QQQQ, now known as QQQ or the "triple-Q," is an exchange-traded fund (ETF) that tracks the NASDAQ-100 Index. This index includes 100 of the largest domestic and international non-financial companies listed on the NASDAQ Stock Market based on market capitalization. The QQQQ was launched in March 1999 by the PowerShares firm and is now one of the most traded ETFs in the world. In 2011, its ticker symbol was changed to QQQ, though many investors still refer to it by its original name. The QQQQ covers a broad range of sectors and industries, although it is heavily weighted towards technology and internet companies. Other sectors represented in the QQQQ include consumer services, health care, and telecommunications. Some of the top holdings in the QQQQ include major tech companies like Apple Inc., Microsoft Corporation, Amazon.com Inc., and Alphabet Inc. (Google's parent company). The QQQQ tracks the NASDAQ-100 Index, which includes the 100 largest non-financial companies listed on the NASDAQ, based on market capitalization. The index excludes financial companies and includes both domestic and international firms. QQQQ shares can be bought and sold just like individual stocks through a brokerage account. They are traded on the NASDAQ exchange and can be purchased during normal trading hours. The Nasdaq-100 Index is heavily weighted toward technology companies, which have historically shown strong growth potential. By investing in QQQQ, you can gain exposure to some of the biggest and most innovative tech companies in the world, such as Apple, Amazon, and Google. Investing in an ETF like QQQQ can provide diversification by giving you exposure to a broad range of companies across different sectors. This can help reduce the risk of individual company failures impacting your portfolio. QQQQ is one of the most actively traded ETFs, with high trading volume and tight bid-ask spreads. This means that it is easy to buy and sell shares, and you can usually do so at a price close to the current market price. ETFs generally have lower fees than mutual funds, as they passively track an index rather than actively managing a portfolio. QQQQ has historically had relatively low expense ratios compared to other ETFs. While there are no guarantees in investing, the Nasdaq-100 Index has historically outperformed the broader market, thanks in part to the strong performance of the technology sector. By investing in QQQQ, you may be able to take advantage of this growth potential over the long term. The Nasdaq-100 Index is heavily concentrated in the technology sector, which can make the ETF vulnerable to shifts in the tech industry or unexpected market events that disproportionately impact these companies. This can lead to more volatility and risk in the portfolio. ETFs like QQQQ are subject to price fluctuations throughout the trading day, which can cause the value of your investment to rise or fall quickly. This can be particularly concerning for short-term investors or those with a low risk tolerance. While QQQQ provides some diversification across the technology sector and other industries, it may not provide the same level of diversification as investing in a broader range of stocks, bonds, and other assets. As with any investment, there is always the risk of losing money when investing in QQQQ. If the companies in the index underperform or experience significant losses, this can negatively impact the value of the ETF. While QQQQ aims to track the performance of the Nasdaq-100 Index, there can be some tracking error due to factors like fees, trading costs, and changes to the index composition. This can cause the ETF's returns to deviate from the index over time. Because QQQQ tracks the performance of the Nasdaq-100 Index, its success is tied to the performance of the companies included in that index. If another index becomes more popular or the Nasdaq-100 Index falls out of favor, this could negatively impact the ETF's