The National Futures Association (NFA) is a self-regulatory organization (SRO) for the US derivatives industry, including futures, forex, and swaps markets. It is headquartered in Chicago, Illinois, with an additional office in New York City. The NFA's primary mission is to safeguard the integrity of the derivatives markets, protect investors, and ensure that its members adhere to ethical standards and regulatory requirements. As an SRO, the NFA operates independently of the government but is subject to oversight by the Commodity Futures Trading Commission (CFTC), the federal agency responsible for regulating the US derivatives markets. The NFA's regulatory activities are funded through membership dues, fees, and assessments paid by its members. The NFA was established in 1982 under the provisions of the Commodity Futures Trading Commission (CFTC) Act of 1974. The CFTC, recognizing the need for a self-regulatory body in the futures industry, granted NFA the status of a registered futures association. The founding objectives of the NFA were to protect investors, maintain high ethical standards, and ensure the integrity of the futures market. Since its inception, the NFA has grown significantly and expanded its regulatory oversight to include other financial instruments, such as swaps and some options markets. Some key milestones in the NFA's history include: 1998: The NFA implemented the first online registration system for futures professionals, known as the Online Registration System (ORS). 2002: The NFA launched its Background Affiliation Status Information Center (BASIC), an online database providing information on the registration and disciplinary history of NFA members and associated persons. 2010: The Dodd-Frank Wall Street Reform and Consumer Protection Act expanded the NFA's regulatory responsibilities to include swap dealers and major swap participants. 2012: The NFA adopted rules for forex dealer members, enhancing the regulatory framework for retail foreign exchange trading. Over the years, the NFA has adapted to changes in the financial industry and expanded its oversight to maintain market integrity and protect investors. Today, the NFA's role extends beyond futures markets, covering swaps and other financial instruments. It also plays an essential role in the development and implementation of industry standards and best practices. There are several categories of NFA membership, including futures commission merchants (FCMs), introducing brokers (IBs), commodity trading advisors (CTAs), commodity pool operators (CPOs), swap dealers (SDs), major swap participants (MSPs), and retail foreign exchange dealers (RFEDs). All entities and individuals that conduct business with the public on US futures and swaps markets must register with the NFA and comply with its rules and regulations. The registration process varies depending on the type of member but typically involves submitting an application, paying registration fees, undergoing a background check, and meeting proficiency requirements. NFA membership comes with several benefits, such as access to educational resources, networking opportunities, and the credibility that comes with being part of a self-regulated organization. However, members must also adhere to the NFA's rules and regulations, maintain accurate records, undergo periodic audits, and cooperate with NFA investigations. The NFA enforces a comprehensive set of rules and regulations governing its members' conduct, designed to ensure market integrity and protect investors. Key areas of regulation include: Registration and proficiency requirements Capital and financial requirements Risk management and internal controls Recordkeeping and reporting Sales practices and customer protection Anti-money laundering and counter-terrorism financing Business conduct standards Cybersecurity and technology risk management Trade practice and market surveillance Dispute resolution and arbitration The NFA monitors its members' compliance with its rules and regulations through regular audits, examinations, and surveillance. It also investigates complaints and potential rule violations. When the NFA detects non-compliance or misconduct, it can take enforcement actions, ranging from issuing warnings and fines to suspending or revoking membership. While the NFA is an independent self-regulatory organization, it works closely with other regulatory agencies, such as the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). The NFA coordinates with these agencies to ensure a consistent and comprehensive regulatory framework for the financial industry. The NFA offers a variety of educational programs and resources for its members and the general public. These include webinars, seminars, conferences, and online learning modules covering various aspects of the derivatives industry, regulatory compliance, and best practices. Investor protection is a core objective of the NFA. The organization provides several resources to help investors make informed decisions and protect themselves from fraud, such as the Background Affiliation Status Information Center (BASIC) and the Investor Complaint Center. The NFA also participates in public awareness campaigns to educate investors about the risks associated with derivatives trading and how to avoid scams. The NFA publishes a wide range of resources, including rulebooks, interpretive notices, and regulatory guides, to help members understand and comply with its rules and regulations. Additionally, the NFA maintains a comprehensive website with information on its regulatory activities, educational programs, and industry news. The NFA conducts ongoing monitoring and surveillance of its members and the derivatives markets to detect potential misconduct, manipulation, or fraud. It uses advanced technology and data analysis tools to identify suspicious trading patterns and potential rule violations. When the NFA identifies potential misconduct or rule violations, it conducts investigations to gather evidence and determine the appropriate enforcement actions. The NFA's disciplinary process involves a fair and impartial hearing, during which the accused member can present their defense. If the NFA finds a member guilty of rule violations, it can impose penalties, such as fines, suspensions, or membership revocations. The NFA's regulatory framework and enforcement activities contribute to creating fair and transparent markets. By ensuring that its members adhere to high ethical standards and comply with industry rules, the NFA helps maintain market integrity and protect investors. Emerging technologies, such as cryptocurrencies and blockchain, pose new challenges for the NFA and the broader financial industry. The NFA must adapt its regulatory framework and oversight mechanisms to address the unique risks and opportunities associated with these innovations. The financial industry is constantly evolving, and the NFA must remain agile in adapting its rules, regulations, and oversight practices to address new products, market structures, and business models. This requires continuous monitoring of industry trends and close collaboration with other regulatory agencies. As financial markets become increasingly interconnected, the NFA must work with international counterparts to address cross-border regulatory challenges and promote global market integrity. This involves participating in international forums, sharing information with foreign regulators, and harmonizing regulatory standards across jurisdictions. The National Futures Association (NFA) is a self-regulatory organization that has a crucial role in safeguarding the integrity of the derivatives market and protecting investors. The NFA enforces a comprehensive set of rules and regulations, provides educational resources, and ensures transparency in the market. This contributes to a stable and secure financial market. As the financial industry continues to evolve and face new challenges, the NFA must remain adaptive and responsive to maintain its effectiveness. To do so, the NFA needs to stay updated with emerging technologies, adapt to changes in the industry, and address global regulatory challenges. By doing this, the NFA can continue to fulfill its mission of safeguarding market integrity and investor protection. A call to action could be to support the NFA's efforts by learning about their resources and following their guidelines to ensure a secure and stable financial market for all.What Is the National Futures Association (NFA)?

