A front-end load is a sales charge or commission an investor pays when purchasing shares of a mutual fund, annuity, or other investment product. It is typically assessed as a percentage of the investment amount and is deducted from the initial investment, thus reducing the actual amount invested in the fund. The main purpose of front-end loads is to compensate financial advisors, brokers, or other intermediaries for their services in recommending and selling investment products. The fee also helps cover the expenses of marketing and distributing the investment product to investors. Front-end loads are most commonly associated with mutual funds but may also apply to other investment products such as annuities, insurance policies, and certain types of bonds. As discussed earlier, a front-end load is a sales charge paid upfront when an investor purchases shares of a mutual fund or other investment product. A back-end load, also known as a contingent deferred sales charge (CDSC), is a sales charge that an investor pays when selling shares of a mutual fund or other investment product. The fee typically decreases over time, eventually reaching zero after a specified holding period. Level load funds charge an ongoing fee, usually a fixed percentage of the investment value, over the life of the investment. This fee covers management, marketing, and distribution expenses and is paid to the financial advisor or broker. No-load funds do not charge any sales commissions or loads. Instead, the fund's operating expenses are covered by the ongoing management fees. Each type of sales charge has its advantages and disadvantages. Front-end loads may be advantageous for long-term investors, while back-end loads may be more suitable for those with shorter investment horizons. Level loads provide a more predictable fee structure, while no-load funds may have lower overall expenses. Front-end loads are generally assessed as a percentage of the investment amount. For example, a 5% front-end load on a $10,000 investment would result in a $500 sales charge, with the remaining $9,500 being invested in the fund. Some mutual funds offer volume discounts, known as breakpoints, on front-end loads. Breakpoints are based on the total amount invested or the length of time the investor commits to holding the investment. The front-end load percentage decreases as the investment amount or holding period increases. Consider a mutual fund with a 5% front-end load and breakpoints at $25,000 and $50,000. An investor purchasing $10,000 of the fund would pay a 5% sales charge. If the investor purchases $30,000, the front-end load might be reduced to 4%; if the investor purchases $60,000, the front-end load might be reduced to 3%. Front-end loads can significantly impact investment returns, particularly for smaller investments and shorter holding periods. The initial sales charge reduces the amount of money available to generate returns, and the effect is magnified for larger front-end loads and shorter investment horizons. Front-end loads help align the interests of financial advisors and brokers with those of the investor. By compensating the advisor upfront, the investor receives personalized advice and assistance in selecting appropriate investments Front-end load funds may have lower ongoing management fees than other types of funds since the front-end load covers some of the fund's marketing and distribution expenses. This can result in lower overall expenses for long-term investors. Investors who hold front-end load funds for an extended period may benefit from reduced trading costs compared to more frequent no-load or lower-cost funds trading. Long-term investors may find that lower trading costs offset the upfront sales charge over time. The main disadvantage of front-end loads is that they reduce the initial investment amount, which can limit the growth potential of the investment. For smaller investments and shorter holding periods, the impact of the front-end load may be more pronounced. Because front-end load funds charge a sales commission upfront, investors who sell their shares shortly after purchasing them may need more time for the investment to grow and offset the initial sales charge. This can result in a lower return on investment than other funds. Front-end loads may create conflicts of interest between investors and financial professionals. Financial advisors and brokers might be incentivized to recommend funds with higher front-end loads, even if they are not the best option for the investor. When evaluating front-end load investments, investors should consider their investment objectives, risk tolerance, and time horizon. Investors with longer time horizons and willing to pay an upfront sales charge may find front-end load funds suitable. Investors should compare the fees and expenses associated with front-end load funds to those of other investment options, including no-load funds, ETFs, and index funds. Lower fees and expenses can lead to higher overall returns. Investors should evaluate the historical performance of front-end load funds, taking into account the impact of the front-end load on investment returns. Comparing the performance of front-end load funds to similar funds with different fee structures can help investors make informed decisions. The quality of the fund manager can play a significant role in the fund's performance. When evaluating front-end load funds, investors should consider the manager's experience, track record, and investment philosophy. The Securities and Exchange Commission (SEC) regulates mutual funds, including those with front-end loads, to protect investors and ensure transparency in fees and expenses. Financial Industry Regulatory Authority (FINRA) provides guidelines and rules for the sale of mutual funds, including front-end load funds, to ensure fair and transparent practices in the financial industry. Mutual fund companies are required to provide investors with a prospectus and annual shareholder reports that disclose important information, including fees, expenses, and performance. Investors have rights and protections under federal securities laws and regulations. This includes the right to receive accurate and timely information about fees, expenses, and the performance of their investments. No-load funds do not charge any sales commissions or loads, offering a lower-cost alternative for investors who want to avoid paying upfront fees. Exchange-Traded Funds (ETFs) are another lower-cost alternative to front-end load funds. They trade like stocks on an exchange and typically have lower expense ratios compared to mutual funds, making them an attractive option for cost-conscious investors. Index funds are designed to track the performance of a specific market index, such as the S&P 500. They typically have lower management fees and expenses compared to actively managed funds, making them a popular alternative for investors seeking lower-cost options. Investors seeking personalized advice without the potential conflicts of interest associated with front-end loads may consider working with fee-based financial advisors. These advisors charge a flat fee or a percentage of assets under management rather than receiving commissions from the sale of investment products. Front-end loads are sales charges paid upfront when purchasing shares of a mutual fund or other investment product. They can impact investment returns, particularly for smaller investments and shorter holding periods. Front-end load funds have both advantages and disadvantages, and investors should carefully consider their investment objectives, fees, expenses, and alternatives when making investment decisions. Investor education and due diligence are essential when selecting investment products, including front-end load funds. Understanding different funds' fees, expenses, and performance can help investors make informed decisions and ultimately achieve their financial goals. As investors become more cost-conscious and regulators continue to focus on transparency and fairness in the financial industry, the landscape of investment fees and expenses may continue to evolve. Investors must stay informed about industry trends and developments in order to make the best investment decisions possible.What Is a Front-End Load?