performance. As an ETF that tracks the Nasdaq-100 Index, QQQQ's performance is closely tied to the performance of the index. The index is made up of the 100 largest non-financial companies listed on the Nasdaq stock exchange, with a heavy focus on technology companies. Changes in the overall performance of these companies can impact the value of the index and, in turn, the performance of QQQQ. Changes in interest rates can have an impact on the stock market as a whole, including the technology sector. When interest rates rise, borrowing becomes more expensive, which can slow down economic growth and cause investors to be less willing to take risks in the stock market. Economic indicators like GDP, inflation, and unemployment can impact the performance of QQQQ and the stock market as a whole. Positive economic indicators can signal growth and encourage investors to take risks, while negative indicators can lead to a more cautious approach. The performance of individual companies within the Nasdaq-100 Index can also impact QQQQ's performance. News of major product releases, partnerships, or other developments can cause a company's stock to rise or fall, which can impact the overall value of the index and QQQQ. Geopolitical events like elections, natural disasters, and international conflicts can impact the stock market as a whole and cause investors to be more cautious or risk-averse. QQQQ can play a key role in diversifying an investment portfolio. By providing exposure to multiple sectors and large-cap companies, it can help spread investment risk. In terms of asset allocation, QQQQ provides exposure to equity markets, particularly to the large-cap and technology segments. Depending on an investor's risk tolerance and investment goals, it can form a significant part of the equity portion of a portfolio. QQQQ can be used in a variety of investment strategies. Growth-focused investors may be attracted to its heavy technology sector concentration, while those looking for diversification might appreciate its broad industry representation. It can also be useful for index-based strategies, where the aim is to replicate the performance of the NASDAQ-100. While QQQQ is one of the most well-known NASDAQ ETFs, it's not the only one. There are several other ETFs that track different NASDAQ indices, each with its own focus and investment strategy. For example, the TQQQ offers leveraged exposure to the NASDAQ-100, providing triple the index's daily performance. Choosing QQQQ over other NASDAQ ETFs largely depends on an investor's individual goals and risk tolerance. QQQQ may be a suitable choice for those seeking exposure to large, non-financial companies, particularly in the technology sector. However, those seeking a different risk or sector exposure might consider other ETFs. The SEC regulates all ETFs, including QQQQ. It ensures that the fund complies with the necessary securities laws designed to protect investors, including periodic reporting of financial information. FINRA oversees brokerage firms and their registered representatives involved in selling ETFs like QQQQ. It enforces rules and regulations related to the sale of these funds. QQQQ is a popular ETF that tracks the NASDAQ-100 Index, providing investors with exposure to a broad range of large, non-financial companies. While it offers potential benefits, such as diversification and growth opportunities, it also carries risks, including volatility and sector concentration risk. Investing in QQQQ can be a strategic move for those looking to diversify their portfolios and gain exposure to the technology sector. However, like with any investment, it's essential to understand the fund and consider it within the context of individual investment goals, risk tolerance, and overall portfolio strategy. As always, prospective investors should consider consulting with a financial advisor or conducting thorough research before making investment decisions.What Is QQQQ?

