A private equity fund is an investment fund owned by a limited number of qualified investors. This type of fund typically collects money from these investors. It then uses it to purchase a business or assets from a publicly traded company, such as a division or a product line. Private equity funds' standard investing strategy is to take a controlling interest in an operating business and actively manage and direct the corporation to grow its value. Other private equity funds may focus on making minority investments in fast-growing companies. Generally speaking, private equity funds are designed to be long-term investments. Therefore, the investors only redeem their money once the fund's lifespan ends and all its assets have been liquidated. Although a SEC-registered adviser may advise a private equity fund, private equity funds are not registered with the Securities and Exchange Commission (SEC). This means they are not subject to regular public disclosure obligations. Private equity funds are usually only available to accredited investors and qualified consumers such as insurance companies, university investors, pension funds, and high net-worth individuals. Private equity investments frequently require significant initial funding. Investing in a private equity fund can attract investors seeking returns with more risk than traditional stocks and bonds. The key challenge is understanding the structure of the investments to properly evaluate how they will fit into their portfolio before committing. Private equity funds have a relatively large minimum investment of $25 million, though some are as low as $250,000. In addition, these investments often require at least five years before any return is realized. For this reason, only investors with a long-term strategy should consider investing in a private equity fund. Private equity funds play an important role in the global investment landscape, providing long-term capital to help businesses grow and develop. Among the main types of private equity funds are venture capital (VC) funds, buyout funds, and growth equity funds. Venture capital is typically used to fund startups and other firms with the potential for significant and rapid growth. Limited partners (LPs) fund VC firms to invest in potential businesses or more significant venture funds. When VC money is granted in exchange for stock in a startup, it is not anticipated to be paid back in the traditional sense. VCs often adopt a longer-term view and invest to see significant returns if the firm is purchased or goes public. When VCs invest in firms, also known as portfolio companies, they often take only minority ownership because the companies become part of the firm's investment portfolio. A buyout is an investment transaction in which one party gains control of a firm through outright purchase or acquiring a controlling equity position of at least 51% of the voting shares. A buyout typically includes acquiring the target's outstanding debt, also known as assumed debt by the acquirer. Two main buyouts are used in the business world: management buyouts (MBOs) and leveraged buyouts (LBOs). A management buyout occurs when a firm's existing management team purchases all or a significant portion of the company from private owners or the parent company. An MBO is also a popular exit strategy for private corporations by retiring founders or for huge organizations selling some divisions that are not vital to their business. The deal frequently necessitates significant funding, typically a combination of equity and debt. A leveraged buyout happens when the purchaser uses an enormous debt to control another company, with the firm's assets under acquisition frequently serving as collateral for the loan. Leveraged buyouts enable buyers to acquire significant companies without committing large capital. Growth equity is a type of investment opportunity in relatively mature companies that are going through a transformational event in their life cycle and have the potential for significant growth. Minority investments are expected in growth equity transactions. Preferred shares are routinely used in such transactions. Growth equity investors prefer companies with little or no debt. Private equity firms, late-stage venture capitalists, and investment funds are typical growth equity investor profiles. Most venture capitalists typically need an adequately prepared exit strategy to be included in a business plan if the anticipated milestones are not met. This can be done through trade sales, secondary buyouts, initial public offerings (IPOs), or share repurchases. A business trade sale is a form of transaction in which the purchasing company continues the business of the company being purchased. The buyer is frequently already involved in the same industry or sector. A trade sale can involve the purchase of the company's stock or assets. Trade sales can sometimes involve bankrupt businesses, especially when employed as an exit strategy from the administration. A secondary buyout occurs when one investment firm, usually a private equity or venture capital firm, sells its controlling position in a company to another investment firm. Assuming the company's