An Offering Memorandum, also known as a Private Placement Memorandum, is a detailed legal document that outlines the terms and conditions of a securities offering, particularly in private transactions. It is designed to provide potential investors with comprehensive information about a company's operations, financial health, and the specific details of the securities being offered. The Offering Memorandum serves a dual purpose. Firstly, it is used as a marketing tool to attract potential investors, offering an in-depth look into a company's business model, strategy, and future prospects. Secondly, it serves to mitigate legal risk by ensuring full disclosure of all material information and potential risks associated with the investment, thereby offering some degree of protection to both the issuer and the investor. As such, the Offering Memorandum is a crucial component of the investment process. The executive summary provides an overview of the business, its operations, and its financial health. It also outlines the purpose of the securities offering and gives potential investors a snapshot of what to expect from the document. This section provides comprehensive information about the securities being offered, including the types of securities, the number of securities, and the price per security. It also details how the securities will be allocated among investors. Here, the issuer provides an in-depth look at the company's operations, products or services, competitive position, and key personnel. The company’s history, strategic vision, and management structure are also outlined in this section. This section provides a detailed description of the securities being offered. This includes the rights and privileges that come with owning the securities, such as voting rights, dividends, and liquidation rights. The "use of proceeds" section is where the issuer outlines how the funds raised from the offering will be used. This could include business expansion, debt reduction, research, and development, or any other purpose that aligns with the company's strategic objectives. In the risk factors section, the issuer must disclose all potential risks associated with the securities offering. This could range from market risks and regulatory risks to specific risks associated with the issuer's business model. In this section, the issuer details all the legal and regulatory matters related to the offering. This could include information about the issuer's legal structure, regulatory environment, tax obligations, and any ongoing or potential legal disputes. Lastly, the Offering Memorandum includes the issuer's financial statements and projections. This provides potential investors with an understanding of the issuer's financial health and future prospects. The first step in creating an Offering Memorandum is determining its purpose. This involves identifying the securities to be offered, the intended use of proceeds, and the target investor audience. The issuer also needs to decide on the key selling points to be highlighted in the document. The next step involves gathering all the necessary information to be included in the OM. This includes company information, financial data, details about the securities offering, risk factors, and legal matters. Once all the necessary information is gathered, the drafting process begins. This involves writing out each section of the Offering Memorandum in a clear, concise, and persuasive manner. After the initial draft is complete, it undergoes several rounds of reviews and revisions. This is to ensure that all information is accurate, complete, and presented in a way that is easy for potential investors to understand. Once the document is finalized, it's time for approval and distribution. This involves obtaining necessary approvals from internal and external stakeholders and then distributing the document to the target investor audience. The issuing company plays a central role in the Offering Memorandum process. It is responsible for determining the purpose of the document, gathering the necessary information, and overseeing the drafting and review process. It is also responsible for ensuring that the Offering Memorandum complies with all legal and regulatory requirements. Legal advisors play a critical role in the Offering Memorandum process. They help ensure that the document complies with all legal and regulatory requirements and that it accurately and fully discloses all material information. They also provide advice on how to present information in a way that minimizes legal risk. Financial advisors provide critical input on the financial aspects of the OM. They help prepare the financial statements and projections, provide advice on the pricing of the securities, and provide input on the financial implications of the offering. Potential investors play a crucial role in the Offering Memorandum process as well. Their feedback and questions can help shape the final document and can provide valuable insights into what information they find most relevant and persuasive. In private equity, OMs are often used to attract institutional investors and high-net-worth individuals to invest in private equity funds. The Offering Memorandum provides detailed information about the fund's strategy, the management team's track record, and the expected returns. In venture capital deals, OMs are used when a startup is looking to raise capital from venture capitalists. The Offering Memorandum provides a detailed overview of the startup's business model, market opportunity, and financial projections. It also outlines the terms of the investment, including the valuation of the startup and the rights and privileges that come with the investment. In the U.S., OMs fall under the purview of Regulation D of the Securities Act of 1933. This regulation allows companies to offer and sell their securities without having to register with the SEC, provided they adhere to certain rules, such as limiting the offering to accredited investors and providing all material information. In Europe, OMs are governed by the European Prospectus Regulation. This regulation requires that any offer of securities to the public must be accompanied by a prospectus that has been approved by the competent authority. In Canada, OMs are governed by National Instrument 45-106. This instrument provides a set of rules for issuing OMs, including a requirement for the issuer to provide audited financial statements and a detailed description of the business. One of the biggest challenges is ensuring compliance with all legal and regulatory requirements. This requires a deep understanding of the relevant laws and regulations and meticulous attention to detail. Ensuring the accuracy of all information presented in the Offering Memorandum is another major challenge. This is particularly true when it comes to financial statements and projections, which require a high level of financial expertise and rigorous data verification. Issuers also face potential liability if they fail to disclose all material information or if they present information in a misleading way. This can lead to legal action from investors and damage to the issuer's reputation. Preparing an Offering Memorandum is a time-consuming and costly process. It requires a significant investment of resources, and any delays or mistakes can have serious financial implications. As with many areas of business, digitization, and automation are set to streamline the Offering Memorandum process. This includes the use of software to automate data gathering and document creation, which can significantly reduce the time and cost involved. Blockchain technology and smart contracts could also revolutionize the Offering Memorandum process. These technologies could be used to create immutable and transparent records of all transactions, reducing the risk of fraud and increasing trust among investors. Artificial intelligence and machine learning are also set to transform the Offering Memorandum process. These technologies can be used to analyze vast amounts of data and provide valuable insights, helping issuers to better tailor their OMs to the needs and preferences of potential investors. An Offering Memorandum is a pivotal instrument in the financial world, bridging the gap between businesses and potential investors. As a meticulously drafted legal document, it demystifies investment terms, showcases a company's potential, and flags associated risks. Its significance permeates various spheres, including private equity and venture capital, aiding the process of fundraising. However, creating an Offering Memorandum entails a multi-layered process, where accuracy and compliance with regulations are paramount, thereby introducing inherent challenges. Looking ahead, the landscape of OMs is poised for a transformation, with technology playing a transformative role. Digitization and automation promise to simplify the creation process, blockchain assures transparency, while artificial intelligence holds the potential to personalize OMs, thereby driving efficiency and accuracy. Ultimately, the Offering Memorandum will continue to be an indispensable facet of finance, evolving in stride with emerging trends.Offering Memorandum Overview

