Net Asset Value (NAV) Return is a critical measurement in the world of investment. It is a performance indicator that reflects the gains or losses made by an investment, as calculated by the change in its net asset value over a specific period. NAV Return represents the rate of growth (or decrease) of an investment and is usually presented as a percentage. It holds significant importance in investment decision-making as it provides a realistic picture of an investment's performance. By comparing the NAV Return of different investment options, investors can determine which investment is performing better over a specific period. It helps investors make informed decisions and mitigate potential risks associated with their investments. Net Asset Value is the total value of an investment fund's assets minus its liabilities. The NAV of a company or fund represents its total asset value per share after accounting for its obligations. It gives a clear idea of what a single share or unit of that entity is worth, which investors can use to make informed decisions. This formula is particularly useful for mutual funds, exchange-traded funds (ETFs), and other similar types of investment funds. The NAV of these funds is usually calculated at the end of each trading day based on the closing market prices of the securities in the fund's portfolio. The NAV provides an accurate picture of the fund's value on a per-share basis, allowing investors to compare it with the market price of each unit or share and determine whether it is overvalued or undervalued. The components of NAV include the total market value of the investment fund's assets, such as stocks, bonds, cash, and other securities, and the fund's liabilities, like management fees, operational costs, and other expenses. The difference between the total assets and total liabilities gives the net asset value of the investment fund. NAV is calculated differently depending on the type of investment. For mutual funds, NAV is calculated by dividing the fund's total net assets by the number of shares outstanding. For ETFs, NAV is calculated by taking the total value of the assets in the portfolio, subtracting liabilities, and dividing by the number of shares outstanding. NAV plays a crucial role in measuring investment performance. It serves as a benchmark for investors to assess the performance of an investment fund. By tracking changes in NAV, investors can evaluate how well their investment is performing over time. An increase in NAV suggests that the investment is performing well, while a decrease indicates poor performance. Return on Investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment. It is calculated by dividing the net profit from an investment by the cost of the investment. ROI is important as it helps investors compare the profitability of different investments, enabling them to make informed decisions. The formula for Return on Investment is: Final Value: This is the value of the investment at the end of the period you are considering. This could include the sale price of the investment, the dividends or interest received, or any other form of return or profit generated by the investment. Initial Cost: This is the original cost or amount of money invested at the start. The difference between the final value and the initial cost gives you the net return or profit. When you divide this net return by the initial cost, you get a measure of the return relative to the size of the initial investment. Multiplying this ratio by 100 gives you the percentage return, which is the ROI. This final step makes it easier to compare the ROI of different investments. The relationship between ROI and NAV is intricate. While ROI measures the total return of an investment, NAV reflects the per-share value of a fund. Changes in NAV can influence the ROI. For example, an increase in NAV can lead to a higher ROI, indicating that the investment is profitable. NAV Return in mutual funds is the percentage change in the fund's NAV over a specific period. It includes any income distributions such as dividends and interest, as well as capital gains distributions from the sale of securities within the fund. NAV Return provides a comprehensive view of a mutual fund's performance. Various factors can affect a mutual fund's NAV Return, including the performance of the underlying assets, the fund manager's skill, market conditions, and the fund's fees and expenses. NAV Return in ETFs, similar to mutual funds, represents the percentage change in the ETF's NAV over a given period. This includes both the price appreciation (or depreciation) of the ETF's holdings and any dividends or interest received during that time. ETF NAV Return is affected by several factors, such as the performance of the ETF's underlying assets, changes in market conditions, and the fund's expense ratio. In addition, the bid-ask spread, which represents the difference between the highest price that buyers are willing to pay and the lowest price that sellers are willing to accept, can also impact ETF's NAV Return. In closed-end funds, NAV Return is calculated as the percentage change in the fund's NAV over a specified period. Unlike open-end funds (such as mutual funds) that issue and redeem shares on demand, closed-end funds issue a fixed number of shares that are traded on an exchange. The NAV Return of closed-end funds is influenced by the performance of the fund's underlying assets, market conditions, the fund's discount or premium to NAV, and the expense ratio. Other factors, such as changes in interest rates and investor sentiment, can also have a significant impact on the NAV Return of closed-end funds. The condition of the market is a significant factor affecting NAV Return. Bull markets generally lead to positive NAV Returns as asset prices increase, while bear markets can result in negative returns as asset prices decline. The investment strategy adopted by the fund manager can significantly influence NAV Return. A strategy that successfully identifies undervalued assets can lead to high NAV Returns, while a poorly executed strategy can lead to low or negative returns. High management fees and expenses can eat into an investment's returns, thereby reducing its NAV Return. On the other hand, a fund with low fees and expenses can have a higher NAV Return, all other things being equal. Tax considerations can also impact NAV Return. For instance, high turnover funds that frequently buy and sell assets can generate significant capital gains taxes, which can reduce the net return to investors and hence the NAV Return. NAV Return, a critical performance indicator in investment, reflects the gains or losses made by an investment based on the change in its net asset value over a specific period. It serves as a benchmark for assessing investment performance and helps investors make informed decisions. NAV Return is calculated differently for various investment types. In mutual funds, it includes income distributions and capital gains, while in ETFs, it considers price appreciation, dividends, and interest. Closed-end funds, on the other hand, calculate NAV Return based on a fixed number of shares traded on an exchange. Factors influencing NAV Return include market conditions, investment strategy, management fees and expenses, and tax considerations. By understanding and monitoring NAV Return, investors can evaluate investment performance and mitigate risks effectively.What Is NAV Return?