value has improved, the investment business will earn from the resell. A secondary buyout is a straightforward procedure. All secondary buyouts occur following a traditional buyout. As this type of exit strategy continues to gain traction, private equity firms must position themselves with sufficient resources to take advantage of it when the opportunity arises. An initial public offering occurs when a private firm sells its first shares of stock to the general public. An IPO indicates that a company's ownership is changing from private to public. Startups and companies that have been in operation for decades can choose to go public through an IPO. Companies often undertake an IPO to raise capital to pay off debts. Similarly, it is used to support expansion projects, boost their public profile, or allow firm insiders to diversify or create liquidity by selling all or a portion of their private shares as part of the IPO. This route often provides the greatest return on investment for all stakeholders, as it generally yields high market valuations. A share repurchase is when a public firm's management buys back company shares previously sold to the public. A firm may opt to repurchase its shares for a variety of reasons. A company may choose to repurchase shares to signal to the market that its stock price is likely to rise or to inflate financial metrics denominated by the number of shares outstanding. It is also carried out to halt a declining stock price or increase its equity stake in the company. Share repurchase represents an attractive exit strategy for those familiar with the landscape but should only be undertaken with due diligence or professional guidance. When investing in private equity funds, there are several factors to consider. The most important of these include illiquidity, fees & expenses, and conflicts of interest. Investments in private equity funds are typically long-term commitments, with investors able to access their money after the end of the term or exit strategy. As such, investors should ensure they have enough liquidity elsewhere to cover any unexpected expenses during this period. Fees and expenses associated with private equity investments can be quite high due to the complex nature of these transactions and the professional fees charged by firms involved in the deal. Investors should carefully read all agreements and understand the transaction's involved costs. Conflicts of interest can arise when a private equity firm has competing interests between its investments and clients. Investors should ensure that the fund is acting in its best interest. This can be done by regularly monitoring performance, requesting regular financial updates, and understanding all fees associated with the investment. Private equity and hedge funds are known as alternative investments, but there are some key differences that investors should be aware of. Private equity investments are typically made with a view to the long term, lasting for several years or even decades. On the other hand, hedge funds tend to take a more short-term approach and look to generate returns over shorter periods. Private equity investments are generally illiquid, meaning investors must be prepared for potentially significant losses if the fund fails to perform as expected. Hedge funds are often more liquid and can provide investors with greater protection against losses. Private equity investments require significant capital upfront and often include a lock-up period where investors cannot withdraw their money before the end of the agreement. On the other hand, hedge funds typically require only a fraction of the capital in private equity funds. They can be more flexible regarding investment terms and liquidity. Private equity investments tend to have relatively long lock-up periods, meaning that investors must wait for extended periods before seeing any investment returns. On the other hand, hedge funds usually offer more flexibility and allow investors access to their money if needed. Private equity investments are often structured as limited partnerships (LPs) or limited liability companies (LLCs), with one or more general partners who manage the fund. On the other hand, hedge funds have a much more diversified structure, such as mutual funds or trusts. Private equity funds are pooled investment vehicles typically employed by institutional investors and high-net-worth individuals. Such funds provide long-term capital to help businesses grow and develop. The main types of private equity funds are venture capital funds, buyout funds, and growth equity funds. A business plan usually includes an exit strategy if the expected milestones are unmet. These are through trade sales, secondary buyouts, initial public offerings, or share repurchases. Private equity and hedge fund transactions are considered alternative investments. However, they invest in distinct types of assets, involve different capital and investment structures, and operate over various periods. Contact a professional financial advisor to learn more about the potential risks, rewards, and how these funds can be incorporated into an investment portfolio.What Is a Private Equity Fund?

