The "order book" is a real-time list of buy and sell orders for a specific security, arranged by price level. Maintained by market exchanges, it offers a detailed view of supply and demand, facilitating informed trading decisions. Each entry represents a trader's intent to buy or sell a certain quantity of a security at a specified price. The order book not only provides real-time data to traders but also offers insights into market depth, indicating the market's ability to absorb large orders without substantial price impacts. It can also reveal trading patterns and signals, enabling traders to devise strategic plans, predict price changes, and carry out trades with a higher probability of success. Buy orders, also known as bids, represent the maximum price that buyers are willing to pay for a security. These orders are arranged in descending order, with the highest bid—the price at which someone is willing to buy the most shares—listed at the top. The accumulation of buy orders at a specific price point can indicate a support level, a price level at which the security's price stops falling due to an increase in demand or interest. Sell orders, also known as asks or offers, indicate the minimum price sellers are willing to accept for a security. These are listed in ascending order, with the lowest ask—the price at which someone is willing to sell the most shares—presented first. When there are many sell orders accumulated at a particular price point, it could suggest a resistance level, a price point at which the price of the security stops rising due to increased supply. Order history refers to the historical data of executed trades that have occurred. This data includes the time of the trade, the price at which the trade was executed, and the number of shares exchanged. Order history provides traders with insights into the trading patterns and can be used to analyze and predict future market trends. Market orders are requests made by traders to buy or sell a security at the best available price in the current market. They are executed almost instantaneously during market hours, given there is enough liquidity in the market. Market orders prioritize speed over price and are suitable for traders who want to quickly enter or exit a position. A limit order is a directive to buy or sell a security at a specific price or better. Unlike market orders, limit orders do not guarantee execution but do ensure that if the trade is executed, it's not at a price less desirable than the limit price. This order type provides control over the execution price but may lead to the order not being filled if the market price does not reach the limit price. Stop orders, also known as stop-loss orders, become market orders when a security reaches a specified price, known as the stop price. A buy stop order is placed above the current market price, while a sell stop order is placed below it. Stop orders are used to limit losses or protect profits on a position in a security. A stop-limit order is a conditional trade that combines the features of a stop order and a limit order. Once the stop price is reached, the stop-limit order becomes a limit order to buy or sell a security at the limit price or better. It allows traders to have precise control over when the order should be filled, but, like limit orders, it's not guaranteed to be executed if the limit price is not met. Market depth, in the context of an order book, refers to the extent of buy and sell orders at different price levels for a particular security. It's a direct representation of supply and demand conditions of the security and provides a measure of the quantity of orders at each price level. The depth of the market is crucial as it helps traders gauge the strength or weakness of a price trend. A deeper market, characterized by larger order volumes at different price levels, tends to be more stable with less price volatility. This depth is beneficial for large institutions and high-frequency traders who trade large volumes of securities without significantly affecting the market price. Market depth significantly influences market liquidity. A market with high depth means there's a large number of buyers and sellers, which often leads to high liquidity. High liquidity allows for quick transactions without significant price changes. Conversely, a shallow market, characterized by fewer orders, can result in large price swings. The depth of an order book can affect a trader's decisions. Traders can use market depth data to understand potential price direction and to identify optimal points for order placement. It also allows them to determine the best strategy for order execution. For instance, in a shallow market, large orders could potentially move the market price. Order books play a significant role in the price discovery process. This process refers to how buyers and sellers determine the price of a security based on supply (sell orders) and demand (buy orders). In essence, the highest bid and the lowest ask in the order book form the spread, which is the current market price of the security. As new orders come in and existing orders get fulfilled, the prices in the order book are continually changing. The dynamic interaction between buyers and sellers in this live market environment is what drives price changes. Large orders, often placed by institutional investors, can significantly impact the market price of a security. For example, a large buy order can quickly absorb the existing sell orders at the lower price levels in the order book, causing the price to increase. Conversely, a large sell order can consume the available buy orders at the higher price levels, leading to a decrease in price. By observing