Non-marginable securities are types of investments that cannot be purchased on margin from a brokerage firm. This means investors must fully fund their purchase with their own money, as opposed to borrowing a portion of the purchase price from the brokerage firm. Securities can be designated as non-marginable for a variety of reasons. These typically include higher levels of risk associated with the specific security, lack of liquidity in the market, regulatory constraints, or the financial stability of the company issuing the security. The Financial Industry Regulatory Authority (FINRA) and the Federal Reserve Board, in the United States, set rules about which types of securities can be purchased on margin, but individual brokerage firms may have their own stricter rules. The most prominent feature of non-marginable securities is in the name itself. These types of securities cannot be bought on margin, which means investors must fully fund their purchase with their own capital. They cannot borrow money from a brokerage firm to acquire these securities. This could be due to a variety of factors, including volatility, a lack of financial stability, or regulatory concerns. Because of this high risk, brokerage firms often deem these securities as unsuitable for margin trading to limit potential losses for both the investor and the brokerage. Potential reasons for this could be subdued trading volumes, diminished investor attention, or an absence of market makers. Reduced liquidity can amplify the risk associated with these securities, as it could pose difficulties for investors attempting to offload the security at their preferred price when they decide to close their position. Regulatory bodies like the Securities and Exchange Commission (SEC) may impose restrictions on margin trading for certain types of securities to protect investors and maintain market integrity. These restrictions often apply to newly issued securities, low-priced stocks, and certain types of bonds. Non-marginable securities are not confined to a single asset class. They can be found across various types of investments, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. Each of these can have non-marginable securities depending upon the risk factors, regulatory restrictions, and brokerage policies. Whether a security is marginable or not can also depend on individual brokerage firm policies. While regulatory guidelines set the broad framework, brokerage firms have the discretion to apply stricter rules based on their own risk assessments. Non-marginable securities come in various types, with each category offering different risks and opportunities for investors. While the specific securities deemed non-marginable may vary between brokerages due to their internal policies, certain types of securities are commonly categorized as non-marginable. Consider the following: Securities from a company that has recently gone public are typically non-marginable for the first 30 days after they start trading. This is due to the volatility often associated with newly listed securities. OTC stocks are not traded on a formal exchange like the NYSE or NASDAQ, making them less liquid and more volatile. Because of these risks, they are often deemed non-marginable. Also known as micro-cap stocks, these are low-priced securities that trade for less than $5 per share. They are often considered risky due to their low price, lack of liquidity, and potential for price manipulation, leading many brokerages to classify them as non-marginable. While many mutual funds and ETFs are marginable, some are not. These might include funds that invest in high-risk areas or those that, for various reasons, have been determined by the brokerage to carry additional risk. Some types of bonds, especially those with lower credit ratings, may be non-marginable. Bonds nearing their maturity date may also be considered non-marginable due to the decreased time frame for price recovery if the market drops. While non-marginable securities carry their own set of challenges, they also come with unique advantages that make them a worthy consideration for some investors. The very feature that classifies securities as non-marginable, i.e., they cannot be bought on margin, also acts as a protective barrier against leverage risk. Investors purchasing these securities are not exposed to the potential for losses that exceed their initial investment, a risk associated with buying securities on margin. Many non-marginable securities, such as penny stocks or certain IPOs, carry the potential for significant returns. These securities might be risky and volatile, but they can also provide substantial