Mutual funds have become a cornerstone of modern investment strategies, offering a blend of diversification, professional management, and accessibility. They pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. This collective approach allows individual investors access to a broader range of assets than would typically be possible. Understanding the nuances of mutual funds is crucial for anyone looking to enhance their investment portfolio. The importance of investing in mutual funds cannot be overstated. They offer a hands-off approach to investing, ideal for those who may not have the time or expertise to manage individual stocks or bonds. By choosing the right mutual fund, investors can align their financial goals with their risk tolerance, ensuring a balanced and strategic approach to wealth growth. Identifying your investment objectives is the first step in selecting the right mutual fund. Are you saving for a short-term goal, like a vacation or a down payment on a house? Or are your sights set on long-term objectives such as retirement or funding a child's education? Short-term investors may prefer less volatile funds, while those with a longer horizon can often afford to take on more risk for potentially greater returns. Risk tolerance is a critical factor in fund selection. It's essential to understand how much risk you can comfortably handle. This is not just a matter of financial capability but also of psychological comfort. Some investors can endure the ups and downs of high-risk funds, while others may prefer a more stable investment. Knowing where you stand on this spectrum will help you choose a fund that matches your comfort level. Equity funds, predominantly invested in stocks, are a popular choice for investors aiming for higher returns. These funds can vary widely, focusing on various market segments like large-cap, mid-cap, or small-cap stocks. Equity funds are suitable for investors with a longer investment horizon and a higher risk tolerance, as stock markets can be volatile in the short term. The potential rewards, however, can be significant, making equity funds a cornerstone for growth-oriented portfolios. Debt funds invest in fixed-income securities like bonds, government securities, and corporate debentures. They are generally considered safer than equity funds, as they provide regular income and are less volatile. These funds are ideal for conservative investors or those looking for a steady income stream. The returns on debt funds might be lower compared to equity funds, but they offer more stability and are less affected by stock market fluctuations. Balanced funds, also known as hybrid funds, combine the characteristics of both equity and debt funds. They allocate their assets in a balanced manner between stocks and fixed-income securities. This blend allows investors to enjoy the growth potential of equities while mitigating risks through the stability of bonds. Balanced funds are suitable for investors looking for a mix of safety, income, and moderate growth. Specialty funds include a variety of fund categories designed to cater to specific investment strategies or sectors. Index funds, for example, track a particular market index, offering a passive investment strategy that mirrors the performance of the market. Sector funds focus on specific industry sectors, such as technology or healthcare, providing opportunities for targeted investment in areas of potential growth. These funds are typically more suitable for investors who have specific market knowledge or investment preferences and are willing to accept the higher risk associated with specialized investing. When selecting a mutual fund, it's crucial to look at its historical performance. This includes not just the returns it has generated but also how it has performed during different market conditions. A fund that consistently outperforms its benchmark in various market scenarios is often a good choice. However, past performance is not indicative of future results, so this should not be the only criterion. Comparing a fund's performance with appropriate benchmark indices is vital in assessing its effectiveness. If a fund consistently lags behind its benchmark, it might be a red flag. However, outperforming the benchmark consistently can indicate strong management and a solid investment strategy. The expense ratio of a mutual fund is the annual fee that all funds charge their shareholders. It includes operating expenses, management fees, and other administrative costs. A lower expense ratio can significantly impact your investment returns over time, especially in a low-return environment. Fees can eat into your investment returns. While a difference of 0.5% in fees might seem small, it can add up to a significant amount over the long term. Therefore, it's essential to compare the fees of different funds and understand how they will affect your overall returns. Mutual funds are either actively or passively managed. Active funds are managed by professionals who actively select the securities in the fund, aiming to outperform the market. Passive funds, like index funds, mirror a market index and are known for lower fees. The choice between active and passive management depends on your investment philosophy and goals. The track record of fund managers is crucial in active management. A manager with a history of smart decision-making and consistent performance can be a valuable asset. However, it's important to note that a change in the fund manager can impact the fund's performance. One of the primary advantages of mutual funds is diversification. By investing in a range of securities, mutual funds can reduce the risk that comes from exposure to a single security or sector. This diversification can protect your investment from market volatility and sector-specific downturns. When choosing a mutual fund, examine its portfolio holdings. Ensure that the fund's investment philosophy and the composition of its portfolio align with your investment goals and risk tolerance. Look for a balance of sectors and asset types that complement your existing investments. Mutual funds can have various tax implications, depending on the type of investments they hold and how they are managed. For example, funds that frequently buy and sell assets can generate higher capital gains, which may be taxable. Understanding these implications is crucial for maximizing your after-tax returns. Some mutual funds are designed for tax efficiency, using strategies that minimize taxable distributions. These funds are particularly beneficial for investors in higher tax brackets or those investing in taxable accounts. Selecting tax-efficient funds can be a crucial part of your overall investment strategy. Investing in mutual funds is not a set-and-forget strategy. Regularly reviewing your fund's performance is essential to ensure that it aligns with your investment goals and performs as expected. This may involve comparing it with its benchmark and peer funds and reviewing the fund manager's decisions. Based on your regular reviews, you may need to adjust your investment strategy. This could involve reallocating your assets, switching to different funds, or rebalancing your portfolio to maintain your desired risk level. Stay informed and flexible to keep your investments on track. Selecting the right mutual fund is a multifaceted process that necessitates a clear understanding of one's financial objectives and risk tolerance. Whether it's equity, debt, balanced, or specialty funds, each type caters to distinct investment needs and preferences. Analyzing a fund's historical performance and comparing it against benchmark indices are critical steps in assessing its potential. Moreover, being mindful of expense ratios and management fees is essential, as these can significantly impact long-term returns. Active versus passive fund management and the fund manager's track record are also pivotal considerations. Furthermore, the importance of diversification in mitigating risks and the role of tax efficiency in optimizing returns cannot be overlooked. Regular monitoring and readiness to adjust investment strategies as market conditions evolve are key to maintaining a robust and effective investment portfolio. Ultimately, the right mutual fund aligns with individual investment goals while balancing risk and reward efficiently.Mutual Funds Overview

