The expense ratio refers to the percentage of an investment's assets that are used to cover the ongoing expenses related to the management and administration of that investment. These expenses typically include management fees, administrative costs, and various other operating expenses that are deducted from the investment's returns. Expense ratios are crucial in making informed investment decisions, as they can significantly impact the overall performance of an investment. A lower expense ratio generally means that more of an investor's money is being put to work, potentially leading to higher returns over time. There are several types of expense ratios, including gross expense ratio, net expense ratio, and total expense ratio. Each of these ratios provides different insights into the costs associated with managing an investment. The gross expense ratio represents the total expenses of an investment, including management fees, administrative expenses, and other operating costs, as a percentage of its average net assets. The net expense ratio is the actual percentage of an investment's assets that are used to cover its ongoing expenses after accounting for fee waivers, reimbursements, or other adjustments made by the investment manager. The total expense ratio takes into account all costs associated with an investment, including transaction costs, taxes, and other charges that may not be included in the gross or net expense ratios. Management fees are the fees paid to the investment manager or advisor for their services in managing the investment portfolio. These fees are usually based on a percentage of the assets under management and are one of the main components of an expense ratio. Administrative expenses cover the costs related to the day-to-day operations of an investment, such as recordkeeping, legal, and accounting services. These expenses vary depending on the size and complexity of the investment. Distribution and service fees, also known as 12b-1 fees, are fees charged by some funds for marketing and distribution purposes. These fees are intended to cover the costs of promoting the fund, attracting new investors, and maintaining existing investors. Other operating expenses may include various costs not covered by the categories mentioned above, such as custodial fees, auditing fees, and registration fees. Mutual funds pool money from multiple investors to invest in a diverse range of assets. Each mutual fund has an expense ratio, which can vary depending on the fund's management style, size, and asset class. Exchange-Traded Funds (ETFs) are investment funds that trade on stock exchanges, much like individual stocks. They generally have lower expense ratios than mutual funds, primarily due to their passive management style and lower administrative costs. Index funds are a type of mutual fund or ETF that aims to replicate the performance of a specific market index. They usually have lower expense ratios than actively managed funds, as they require less management and research resources. Separately Managed Accounts (SMAs) are personalized investment portfolios managed by professional investment managers on behalf of individual investors. The expense ratios for SMAs can vary greatly depending on the level of customization and the investment manager's fees. Expense ratios directly impact an investment's returns by reducing the amount of money available for investment growth. A higher expense ratio means that more of an investor's money is being used to cover expenses, potentially leading to lower returns over time. The impact of expense ratios on investment performance becomes more pronounced over time due to the compounding effect. As investment grows, the costs associated with a higher expense ratio also grow, further reducing the potential for higher returns. Over the long term, even a seemingly small difference in expense ratios can have a significant impact on an investor's overall returns. For long-term investors, it is crucial to consider expense ratios when evaluating investment options. Lower expense ratios can lead to higher returns over time, which can make a substantial difference in the growth of an investment portfolio. When comparing expense ratios, it is essential to compare similar investment vehicles, such as funds within the same asset class or with similar investment strategies. This allows for a more accurate evaluation of whether a particular expense ratio is competitive within its specific market segment. While a lower expense ratio can contribute to higher returns, it is also essential to consider other factors that influence an investment's performance. For example, a fund with a higher expense ratio may deliver superior returns due to better management or investment strategy. It is important to analyze expense ratios in the context of the overall investment performance. A higher expense ratio may be justified if it corresponds to higher-quality management or services provided by the investment manager. Investors should consider whether the management team has a strong track record and whether the additional fees are likely to result in better investment outcomes. Passive investment strategies, such as index funds and ETFs, generally have lower expense ratios than actively managed funds. Investors seeking to minimize expense ratios may choose to allocate a larger portion of their portfolio to passive investments. Investors can minimize expense ratios by selecting low-cost investment vehicles, such as low-cost index funds, mutual funds, or ETFs with competitive expense ratios within their respective categories. Tax-efficient investing strategies, such as investing in tax-advantaged accounts or selecting tax-efficient investment vehicles, can help minimize the overall costs associated with an investment, including the impact of expense ratios. Investors should periodically review and reassess their investment holdings to ensure that they are still benefiting from competitive expense ratios and that the investment continues to align with their financial goals. A comprehensive understanding of expense ratios is crucial for making informed investment decisions. By considering the impact of expense ratios on investment performance, investors can better evaluate and compare different investment options. While minimizing expense ratios is an essential aspect of investment success, it is also crucial to consider other factors such as investment strategy, management quality, and overall performance. By balancing these considerations, investors can make more informed decisions and optimize their investment portfolios for long-term success.Definition of Expense Ratio