profits if the investor's predictions about their performance prove accurate. Non-marginable securities can offer access to unique investment opportunities. For instance, investing in an IPO or a smaller company not yet listed on a major exchange can be an opportunity for substantial growth if the company performs well. With non-marginable securities, investors don't have to worry about margin calls because they aren't borrowing money from the broker to purchase these securities. This absence of debt reduces stress and provides financial stability, especially in volatile market conditions. Non-marginable securities require upfront payment in full, promoting financial discipline among investors. Since you can't borrow to purchase these securities, it encourages careful financial planning, diligent research, and thoughtful decision-making. While non-marginable securities can offer substantial returns, they also come with a unique set of drawbacks and risks that investors should be aware of. Non-marginable securities often come with higher levels of risk and volatility. This is typically because these securities include assets like penny stocks or newly issued securities that can exhibit significant price swings. Many non-marginable securities suffer from low liquidity. This means that there may not always be a buyer when you wish to sell, potentially forcing you to sell at a less than ideal price. Moreover, low liquidity can lead to higher volatility, which adds to the investment risk. Non-marginable securities often face more regulatory restrictions than marginable securities. These regulations can limit the investor's ability to buy or sell these securities, potentially impacting their investment strategy. Since non-marginable securities can't be purchased on margin, they require more upfront capital. This can limit an investor's ability to diversify their portfolio or invest in other opportunities that may arise. It is crucial to thoroughly analyze the risks associated with non-marginable securities before investing. These securities typically carry higher risks and volatility than their marginable counterparts. Investors should tailor their portfolio to their risk tolerance, adjusting the proportion of non-marginable securities accordingly. Non-marginable securities are not suited for short-term trading strategies due to their inherent risks and volatility. Instead, investors may consider a long-term investment perspective, focusing on securities with solid fundamentals despite their non-marginable status. Investing in a variety of non-marginable securities across different sectors and asset classes can help manage risk. This ensures that the portfolio is not overly dependent on the performance of a single security or sector. If options are available, investors can use them to hedge against potential losses. For instance, buying put options can help limit downside risk. Inverse ETFs can be used to hedge against market downturns. These ETFs are designed to move in the opposite direction of a particular index or asset class. Given the inability to trade non-marginable securities on margin, investors should maintain sufficient cash reserves to allow for flexibility in trading and managing their portfolio. Investors should regularly monitor the liquidity of non-marginable securities. If liquidity decreases significantly, it may be harder to sell the security without impacting its price. A portion of the portfolio should be allocated to liquid, marginable securities. This can provide a buffer in terms of liquidity and help to meet any unexpected cash needs. Non-marginable securities present unique characteristics and considerations for investors. These securities cannot be purchased on margin, requiring investors to fully fund their purchases with their own capital. Non-marginable securities offer benefits such as limitations on leverage risk, the potential for high returns, access to unique investment opportunities, and promoting financial discipline. However, investors should be aware of the drawbacks associated with non-marginable securities, including higher risk and volatility, lack of liquidity, regulatory restrictions, and the requirement of more upfront capital. It is crucial for investors to conduct thorough risk assessments, adopt a long-term perspective, diversify their portfolios, employ hedging strategies, and practice effective liquidity management. By considering implementing sound investment practices, investors can navigate the unique landscape of non-marginable securities and make informed decisions that align with their risk tolerance and investment goals.What Are Non-marginable Securities?

