What Is a Money Market Fund?

A money market fund is an open-ended mutual fund that invests in short-term debt securities with the primary objective of preserving principal and providing liquidity. These funds aim to maintain a stable net asset value (NAV) of $1 per share while generating modest income.

Money market funds typically offer easy access to funds, daily accrual of interest, and a diversified portfolio of short-term debt securities. They are subject to regulations that limit the types of investments they can hold and the duration of those investments.

Money market funds are popular among individual and institutional investors who seek a safe and liquid investment option for short-term cash management or as part of a diversified investment portfolio.

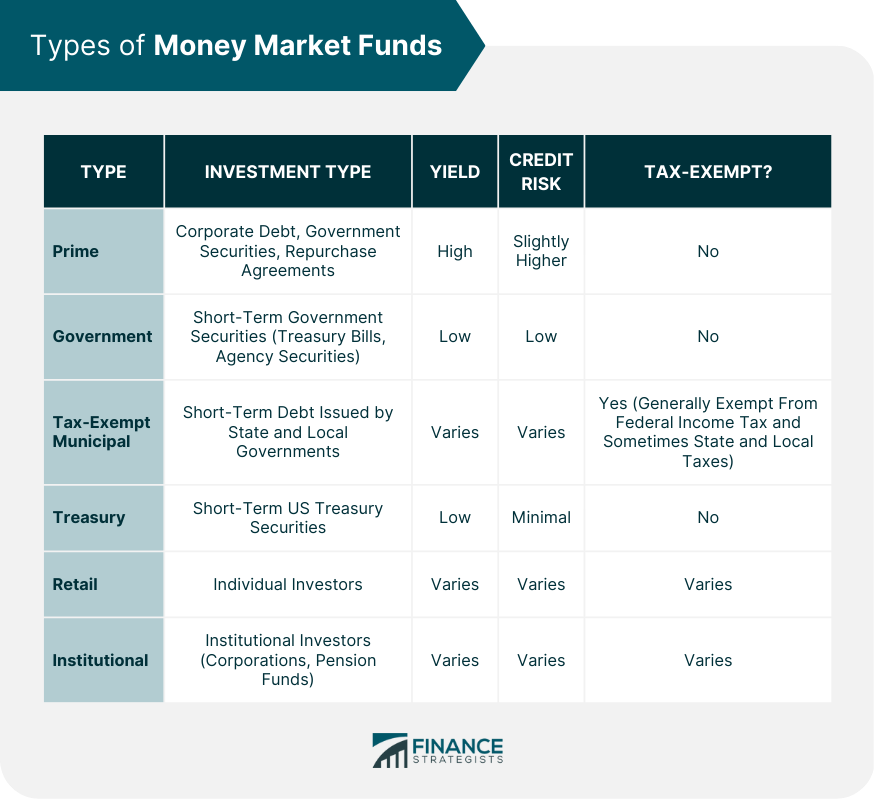

Types of Money Market Funds

Prime Money Market Funds

Prime money market funds invest in a mix of short-term corporate debt, government securities, and repurchase agreements. They are designed to offer higher yields compared to government money market funds, but with slightly higher risk.

Government Money Market Funds

These funds invest exclusively in short-term government securities, such as Treasury bills and agency securities. They generally offer lower yields than prime money market funds but carry lower credit risk.

Tax-Exempt Municipal Money Market Funds

Tax-exempt municipal money market funds invest in short-term debt issued by state and local governments. The interest earned on these funds is generally exempt from federal income tax and, in some cases, state and local taxes.

Treasury Money Market Funds

Treasury money market funds invest exclusively in short-term U.S. Treasury securities, which are considered among the safest investments. These funds usually offer lower yields than other money market funds but carry minimal credit risk.

Retail and Institutional Money Market Funds

Retail money market funds cater to individual investors, while institutional money market funds are designed for institutional investors, such as corporations and pension funds.

Institutional funds typically have higher minimum investment requirements and lower expense ratios compared to retail funds.

Investment Instruments in Money Market Funds

Short-Term Debt Securities

Commercial Paper

Commercial paper is a short-term, unsecured promissory note issued by corporations to meet their short-term funding needs. It typically has a maturity of up to 270 days and is considered relatively low risk.

Repurchase Agreements

Repurchase agreements, or repos, are short-term transactions where a borrower sells a security with the agreement to repurchase it at a later date at a specified price. They are commonly used by money market funds to invest in government securities.

