Go-Go Funds are actively managed investment funds that target high-growth, high-risk investments in rapidly growing companies, disruptive technologies, and promising sectors. These funds aim to provide significant capital appreciation in a relatively short time frame. Go-Go Funds have aggressive strategies and are suitable for investors with a high-risk tolerance. They focus on identifying market trends, new technologies, and emerging sectors for substantial growth. Originating in the 1960s, they capitalized on rapid technological advancements and economic growth. In recent years, Go-Go Funds have expanded to include technology, small-cap, and sector-specific funds, catering to diverse investor preferences. Aggressive growth funds are a type of Go-Go Fund that primarily invests in high-growth companies. These funds seek out investments that offer the potential for rapid capital appreciation, often focusing on companies with high projected earnings growth rates, innovative business models, or unique competitive advantages. Technology-focused funds are Go-Go Funds that concentrate on investing in the technology sector. These funds aim to capitalize on the rapid advancements in technology and the growth potential of innovative companies. They may invest in various subsectors, such as artificial intelligence, biotechnology, or renewable energy, depending on the fund's specific focus. Small-cap funds are Go-Go Funds that invest primarily in small-capitalization companies. These companies typically have a market capitalization of less than $2 billion and are often seen as having greater growth potential than their large-cap counterparts. Investing in small-cap funds can be riskier due to the inherent volatility of smaller companies, but they also offer the potential for higher returns. Sector-specific funds are Go-Go Funds that focus on a particular industry or market sector. Examples of such funds include healthcare funds, which invest in pharmaceutical and biotechnology companies, or financial sector funds, which focus on banks, insurance companies, and other financial institutions. These funds aim to capitalize on the growth potential of their target sector while providing investors with a more focused investment strategy. Go-Go Funds are characterized by their high-risk, high-return profiles. They often invest in companies with significant growth potential, but these investments can also be subject to a higher degree of risk. Investors must be prepared for the possibility of substantial losses in exchange for the chance of substantial returns. Given the nature of their investments, Go-Go Funds can be subject to considerable volatility. Rapid fluctuations in market prices can lead to significant short-term gains or losses. Investors considering Go-Go Funds should be prepared for this volatility and have appropriate risk tolerance. Go-Go Funds are actively managed, meaning that the fund manager makes investment decisions based on research and analysis, aiming to outperform the market. Active management can result in higher returns but also comes with higher fees and expenses compared to passively managed funds. Go-Go Funds often invest in rapid-growth companies, which are characterized by high revenue and earnings growth rates. These companies may have innovative business models or unique competitive advantages that drive their growth. Examples of rapid growth companies include tech giants like Amazon and Tesla or innovative startups in emerging industries. Go-Go Funds may also capitalize on market trends, identifying and investing in sectors or industries that are experiencing significant growth. This approach allows the fund manager to take advantage of emerging opportunities and ride the wave of market momentum. Examples of market trends include the rise of renewable energy, the increasing demand for electric vehicles, or the growing popularity of e-commerce. Disruptive technologies are innovations that change the way industries or markets operate, often displacing established products, services, or companies. Go-Go Funds may invest in companies developing or utilizing disruptive technologies, seeking to benefit from the transformative potential of these innovations. Examples of disruptive technologies include artificial intelligence, blockchain, and gene editing. Go-Go Funds are typically benchmarked against a specific index or market average to evaluate their performance. However, given their focus on high-risk, high-growth investments, the performance of Go-Go Funds can be quite volatile, with significant fluctuations in returns. Investors should carefully consider the fund's historical performance and risk profile when evaluating a Go-Go Fund. Investors considering Go-Go Funds should have a high-risk tolerance. Due to the aggressive investment strategies and volatile nature of the underlying assets, these funds can experience significant fluctuations in value. Investors must be comfortable with the potential for substantial losses in pursuit of high returns. A longer investment time horizon is generally recommended for investors considering Go-Go Funds. This allows for the possibility of riding out periods of market volatility and provides a better chance of realizing the potential gains from high-growth investments. A minimum time horizon of five to ten