A no-load fund is a type of mutual fund in which investors can purchase shares without paying a load, otherwise known as a sales or commission charge. It is the opposite of a load fund which can charge sales fees on the front-end, the back-end, or annually. By avoiding sales fees and commission fees typically attached to load funds, no-load funds enable investors to keep more of their principal investment while potentially gaining greater returns. Thus, investors benefit more from their investments over time. It is important to note that while there may not be an upfront sales fee associated with a no-load fund, other ongoing costs, such as maintenance or administrative fees, may still apply. Thus, these additional costs should be considered when investing in any type of mutual fund. Potential investors who seek good value for their money should note that no-load funds are not exempted from other types of expenses, especially those necessary for the maintenance and management of the fund. The fees associated with no-load funds are factored into its annual expense ratio (ER), which includes costs related to the fund's administration, management, and marketing. These are similar to some of the costs of running a load fund. Administrative expenses include record keeping, accounting, legal services, and other operational costs associated with running the fund. Meanwhile, management fees are typically charged as a percentage of the total assets in the fund and are used to pay for investment research and portfolio management services. In addition, investors are asked to pay 12b-1 fees, which cover the fund's promotion, service, and distribution expenses. Some popular no-load funds include the following: No-load funds can be purchased through various channels depending on the individual investor's needs and preferences.

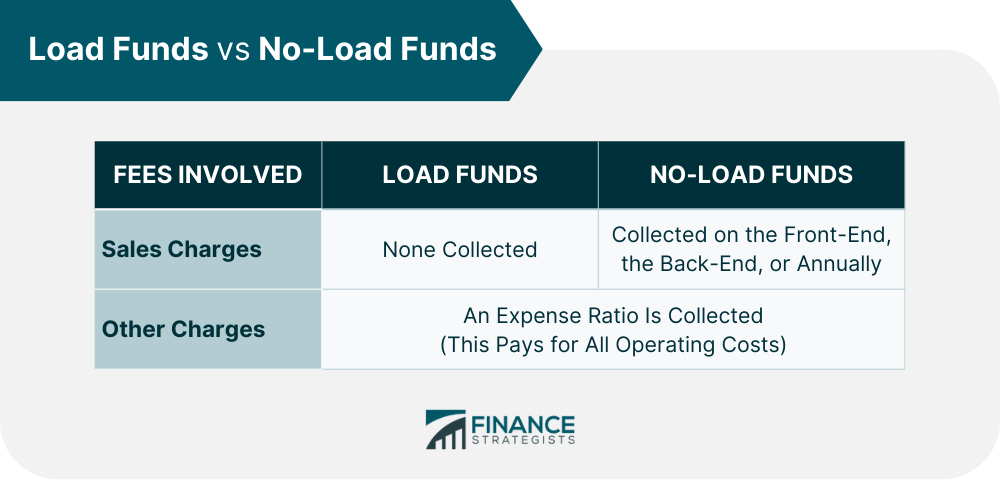

When it comes to investing, many options are available. Mutual funds can be a good investment alternative for individuals seeking higher returns than traditionally seen with an independent savings account. No-load funds are a particularly attractive type of mutual fund to budget-conscious investors since they are purchased without the requirement of sales charges. With this feature, investors may hold onto significantly more of their gains instead of paying additional costs over time. Ultimately, investing in a no-load fund may be the right choice for investors looking to build their portfolio (minus the sales costs) and maximize their return on investment over time. The distinction between load and no-load mutual funds is critical for investors to understand. A load mutual fund collects a sales charge, typically called a "load." This implies that when an investor buys or redeems shares in the fund, the investment firm charges them a commission. This fee can be collected on the front-end, the back-end, or annually. On the other hand, investing in a no-load mutual fund does not involve commissions or fees associated with purchasing and redeeming shares. This type of mutual fund only charges investors for the fund's management. For both types of mutual funds, operating expenses are collected in the form of an annual expense ratio. If the load mutual fund has been carefully selected and performs well, the extra cost may be worth it for some investors. Conversely, no-load funds may be best suited for those who value paying lower prices and are comfortable making their own decisions. While investing solely in no-load funds may be tempting, investors should remember that a different fee structure does not necessarily equate to inferior performance. Thus, they must consider their individual needs before selecting either type of mutual fund. A no-load fund is a mutual fund that does not charge an investor a sales load on their investment. It is the direct opposite of a load fund which charges investors a sales commission, whether on the front-end, the back-end, or annually. Investors of no-load funds may pay lower fees since they are not required to pay commissions to brokers or advisors. As such, they can keep more profits and allocate them to their portfolios. However, potential investors should note that no-load funds charge for other expenses, such as those necessary for the maintenance and management of the fund. In addition, investors should monitor the performance of no-load funds over time as they may vary relative to other equity investments. Ultimately, before investing in a no-load fund, it is essential to consider the risks, reward potential, and any hidden costs associated with the investment. Researching options and consulting a certified financial advisor can ensure that you make an informed and responsible decision before making any investment decision.What Is a No-Load Fund?

Costs Involved in No-Load Funds

Real-World Examples of No-Load Funds

How to Invest in No-Load Funds

Is a No-Load Fund the Right Investment for You?

Load vs No-Load Mutual Funds

Final Thoughts

No-Load Fund FAQs

A no-load fund is a mutual fund that does not charge sales commissions or loads when you buy or sell units. However, no-load funds charge for other expenses, such as those necessary for the maintenance and management of the fund.

No-load funds make money through management fees and other expenses associated with running the fund. However, their annual expense ratio can be much lower than that of a load mutual fund because no sales charge is collected.

One potential disadvantage of a no-load fund is that it may offer a different level of services than a load fund, such as advice and guidance.

The difference between a load fund and a no-load fund is that while load funds charge sales commissions or loads when you buy or sell them, no-load funds do not. Load funds may also offer additional services, but these come with higher fees which can reduce overall returns.

No-load funds can be an excellent option for investors looking to save money on investing costs. However, it is essential to research the fund before investing and ensure that it meets your needs and goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.