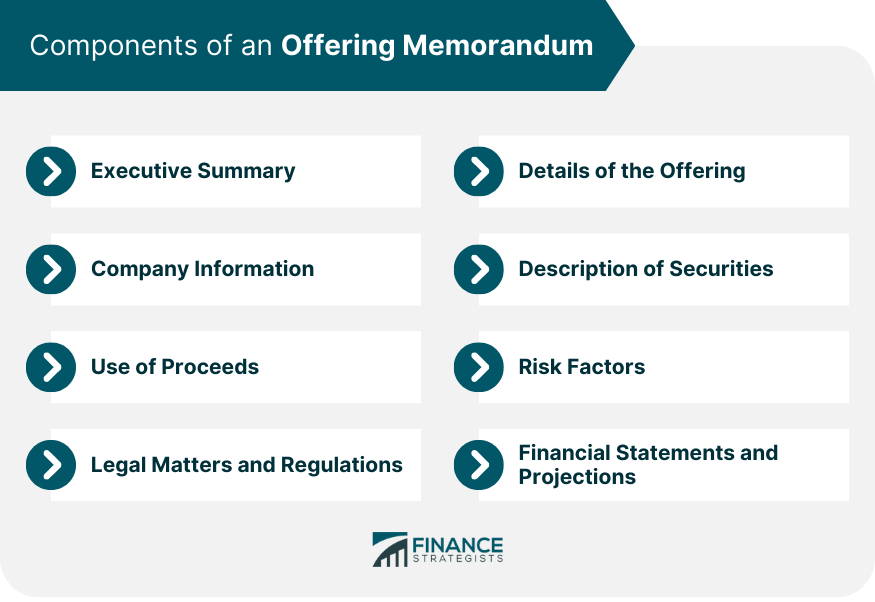

Components of an Offering Memorandum

Executive Summary

Details of the Offering

Company Information

Description of Securities

Use of Proceeds

Risk Factors

Legal Matters and Regulations

Financial Statements and Projections

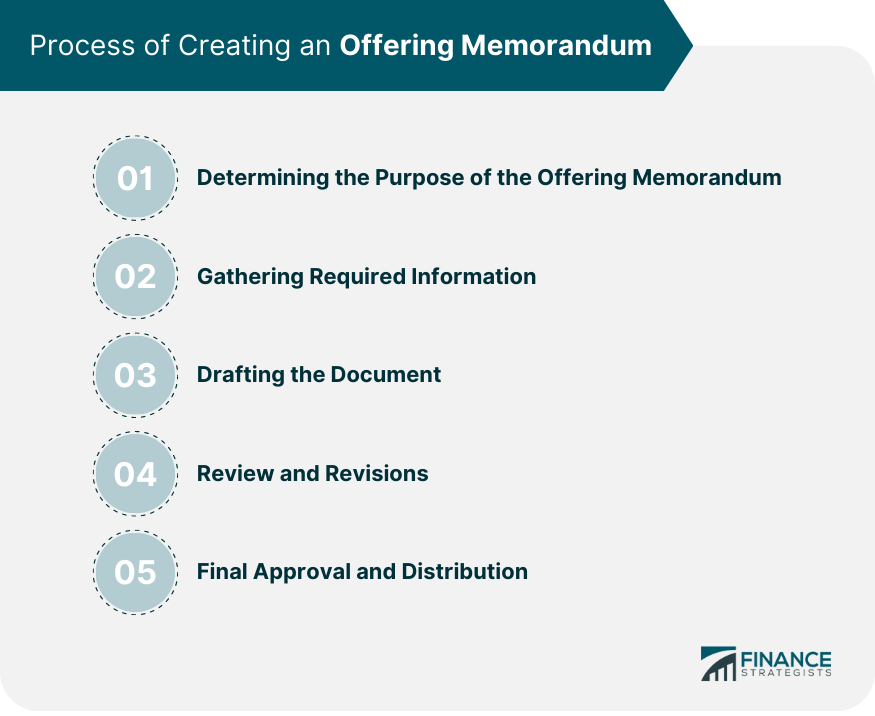

Process of Creating an Offering Memorandum

Determining the Purpose of the Offering Memorandum

Gathering Required Information

Drafting the Document

Review and Revisions

Final Approval and Distribution

Role of Key Parties in the Offering Memorandum Process

Issuing Company

Legal Advisors

Financial Advisors

Potential Investors

Importance of Offering Memorandum in Private Equity and Venture Capital

Raising Funds in Private Equity

Use in Venture Capital Deals

Offering Memorandum in Different Jurisdictions

The US (Regulation D)

Europe (European Prospectus Regulation)

Canada (National Instrument 45-106)

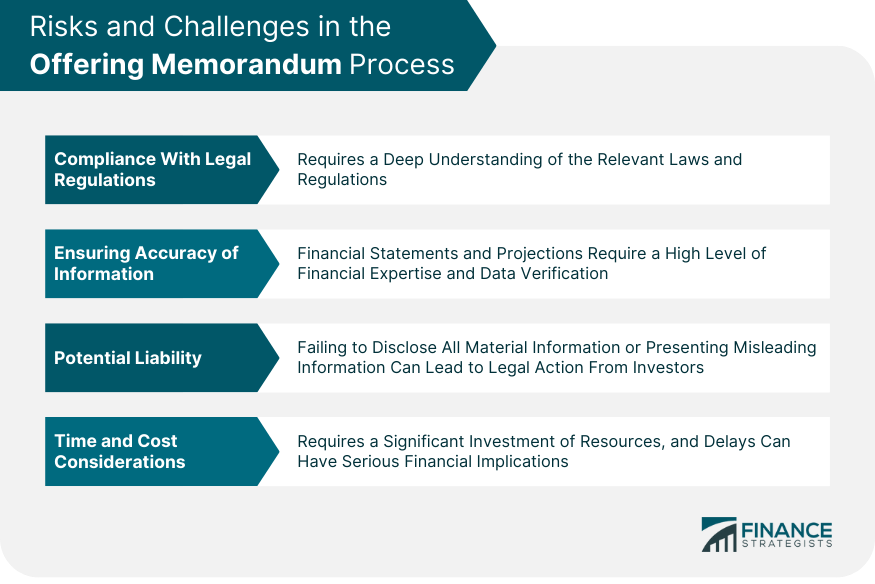

Risks and Challenges in the Offering Memorandum Process

Compliance With Legal Regulations

Ensuring Accuracy of Information

Potential Liability

Time and Cost Considerations

Future Trends and Impact of Technology on Offering Memorandums

Digitization and Automation of the Process

Blockchain and Smart Contracts

Influence of AI and Machine Learning

Final Thoughts

Offering Memorandum FAQs

An Offering Memorandum serves the dual purpose of attracting potential investors by providing comprehensive information about a company's operations and financial health and mitigating legal risk by ensuring full disclosure of material information and potential investment risks.

An Offering Memorandum typically includes an executive summary, details of the offering, company information, description of securities, use of proceeds, risk factors, legal matters and regulations, and financial statements and projections.

The process of creating an Offering Memorandum involves determining its purpose, gathering the required information, drafting the document, conducting reviews and revisions, obtaining final approval, and distributing the document to the target investor audience.

Potential investors play a crucial role in shaping the final Offering Memorandum by providing feedback and asking questions that help refine the document. Their insights provide valuable information on what information is relevant and persuasive.

Offering Memorandums are governed by different regulations in different jurisdictions. For example, in the U.S., they fall under Regulation D of the Securities Act of 1933, while in Europe, they are governed by the European Prospectus Regulation. It's important to be aware of and comply with the specific rules and requirements of each jurisdiction.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.