years is typically suggested. Go-Go Funds are suitable for investors seeking capital appreciation as their primary investment objective. They may not be appropriate for those focused on income generation or capital preservation. Investors should consider their overall financial goals and objectives before allocating a portion of their portfolio to Go-Go Funds. Before investing in Go-Go Funds, investors should conduct thorough research and due diligence. This includes understanding the fund's investment strategy, historical performance, risk profile, and fees. Reading fund reviews and seeking advice from financial professionals can also be helpful. Investors should review the fund's prospectus, which provides essential information about the fund's investment objectives, strategies, risks, fees, and performance. The prospectus can help investors gain a better understanding of the specific Go-Go Fund and determine whether it aligns with their investment goals and risk tolerance. After conducting research and reviewing the prospectus, investors should carefully select the most suitable Go-Go Fund for their needs. Factors to consider include the fund's track record, management team, fees, and specific investment focus. Investing in Go-Go Funds requires ongoing monitoring and management. Investors should regularly review their fund's performance and assess whether it continues to align with their financial goals and risk tolerance. Rebalancing the portfolio and adjusting investment allocations may be necessary to maintain the desired level of risk and return. The primary advantage of investing in Go-Go Funds is the potential for significant capital appreciation. By investing in high-growth companies, disruptive technologies, or rapidly expanding sectors, these funds seek to generate substantial returns for their investors. Go-Go Funds can offer diversification benefits, particularly for investors who have a predominantly conservative or income-focused portfolio. By including high-growth investments, investors can potentially enhance their overall portfolio returns and spread risk across different asset classes or sectors. Investing in Go-Go Funds provides investors with access to professional fund management. Fund managers possess the expertise, resources, and experience necessary to identify and capitalize on high-growth investment opportunities, which may be difficult for individual investors to replicate. Active management, a characteristic of Go-Go Funds, often results in higher fees and expenses compared to passively managed funds. These higher costs can erode investment returns, particularly in periods of underperformance. Given their high-risk profile, Go-Go Funds carry the potential for significant losses. Investing in these funds requires a high degree of risk tolerance, as the potential for large gains comes with the possibility of substantial losses. Go-Go Funds may have a short-term focus, seeking to capitalize on rapid growth opportunities. This approach can result in increased portfolio turnover, which can lead to higher trading costs and potential tax implications for investors. Go-Go Funds are subject to regulations enforced by the U.S. Securities and Exchange Commission (SEC). These regulations aim to protect investors by ensuring transparency, disclosure, and fair practices in the securities industry. The Investment Company Act of 1940 is a federal law governing the registration, regulation, and oversight of investment companies, including Go-Go Funds. The Act imposes various requirements on funds, including periodic financial reporting, disclosure of investment policies and objectives, and fiduciary standards for fund management. In addition to SEC regulations and the Investment Company Act of 1940, Go-Go Funds may be subject to other rules and regulations, such as state securities laws or industry-specific regulations. Investors should be aware of the regulatory landscape and any potential changes that may impact their investments. Go-Go Funds are high-risk, high-growth investment vehicles that focus on rapidly growing companies, disruptive technologies, and emerging market trends. There are various types of Go-Go Funds, such as aggressive growth funds, technology-focused funds, small-cap funds, and sector-specific funds. Each type caters to different investment objectives and preferences. These funds are characterized by their high risk and return potential, volatility, active management, and investment strategies centered on rapid growth companies, market trends, and disruptive technologies. Investing in Go-Go Funds comes with both pros and cons, including the possibility of significant capital appreciation, diversification benefits, and access to expert fund management, as well as higher fees, the risk of significant losses, and a short-term focus. To successfully invest in Go-Go Funds, it is crucial to conduct thorough research, understand the fund offerings and prospectus, select the appropriate fund, and monitor and manage investments regularly. Investors should also be aware of their risk tolerance, investment time horizon, and financial goals when considering these funds. Investors interested in exploring the potential of Go-Go Funds should consider seeking the guidance of professional wealth management services. What Is a Go-Go Fund?