Bankers' Acceptances

Bankers' acceptances are short-term debt instruments issued by a company and guaranteed by a bank. They are used in international trade transactions and considered low risk.

Government Securities

Treasury Bills

Treasury bills, or T-bills, are short-term government securities issued by the U.S. Department of the Treasury. They are considered one of the safest investments and have maturities ranging from a few days to one year.

Agency Securities

Agency securities are issued by government-sponsored enterprises, such as Fannie Mae and Freddie Mac. They carry a slightly higher risk than Treasury securities but are still considered relatively safe and effective investments.

Certificates of Deposit (CDs)

Certificates of deposit are time deposits offered by banks, with maturities ranging from a few weeks to several years. They are FDIC-insured up to $250,000 and generally offer a fixed interest rate.

Money market funds may invest in negotiable CDs, which can be bought and sold in the secondary market.

Municipal Securities

Municipal securities are debt instruments issued by state and local governments to finance public projects. Money market funds may invest in short-term municipal notes, which typically have maturities of one year or less.

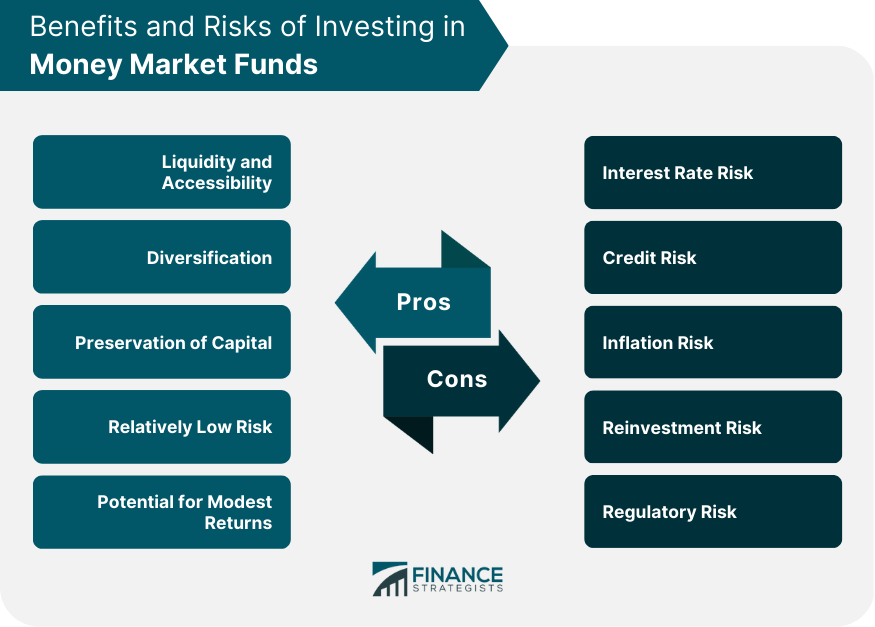

Benefits of Investing in Money Market Funds

Liquidity and Accessibility

Money market funds offer high liquidity, allowing investors to easily access their funds when needed. Many funds allow same-day transactions, making them a convenient option for short-term cash management.

Diversification

Investing in money market funds can help diversify an investment portfolio by providing exposure to various types of short-term debt securities.

Preservation of Capital

Money market funds aim to maintain a stable NAV of $1 per share, making them a relatively safe investment for preserving capital.

Relatively Low Risk

By investing in short-term, high-quality debt securities, money market funds offer a lower risk profile compared to other investment options, such as stocks and long-term bonds.

Potential for Modest Returns

While money market funds typically generate lower returns than other investments, they can provide modest income in a low-interest-rate environment.

Risks Associated With Money Market Funds

Interest Rate Risk

Changes in interest rates can impact the value of the securities held in a money market fund, which may affect the fund's yield.

Credit Risk

The risk that an issuer of a security held in a money market fund may default on its payment obligations, resulting in a loss for the fund.

Inflation Risk

Inflation can erode the purchasing power of money market fund returns, particularly when interest rates are low.

Reinvestment Risk

The risk that a money market fund may not be able to reinvest the proceeds from maturing securities at a comparable yield, which could result in a decline in the fund's income.

Regulatory Risk

Changes in regulations governing money market funds can impact the fund's operations, returns, and risk profile.

