A pooled investment vehicle is a financial product that combines investor funds together. It is used to purchase a variety of investments under one umbrella, allowing for diversification that individual investors may not be able to access on their own, at a lower cost. This helps reduce risk by spreading it over different assets, sectors, and strategies, while returns are earned through dividends, interest payments, and capital gains. Pooled investment vehicles are often used as an alternative to direct investing. They are managed by a team of fund managers or financial advisors who are experts in their respective fields that decide what investments to make and how to allocate the pooled funds among them. These fund managers are paid an expense ratio for their services. Common pooled investment vehicles are mutual funds, exchange-traded funds (ETFs), hedge funds, private equity funds, closed-end funds, real estate investment trusts (REITs), unit investment trusts (UITs), and pension funds. Mutual funds are the most common type of pooled investment vehicle because they require investors little effort or research. They are open-ended, meaning new shares can be issued or redeemed on demand by the mutual fund company. Mutual funds are professionally managed and invested in stocks, bonds, and other securities, allowing investors to benefit from economies of scale. Fund managers can do passive investing and try to perform within the same range of indexes like NASDAQ or S&P 500. They can also take an active approach and try to outperform the indexes. It should be noted that since active investing is more hands-on, it is typically more expensive. It also requires a higher level of expertise and frequent trading, which can incur additional costs. ETFs are similarly pooled like mutual funds but trade on the stock exchanges like individual stocks. They are more liquid —investors can buy or sell ETFs during regular trading hours on any given day, unlike mutual funds which only allow transactions at the end of the trading day. Additionally, because ETF shares trade like stocks, managers can use more sophisticated strategies such as short-selling and margin trading that may not be available with other types of pooled investment vehicles. ETFs also track an index like the S&P 500 passively or actively, but they may also hold specific industries, such as technology and healthcare, or particular countries and regions. This makes ETFs more specialized than traditional mutual funds and gives investors greater flexibility. Lastly, ETFs generally charge lower expense ratios than mutual funds. Hedge funds are investments that use sophisticated strategies such as leveraging, arbitrage, and short-selling to generate returns. These strategies can be very risky and often require a high level of expertise to manage successfully. Unlike mutual funds and ETFs, they are not open to the general public and are reserved for accredited managers and investors who meet certain criteria and understand the associated risks. Hedge funds also usually have a minimum investment amount. As such, they typically charge higher performance and management fees. This makes them much more expensive than other pooled investment vehicles. However, in some cases, these higher costs may be worth it if the fund manager can generate significant returns. Private equity funds are similar to hedge funds but focus on investments in private companies such as startups and venture capital. They require a high minimum investment amount and have complex legal structures that make it difficult for investors to understand their fees and other related information. These vehicles can be risky since there is no public market for private company stock. However, because of the higher risk involved, private equity funds may offer greater potential returns than other pooled investment vehicles. Closed-end funds are akin to mutual funds but with a few key differences. They are also professionally managed, but the fund size is fixed, and issued shares cannot be redeemed on demand. That means that investors who want to sell their shares must do so in the open market unlike ETFs, which can be sold during regular trading hours. As such, prices for closed-end funds may fluctuate more than other pooled investment vehicles. Furthermore, closed-end funds are typically leveraged — meaning they borrow money to invest more than their assets’ value. This can increase potential returns, but it also carries greater risk if the investments do not pan out as expected. REITs are pooled investments that allow investors to access the real estate market without buying properties directly. Like ETFs, REITs are traded on stock exchanges, holding a portfolio of income-producing properties such as office buildings, apartments, or malls. Investors benefit from these properties' dividends and exposure to the real estate market. Furthermore, some REITs specialize in specific real estate sectors such as healthcare or data centers — allowing for more targeted investment strategies. The main difference between REITs and other pooled investment vehicles is that REITs focus solely on real estate-related investments. As such, investors must be wary of additional risks, like changing market trends, interest rate fluctuations, and tenant turnover. UITs are also professionally managed and hold a portfolio of investments such as stocks, bonds, or other securities, similar to mutual funds and ETFs. The main difference with UITs is that the portfolio is fixed and cannot be changed. This means that investors will not benefit from any adjustments the fund manager makes. UITs also have an expiration date, at which point they must liquidate their holdings and return the proceeds to the investors, making them suitable only as short-term investments. Nonetheless, they offer the advantage of greater transparency than other pooled investment vehicles because the holdings are disclosed upfront. Pension funds are investment vehicles set up by employers to provide retirement benefits to their employees. This pooled investment is designed to accumulate assets over the long term to ensure pensions are covered and potentially increase benefits to retirees. As such, pension funds typically have low-risk portfolios that focus on steady growth rather than aggressive strategies. Their investments may include stocks, bonds, real estate, commodities, derivatives, and other assets. Pension funds are managed by organizations, often with contributions from both employer and employee. They offer tax advantages as contributions may be deductible against taxable income, and gains will not be taxed until withdrawal at retirement. Advantages include diversification, guaranteed professional management, tax savings, and increased negotiating power. Pooled investment vehicles offer diversification since they involve investing in many different investments simultaneously. This reduces overall risk since any losses or gains are spread out among the investments involved. It also allows investors to benefit from various markets, such as stocks, bonds, and commodities, without having to own each one individually. Pooled investment vehicles are professionally managed by experienced advisors who know how to handle investments and make decisions on behalf of the client. Investors do not have to worry about researching or making decisions independently. This provides an added layer of security and peace of mind, as the investor does not have to worry about making incorrect decisions that could result in losses. When investors pool their resources, they can purchase larger blocks of securities or fund investments, which may not have been possible for them individually. They are treated like large investors and benefit from economies of scale. This gives the pooled vehicle greater leverage in negotiations with sellers and other buyers, which can result in more favorable prices and terms such as lower management fees or higher yields. This can translate into better returns for the investors in the pooled vehicle. Drawbacks must also be considered, including lack of control over investment decisions, being subject to management fees, lower liquidity, and potential tax consequences. Pooled investment vehicles are operated by a portfolio or fund manager responsible for making investment decisions. As such, investors have no control over the asset allocation of their funds and may not agree with all of the investments chosen for them. It also means that if a pooled vehicle performs poorly, investors cannot restructure it as they would be able to do with individual stocks or bonds that they own directly. These fees vary depending on the type of pooled investment vehicle. They may include administrative costs, custodial fees, and transaction costs, typically deducted automatically from the pooled vehicle’s performance before returns are distributed to investors. This can reduce investor returns significantly over time. Investors should compare expected return and total cost, including management fees, when evaluating different pooled investments to determine which option is right. Some pooled investment vehicles tend to be less liquid than traditional investments, such as stocks or bonds. Investors may need to wait for the fund’s redemption period to expire before being able to withdraw any invested capital. This can make it difficult to access funds quickly to meet short-term needs or take advantage of investment opportunities. In addition, while some funds allow frequent trading, this activity can incur significant transaction costs and reduce returns on the investment. Investors in pooled investment vehicles may need to pay taxes on any capital gains or dividends received from the fund since gains or losses must be reported in accordance with relevant regulations. It is important to understand the tax implications of redeeming shares from the fund before investing. Investors need to consider these potential implications and consult a tax accountant when evaluating different pooled investments for their portfolios. Pooled investment vehicles are financial instruments that allow multiple investors to aggregate funds to benefit from economies of scale and earn individual returns. Common types are mutual funds, ETFs, REITs, UITs, and hedge funds. Pooled investment vehicles can be a great way for investors to diversify their portfolios and access professional money management. However, investors must understand the associated fees and potential tax implications when evaluating these options. Finally, they should consider their investment goals and risk tolerance before investing in any pooled vehicle. By considering these factors and consulting with an experienced financial advisor, investors can determine if a pooled investment vehicle suits their needs.What Is a Pooled Investment Vehicle?

