Net Asset Value, or NAV, shows the net value of a company or corporation and is mainly used when evaluating mutual funds or exchange-traded funds. The NAV shows the price of the per share of the fund or other entity at a certain point in time and is used by investors to evaluate the worth of that entity. The NAV reflects the price point at which shares are traded and thus is important for investors to examine for potential opportunities. The NAV is determined by subtracting the total value of an entity's liabilities from its assets or securities. When divided by total shares owned, the NAV represents a per-share value of the fund, which helps investors evaluate and make decisions about managing or buying shares in that particular fund or entity. The NAV is usually presented on a per-share basis. According to the United States Securities and Exchange Commission, mutual funds and Unit Investment Trusts must calculate their NAV at least once every business day. Investors typically do not compare the NAV of different funds, as that only shows the size of the fund. Rather, it is best to evaluate the NAV of the same fund at different points in time, as that can provide insight into the performance of a fund over time, specifically whether its profits are increasing. Mutual funds usually pay out all of their income and capital gains to their shareholders on a regular basis, the NAV is often a crude measure of performance for these funds because those regular payouts decrease the NAV. However, the NAV can still be a helpful tool when used in conjunction with other, more precise evaluations of mutual funds like annual total return and compounded annual growth rate. Other important factors when choosing between funds to invest in include the performance history of each mutual fund, the diversity of the securities within each fund and track record of the fund manager. Because the NAV of most funds is only calculated once per day, their shares often do not trade in real time like stocks do. Instead, each investor receives a certain number of shares based on the amount of their investment into the fund. The investors are free to sell those shares and pocket the money they make from those sales. The NAV is computed for each day by using all assets and liabilities in each fund at the end of the day. Mutual funds work by collecting money from large amounts of investors than investing that money as they see fit. A mutual fund's assets include those investments as well as cash, receivables, and accrued income. Much of the investments are determined by closing prices of corresponding stocks and make up the bulk of the value of the securities in a fund, and thus, its NAV. Receivables include things like dividend and interest that have not yet been paid to the fund, while accrued investments represent incoming cash to the fund. Liabilities of a mutual fund include things like money owed to banks, pending payments and other cash outflows as well. They can also include accrued expenses, which represent money soon to be paid, as well as operating costs and fees. All buys and sells of mutual funds are calculated based on the NAV of that day. Liabilities of a mutual fund include things like money owed to banks, pending payments and other cash outflows as well. They can also include accrued expenses, which represent money soon to be paid, as well as operating costs and fees. All buys and sells of mutual funds are calculated based on the NAV of that day. Fund accounting shows the maintenance of financial records in a fund. These records track investor and investment activity and well income and expenses accrued. A good accounting standard leads to an accurate NAV, so these records must be tracked regularly in order to keep investors updated.Define Net Asset Value (NAV)

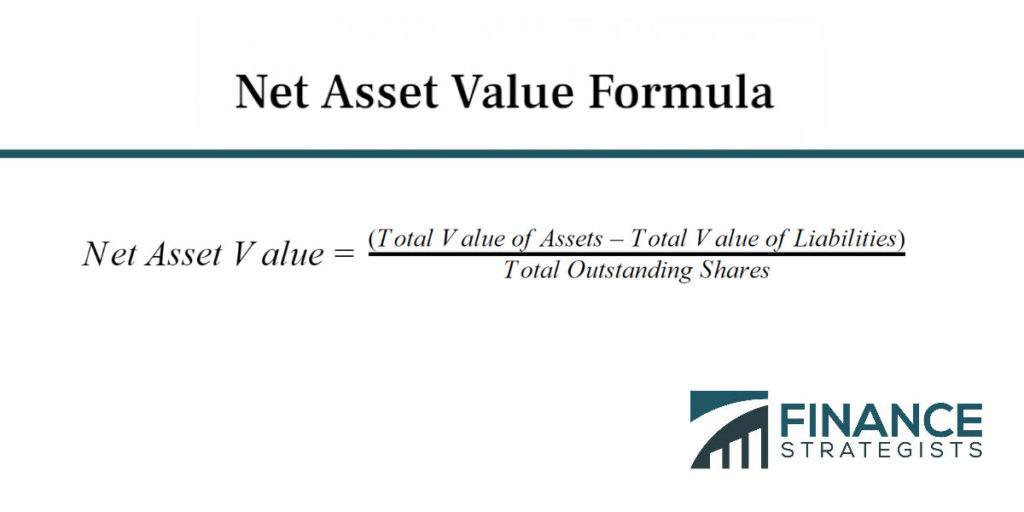

Net Asset Value Formula

How Often Is NAV Calculated?

NAV Investment

NAV Exceptions

NAV Stocks

Mutual Fund NAV

Mutual Fund Liabilities

NAV Accounting

Fund Accounting

Net Asset Value (NAV) FAQs

NAV is an acronym for a company’s Net Asset Value.

Net Asset Value, or NAV, shows the net value of a company or corporation and is mainly used when evaluating mutual funds or exchange-traded funds.

The NAV shows the price per share of the fund or other entity at a certain point in time and is used by investors to evaluate the worth of that entity.

The NAV reflects the price point at which shares are traded and thus is important for investors to examine for potential opportunities.

The SEC requires that mutual funds must calculate their NAV at least once daily.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.