Investors are continually searching for ways to maximize their returns while minimizing costs, and no transaction fee (NTF) mutual funds offer one such option. NTF mutual funds are a class of mutual funds that do not charge investors any fees for buying or selling shares. By eliminating transaction fees, NTF mutual funds can be a more cost-effective investment option for long-term investors. Mutual funds generally fall into two categories: load funds, which charge a fee for buying or selling shares, and no-load funds, which do not. No transaction fee mutual funds are a subset of no-load funds, offering investors the additional benefit of not having to pay any fees for transactions made within the fund. One of the primary benefits of NTF mutual funds is the cost savings they offer investors. Without the burden of transaction fees, investors can allocate more of their investment capital directly to the fund, potentially increasing their returns over time. This benefit can be especially significant for investors who make frequent transactions, such as dollar-cost averaging or portfolio rebalancing. NTF mutual funds encourage long-term investing by eliminating the fees associated with buying and selling shares. This approach can help investors resist the temptation to time the market or engage in short-term trading strategies, which can lead to higher costs and lower returns. By promoting a long-term investment mindset, NTF mutual funds can contribute to a more disciplined and successful investment strategy. Many brokerage firms and investment platforms offer a broad selection of NTF mutual funds, providing investors with access to a diverse array of investment options. This variety allows investors to build a well-diversified portfolio tailored to their specific investment goals and risk tolerance. While NTF mutual funds do not charge transaction fees, they may have higher expense ratios compared to other mutual funds. The expense ratio is the annual fee that covers the fund's operating expenses, such as management fees, administrative costs, and marketing expenses. A higher expense ratio can eat into an investor's returns over time, potentially offsetting the cost savings from the absence of transaction fees. Although many brokerage firms offer a wide range of NTF mutual funds, the selection may be more limited compared to the entire universe of mutual funds available in the market. This constraint can make it challenging for investors to find the ideal fund that aligns with their investment goals and risk tolerance. Some NTF mutual funds may have hidden fees that investors should be aware of, such as redemption fees, account maintenance fees, or minimum investment requirements. These fees can add up over time, potentially eroding the cost savings associated with no transaction fees. It's essential for investors to thoroughly research and understand the fee structure of any NTF mutual fund before investing. The first step in investing in NTF mutual funds is selecting a brokerage firm or investment platform that offers a wide range of NTF mutual funds. Many online brokerages and discount brokers provide access to NTF mutual funds, often through partnerships with fund families or investment managers. It's crucial to compare different brokerages and platforms to find the one that best meets your needs and investment objectives. Once you've chosen a brokerage or investment platform, the next step is to research the available NTF mutual funds to find those that align with your investment goals and risk tolerance. Look for funds with strong historical performance, low expense ratios, and solid management teams. Be sure to consider various factors, such as the fund's investment objective, holdings, and sector allocation. Diversification is crucial for any investment portfolio, and NTF mutual funds can play an essential role in achieving this goal. When building your portfolio, aim to include a mix of different asset classes, such as stocks, bonds, and cash equivalents, to spread risk and enhance returns. Diversification can be further achieved by investing in NTF mutual funds that focus on various sectors, geographies, and investment styles. Regularly monitoring your NTF mutual fund investments is critical to ensure that your portfolio remains aligned with your investment goals and risk tolerance. Over time, market fluctuations and changes in the values of your investments may require you to rebalance your portfolio to maintain the desired asset allocation. Remember that one of the advantages of NTF mutual funds is the absence of transaction fees, making portfolio rebalancing more cost-effective. While both NTF mutual funds and ETFs can offer cost savings to investors, their fee structures differ significantly. NTF mutual funds eliminate transaction fees, but they may have higher expense ratios compared to ETFs. In contrast, ETFs usually have lower expense ratios but incur trading commissions and bid-ask spreads, which can add up for frequent traders. ETFs are traded on exchanges like stocks, providing intraday liquidity and allowing investors to buy or sell shares at any time during the trading day. NTF mutual funds, on the other hand, are bought and sold only at the end of the trading day at their net asset value (NAV). This difference in trading flexibility may appeal to active traders who prefer the immediacy and control offered by ETFs. ETFs tend to be more tax-efficient than mutual funds due to their unique creation and redemption process. This structure allows ETFs to avoid triggering capital gains taxes when buying and selling underlying securities. In contrast, mutual funds may generate more capital gains taxes for investors when the fund manager buys and sells securities within the fund. Both NTF mutual funds and ETFs offer a wide range of investment strategies, including passive index-tracking, active management, and thematic investing. However, ETFs typically have a greater focus on passive strategies, while mutual funds are more likely to be actively managed. The choice between NTF mutual funds and ETFs will depend on the investor's preferences and desired level of involvement in their investment strategy. Before investing in NTF mutual funds, it is crucial to have a clear understanding of your investment goals, time horizon, and risk tolerance. This information will help you select the appropriate funds that align with your financial objectives and risk appetite. Researching the fund management team's expertise, experience, and track record is essential when selecting NTF mutual funds. Analyze the fund's historical performance, risk-adjusted returns, and consistency over time to determine if the fund is a good fit for your investment strategy. Regularly reviewing your NTF mutual fund investments and assessing their performance in relation to your overall investment strategy is crucial. Rebalancing your portfolio periodically will help you maintain your desired asset allocation and manage risk effectively. Keeping up to date with market trends, economic news, and industry developments can help you make informed decisions about your NTF mutual fund investments. This knowledge will enable you to adjust your investment strategy as needed and capitalize on new opportunities as they arise. No transaction fee mutual funds offer a compelling investment option for investors looking to reduce their costs and encourage a long-term investment mindset. These funds provide investors with cost savings and access to a diverse range of investment options. However, it's essential to consider the potential drawbacks of NTF mutual funds, such as higher expense ratios and possible hidden fees. Investors should research and understand the fee structure of any NTF mutual fund before investing, and diversify their portfolio to achieve a mix of different asset classes. They should also regularly monitor their investments and rebalance their portfolio when necessary to maintain the desired asset allocation. While NTF mutual funds and ETFs both offer cost savings to investors, their fee structures differ significantly, and investors should carefully consider their trading preferences and tax efficiency before choosing either option. Overall, NTF mutual funds can be an excellent option for investors looking to build a cost-effective and diversified investment portfolio.What Is a No Transaction Fee Mutual Fund?