Understanding Net Asset Value (NAV)

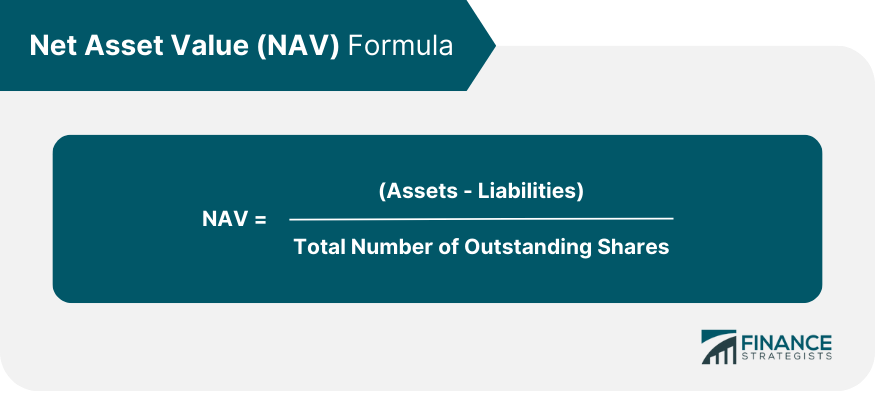

Explanation of Net Asset Value

Components of Net Asset Value

How NAV Is Calculated in Different Types of Investments

Role of NAV in Measuring Investment Performance

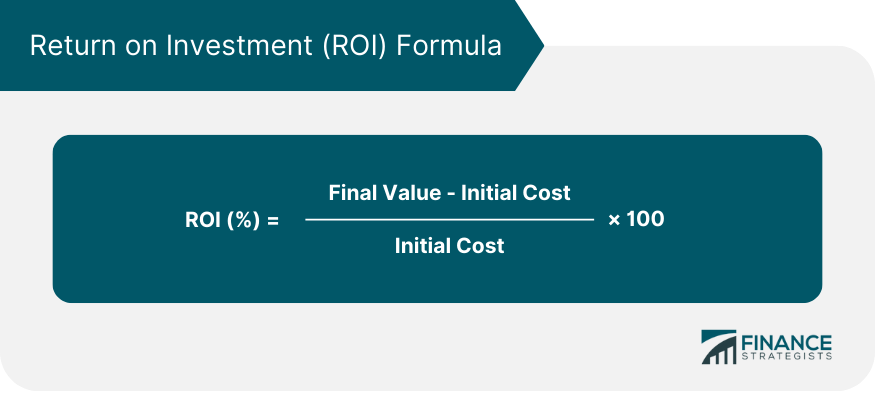

Understanding Return on Investment (ROI)

Calculation of ROI

Relationship Between ROI and NAV

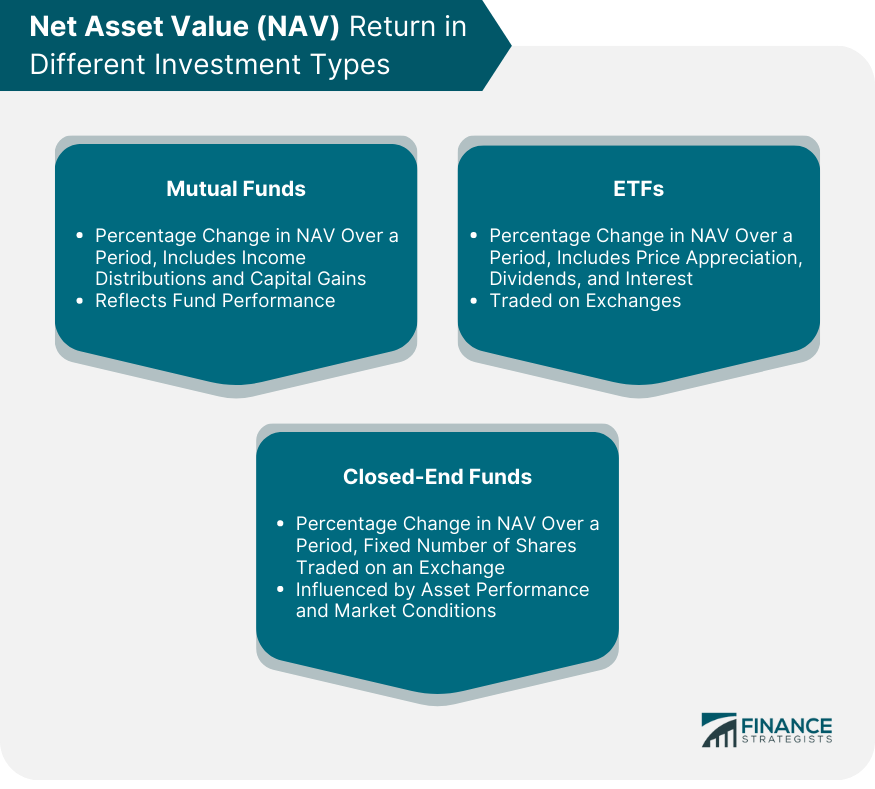

NAV Return in Different Investment Types

NAV Return in Mutual Funds

NAV Return in ETFs

NAV Return in Closed-End Funds

Factors Influencing NAV Return

Market Conditions

Investment Strategy

Management Fees and Expenses

Tax Considerations

Final Thoughts

NAV Return FAQs

NAV Return is a measure of the performance of an investment, calculated by the percentage change in its Net Asset Value over a specific period.

NAV Return is calculated by taking the change in NAV, adding any distributions such as dividends or capital gains, and then dividing by the initial NAV. The result is then multiplied by 100 to get a percentage.

NAV Return can be influenced by various factors, including market conditions, the investment strategy of the fund manager, management fees and expenses, and tax considerations.

NAV Return is crucial in investment decision-making as it provides a realistic picture of an investment's performance. It helps investors compare different investment options and make informed decisions.

While NAV Return is a useful performance measure, it may not fully reflect a fund's risk level, and past performance is not necessarily indicative of future returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.