An Open-Ended Investment Company is a type of investment fund that is structured as a company and issues shares to investors. OEICs are similar to mutual funds in that they pool together money from a large number of investors to invest in a diversified portfolio of assets, such as stocks, bonds, and other securities. However, unlike mutual funds, OEICs are structured as companies and issue shares that can be bought and sold on the open market, like stocks. OEICs are "open-ended" because they can issue an unlimited number of shares to investors and can also buy back shares from investors when they choose to sell. This means that the size of the fund can grow or shrink as investors buy or sell shares, and the fund's net asset value (NAV) is recalculated daily to reflect the current value of its underlying assets. OEICs are typically managed by professional investment managers who make investment decisions on behalf of the fund and aim to achieve the fund's investment objectives. Investors in OEICs are typically charged an ongoing management fee, which covers the costs of managing the fund, as well as other expenses such as administrative and marketing costs. OEICs are structured as corporations and are governed by a board of directors. They issue shares to investors and have a variable capital structure, allowing the number of shares in circulation to increase or decrease as investors buy or sell shares. Some OEICs offer multiple share classes, each with different fee structures and investment minimums, to cater to various investor types. An OEIC relies on several key service providers to manage its day-to-day operations. The investment manager is responsible for making investment decisions and managing the portfolio in line with the fund's objectives. A fund administrator handles administrative tasks such as accounting, shareholder services, and regulatory reporting. Lastly, a custodian and depositary safeguard the fund's assets and ensure compliance with regulatory requirements. Equity funds primarily invest in stocks of publicly traded companies. They may focus on specific regions (e.g., U.S., Europe, or emerging markets), sectors (e.g., technology, healthcare, or financials), or investment styles (e.g., growth, value, or dividend investing). Fixed-income funds invest in debt securities such as government bonds, corporate bonds, and asset-backed securities. These funds typically aim to generate income for investors while preserving capital. They may focus on different credit qualities (e.g., investment grade, high yield) or maturities (e.g., short, intermediate, or long-term). Money market funds invest in short-term debt securities, such as treasury bills, commercial paper, and certificates of deposit. These funds aim to provide investors with liquidity, capital preservation, and a stable income stream. Multi-asset funds invest in a diversified mix of asset classes, including equities, fixed income, and alternatives (e.g., commodities, real estate, or private equity). These funds typically aim to balance risk and return by adjusting their asset allocations based on market conditions and economic outlook. Property funds invest in real estate, either directly through property ownership or indirectly through real estate investment trusts (REITs) and property-related securities. These funds typically target income generation and capital appreciation through rental income and property value appreciation. Specialist and thematic funds focus on specific investment themes or sectors, such as infrastructure, renewable energy, or artificial intelligence. These funds typically aim to capitalize on long-term trends and structural changes in the economy. OEICs are managed by professional investment managers with expertise in portfolio construction, risk management, and asset selection. This allows investors to benefit from the manager's knowledge and experience without having to manage their investments actively. OEICs invest in a broad range of assets, which can help to reduce risk by spreading investments across different sectors, regions, and asset classes. Diversification is particularly beneficial for smaller investors who may not have the resources to create a well-diversified portfolio on their own. OEIC shares can generally be bought or sold on any business day, providing investors with the flexibility to enter or exit their investments as needed. This liquidity is particularly advantageous for investors who may need access to their funds on short notice or wish to rebalance their portfolios periodically. OEICs offer a wide variety of investment options, catering to different risk tolerances, investment horizons, and objectives. Investors can choose from various fund types, investment styles, and asset classes, allowing them to create a customized investment portfolio that meets their specific needs. Investing in an OEIC can be cost-efficient due to economies of scale. As the fund's assets grow, the fixed costs of managing the fund can be spread across a larger asset base, potentially resulting in lower fees for investors. OEICs are subject to strict regulatory requirements, which ensure transparency in their operations, investment strategies, and performance reporting. Investors can access information on the fund's holdings, fees, and performance through regular financial statements and other disclosures. Investments in OEICs are subject to market risk, which refers to the potential for losses due to fluctuations in market prices. Market risk can be influenced by various factors, including economic conditions, interest rates, and geopolitical events. Fixed-income funds, in particular, are exposed to credit risk, which is the risk that the issuer of a debt security may default on its interest or principal payments. Higher credit risk can result in higher yields but also increases the potential for losses. Fixed-income