A load fund is a type of mutual fund that charges a sales commission or "load" to investors at the time of purchase or sale. The load is typically a percentage of the amount invested in the fund and is used to compensate brokers or financial advisors who sell the fund to investors. Load funds are also referred to as "front-end load funds" or "back-end load funds," depending on when the load is charged. Load funds are often sold through financial advisors or brokers who receive a commission for selling the fund. This commission can create a conflict of interest, as the financial advisor or broker may be incentivized to recommend funds with higher loads, even if they are not necessarily the best investment for the client. As a result, many investors opt to invest in no-load funds, which do not charge a sales commission and may have lower expense ratios overall. Load fees can be classified into three main types: front-end, back-end, and level load fees. Each of these fees has unique characteristics and may impact investors differently depending on their investment goals and time horizons. Front-end load fees are charged when an investor purchases shares in a load fund. This fee is typically calculated as a percentage of the initial investment and may range from 1% to 8.5%. The front-end load fee is deducted from the investment amount, reducing the total amount invested in the fund. As a result, investors must consider the impact of front-end load fees on their investment returns, particularly if they plan to invest for a short period or have limited funds. Back-end load fees, also known as contingent deferred sales charges (CDSC), are charged when an investor sells shares in a load fund. These fees are typically calculated as a percentage of the investment value at the time of sale and may decrease over time. For example, a fund may charge a 5% back-end load fee if shares are sold within the first year, but the fee may decrease to 4% if shares are sold during the second year. Some back-end load fees may eventually disappear if the investor holds the shares for a specified period, making them more suitable for long-term investors. Level load fees, also referred to as 12b-1 fees, are ongoing fees charged annually by a load fund to cover distribution and marketing expenses. These fees are typically lower than front-end or back-end load fees and are charged as a percentage of the fund's net asset value (NAV). Level load fees can impact investment returns over time, particularly for investors who hold shares in a fund for an extended period. No-load funds are mutual funds that do not charge any load fees to buy or sell shares. These funds are typically sold directly to investors, bypassing financial advisors and brokers. While no-load funds may have lower fees, they may also have higher ongoing management fees compared to load funds. There are both advantages and disadvantages to investing in load funds. It's essential to understand these factors when deciding whether to invest in a load fund or a no-load fund. One of the main advantages of investing in load funds is access to professional financial advice. Load fees are used to compensate financial advisors and investment brokers for their services, which can be valuable for investors who need guidance in selecting and managing their investments. Load funds may have lower ongoing management fees compared to no-load funds. This can offset the impact of load fees on investment returns, particularly for long-term investors who hold shares for an extended period. Load fees can significantly impact investment returns, particularly for short-term investors or those with limited funds. High sales charges can reduce the amount of money initially invested, while ongoing fees can erode returns over time. Load funds may not be the best choice for short-term investors or those with limited funds, as the load fees can significantly impact investment returns. No-load funds may be more suitable for these investors, as they do not charge any fees to buy or sell shares. When comparing load and no-load funds, it is essential to consider several factors, including fees and expenses, historical performance, and the management team. Understanding these factors can help investors make informed decisions about which type of fund is best suited to their investment goals, time horizon, and risk tolerance. One of the most critical factors to consider when comparing load and no-load funds is the fees and expenses associated with each fund. Load funds typically charge fees to buy or sell shares, while no-load funds do not. However, no-load funds may have higher ongoing management fees compared to load funds. While past performance is not an indicator of future results, it is essential to evaluate the historical performance of load and no-load funds. Comparing the performance of similar funds with and without load fees can help investors determine whether the fees are justified. The quality of a fund's management team is another crucial factor to consider when comparing load and no-load funds. A strong management team with a proven track record of success