A Voluntary Accumulation Plan (VAP) is a savings or investment strategy, often sponsored by employers, wherein individuals can choose to contribute a portion of their income toward a specified investment vehicle. This systematic approach allows individuals to build their wealth over time, often benefiting from compound interest and tax advantages. The funds accumulated can be used for a variety of purposes, most commonly retirement. The primary purpose of a VAP is to facilitate long-term savings and investments, enabling individuals to accumulate wealth over their working lives. These plans often come with significant tax advantages, such as tax-deductible contributions or tax-free growth. Moreover, many employers offer matching contributions, effectively providing "free money" to incentivize participation in these plans. One of the key benefits of a VAP is that it encourages disciplined, regular savings. By automating contributions from each paycheck, individuals can "set and forget" their savings, reducing the temptation to spend and increasing the likelihood of achieving their long-term financial goals. An Employee Stock Purchase Plan (ESPP) is a type of voluntary accumulation plan that allows employees to purchase company stock, often at a discount. By contributing a portion of their pre-tax salary, employees can accumulate shares over time and potentially benefit from the growth of the company. One of the most well-known types of VAPs, 401(k) plans, are retirement savings accounts sponsored by employers. Employees can elect to contribute a portion of their pre-tax salary to their 401(k) account, which can then be invested in a variety of assets. Many employers also offer matching contributions up to a certain percentage, providing an additional incentive for employees to save for retirement. Individual Retirement Accounts (IRAs) are another popular type of VAP. Unlike 401(k) plans, which are typically employer-sponsored, IRAs can be opened by individuals, providing a flexible option for those who may not have access to a workplace retirement plan. There are several types of IRAs, including traditional IRAs, Roth IRAs, and SEP IRAs, each with different tax implications and eligibility requirements. Mutual fund accumulation plans allow individuals to invest in mutual funds on a regular schedule, often with low minimum investment requirements. These plans take advantage of dollar-cost averaging, a strategy that involves investing a fixed amount at regular intervals, regardless of the share price. Over time, this can reduce the average cost per share and potentially increase returns. The eligibility criteria for VAPs depend on the type of plan. For employer-sponsored plans like 401(k)s or ESPPs, you generally need to be a full-time employee and may need to meet certain tenure requirements. For IRAs, eligibility is often based on income and tax filing status. Once you're eligible for a VAP, the registration process typically involves filling out an enrollment form and selecting your contribution amount. For investment-based plans, you'll also need to choose your investments. Most plans offer a range of options, from conservative bonds to riskier stocks, allowing you to tailor your investment strategy to your risk tolerance and financial goals. The selection of investment options in a VAP is a critical step. This is where you decide how your contributions will be invested. The available options typically include a variety of mutual funds, index funds, and sometimes company stock. It's important to diversify your investments to spread risk and align your choices with your investment horizon, risk tolerance, and financial goals. Contributions to a VAP are typically made every pay period, allowing you to build your savings gradually over time. The frequency of your contributions can impact your savings growth due to the power of compound interest - the more frequently you contribute, the faster your savings can grow. There are annual limits on how much you can contribute to a VAP. For example, in 2024, the limit for 401(k) contributions is $23,000 per year for individuals under 50 and $30,500 for those 50 and older. For IRAs, the contribution limit is $7,000 per year or $8,000 for those 50 and older. ESPPs have a limit of $25,000 per year. Any changes to your salary can impact your VAP contributions, particularly if you're contributing a percentage of your income. If your salary increases, your contributions will increase proportionally, accelerating your savings growth. Conversely, a decrease in salary will reduce your contributions. Contributions to a VAP can have significant tax implications. In traditional 401(k) plans and IRAs, your contributions are made pre-tax, reducing your taxable income for the year. Your investments grow tax-deferred, but you'll owe income tax upon withdrawal. On the other hand, Roth 401(k)s and Roth IRAs are funded with after-tax dollars, but withdrawals in retirement are tax-free. ESPPs can offer tax benefits as well, depending on how long you hold the stock. One of the