Understanding Your Investment Goals

Short-Term vs Long-Term Goals

Risk Tolerance Assessment

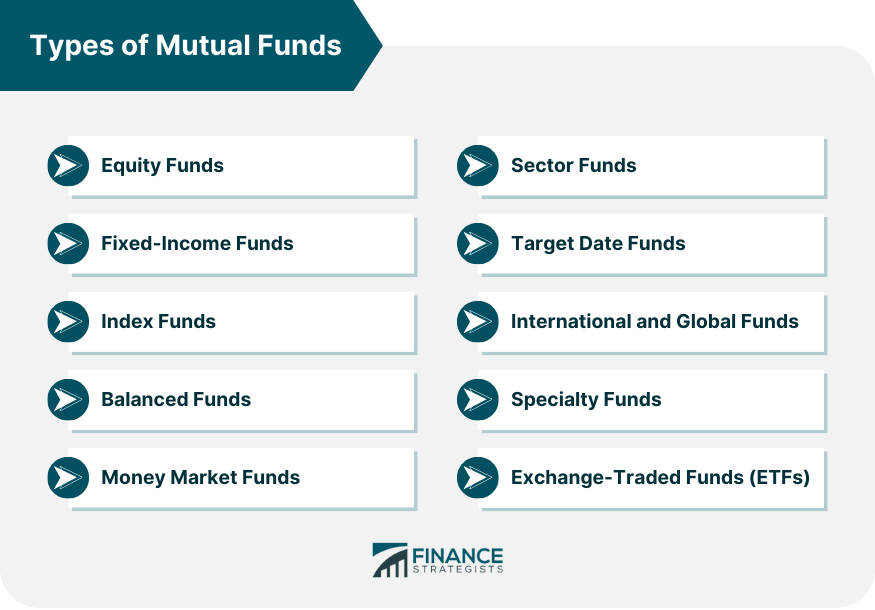

Types of Mutual Funds

Equity Funds

Debt Funds

Balanced Funds

Specialty Funds

Evaluating Fund Performance

Historical Performance Analysis

Comparison With Benchmark Indices

Expense Ratios and Fees

Understanding Expense Ratios

Impact of Fees on Returns

Fund Management

Active vs Passive Management

Track Record of Fund Managers

Diversification and Portfolio Composition

Importance of Diversification

Assessing Portfolio Holdings

Tax Efficiency

Tax Implications of Mutual Funds

Tax-Efficient Investment Strategies

Monitoring and Reviewing Investments

Regular Review of Mutual Fund Performance

Adjusting Investment Strategy

Final Thoughts

How to Choose the Best Mutual Fund FAQs

For short-term goals, think about less volatile funds that prioritize capital preservation. For long-term goals, funds with a higher risk-reward ratio, typically equity funds, are more suitable as they offer potentially higher returns over a longer period.

Understanding your risk tolerance is crucial. If you're comfortable with high-risk investments, equity funds may be suitable. Conversely, if you prefer stability, debt funds are a better choice. Balancing risk and comfort is key in mutual fund selection.

Yes, higher expense ratios and fees can eat into your investment returns over time. It's vital to compare these costs across various funds, considering both the potential returns and the impact of fees.

In actively managed funds, the fund manager plays a critical role in selecting securities and making investment decisions. Their track record and decision-making skills can significantly impact the fund's performance.

Regularly reviewing your mutual fund investments is essential, ideally at least annually. This helps ensure that the fund still aligns with your financial goals, risk tolerance, and market conditions, allowing for timely adjustments if needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.