Key Features of Non-marginable Securities

Cannot Be Purchased on Margin

Often High Risk

Limited Liquidity

Subject to Regulatory Restrictions

Varying Types

Subject to Brokerage Policies

Types of Non-marginable Securities

Initial Public Offering (IPO) Shares

Over-The-Counter (OTC) Stocks

Penny Stocks

Certain Mutual Funds and ETFs

Certain Bonds

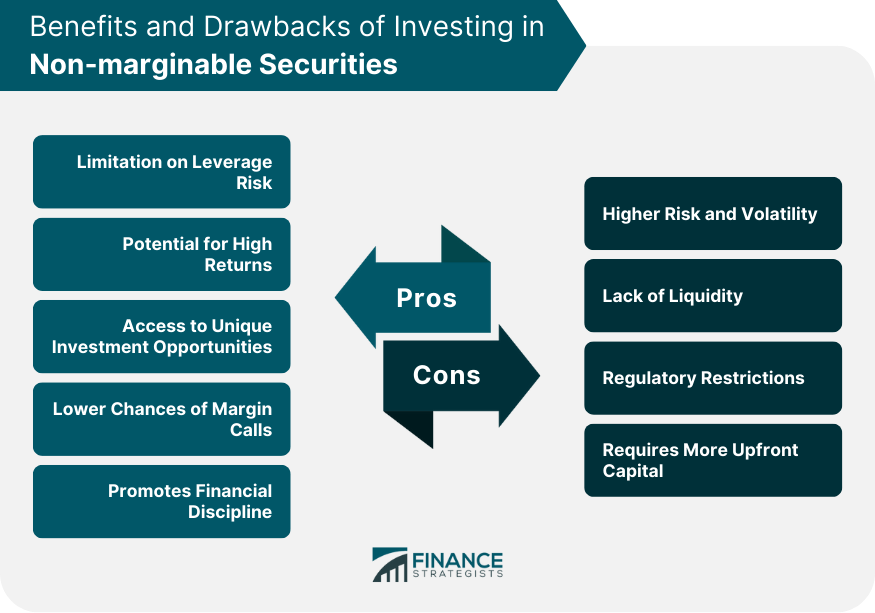

Benefits of Investing in Non-marginable Securities

Limitation on Leverage Risk

Potential for High Returns

Access to Unique Investment Opportunities

Lower Chances of Margin Calls

Promotes Financial Discipline

Drawbacks of Investing in Non-marginable Securities

Higher Risk and Volatility

Lack of Liquidity

Regulatory Restrictions

Requires More Upfront Capital

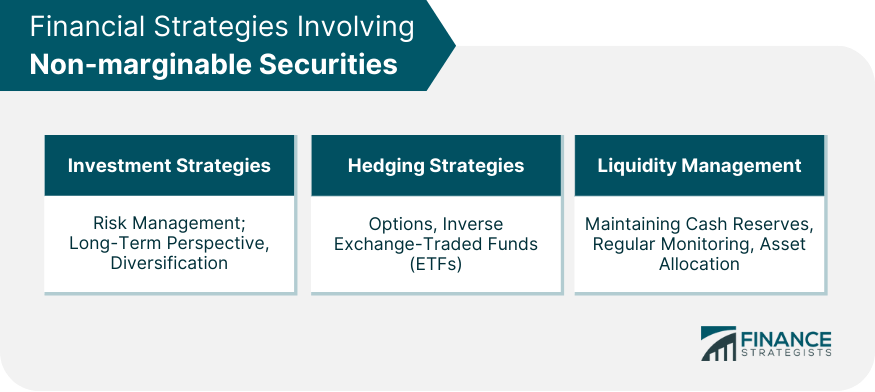

Financial Strategies Involving Non-marginable Securities

Investment Strategies

Risk Management

Long-Term Perspective

Diversification

Hedging Strategies

Options

Inverse ETFs

Liquidity Management

Maintaining Cash Reserves

Regular Monitoring

Asset Allocation

Final Thoughts

Non-marginable Securities FAQs

No, non-marginable securities cannot be purchased using borrowed funds from a brokerage. Investors must fully fund their purchase with their own capital.

Securities can be designated as non-marginable due to various reasons, including higher risk levels associated with the security, limited liquidity in the market, regulatory constraints, or concerns about the financial stability of the issuing company.

While non-marginable securities can offer potentially high returns, it's important to note that they often come with higher risk and volatility. These securities may include assets like penny stocks or newly issued securities that can experience significant price swings.

Yes, certain securities become non-marginable due to regulatory constraints imposed by entities like the Securities and Exchange Commission (SEC). These restrictions may apply to newly issued securities, low-priced stocks, or specific types of bonds.

To manage risks, investors should conduct thorough risk assessments, adopt a long-term perspective, diversify their portfolios, employ hedging strategies, and practice effective liquidity management. Regular monitoring, maintaining cash reserves, and allocating a portion of the portfolio to liquid, marginable securities are also important risk management measures.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.