most significant benefits of a VAP is the potential for long-term savings and investment growth. By contributing regularly to a VAP, individuals can take advantage of the power of compounding, where interest is earned on interest, leading to exponential growth over time. Additionally, VAPs often provide access to a diverse array of investments that can further enhance the potential for significant long-term growth. VAPs typically offer significant tax advantages. In traditional IRAs and 401(k) plans, contributions are made with pre-tax dollars, lowering your taxable income. Additionally, any gains or earnings from these investments are tax-deferred until you start making withdrawals. Roth 401(k) plans and Roth IRAs, on the other hand, are funded with after-tax dollars, but qualified distributions are tax-free, allowing your investments to grow tax-free over time. The power of compound interest is a key benefit of VAPs. Compound interest refers to earning interest not only on your original contributions but also on any interest, dividends, and capital gains that accumulate. Over time, this can result in exponential growth of your savings, particularly if you start contributing early and regularly. Many employers offer matching contributions to their employees' 401(k) accounts, providing an excellent incentive to participate in these plans. Employer matches can significantly boost your savings rate, effectively providing you with free money for your retirement. It's wise to contribute at least enough to take full advantage of any employer match. While VAPs can provide significant benefits, they are not without risk. One of the primary risks is market risk, or the potential for investments to lose value due to overall market fluctuations. It's essential to diversify your investments within your VAP to mitigate this risk and align your investment choices with your risk tolerance and time horizon. Early withdrawals from VAPs can result in substantial penalties. For example, withdrawals from a 401(k) or traditional IRA before age 59 ½ are typically subject to a 10% early withdrawal penalty in addition to regular income taxes. It's crucial to consider your liquidity needs before contributing to a VAP and to build an emergency fund separately to avoid the need for early withdrawals. Contributions to a VAP will reduce your take-home pay, which could impact your cash flow. Before starting a VAP, it's essential to create a budget and ensure you can comfortably afford your contributions without sacrificing your other financial obligations. Choosing the right investments within your VAP is critical, but it can be challenging. Investment selection risk refers to the potential for loss due to poor investment choices. Working with a financial advisor or taking the time to educate yourself about investing can help mitigate this risk. Withdrawal rules for VAPs vary based on the type of plan and your age. Generally, you can begin taking penalty-free distributions from your 401(k) or IRA once you reach age 59 ½. Required Minimum Distributions (RMDs), or mandatory withdrawals, typically begin at age 72. As mentioned earlier, taking early withdrawals from your VAP can lead to penalties. However, there are exceptions to this rule for certain situations, such as first-time home purchase, higher education expenses, or certain medical expenses, among others. Understanding these rules can help you avoid unnecessary penalties. The tax implications of withdrawals from a VAP depend on the type of plan. For traditional 401(k) plans and IRAs, withdrawals are taxed as regular income. On the other hand, qualified withdrawals from Roth 401(k) plans and Roth IRAs are tax-free, provided you meet certain conditions. It's important to consider these tax implications when planning your retirement income strategy. A Voluntary Accumulation Plan (VAP) is a type of savings or investment plan that allows individuals to contribute a portion of their income towards a specified investment vehicle, often providing significant tax advantages. There are several types of VAPs, including Employee Stock Purchase Plans (ESPPs), 401(k) plans, Individual Retirement Accounts (IRAs), and Mutual Funds Accumulation Plans. Setting up a VAP involves understanding the eligibility criteria, going through the registration process, and carefully selecting investment options. However, it's essential to consider the potential risks and drawbacks, such as market risk, early withdrawal penalties, impact on cash flow, and investment selection risk. When it's time to withdraw from a VAP, understanding the retirement withdrawal rules, potential early withdrawal penalties, and tax implications of withdrawals is crucial. The benefits of participating in a VAP, such as long-term savings growth, tax advantages, and potential employer-matching contributions, often outweigh the risks for many individuals. If you're considering setting up a VAP, it may be beneficial to seek the advice of a financial advisor or wealth management professional. What Is a Voluntary Accumulation Plan?