Types of Sales Charges

Front-End Load

Back-End Load

Level Load

No-Load Funds

Comparison and Differences

Calculation of Front-End Load

Percentage-Based Charges

Breakpoints and Volume Discounts

Examples and Scenarios

Impact on Investment Returns

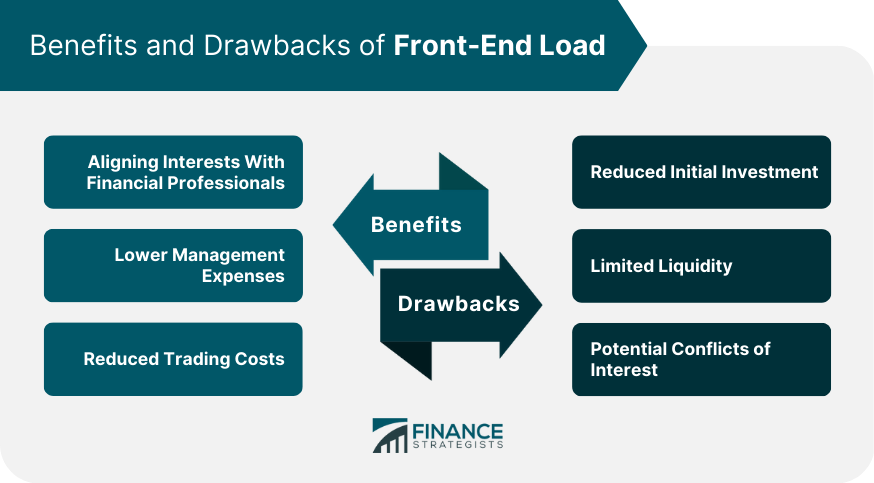

Benefits of Front-End Load for Investors

Aligning Interests With Financial Professionals

Lower Management Expenses

Reduced Trading Costs

Drawbacks of Front-End Load for Investors

Reduced Initial Investment

Limited Liquidity

Potential Conflicts of Interest

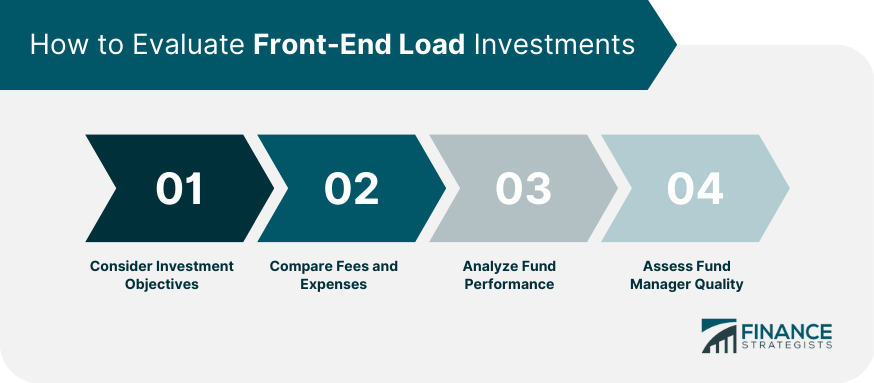

How to Evaluate Front-End Load Investments

Consider Investment Objectives

Compare Fees and Expenses

Analyze Fund Performance

Assess Fund Manager Quality

Regulation and Disclosure of Front-End Loads

Securities and Exchange Commission Oversight

Financial Industry Regulatory Authority Guidelines

Prospectus and Shareholder Reports

Investor Rights and Protections

Alternatives to Front-End Load Investments

No-Load Funds

Exchange-Traded Funds

Index Funds

Fee-Based Financial Advisors

Conclusion

Front-End Load FAQs

A front-end load, also known as a sales charge or load fee, is a one-time fee that investors pay when purchasing shares of a mutual fund. It is typically a percentage of the total investment amount and is deducted from the initial investment.

The front-end load is calculated as a percentage of the total investment amount. For example, if the front-end load is 5% and an investor invests $10,000, the load fee would be $500 (5% of $10,000), and the investor would only be investing $9,500 in the fund.

One advantage of investing in a front-end load fund is that the annual fees are usually lower compared to no-load funds. Additionally, the load fee can act as an incentive for long-term investment and can lead to more predictable returns.

One disadvantage of front-end load funds is the high upfront cost, which can be a barrier for some investors. Additionally, front-end load funds may have limited flexibility, and if an investor withdraws their investment early, they may lose a significant portion of their returns.

When selecting a front-end load fund, it's important to consider your investment goals, time horizon, and risk tolerance. Additionally, there are different types of front-end load funds, such as equity, bond, and hybrid funds, so choosing a fund that aligns with your investment strategy is important.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.