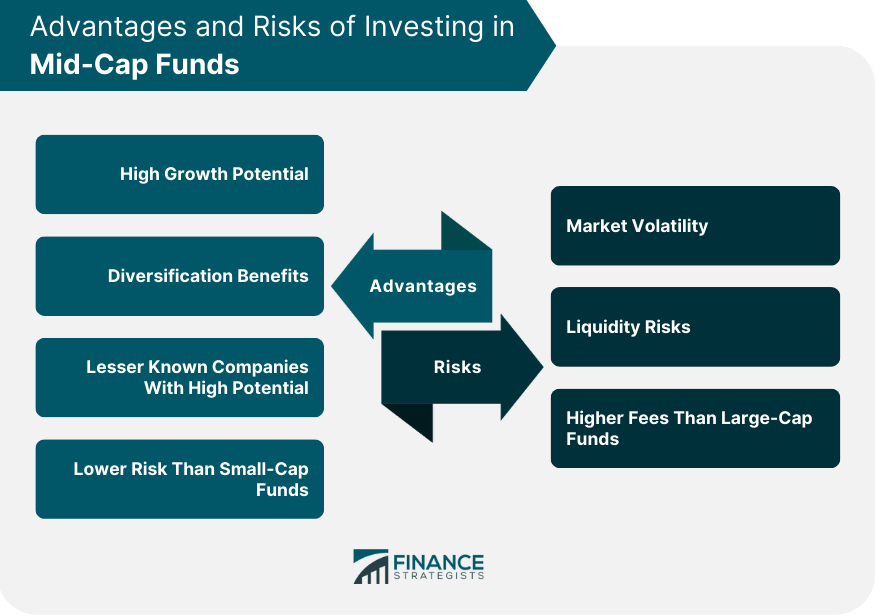

Advantages of Investing in Mid-Cap Funds

High Growth Potential

Diversification Benefits

Lesser Known Companies With High Potential

Lower Risk Than Small-Cap Funds

Risks of Investing in Mid-Cap Funds

Market Volatility

Liquidity Risks

Higher Fees Than Large-Cap Funds

Factors to Consider When Choosing Mid-Cap Funds

Fund Manager's Expertise

Fund's Investment Strategy

Fund's Historical Performance

However, it is crucial to note that past performance does not guarantee future results.Fund's Expense Ratio

Fund's Risk Profile

Conclusion

Mid-Cap Funds FAQs

Mid-cap funds are mutual funds that invest in companies with market capitalizations between $2 billion to $10 billion.

Mid-cap funds have the potential for higher returns than large-cap funds, and are less risky than small-cap funds.

Mid-cap funds are subject to market volatility and economic downturns. Additionally, mid-cap companies may be less established and have less financial stability than large-cap companies.

Look for a fund with a proven track record of consistent returns, low expense ratios, and experienced fund managers.

Yes, many 401(k) plans offer mid-cap funds as an investment option. Check with your plan administrator to see if this option is available to you.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.