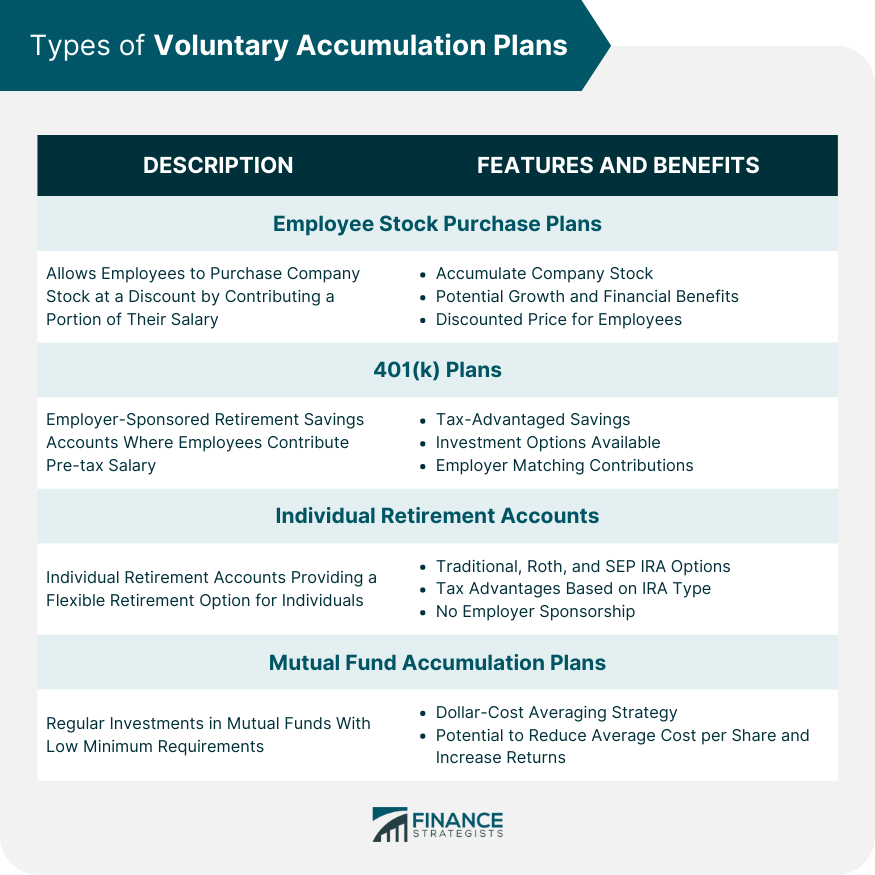

Types of Voluntary Accumulation Plans

Employee Stock Purchase Plans (ESPPs)

401(k) Plans

Individual Retirement Accounts (IRAs)