The History of the NFA

Formation and Founding Objectives

Key Milestones and Developments

Evolution of the NFA's Role Over Time

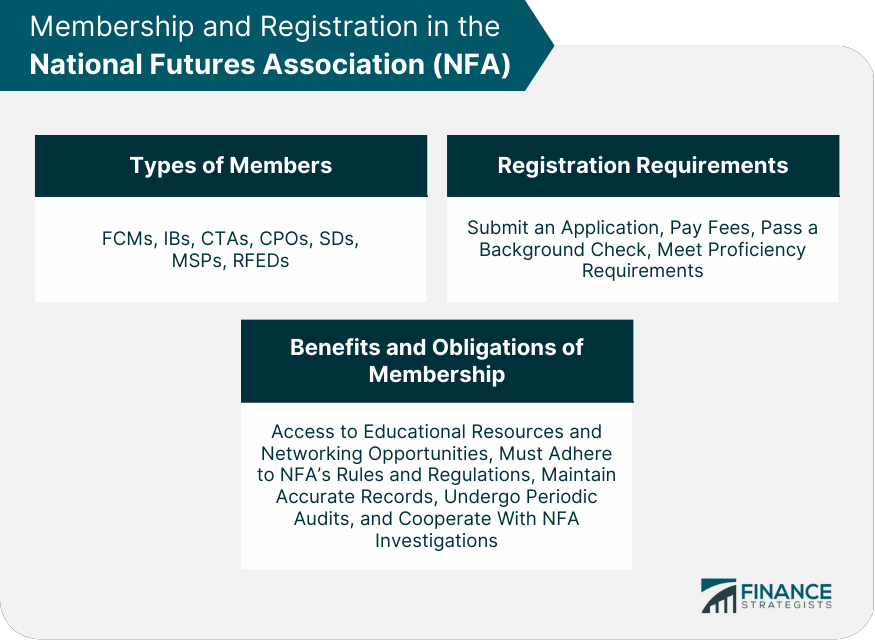

Membership and Registration in the NFA

Types of Members

Registration Requirements

Benefits and Obligations of Membership

Regulatory Framework of the NFA

Key NFA Rules and Regulations

Compliance and Enforcement Mechanisms

Relationship With Other Regulatory Agencies

Education and Resources Provided by the NFA

Educational Programs for Members and the Public

Investor Protection Initiatives

Publications and Online Resources

NFA's Role in Market Integrity and Transparency

Monitoring and Surveillance Activities

Investigative and Disciplinary Processes

Role in Promoting Fair and Transparent Markets

Future Developments and Challenges for the NFA

Impact of Emerging Technologies

Adapting to Changes in the Financial Industry

Addressing Global Regulatory Challenges

Conclusion

National Futures Association (NFA) FAQs

The National Futures Association (NFA) is an independent regulatory organization that oversees the futures market in the United States. It was established in 1982 under the Commodity Futures Trading Commission (CFTC).

The role of the National Futures Association (NFA) is to protect investors and maintain the integrity of the futures market by setting industry standards, enforcing compliance with regulations, and providing education and resources to market participants.

The National Futures Association (NFA) regulates all entities and individuals involved in the futures market, including futures commission merchants, commodity pool operators, commodity trading advisors, introducing brokers, and retail forex dealers.

The National Futures Association (NFA) enforces its regulations through a variety of means, including investigations, audits, and disciplinary actions. It has the authority to impose fines, suspend or revoke registration, and take other actions to ensure compliance with its rules.

You can verify if a futures firm is registered with the National Futures Association (NFA) by using the NFA's online Background Affiliation Status Information Center (BASIC) system. This system allows you to search for firms and individuals registered with the NFA and view their registration status, disciplinary history, and other information.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.