Overview of Short-Term Investments

Short-term investments, also known as marketable securities or temporary investments, are financial instruments that mature within one year or can be easily liquidated. They offer a way for investors to earn returns on their money while keeping funds accessible.

These investments are typically less risky than long-term investments, making them an attractive option for investors who prioritize safety and liquidity. They can serve as a place to park cash or provide a steady income stream with minimal risk exposure.

The primary objectives of short-term investments are preserving capital, ensuring liquidity, and generating income. Investors use these investments to protect their principal while earning a modest return.

Short-term investments can also be used to diversify a portfolio, manage cash flow needs, or act as a temporary holding for funds. They are especially popular among conservative investors or those with short-term financial goals.

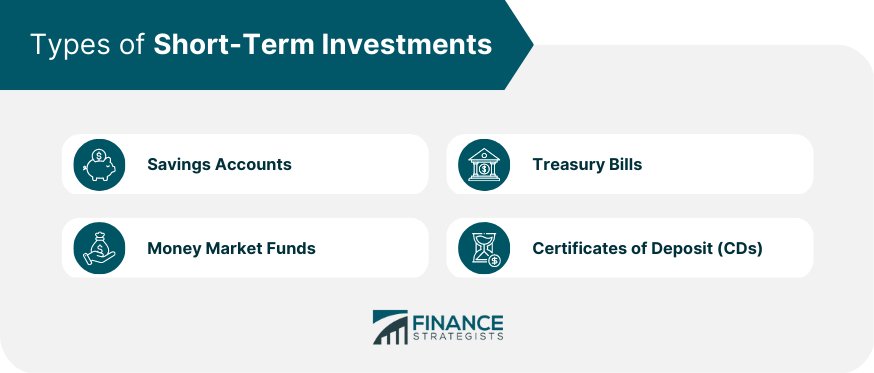

Types of Short-Term Investments

Savings Accounts

Savings accounts are highly liquid, low-risk accounts offered by banks and credit unions. They allow individuals to deposit money, earn interest, and withdraw funds as needed.

Though not known for high returns, savings accounts provide a secure place for funds and offer FDIC insurance, making them an ideal choice for conservative investors or as an emergency fund.

Certificates of Deposit (CDs)

Certificates of deposit (CDs) are time deposits offered by banks and credit unions, typically with fixed interest rates and maturities ranging from a few months to several years.

Investors agree to leave their funds in the account for a specified term, in exchange for higher interest rates than regular savings accounts.

CDs are a low-risk investment option, as they are insured by the FDIC, but they require investors to lock up their funds for the term of the deposit. Early withdrawal penalties may apply if funds are accessed before maturity.

Money Market Funds

Money market funds are a type of mutual fund that invests in short-term, high-quality debt securities such as Treasury bills, commercial paper, and repurchase agreements. They aim to maintain a stable net asset value (NAV) and provide investors with a modest return.

These funds offer a higher yield than traditional savings accounts and are highly liquid, making them an attractive option for short-term investors seeking a balance between safety and returns.

Treasury Bills

Treasury bills, or T-bills, are short-term government securities issued by the U.S. Department of the Treasury with maturities ranging from a few days to 52 weeks.

They are considered among the safest investments available, as they are backed by the full faith and credit of the U.S. government.

T-bills are sold at a discount to their face value, and investors receive the full face value upon maturity. The difference between the purchase price and the face value represents the interest earned, making them an appealing choice for risk-averse investors.

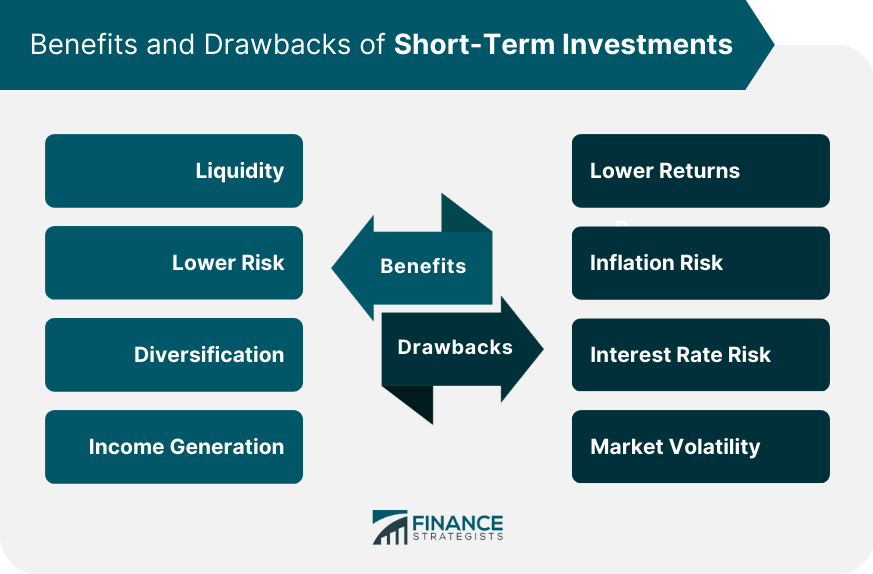

Benefits of Short-Term Investments

Liquidity

Short-term investments are highly liquid, meaning they can be easily converted to cash with minimal impact on their value. This liquidity allows investors to access their funds quickly in case of unexpected expenses or investment opportunities.