may justify the fees associated with a load fund. Load fees can have a significant impact on investment returns, particularly for short-term investors or those with limited funds. It is essential for investors to understand and evaluate the fees associated with a load fund and consider their impact on investment performance. Load fees can reduce the amount of money initially invested in a fund, thereby impacting the potential for growth. Ongoing fees, such as level load fees, can also erode returns over time. Investors must consider the impact of load fees on their investment returns and weigh them against the potential benefits, such as access to professional advice and lower ongoing management fees. Understanding and evaluating the fees associated with load funds is crucial for investors to make informed decisions about their investments. By considering the impact of fees on investment returns and comparing them to no-load funds, investors can determine whether a load fund is the best choice for their investment goals and time horizon. Regulatory bodies, such as the Securities and Exchange Commission (SEC), play a crucial role in ensuring the transparency and disclosure of fees associated with load funds. This helps investors make informed decisions about their investments and understand the potential impact of fees on their returns. The SEC and other regulatory bodies oversee the mutual fund industry and establish rules and regulations to protect investors. These regulatory bodies require mutual funds to disclose their fees and expenses in a clear and transparent manner, enabling investors to compare and evaluate different funds effectively. Transparency and disclosure of fees are essential to help investors make informed decisions about their investments. By understanding the fees associated with a load fund and comparing them to other funds, investors can determine whether the fees are justified and in line with their investment goals and risk tolerance. When deciding whether to invest in load or no-load funds, investors should consider several factors, including their financial goals, risk tolerance, investment time horizon, and expected return on investment. Investors should consider their financial goals when choosing between load and no-load funds. Load funds may be more suitable for investors who value professional advice and are willing to pay for it. Conversely, no-load funds may be more appropriate for investors who prefer to manage their investments independently and are focused on minimizing fees. Risk tolerance is an essential factor to consider when choosing between load and no-load funds. Load funds may be more suitable for conservative investors who value professional advice and guidance in managing their investments. No-load funds may be more appropriate for more experienced investors who are comfortable managing their investments and have a higher risk tolerance. Investment time horizon plays a crucial role in determining whether to invest in load or no-load funds. Long-term investors may find load funds more suitable, as the impact of load fees can be offset by lower ongoing management fees and professional advice. Short-term investors or those with limited funds may prefer no-load funds, as the fees associated with load funds can significantly impact investment returns. Investors should consider the expected return on investment when choosing between load and no-load funds. Load funds may offer higher returns due to professional advice and active management, but the fees associated with these funds can impact overall returns. No-load funds may provide lower returns due to passive management but have the potential for higher net returns due to lower fees. Load funds are mutual funds that charge sales commissions or "loads" to investors at the time of purchase or sale. There are three types of load fees: front-end, back-end, and level load fees, each of which has unique characteristics that may impact investors differently. While load funds can provide access to professional financial advice and may have lower ongoing management fees compared to no-load funds, they can also significantly impact investment returns, particularly for short-term investors or those with limited funds. As a result, investors must carefully evaluate the fees and expenses associated with load funds and consider their investment goals, time horizon, and risk tolerance when deciding whether to invest in a load or no-load fund. When comparing load and no-load funds, investors should consider several factors, including fees and expenses, historical performance, and the management team. While past performance is not an indicator of future results, evaluating the historical performance of similar funds with and without load fees can help investors determine whether the fees are justified. Moreover, a strong management team with a proven track record of success may justify the fees associated with a load fund. Overall, investors should carefully evaluate their options before investing in a load fund and consider the impact of load fees on their investment returns.What Is a Load Fund?