Composition of QQQQ

Sectors and Industries Represented in QQQQ

Top Holdings in QQQQ

Criteria for Inclusion in QQQQ

Investing in QQQQ

How to Buy and Sell QQQQ

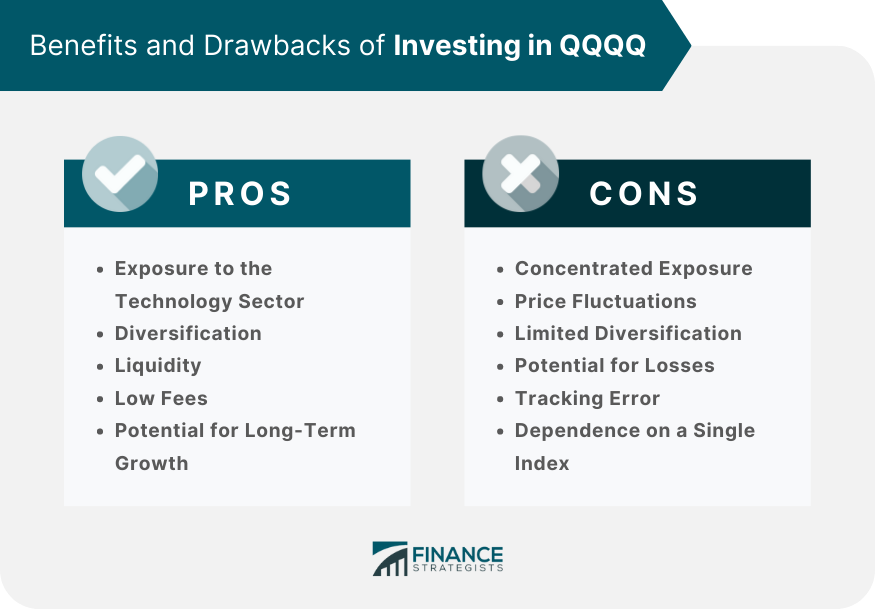

Benefits of Investing in QQQQ

Exposure to the Technology Sector

Diversification

Liquidity

Low Fees

Potential for Long-Term Growth

Risks and Drawbacks of Investing in QQQQ

Concentrated Exposure

Price Fluctuations

Limited Diversification

Potential for Losses

Tracking Error

Dependence on a Single Index

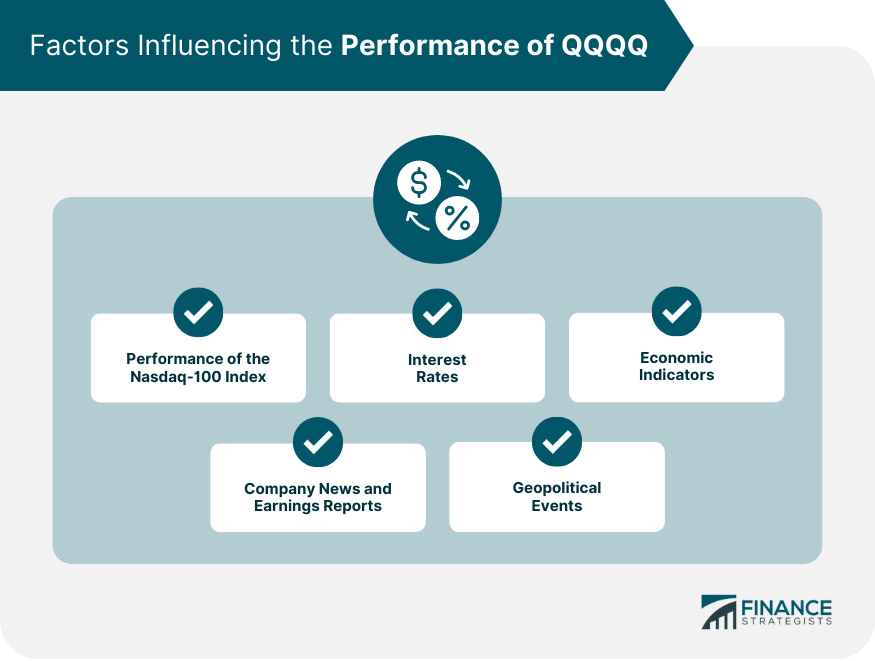

Factors Influencing the Performance of QQQQ

Performance of the Nasdaq-100 Index

Interest Rates

Economic Indicators

Company News and Earnings Reports

Geopolitical Events

Role of QQQQ in Portfolio Diversification

How QQQQ Can Enhance Portfolio Diversification

QQQQ in the Context of Asset Allocation

QQQQ in Various Investment Strategies

QQQQ vs Other Nasdaq ETFs

Comparison of QQQQ With Other Nasdaq ETFs

When to Choose QQQQ Over Other Nasdaq ETFs

Regulatory and Oversight Bodies for QQQQ

Securities and Exchange Commission (SEC)

Financial Industry Regulatory Authority (FINRA)

Conclusion

QQQQ FAQs

QQQQ is an exchange-traded fund that tracks the performance of the Nasdaq 100 Index. The ETF is managed by Invesco and provides investors with exposure to the top 100 non-financial companies listed on the Nasdaq Stock Market.

QQQQ works by investing in the same securities as the Nasdaq 100 Index, which is a market capitalization-weighted index of the 100 largest domestic and international non-financial companies listed on the Nasdaq Stock Market.

The benefits of investing in QQQQ include exposure to a diversified portfolio of large-cap growth companies, low expenses, and the ability to trade the ETF like a stock throughout the trading day.

The risks of investing in QQQQ include market risk, sector concentration risk, and the possibility that the ETF may trade at a premium or discount to its net asset value.

Investors can invest in QQQQ by purchasing shares through a brokerage account. The ETF can be bought or sold like a stock on a stock exchange during trading hours.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.