Money Market Fund Regulations

Investment Company Act of 1940

The Investment Company Act of 1940 provides the regulatory framework for money market funds and other investment companies in the United States.

Securities and Exchange Commission (SEC) Rules

Rule 2a-7

Rule 2a-7, established by the SEC, governs the quality, maturity, and diversification requirements for money market funds to maintain a stable NAV and minimize risk.

Liquidity Requirements

Money market funds are subject to liquidity requirements, which dictate that a certain percentage of a fund's assets must be invested in highly liquid securities.

Financial Stability Oversight Council (FSOC)

The FSOC monitors the stability and systemic risk of the financial system, including money market funds, and can recommend regulatory changes to address potential risks.

Historical Events and the Money Market Fund Industry

The Reserve Primary Fund and the 2008 Financial Crisis

The Reserve Primary Fund "broke the buck" in 2008 when its NAV fell below $1 per share due to losses on Lehman Brothers' debt securities. This event triggered a run on money market funds and led to significant reforms in the industry.

Money Market Fund Reforms Since 2008

In response to the 2008 financial crisis, regulatory reforms have been implemented to enhance the stability and resilience of money market funds, including stricter liquidity requirements and enhanced transparency.

Performance Evaluation and Comparisons

Benchmarking Against Other Investment Options

Money market funds can be compared to other investment options, such as savings accounts, CDs, and short-term bonds, based on factors such as risk, return, and liquidity.

Evaluating Money Market Fund Performance

Expense Ratio

The expense ratio represents the annual operating expenses of a money market fund as a percentage of its assets. Lower expense ratios typically lead to higher net returns for investors.

Yield

The yield of a money market fund represents the income generated by the fund's investments, expressed as a percentage of its NAV. Investors can compare yields across different money market funds to evaluate their relative performance.

Net Asset Value

The NAV is the per-share value of a money market fund's assets, minus liabilities. Although money market funds aim to maintain a stable NAV of $1 per share, fluctuations in NAV can still occur, and investors should monitor them closely.

Comparisons With Other Cash Management Alternatives

Investors can compare money market funds to other cash management alternatives, such as bank savings accounts, high-yield savings accounts, and certificates of deposit, to determine the most suitable option for their needs based on factors such as liquidity, returns, and risk.

How to Choose a Money Market Fund

Assessing Your Investment Goals and Risk Tolerance

Before investing in a money market fund, consider your investment objectives, time horizon, and risk tolerance. Money market funds are best suited for investors seeking capital preservation and liquidity over short-term periods.

Researching Fund Providers and Offerings

Review the offerings from various fund providers, such as Vanguard, Fidelity, and Schwab, to understand their investment strategies, fees, and historical performance.

Analyzing Fund Performance and Fees

When selecting a money market fund, consider factors such as yield, expense ratio, and historical performance. Lower expense ratios and higher yields are generally preferable, but investors should also weigh these factors against their risk tolerance and investment objectives.

Conclusion

Role of Money Market Funds in a Diversified Portfolio

Money market funds can play a crucial role in a diversified investment portfolio by providing a safe and liquid option for short-term cash management or as a temporary holding for funds awaiting investment in other asset classes.

Balancing Risk and Reward With Money Market Funds

While money market funds offer relatively low risk and stable returns, they may not provide the same level of growth potential as other investments, such as stocks and bonds.

Investors should consider their investment goals, risk tolerance, and time horizon when deciding how to allocate their assets among various investment options, including money market funds.

Money Market Funds FAQs

A money market fund is a type of mutual fund that invests in short-term, low-risk debt securities, such as Treasury bills, commercial paper, and certificates of deposit.

Money market funds are a relatively low-risk investment that can provide a higher rate of return than a traditional savings account. They also offer liquidity, meaning you can easily buy or sell shares in the fund.

Money market funds are regulated by the Securities and Exchange Commission (SEC). The SEC sets guidelines for the types of securities that money market funds can invest in and requires them to maintain a stable net asset value (NAV) of $1 per share.

While money market funds are generally considered low-risk investments, there is still a risk of loss. If the issuers of the securities held by the fund default or the interest rates on those securities fall, the value of the fund may decline.

Money market funds are not insured by the Federal Deposit Insurance Corporation (FDIC) like bank deposits are. However, some money market funds may be insured by private insurance companies or may participate in a voluntary insurance program. It is important to read the fund's prospectus to understand the insurance options available.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.