Types of Load Fees

Front-End Load Fees

Back-End Load Fees

Level Load Fees

No-Load Funds

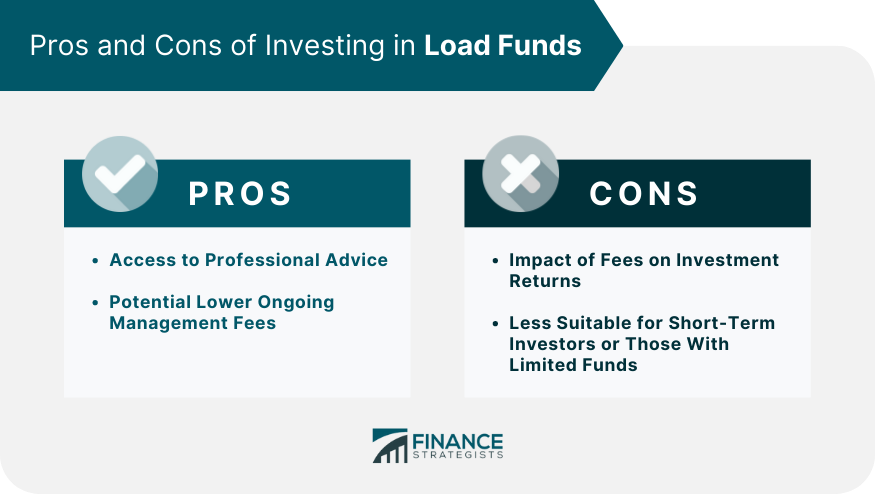

Pros and Cons of Investing in Load Funds

Advantages of Load Funds

Access to Professional Advice

Potential Lower Ongoing Management Fees

Disadvantages of Load Funds

Impact of Fees on Investment Returns

Less Suitable for Short-Term Investors or Those With Limited Funds

Comparing Load Funds and No-Load Funds

Factors to Consider When Comparing Load and No-Load Funds

Fees and Expenses

Historical Performance

Management Team

Load Funds and Investment Performance

Impact of Load Fees on Investment Returns

Importance of Understanding and Evaluating Fees

Regulation and Disclosure of Load Fees

Role of Regulatory Bodies

Importance of Transparency and Disclosure of Fees

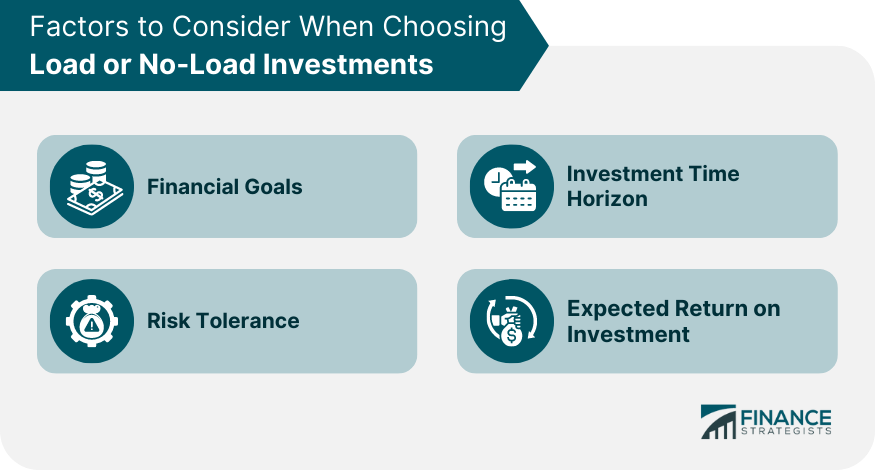

Factors to Consider When Choosing Load or No-Load Investments

Financial Goals

Risk Tolerance

Investment Time Horizon

Expected Return on Investment

Final Thoughts

Load Fund FAQs

A load fund is a type of mutual fund that charges a sales commission or fee when an investor buys or sells shares. The sales charge can be a front-end load, which is taken out when an investor buys shares, or a back-end load, which is charged when an investor sells shares.

Load funds charge a sales commission or fee, while no-load funds do not. This means that the total cost of investing in a load fund is higher than that of a no-load fund, even if the underlying investment performance is the same.

Load funds are often sold by financial advisors or brokers who provide investment advice and guidance, which can be valuable for novice investors. Additionally, load funds may offer certain benefits, such as lower expense ratios or access to exclusive investment opportunities.

The main disadvantage of load funds is the upfront cost of the sales commission or fee, which can be a significant drag on investment returns. Additionally, load funds may have higher ongoing expenses than comparable no-load funds, which can further reduce returns over time.

It is important to weigh the benefits and drawbacks of load funds against your investment goals and risk tolerance. Consider factors such as the size of the sales commission or fee, the quality of the fund's investment management, and the fund's historical performance relative to its benchmark and peers. Additionally, consider whether you would benefit from the guidance of a financial advisor or broker.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.