Importance of Expense Ratio in Investment Decisions

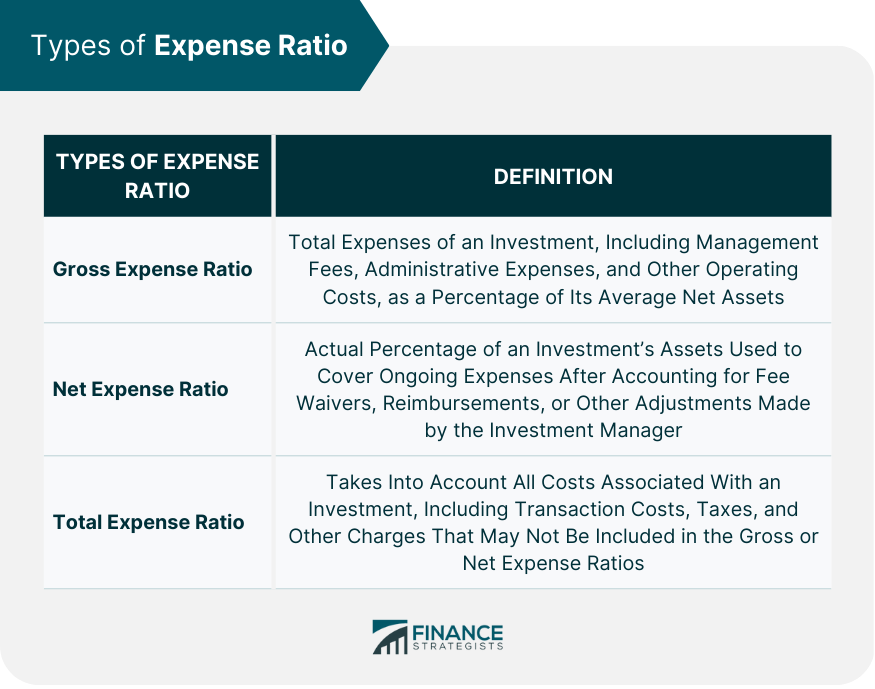

Types of Expense Ratios

Gross Expense Ratio

Net Expense Ratio

Total Expense Ratio

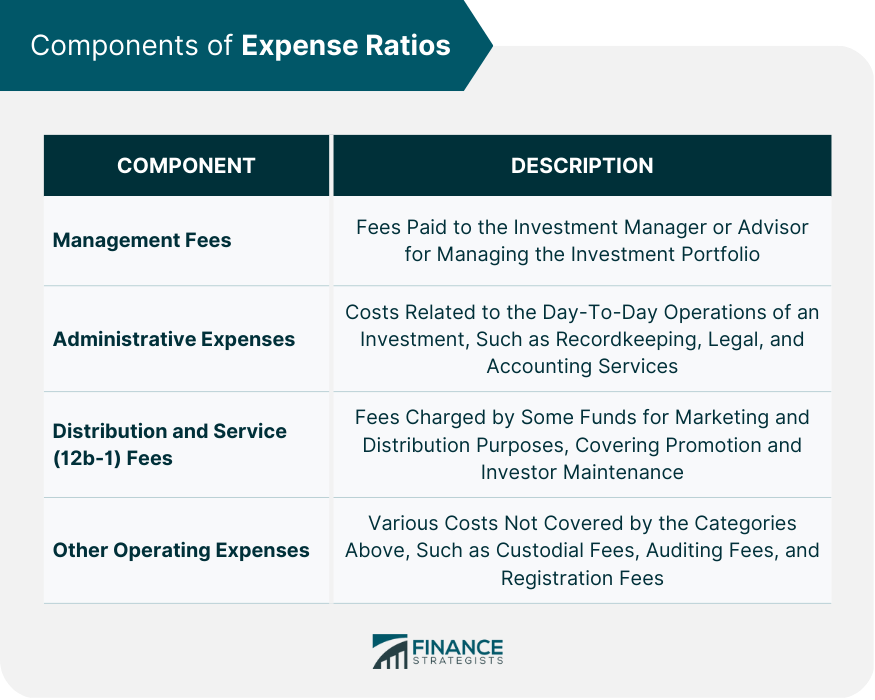

Components of Expense Ratios

Management Fees

Administrative Expenses

Distribution and Service (12b-1) Fees

Other Operating Expenses

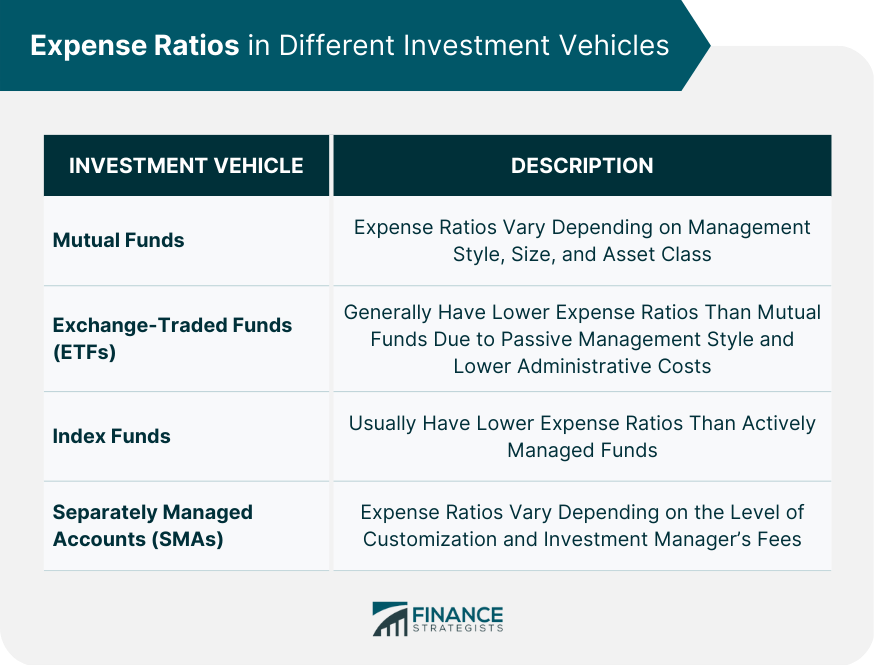

Expense Ratios in Different Investment Vehicles

Mutual Funds

Exchange-Traded Funds (ETFs)

Index Funds

Separately Managed Accounts (SMAs)

Impact of Expense Ratios on Investment Performance

How Expense Ratios Affect Returns

Compounding Effect of Expense Ratios

Importance of Considering Expense Ratios in Long-Term Investing

How to Compare and Evaluate Expense Ratios

Benchmarking Against Similar Investment Vehicles

Analyzing Expense Ratios in Relation to Fund Performance

Evaluating the Quality of Management and Services Provided

Strategies for Minimizing Expense Ratios

Passive vs Active Investment Strategies

Choosing Low-Cost Investment Vehicles

Utilizing Tax-Efficient Strategies

Regularly Reviewing and Reassessing Investment Holdings

Conclusion

Expense Ratio FAQs

An expense ratio is the percentage of an investment's assets used to cover ongoing expenses related to managing and administering the investment. It is important for investors because it directly impacts the investment's returns, with lower expense ratios generally leading to higher returns over time.

Expense ratios impact the performance of mutual funds and ETFs by reducing the amount of money available for investment growth. Funds with lower expense ratios typically have more of the investors' money working towards growth, which can lead to higher returns, especially in the long run.

A higher expense ratio may be justified if it corresponds to higher-quality management or services provided by the investment manager. Investors should evaluate the management team's track record and consider whether the additional fees are likely to result in better investment outcomes.

Some strategies for minimizing expense ratios include adopting passive investment strategies, choosing low-cost investment vehicles like index funds and ETFs, utilizing tax-efficient strategies, and regularly reviewing and reassessing investment holdings to ensure competitive expense ratios.

Investors can compare and evaluate expense ratios by benchmarking against similar investment vehicles, analyzing expense ratios in relation to fund performance, and evaluating the quality of management and services provided. This allows for a more accurate assessment of whether a particular expense ratio is competitive and suitable for the investor's financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.