Money mutual funds are a type of investment vehicle that pools money from various investors to purchase a diversified portfolio of securities. These funds are managed by professional investment managers who allocate the fund's assets to pursue a specific financial goal. Treasury money mutual funds specifically invest in United States Treasury securities, which include bills, notes, bonds, and Treasury Inflation-Protected Securities (TIPS). The primary objective of these funds is to provide investors with a secure and stable means of earning interest income. The types of securities held by treasury money mutual funds include a variety of short, medium, and long-term Treasury securities. These may comprise Treasury bills (T-bills), Treasury notes (T-notes), Treasury bonds (T-bonds), and Treasury Inflation-Protected Securities (TIPS). T-bills are short-term securities with maturities of one year or less. They are sold at a discount to their face value and do not pay interest before maturity. Instead, their return comes from the difference between the purchase price and the value at maturity. T-notes are medium-term securities with maturities ranging from 2 to 10 years. They pay interest semi-annually and return the face value to the investor at maturity. T-bonds are long-term securities with maturities of 20 to 30 years. Like T-notes, they pay interest semi-annually and return the face value at maturity. TIPS are securities that protect against inflation. They pay interest semi-annually and adjust the principal value based on changes in the Consumer Price Index (CPI). Fund managers buy and sell Treasury securities in the open market, based on the fund's investment objectives and market conditions. The NAV of a fund is calculated daily, by dividing the total value of the fund's assets, minus its liabilities, by the number of outstanding shares. This NAV fluctuates based on the value of the securities in the fund's portfolio and the amount of interest they accrue. Interest earned on Treasury securities is typically distributed to investors in the form of dividends. These payments can be received as cash or reinvested to buy additional shares of the fund. Short-term treasury funds primarily invest in T-bills and other securities with maturities of one year or less. These funds offer lower yields but also lower risk. Medium-term funds invest in a mix of T-bills, T-notes, and other securities with maturities between one and ten years. These funds strike a balance between risk and yield. Long-term funds invest predominantly in T-bonds and other securities with maturities of ten years or more. These funds offer higher yields but also greater exposure to interest rate risk. Treasury money mutual funds are considered a low-risk investment because the securities they invest in are backed by the full faith and credit of the U.S. government. This means that the government guarantees the repayment of principal and interest, which makes these funds an extremely safe investment. Another aspect of their low-risk nature is the stable value of these funds. Because they invest in fixed-income securities, these funds generally maintain a stable net asset value (NAV). Treasury money mutual funds provide high liquidity, meaning investors can easily redeem their shares at any time. This makes these funds an excellent choice for investors seeking easy access to their money. Unlike certain investments, there is no minimum holding period for treasury money mutual funds. Investors can buy and sell shares of the fund on any business day without penalty. One of the major tax advantages of treasury money mutual funds is that the interest income they generate is exempt from state and local income taxes. Additionally, Treasury securities receive favorable federal tax treatment. While the interest income is subject to federal income tax, it may be taxed at a lower rate than ordinary income. While treasury money mutual funds offer safety and stability, they typically provide lower returns than riskier investments like stocks or corporate bonds. Interest rate risk is the risk that the value of a bond will decrease due to a rise in interest rates. When interest rates rise, bond prices fall, and vice versa. This can impact the NAV of a treasury money mutual fund. Reinvestment risk is the risk that the interest income from a fund will have to be reinvested at a lower rate if interest rates have fallen. This can lower the overall return of the fund. Inflation risk is the risk that the purchasing power of the returns from a fund will be eroded by inflation. This is a particular concern for long-term funds, as the purchasing power of their returns can be significantly reduced over time. The real return of an investment is the return after adjusting for inflation. If the inflation rate is higher than the return rate of a fund, the real return can be negative. When selecting a treasury money mutual fund, consider the reputation and track record of the fund manager. A skilled and experienced manager can significantly impact the performance of a fund. The past performance of a fund can provide valuable insight into its potential future returns. However, past performance is not a guarantee of future results. The expense ratio is the annual fee that all funds charge their shareholders. It's important to choose a fund with a low expense ratio, as high fees can significantly reduce your returns. Make sure the fund's investment strategy and objectives align with your own investment goals and risk tolerance. Look at the fund's portfolio composition to understand what types of securities it invests in and how diversified it is. A fund company's customer service and support can be crucial in providing information and resolving any issues you may have. The SEC is the primary regulator of mutual funds in the United States. It enforces securities laws and protects investors. FINRA is a self-regulatory organization that oversees brokerage firms and their registered representatives. It enforces rules and regulations related to the sale of mutual funds. The Investment Company Act of 1940 is the primary source of regulation for mutual funds. It contains standards for the organization, management, and operation of mutual funds to protect investors. In addition to federal regulations, mutual funds are also subject to state securities laws, which are enforced by state regulatory authorities. United States Treasury Money Mutual Funds play an essential role in the financial ecosystem. They offer a safe and stable investment option for conservative investors, those nearing retirement, or anyone looking for a place to park their cash with a low risk of loss. When considering investing in a Treasury money mutual fund, it's important to understand both the benefits and the potential risks. While these funds offer significant advantages, such as low risk, high liquidity, and tax advantages, they also have limitations, including lower returns compared to other investments, interest rate risk, and inflation risk. The future of Treasury money mutual funds looks positive. As long as the U.S. government continues to issue Treasury securities, these funds will continue to be a vital part of the investment landscape. Advancements in technology and changes in regulatory policies may also influence the future development and operation of these funds. However, as with any investment, potential future changes must be closely monitored to ensure a solid return on investment.United States Treasury Money Mutual Funds: Overview