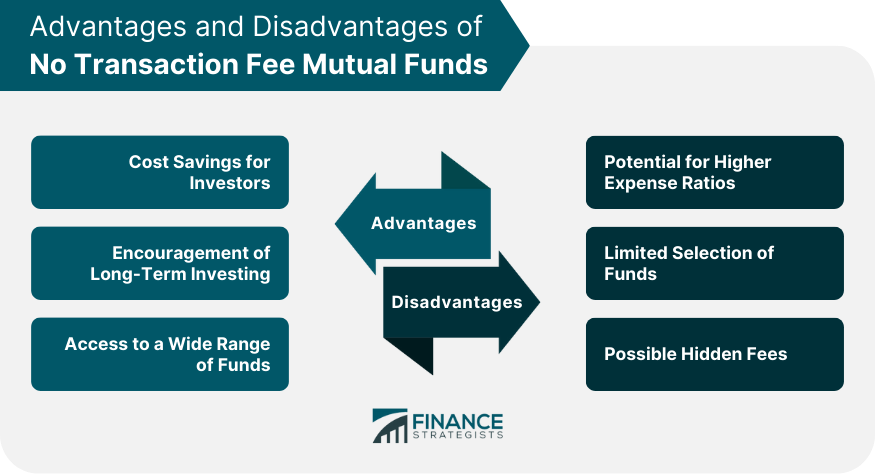

Advantages of No Transaction Fee Mutual Funds

Cost Savings for Investors

Encouragement of Long-Term Investing

Access to a Wide Range of Funds

Disadvantages of No Transaction Fee Mutual Funds

Potential for Higher Expense Ratios

Limited Selection of Funds

Possible Hidden Fees

How to Invest in No Transaction Fee Mutual Funds

Choosing a Brokerage or Investment Platform

Researching Suitable Funds

Diversifying Your Portfolio

Monitoring and Rebalancing Your Investments

No Transaction Fee Mutual Funds vs Exchange-Traded Funds (ETFs)

Fee Structures Comparison

Liquidity and Trading Flexibility

Tax Efficiency

Investment Strategies

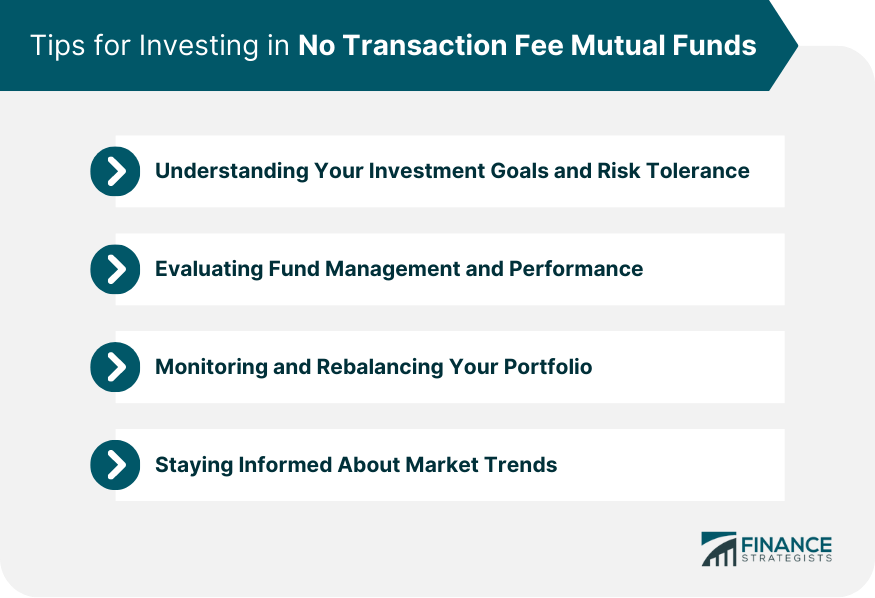

Tips for Investing in No Transaction Fee Mutual Funds

Understanding Your Investment Goals and Risk Tolerance

Evaluating Fund Management and Performance

Monitoring and Rebalancing Your Portfolio

Staying Informed About Market Trends

Final Thoughts

No Transaction Fee Mutual Fund FAQs

A no transaction fee mutual fund is a type of mutual fund that investors can buy and sell without paying any transaction fees or sales charges. These funds are typically offered through brokerage firms and online trading platforms.

The main advantage of investing in a no transaction fee mutual fund is that investors can avoid paying fees that can eat into their returns. Since these funds do not charge transaction fees, investors can buy and sell shares of the fund without incurring any additional costs.

No, not all mutual funds are available as no transaction fee mutual funds. Only a select group of mutual funds are available as no transaction fee funds, and the selection can vary depending on the brokerage or online trading platform.

While no transaction fee mutual funds do not charge fees for buying or selling shares, they may still have other fees associated with them, such as expense ratios and management fees. It's important to carefully review the fees associated with any mutual fund before investing.

No transaction fee mutual funds can be a good choice for investors who want to minimize fees and transaction costs. However, it's important to carefully evaluate any investment before making a decision, taking into account factors such as the fund's investment strategy, past performance, and overall risk level.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.