investments are sensitive to changes in interest rates. When interest rates rise, bond prices tend to fall, which can lead to losses for fixed-income fund investors. OEICs that invest in foreign securities may be subject to currency risk, which arises from fluctuations in exchange rates. Currency risk can impact the value of an investor's holdings and may lead to losses if the investor's base currency appreciates against the currency of the foreign investment. While OEICs generally offer daily liquidity, there may be instances where the fund's assets become difficult to sell, potentially leading to delays in redemptions or even temporary suspensions. Liquidity risk can be higher for funds investing in less liquid asset classes, such as property or emerging market securities. OEICs are subject to operational risks related to their day-to-day management, such as errors in valuation, trade execution, or settlement. While these risks are typically managed through robust controls and oversight, unforeseen issues can still occur and potentially impact the fund's performance. Investors should consider the tax implications of investing in OEICs, as different fund structures and investment types may be subject to varying tax treatments. It is essential for investors to consult with a tax professional to understand the specific tax implications of their investments. Investors can purchase OEIC shares directly from the fund provider through their websites or by phone. This approach typically involves lower fees but may require a more substantial initial investment. Investors can seek advice from financial advisors who can recommend suitable OEICs based on their individual needs, risk tolerance, and investment objectives. Financial advisors may charge a fee for their services or receive a commission from the fund provider. Investors can access OEICs through online platforms and brokers, which allow them to compare, buy, and sell funds from various providers. This option offers convenience and the ability to consolidate investments in one place, although transaction fees and platform charges may apply. OEICs can also be accessed through workplace pension schemes and self-invested personal pensions (SIPPs). These options allow investors to benefit from tax advantages while building a diversified retirement portfolio. Several key performance indicators (KPIs) can be used to evaluate the performance of OEICs. The net asset value (NAV) represents the per-share value of the fund's assets, while the total return measures the fund's overall performance, including capital gains and income distributions. Alpha and beta are metrics used to assess the fund's risk-adjusted performance compared to a benchmark index. OEIC performance is often compared to a benchmark index, which serves as a reference point for evaluating the fund's performance. Benchmarks can be broad market indices, such as the S&P 500 or FTSE 100, or more specific indices tailored to the fund's investment focus. Risk-adjusted performance measures take into account both the fund's returns and the level of risk involved in achieving those returns. Common risk-adjusted performance metrics include the Sharpe ratio, Sortino ratio, and the Treynor ratio. These metrics help investors to assess the efficiency of the fund in balancing risk and return. Several independent research firms and rating agencies provide ratings and rankings for OEICs based on various factors, including performance, risk, fees, and manager tenure. Some well-known rating providers include Morningstar, Lipper, and Standard & Poor's. These ratings can serve as a useful starting point for investors when selecting OEICs but should not be the sole basis for investment decisions. In the United Kingdom, OEICs are regulated by the Financial Conduct Authority (FCA), which enforces rules and guidelines to ensure transparency, investor protection, and market integrity. Many OEICs are structured as Undertakings for Collective Investment in Transferable Securities (UCITS) or are subject to the Alternative Investment Fund Managers Directive (AIFMD). These European regulatory frameworks impose stringent requirements on fund management, risk management, and reporting to ensure a high level of investor protection. OEICs are subject to know-your-customer (KYC) and anti-money laundering (AML) regulations, which require them to verify the identity of their investors and monitor transactions to prevent financial crime. OEICs are required to provide regular financial statements and other disclosures to investors and regulators, including information on their holdings, fees, performance, and risk profile. These reporting requirements help ensure transparency and enable investors to make informed investment decisions. In summary, Open Ended Investment Companies provide a flexible and diverse investment vehicle for investors, offering exposure to various asset classes, sectors, and investment styles. The key benefits of investing in OEICs include professional management, diversification, liquidity, flexibility, cost efficiency, and transparency. However, investors must also consider the risks and implications associated with OEIC investments, such as tax implications and market, credit risk, interest rate, currency, liquidity, and operational risks. It is crucial to evaluate each OEIC's performance using metrics like net asset value (NAV), total return, risk-adjusted performance, and fund ratings and rankings. Investing in OEICs can be approached through direct investment, financial advisors, online platforms and brokers, or workplace pensions and SIPPs. By understanding the structure, advantages, risks, and trends associated with OEICs, investors can make informed decisions and build diversified portfolios that align with their financial goals and risk tolerance.What Is an Open Ended Investment Company (OEIC)?