these large orders and their impact on the order book, traders can glean valuable information about potential future price movements and make strategic trading decisions. An order book can offer traders valuable insights into market sentiment. For instance, if the order book shows more buy orders than sell orders at a particular time, it could suggest bullish sentiment, indicating that the price may increase. Conversely, more sell orders than buy orders could signal bearish sentiment, hinting that the price may decrease. Furthermore, by analyzing the order sizes at different price levels, traders can identify key support and resistance levels. These are price levels where a security's price trend is likely to reverse, helping traders time their trades more effectively. Order books can also aid in detecting potential market manipulation. For example, a trader may place a large order to create an illusion of high demand or supply, aiming to influence other traders. This tactic, known as "spoofing," can be spotted by observing the order book for large orders that are frequently placed and then canceled. By enhancing market transparency, the order book serves as a vital tool for regulators and trading platforms to maintain fair and orderly markets. They can use the data from the order book to monitor trading activities, identify irregular trading patterns, and take necessary actions to protect market integrity. One of the most practical applications of an order book in trading strategies is identifying support and resistance levels. These levels represent the price points where a security's price trend tends to pause or reverse, due to the concentration of buy orders (support levels) or sell orders (resistance levels). When the order book shows a large number of buy orders at a certain price level, it means many traders are willing to buy the security at that price. This accumulation of demand could prevent the security's price from falling further, establishing a support level. On the other hand, a large number of sell orders at a specific price can signal a resistance level. Here, the supply of the security potentially outweighs demand, preventing the price from rising further. Identifying these levels can help traders time their entries and exits more effectively, improve their risk management, and formulate more precise trading strategies. Another strategy that relies heavily on the order book is momentum trading. Momentum traders seek to capitalize on securities that are moving significantly in one direction on high volume. By examining an order book, these traders can gauge the strength of the price momentum by looking at the number and size of orders at different price levels. If a security's price is rising and the order book shows strong demand (large buy orders) at higher price levels, a momentum trader may decide to enter a long position, expecting the price to continue its upward movement. Conversely, if the security's price is falling, and the order book reveals strong supply (large sell orders) at lower prices, the trader may consider short selling the security, anticipating further decline. While order books can provide valuable market insights, they're not without limitations. The advent of high-frequency trading (HFT) – where algorithms are used to trade securities in fractions of a second – can sometimes distort the information in the order book. HFT firms, leveraging their speed advantage, can place and then cancel orders faster than human traders can react, making the depth of the order book appear more significant than it really is. This practice, known as quote stuffing or spoofing, can mislead other market participants about the supply and demand of a security, leading to potential price manipulation. Order books present raw data, which must be correctly interpreted to be useful. A common pitfall is misinterpreting the market depth. A deep order book, characterized by large orders at each price level, may suggest strong liquidity. However, it could also be a sign of a major market participant preparing to sell or buy a large quantity, which could significantly move the market price once the order is executed. Additionally, market depth can change rapidly, especially in volatile markets. Therefore, while order books can provide a snapshot of the market at a specific point in time, the information can quickly become outdated. Traders must, therefore, use the order book as part of a comprehensive trading strategy, alongside other tools such as technical analysis, fundamental analysis, and risk management techniques. Despite its limitations, when used correctly, the order book remains a powerful tool in a trader's arsenal, providing real-time insights that can help inform trading decisions. The order book, an essential tool in financial markets, provides real-time, detailed information about buy and sell orders for a specific security. Its key components include buy and sell orders, and the order history, each contributing to market depth perception. Market orders, limit orders, stop orders, and stop-limit orders are the typical types of orders one can find in an order book. Effective utilization of an order book allows traders to identify support and resistance levels and conduct momentum trading, among other strategies. However, the risk of high-frequency trading and order book manipulation, and the potential for misinterpretation of market depth, highlight the limitations of order books. To navigate the complexities of an order book, consider seeking wealth management services. Professionals can provide invaluable guidance, helping you make the most of tools like order books and other trading resources.What Is the Order Book?