Types of Pooled Investment Vehicles

Mutual Funds

Exchange-Traded Funds

Hedge Funds

Private Equity Funds

Closed-End Funds

Real Estate Investment Trusts

Unit Investment Trusts

Pension Funds

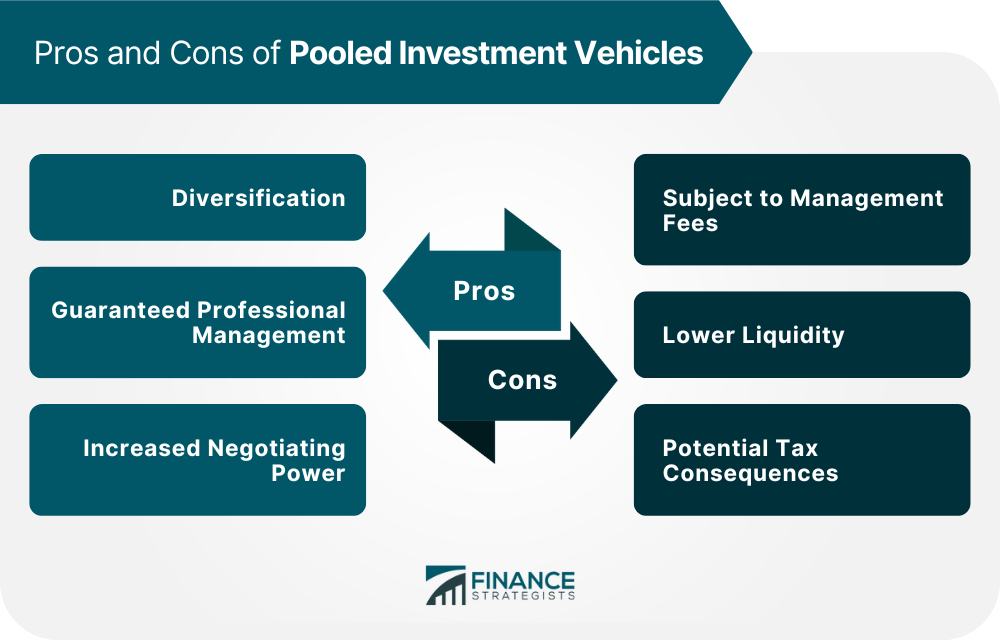

Pros of Pooled Investment Vehicles

Diversification

Guaranteed Professional Management

Increased Negotiating Power

Cons of Pooled Investment Vehicles

No Control Over Investment Decisions

Subject to Management Fees

Lower Liquidity

Potential Tax Consequences

Final Thoughts

Pooled Investment Vehicle FAQs

Pooled investment vehicles are a type of financial instrument that allow multiple investors to pool their funds together and receive individual returns. Pooled investments are designed to give investors access to larger and more diverse portfolios than they would have if they invested alone, as well as offer cost savings through shared resources.

Yes, a private equity fund is a type of pooled investment vehicle. Private equity funds are investments in businesses that are not publicly traded. These funds collect capital from investors and then use the money to buy or invest in operating companies, real estate projects, venture capital opportunities, and other investments.

Pooled investment vehicles work by collecting money from investors and using the funds to purchase a variety of investments. The returns each investor receives depend on their contribution and the performance of the underlying investments held in the fund.

The main advantages of pooled investment vehicles are access to professional money management, diversification, cost savings and increased negotiating power through shared resources, and the ability to access investments that would be unavailable to individual investors.

The main disadvantage of pooled investment vehicles is a lack of control over asset allocation. In addition, some funds may have lower liquidity than traditional investments and there can be potential tax consequences associated with investing in a pooled vehicle.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.