Mutual Fund Accumulation Plans

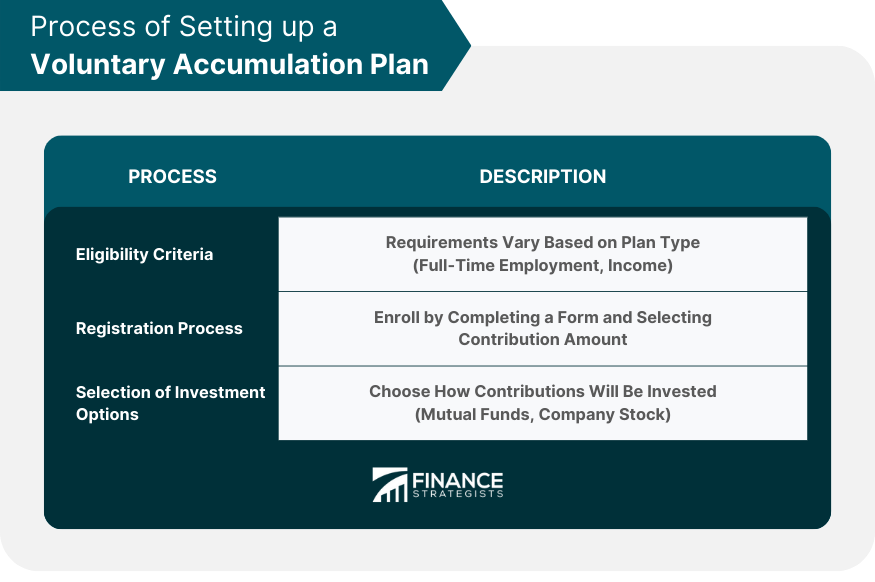

Process of Setting up a Voluntary Accumulation Plan

Eligibility Criteria

Registration Process

Selection of Investment Options

Contributions to a Voluntary Accumulation Plan

Frequency of Contributions

Contribution Limits

Impact of Salary Changes

Tax Implications of Contributions

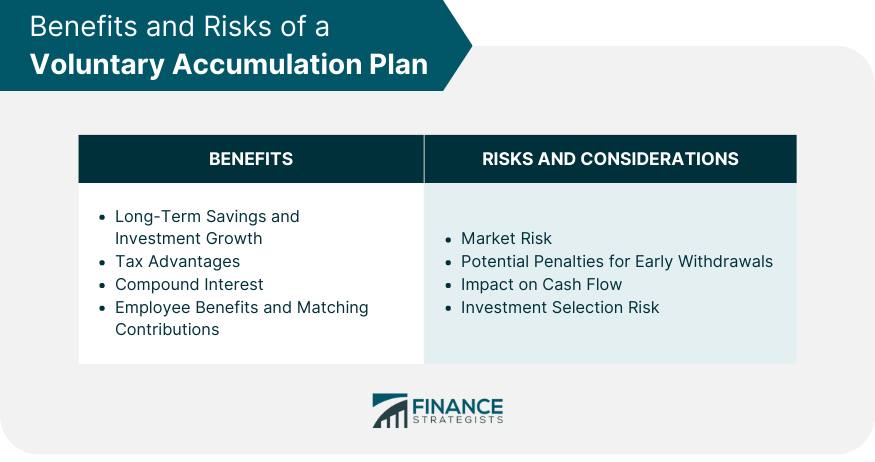

Benefits of a Voluntary Accumulation Plan

Long-Term Savings and Investment Growth

Tax Advantages

Compound Interest

Employee Benefits and Matching Contributions

Risks and Considerations of a Voluntary Accumulation Plan

Market Risk

Potential Penalties for Early Withdrawals

Impact on Cash Flow

Investment Selection Risk

How to Withdraw From a Voluntary Accumulation Plan

Retirement Withdrawal Rules

Early Withdrawal Penalties

Tax Implications of Withdrawals

Final Thoughts

Voluntary Accumulation Plan FAQs

A Voluntary Accumulation Plan (VAP) is a savings or investment strategy that allows individuals to contribute a portion of their income towards a specified investment vehicle, often with tax advantages. VAPs can help individuals accumulate wealth over time, usually for retirement purposes.

There are several types of VAPs, including Employee Stock Purchase Plans (ESPPs), 401(k) plans, Individual Retirement Accounts (IRAs), and Mutual Funds Accumulation Plans. Each type of plan has its own set of rules, benefits, and tax implications.

To set up a VAP, you'll need to meet the eligibility criteria, which may vary depending on the type of plan. For employer-sponsored plans, you typically need to be a full-time employee, while IRAs have income and tax filing status requirements. Once eligible, you'll need to complete the registration process, select your contribution amount, and choose your investments.

The tax advantages of a VAP depend on the type of plan. Traditional 401(k) plans and IRAs allow for pre-tax contributions, reducing your taxable income for the year and tax-deferred growth of your investments. Roth 401(k)s and Roth IRAs, on the other hand, are funded with after-tax dollars, but qualified withdrawals are tax-free.

Risks associated with a VAP include market risk, potential penalties for early withdrawals, impact on cash flow, and investment selection risk. To mitigate these risks, it's essential to diversify your investments, have a contingency plan for market downturns, and seek professional advice or educate yourself on investment strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.