In finance, the term "load" refers to a type of fee that is charged on an investment, typically a mutual fund, annuity, or insurance policy. A load is a sales charge or commission that is paid by an investor when they purchase or sell an investment. Loads are used to compensate brokers and financial advisors for their services in helping investors select investments. However, they can also reduce the total return of an investment and should be carefully considered by investors when evaluating investment options. Understanding the concept of load and its impact on investment returns is essential for investors to make informed decisions. There are several types of load fees that investors may encounter when investing in financial products. Each type of load has its unique characteristics and effects on investment returns. Front-end load is a sales charge that investors pay when they purchase an investment product. This fee is calculated as a percentage of the initial investment and is usually deducted from the amount invested. For example, if an investor buys a mutual fund with a 5% front-end load and invests $10,000, the load fee would be $500, and the investment's initial value would be $9,500. The impact of front-end load on investments can be significant, particularly for investors with a shorter investment horizon. The front-end load reduces the amount of money initially invested, which may result in lower returns over time. However, some investors may prefer investments with front-end loads, as they often come with lower ongoing management fees. Back-end load, also known as a contingent deferred sales charge (CDSC), is a sales charge that investors pay when they sell an investment product. The back-end load is typically calculated as a percentage of the investment's value at the time of sale and may decrease over time. For instance, an investor might pay a 6% back-end load if they sell their investment within one year, with the charge decreasing by 1% each year until it reaches zero. The impact of back-end load on investments can also be significant, especially for those who need to sell their investments within a short period. However, investments with back-end loads typically have lower upfront costs and ongoing management fees, making them attractive to long-term investors. Level load refers to a sales charge that investors pay periodically, usually annually, for as long as they hold the investment. This fee is calculated as a percentage of the investment's value and is designed to cover ongoing expenses, such as management and distribution costs. For example, an investor might pay a 1% level load each year on a mutual fund with a value of $10,000, resulting in an annual fee of $100. Level load fees can have a moderate impact on investment returns, as they are smaller than front-end or back-end loads but are incurred annually. Investors who prefer a more predictable fee structure may find level load investments appealing. No-load investments are financial products that do not charge front-end, back-end, or level load fees. These investments are often marketed as a lower-cost alternative to load-bearing investments, as they do not have sales charges that can reduce investment returns. However, no-load investments may still have other fees, such as management and administration expenses. No-load investments are generally more attractive to cost-conscious investors, as they allow for the full amount of the initial investment to be put to work immediately. However, it is essential to consider other fees and expenses when comparing no-load investments to their load-bearing counterparts. Load fees play a significant role in the mutual fund industry, as they can have a substantial impact on investment returns. Mutual funds may be subject to front-end, back-end, or level load fees, depending on the fund's structure and share class. These fees are typically used to compensate financial advisors or brokers for their services in selling the fund to investors. It is essential for investors to understand the load fees associated with a particular mutual fund, as they can directly impact the investment's performance. There are both advantages and disadvantages to investing in load mutual funds. Some of the pros include access to professional advice and potentially lower ongoing management fees. Investors who work with financial advisors may benefit from personalized guidance and recommendations tailored to their financial goals and risk tolerance. On the other hand, the cons of investing in load mutual funds primarily revolve around the fees that can reduce investment returns. These sales charges can be particularly detrimental to short-term investors or those with limited funds to invest. When comparing load and no-load mutual funds, investors should consider several factors, including the fees, historical performance, and management team. No-load funds may appear more attractive due to their lack of sales charges, but it is essential to evaluate the fund's overall expenses and performance history before making a decision. Additionally, investors should consider their investment goals, time horizon, and risk tolerance when choosing between load and no-load funds. Annuities are another financial product where load fees can play a crucial role. Annuities may have front-end, back-end, or level load fees, similar to mutual funds. These charges are used to compensate financial professionals for their services in selling the annuity to investors. The specific fees associated with an annuity product will depend on the contract's structure and terms. Investing in load annuities can offer some advantages, such as access to professional advice and potentially lower ongoing expenses. However, the fees associated with load annuities can also be a significant drawback, especially for those with a shorter investment horizon or limited funds. When evaluating load and no-load annuities, investors should consider the fees, contract terms, and financial strength of the issuing insurance company. No-load annuities may seem more appealing due to their lack of sales charges, but it is crucial to compare the overall expenses and contract provisions before making a decision. Life insurance policies can also be subject to load fees, which can impact the policy's overall cost and value. Load fees in life insurance policies are typically incorporated into the premium payments or policy charges. These fees are used to cover the costs associated with marketing and selling the policy, as well as compensating financial professionals for their services. The primary advantage of investing in load life insurance policies is access to professional advice and personalized recommendations. However, the fees associated with these policies can be a significant disadvantage, as they can reduce the policy's overall value and increase the cost of coverage. When comparing load and no-load life insurance policies, investors should consider the fees, coverage options, and financial strength of the issuing company. No-load policies may be more attractive due to their lower costs, but it is crucial to evaluate the overall value and benefits before making a decision. When deciding between load and no-load investments, investors should consider their financial goals, risk tolerance, investment time horizon, and expected return on investment. Additionally, it is essential to evaluate the fees and expenses associated with each investment option and understand how these charges can impact investment returns. Regulatory bodies, such as the Securities and Exchange Commission (SEC), play a critical role in governing load fees and ensuring transparency and disclosure. These organizations require investment companies to disclose fees and expenses in their prospectuses, making it easier for investors to understand and compare the costs associated with different financial products. Investors should always review the prospectus and other disclosure materials before making an investment decision. Load fees can significantly impact investment performance, particularly for short-term investors or those with limited funds. High sales charges can reduce the amount of money initially invested, while ongoing fees can erode returns over time. It is crucial for investors to understand the fees associated with their investments and consider the potential impact on their overall financial goals. Load fees are a crucial factor to consider when selecting financial products, as they can directly impact investment returns. It is essential for investors to understand the various types of load fees and their potential effects on investments to make informed decisions. By taking into account their financial goals, risk tolerance, investment time horizon, and expected return on investment, investors can better determine whether load or no-load investments are appropriate for their needs. Transparency and disclosure of fees are promoted by regulatory bodies like the SEC, enabling investors to make well-informed choices. In conclusion, investors should carefully assess the fees and expenses associated with each investment option and comprehend how these charges can affect their investment performance. By doing so, they can make more informed decisions and choose investments that align with their financial objectives. No matter the investment type, understanding and evaluating the impact of load fees is a crucial step in the investment process, ensuring that investors maximize their potential returns and achieve their financial goals.What Is a Load?