Who Can Invest in a Private Equity Fund?

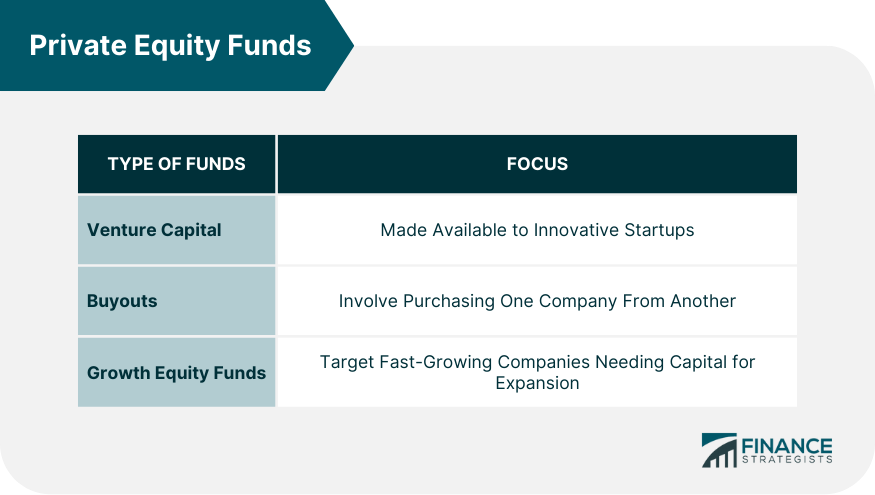

Types of Private Equity Funds

Venture Capital

BuyoutsManagement Buyouts

Leveraged Buyouts

Growth Equity Funds

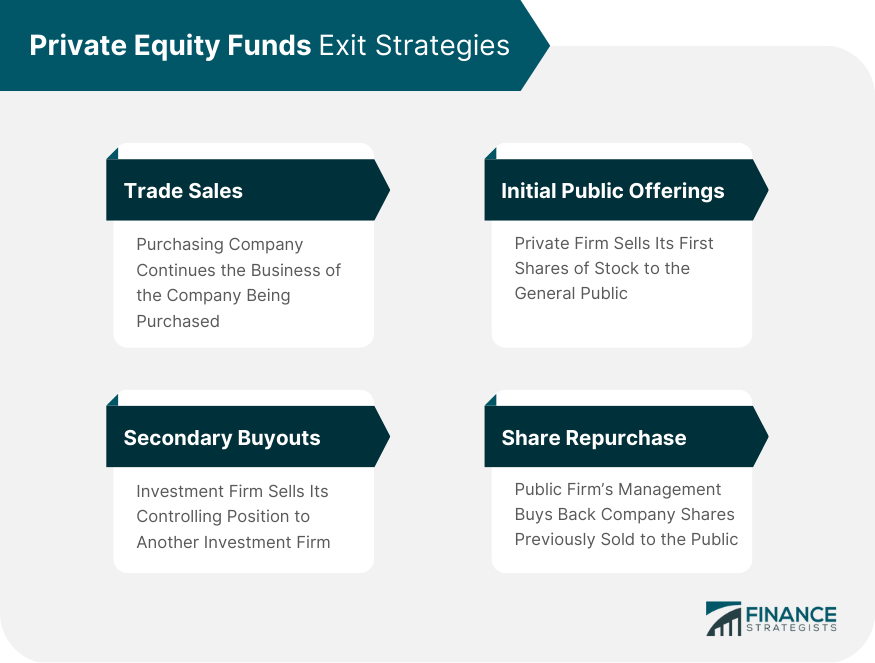

Private Equity Funds Exit Strategies

Trade Sales

Secondary Buyouts

Initial Public Offerings

Share Repurchase

Factors to Consider When Investing in Private Equity Funds

Illiquidity

Fees and Expenses

Conflicts of Interest

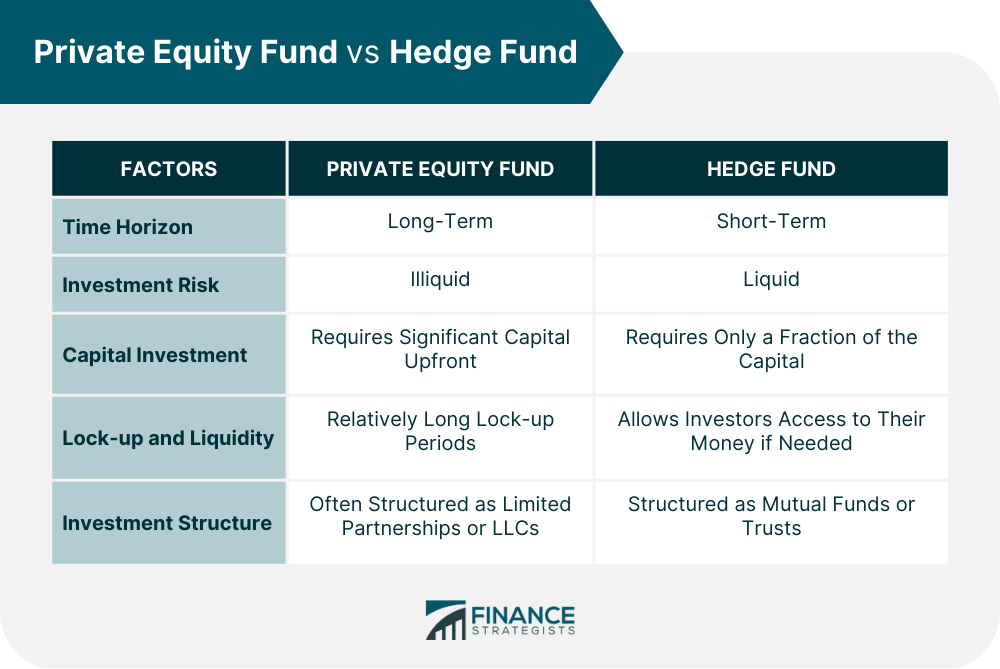

Private Equity Fund vs Hedge Fund

Time Horizon

Investment Risk

Capital Investment

Lock-up and Liquidity

Investment Structure

Final Thoughts

Private Equity Fund FAQs

Private equity funds are managed by a team of professionals with expertise in investments and the industry sector in which they invest. The group typically includes an investment advisor, portfolio managers, analysts, and other professionals who evaluate opportunities and decide where to allocate capital.

Like any investment, there are potential risks associated with private equity funds. These include the fact that they are highly illiquid investments, meaning investors may not be able to access their money when they need it. Additionally, since these funds often invest in high-risk ventures and have higher fees than other types of investments, there is a greater chance of experiencing significant losses.

The main difference between private equity and hedge funds is that private equity funds focus on investing in companies or other entities to make long-term capital gains. In contrast, hedge funds are more focused on short-term investments. Hedge funds also tend to be more liquid, meaning investors can access their money more quickly.

Some private equity funds offer individual investments, but not all do. Check with the specific fund you want to invest in to see if it has this option and what requirements need to be met before you can support it.

An investment advisor or portfolio manager typically manages a private equity fund. This individual oversees the investments and ensures that the fund meets its goals. They also manage and monitor the performance of the investments, ensuring that they remain in line with the stated objectives. The team may also include analysts who analyze potential investments and provide research to the managers.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.