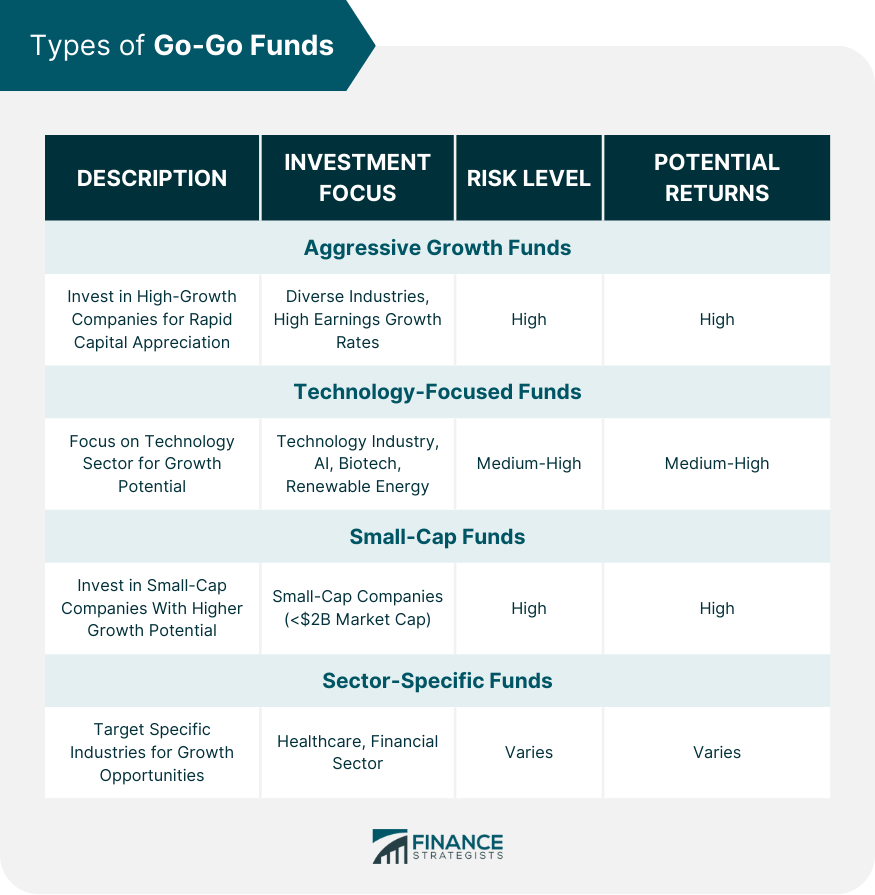

Types of Go-Go Funds

Aggressive Growth Funds

Technology-Focused Funds

Small-Cap Funds

Sector-Specific Funds

Characteristics of Go-Go Funds

High Risk and High Return Potential

Volatility

Active Management

Investment Strategies

Rapid Growth Companies

Market Trends

Disruptive Technologies

Performance Measurement

Investor Profile for Go-Go Funds

Risk Tolerance

Investment Time Horizon

Financial Goals and Objectives

How to Invest in Go-Go Funds

Research and Due Diligence

Understanding Fund Offerings and Prospectus

Selecting the Appropriate Fund

Monitoring and Managing Investments

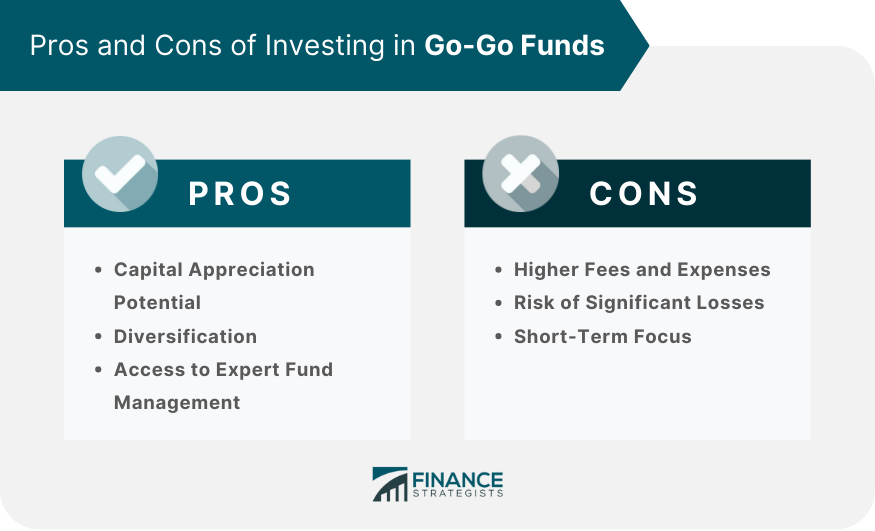

Pros of Investing in Go-Go Funds

Capital Appreciation Potential

Diversification

Access to Expert Fund Management

Cons of Investing in Go-Go Funds

Higher Fees and Expenses

Risk of Significant Losses

Short-Term Focus

Regulatory and Compliance Aspects of Go-Go Funds

SEC Regulations

Investment Company Act of 1940

Other Applicable Rules and Regulations

Final Thoughts

Go-Go Fund FAQs

Go-Go Funds are high-risk, high-growth investment vehicles that focus on investing in rapidly growing companies, disruptive technologies, and emerging market trends. These funds aim to generate substantial capital appreciation by taking advantage of growth opportunities in various sectors.

There are several types of Go-Go Funds, including aggressive growth funds, technology-focused funds, small-cap funds, and sector-specific funds. Each type targets different investment objectives and preferences, catering to investors with varying risk tolerances and growth expectations.

Go-Go Funds are characterized by their high-risk, high-return potential, volatility, active management, and investment strategies that focus on rapid growth companies, market trends, and disruptive technologies. These funds often experience significant fluctuations in value, making them suitable for investors with a high-risk tolerance.

The pros of investing in Go-Go Funds include the potential for significant capital appreciation, diversification benefits, and access to expert fund management. The cons include higher fees and expenses, the risk of significant losses due to their high-risk profile, and a short-term focus that may lead to increased portfolio turnover.

To choose the right Go-Go Fund, investors should conduct thorough research, review the fund's prospectus to understand its investment objectives, strategies, risks, and fees, and assess the fund's historical performance and risk profile. It is also essential to consider one's risk tolerance, investment time horizon, and financial goals before investing in a Go-Go Fund.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.