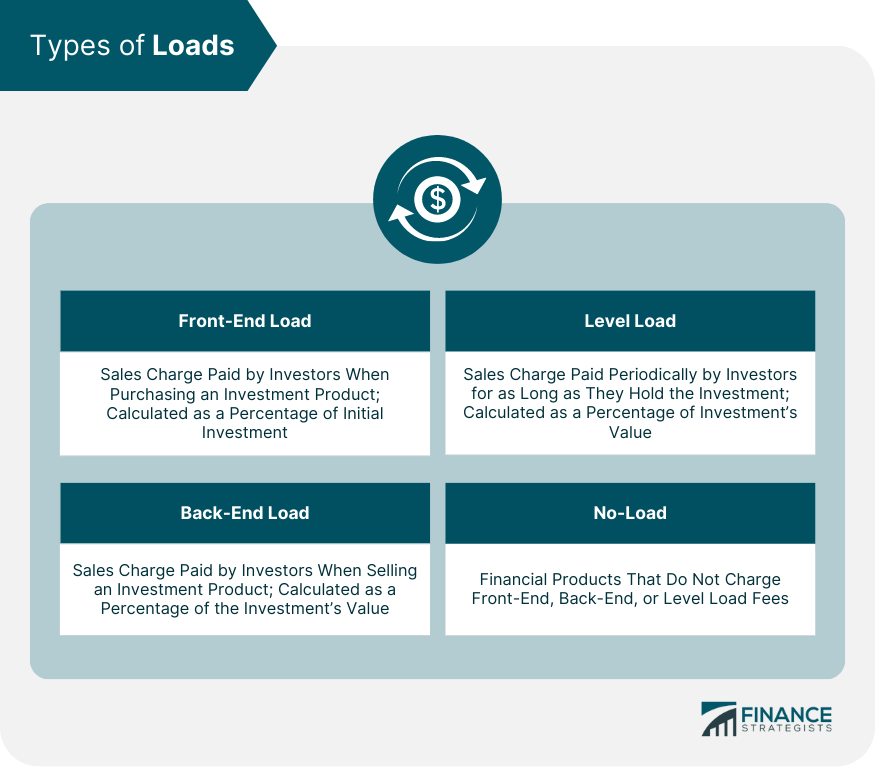

Types of Loads

Front-End Load

Back-End Load

Level Load

No-Load

Loads and Mutual Funds

How Load Fees Are Applied to Mutual Funds

Pros and Cons of Investing in Load Mutual Funds

Comparing Load and No-Load Mutual Funds

Loads and Annuities

How Load Fees Are Applied to Annuities

Pros and Cons of Investing in Load Annuities

Comparing Load and No-load Annuities

Loads and Life Insurance Policies

How Load Fees Are Applied to Life Insurance Policies

Pros and Cons of Investing in Load Life Insurance Policies

Comparing Load and No-Load Life Insurance Policies

Factors to Consider When Choosing Load or No-Load Investments

Regulation and Disclosure of Load Fees

Load Fees and Investment Performance

Conclusion

Load FAQs

A load is a sales charge or commission paid to a broker or financial advisor when buying or selling certain investment products, such as mutual funds or annuities.

Loads can be front-end or back-end. Front-end loads are charged at the time of purchase, while back-end loads are charged when the investment is sold. Some investments may also have a level-load structure, where the charge is spread out over time.

Load charges can vary widely depending on the investment product and the broker or advisor. Front-end loads can range from 1% to 5% of the investment amount, while back-end loads can be as high as 10% or more. Level-load investments may have an ongoing annual fee of around 1%.

Yes, there are many investment products available that do not charge loads, such as index funds and exchange-traded funds (ETFs). These investments typically have lower fees overall, making them a popular alternative for many investors.

Not necessarily. Some investors may find that the advice and guidance provided by a financial advisor justifies the cost of the load. However, it is important to carefully evaluate the potential costs and benefits of any investment before making a decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.