Structure and Functioning of an Open Ended Investment Company

Legal Structure

Operational Aspects

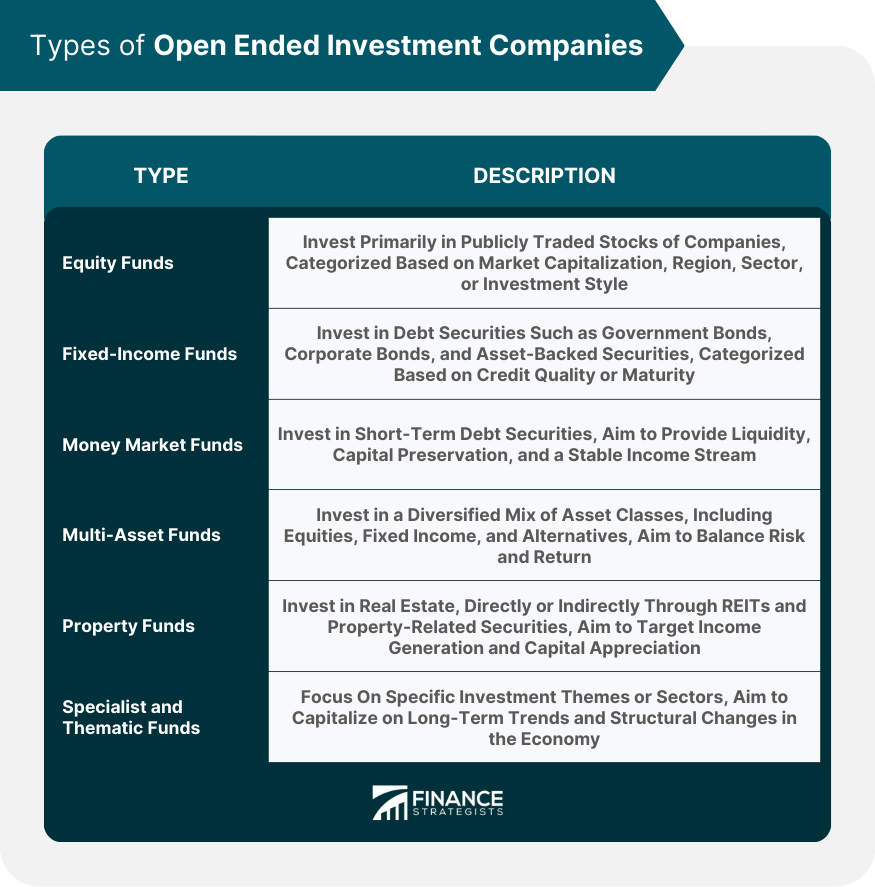

Types of Open Ended Investment Companies

Equity Funds

Fixed-Income Funds

Money Market Funds

Multi-Asset Funds

Property Funds

Specialist and Thematic Funds

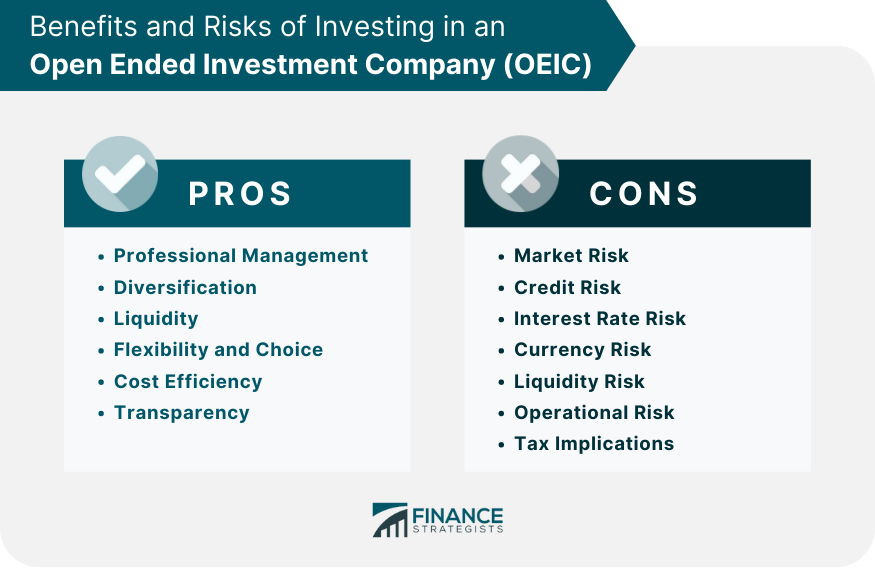

Advantages of Investing in an Open Ended Investment Company

Professional Management

Diversification

Liquidity

Flexibility and Choice

Cost Efficiency

Transparency

Risks and Considerations of Investing in an Open Ended Investment Company

Market Risk

Credit Risk

Interest Rate Risk

Currency Risk

Liquidity Risk

Operational Risk

Tax Implications

How to Invest in an Open Ended Investment Company

Direct Investment

Financial Advisors

Online Platforms and Brokers

Workplace Pensions and SIPPs

Performance Measurement of Open Ended Investment Companies

Key Performance Indicators

Benchmark Comparisons

Risk-Adjusted Performance

Fund Ratings and Rankings

Regulatory and Compliance Requirements for Open Ended Investment Companies

Financial Conduct Authority (FCA) Regulation

UCITS and AIFMD Frameworks

KYC and AML Requirements

Reporting and Disclosure Obligations

Final Thoughts

Open Ended Investment Company (OEIC) FAQs

An Open Ended Investment Company is a type of investment fund that operates as a company. It can issue and redeem shares on a continuous basis, based on investor demand.

Unlike traditional investment companies, OEICs can issue and redeem shares on a continuous basis. This means that the size of the fund can increase or decrease based on investor demand, rather than being fixed at a certain number of shares.

OEICs are regulated by the Financial Conduct Authority (FCA) in the UK. They are required to meet certain regulatory standards in order to operate, including rules on the management of the fund, the provision of information to investors, and the handling of investor complaints.

Investing in an OEIC can provide diversification benefits, as the fund may hold a variety of different assets. Additionally, because the size of the fund can increase or decrease based on investor demand, the fund manager can more easily adjust the fund's holdings to respond to changing market conditions.

As with any investment, there are risks associated with investing in an OEIC. These can include fluctuations in the value of the underlying assets, the possibility of the fund underperforming its benchmark, and the risk that the fund manager may make poor investment decisions. Additionally, investors may be exposed to currency risk if the fund invests in assets denominated in foreign currencies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.