How United States Treasury Money Mutual Funds Work

Types of Treasury Securities

Treasury Bills (T-Bills)

Treasury Notes (T-Notes)

Treasury Bonds (T-Bonds)

Treasury Inflation-Protected Securities (TIPS)

Investment Process

Buying and Selling Treasury Securities

Determining the Net Asset Value (NAV)

Dividends and Interest Payments

Duration and Maturity

Short-Term Funds

Medium-Term Funds

Long-Term Funds

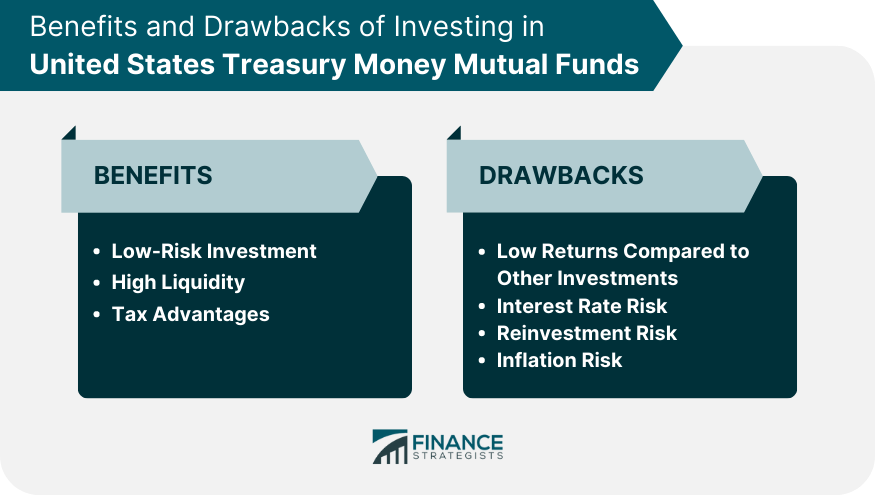

Benefits of Investing in United States Treasury Money Mutual Funds

Low Risk Investment

Backed by the US Government

Stable Value

High Liquidity

Easy Access to Funds

No Minimum Holding Period

Tax Advantages

Exemption From State and Local Income Taxes

Favorable Federal Tax Treatment

Risks and Drawbacks of Investing in United States Treasury Money Mutual Funds

Low Returns Compared to Other Investments

Interest Rate Risk

Impact on Bond Prices

Reinvestment Risk

Inflation Risk

Erosion of Purchasing Power

Real Returns

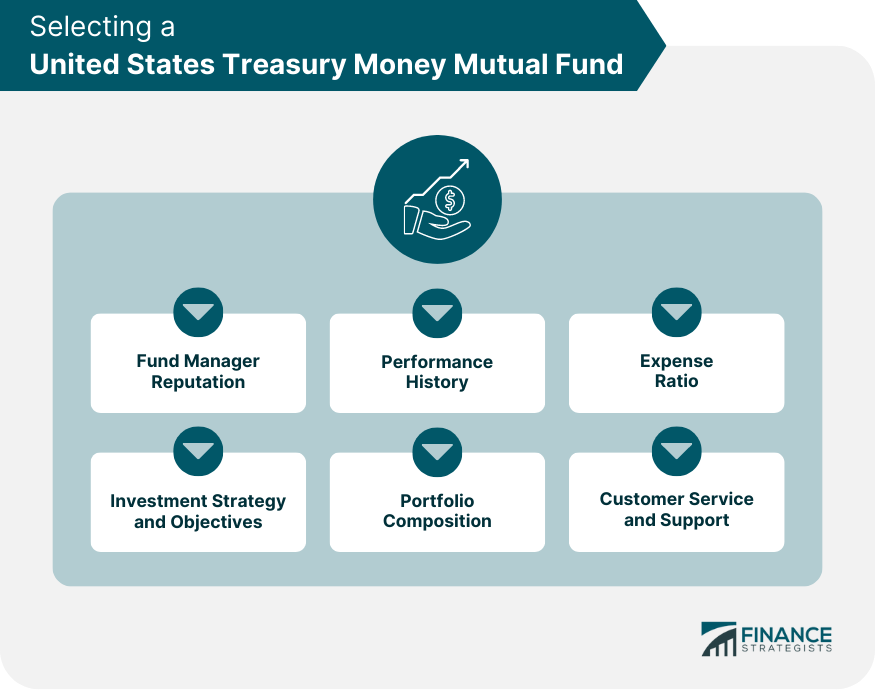

Selecting a United States Treasury Money Mutual Fund

Fund Manager Reputation

Performance History

Expense Ratio

Investment Strategy and Objectives

Portfolio Composition

Customer Service and Support

Regulations and Industry Oversight on United States Treasury Money Mutual Fund

Securities and Exchange Commission (SEC)

Financial Industry Regulatory Authority (FINRA)

Investment Company Act of 1940

State Regulatory Authorities

Conclusion

United States Treasury Money Mutual Fund FAQs

United States Treasury Money Mutual Funds are mutual funds that invest in short-term debt securities issued by the U.S. Treasury. These securities include Treasury bills, notes, and bonds, which have a maturity of one year or less.

The primary objective of United States Treasury Money Mutual Funds is to provide investors with a safe, low-risk, and high-liquidity investment option. These funds aim to preserve capital and generate income through short-term investments in U.S. Treasury securities.

United States Treasury Money Mutual Funds pool money from individual investors and invest it in a diversified portfolio of U.S. Treasury securities. The funds are managed by professional investment managers who aim to maintain a stable net asset value (NAV) of $1 per share. The income generated from the securities is distributed to the investors in the form of dividends.

Investing in United States Treasury Money Mutual Funds can provide investors with a safe and stable investment option. The funds have low risk and are highly liquid, making them an ideal investment for investors looking to preserve their capital and generate income in the short term. The funds are also backed by the U.S. government, which provides an additional layer of safety for investors.

United States Treasury Money Mutual Funds may not be suitable for all investors. These funds have low returns compared to other investment options and are subject to interest rate risk. Investors who are looking for higher returns may need to consider other investment options. However, for investors

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.