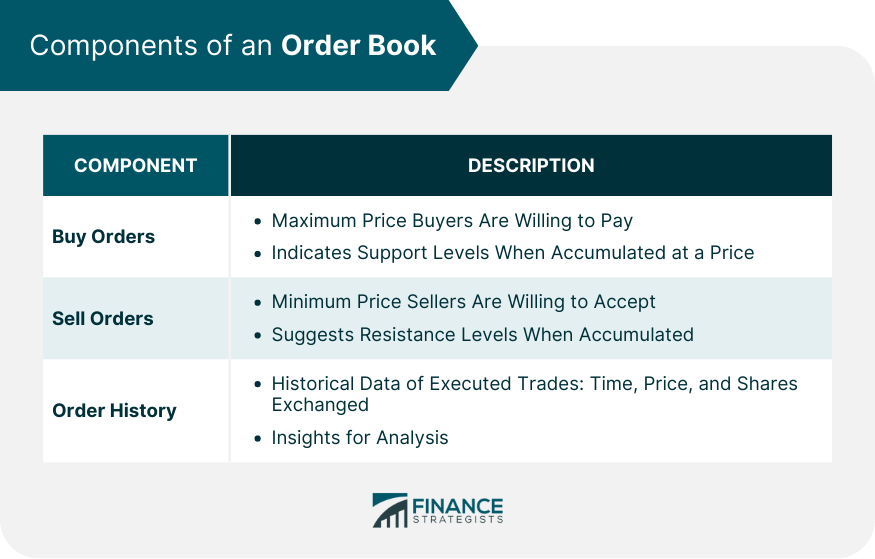

Components of an Order Book

Buy Orders

Sell Orders

Order History

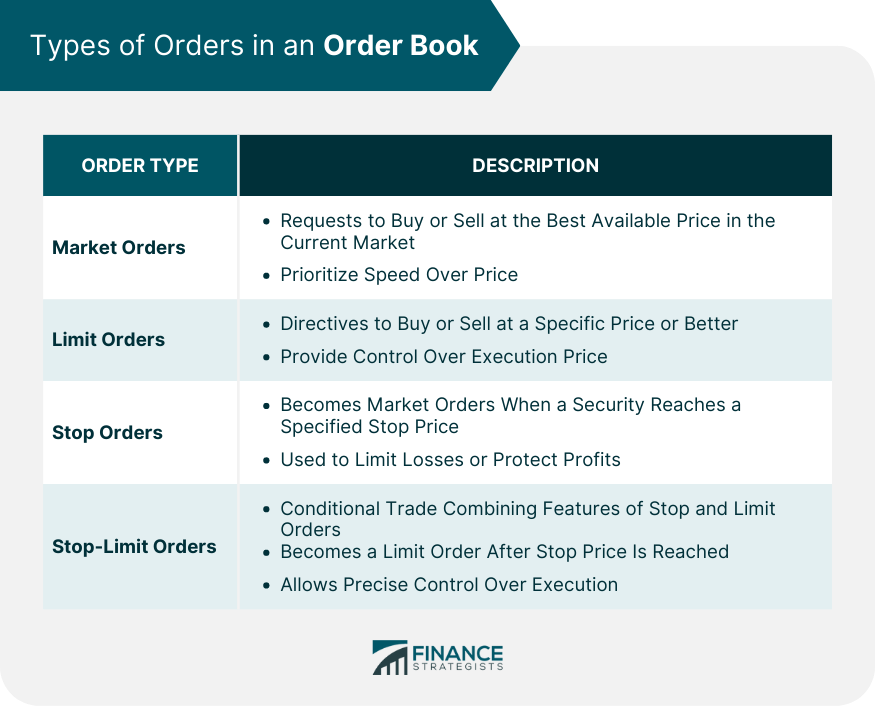

Types of Orders in an Order Book

Market Orders

Limit Orders

Stop Orders

Stop-Limit Orders

Understanding the Market Depth in an Order Book

Market Depth Definition and Importance

Impact on Liquidity and Trading Decisions

How Order Books Influence Market Prices

Price Discovery Process

Impact of Large Orders

Role of Order Books in Market Transparency

Insights Into Market Sentiment

Detecting Market Manipulation

Utilizing Order Books in Trading Strategies

Identifying Support and Resistance Levels

Momentum Trading

Limitations and Risks of Using an Order Book

High Frequency Trading and Order Book Manipulation

Misinterpretation of Market Depth

Final Thoughts

Order Book FAQs

An order book is an electronic list of buy and sell orders for a specific security or financial instrument, organized by price level. It's a vital tool for traders as it provides real-time data about market depth and price levels.

An order book typically contains four types of orders: market orders, limit orders, stop orders, and stop-limit orders. Each type has unique characteristics and uses within trading strategies.

An order book contributes to market transparency by providing real-time information about the number of shares being bid on or offered at each price point. This information can help traders understand market sentiment and spot potential market manipulation.

Traders use order books to identify support and resistance levels, anticipate price changes, and inform their momentum trading strategies. It's crucial to remember that the order book should be used in conjunction with other trading tools for the best results.

The limitations of using an order book include potential manipulation by high-frequency trading practices and the risk of misinterpreting market depth. Moreover, market depth can change rapidly, meaning the information in the order book can quickly become outdated.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.