Liquidity is a key consideration for investors with short-term financial goals or those who may need to access their funds on short notice. It helps ensure that funds can be withdrawn without incurring significant penalties or losses.

Lower Risk

Short-term investments generally carry lower risk than long-term investments, as they are less susceptible to market fluctuations and economic downturns.

Investors are less likely to experience substantial losses in the short term, making these investments an attractive option for conservative investors.

Lower-risk investments can provide a stable source of income and help preserve capital. This makes short-term investments an essential component of a diversified portfolio, particularly for risk-averse investors or those with short-term financial goals.

Diversification

Diversification is a key principle of investing, as it helps to spread risk across various asset classes and investment vehicles.

Short-term investments can play a crucial role in diversifying a portfolio, as they often exhibit lower correlation with long-term investments, such as stocks.

Including short-term investments in a portfolio can help to balance risk and reward, offering stability during market volatility. This strategy can be particularly beneficial for investors nearing retirement or those seeking to preserve capital while generating income.

Income Generation

Short-term investments can provide a steady stream of income through interest or dividends, making them an attractive option for investors looking for reliable returns.

This income can be used to supplement other sources of revenue or be reinvested to grow the overall investment portfolio.

While the returns on short-term investments may be lower than those on long-term investments, they can still contribute to overall portfolio growth.

Investors seeking income without exposing their principal to significant risk may find short-term investments to be a suitable option.

Potential Drawbacks of Short-Term Investments

Lower Returns

Short-term investments generally offer lower returns than long-term investments due to their lower risk profile and shorter investment horizon.

This trade-off may be acceptable for investors seeking stability and liquidity, but it may not be suitable for those focused on long-term growth or wealth accumulation.

Investors should carefully consider their risk tolerance and financial goals when deciding how much of their portfolio to allocate to short-term investments.

Inflation Risk

Inflation risk refers to the potential loss of purchasing power due to rising prices. Short-term investments, particularly those with low returns, may not keep pace with inflation, resulting in a loss of real value over time.

Investors should be mindful of inflation risk when selecting short-term investments and consider options that provide returns above the rate of inflation to preserve their purchasing power.

Interest Rate Risk

Interest rate risk is the potential for the value of an investment to decrease due to changes in interest rates. Short-term investments, particularly fixed-income securities such as bonds or CDs, can be sensitive to changes in interest rates.

Investors should monitor interest rate trends and consider the potential impact on their short-term investments, adjusting their portfolio as needed to manage this risk.

Market Volatility

While short-term investments are generally less susceptible to market volatility than long-term investments, they are not immune to fluctuations in value.

Investors should be prepared for the possibility of short-term losses and ensure that their portfolio is well-diversified to minimize risk.

By maintaining a balanced portfolio of short-term investments, investors can navigate market volatility while preserving capital and generating income.

Considerations for Selecting Short-Term Investments

Investment Goals

When selecting short-term investments, it is essential to consider the specific financial goals and objectives that the investments are intended to achieve.

Different short-term investments may be better suited for various purposes, such as emergency funds, short-term savings goals, or income generation.

Investors should carefully assess their needs and time horizons to determine the most appropriate short-term investments for their situation. This approach can help to ensure that the chosen investments align with the investor's overall financial strategy.

Risk Tolerance

Risk tolerance refers to an investor's willingness and ability to accept fluctuations in the value of their investments. It is crucial to consider risk tolerance when selecting short-term investments, as different investment vehicles carry varying levels of risk.

Conservative investors may prefer to focus on lower-risk options, such as savings accounts or Treasury bills, while those with a higher risk tolerance may opt for investments with greater return potential, such as short-term bonds or money market funds.

Time Horizon

The time horizon, or the length of time an investor expects to hold an investment before needing the funds, plays a critical role in selecting short-term investments. Some investments may require a minimum holding period or incur penalties for early withdrawal.

By considering the time horizon, investors can ensure that they select investments that offer the appropriate balance between liquidity and returns, while minimizing potential penalties or fees.

Fees and Expenses

When selecting short-term investments, it is important to consider the fees and expenses associated with each investment option. High fees can erode returns, particularly in low-yield environments.

Investors should carefully evaluate the costs of each investment and weigh them against the potential returns to ensure that they are making a cost-effective choice.

Strategies for Short-Term Investing

Laddering

Laddering is a strategy that involves purchasing a series of investments with staggered maturity dates. This approach allows investors to take advantage of changing interest rates and ensures that funds are consistently available for reinvestment or withdrawal.

By employing a laddering strategy, investors can benefit from both liquidity and the potential for higher returns, making it a useful approach for managing short-term investments.

Active Management

Active management involves closely monitoring and adjusting a portfolio of short-term investments based on market conditions, economic indicators, or individual investment performance.

This hands-on approach aims to capitalize on investment opportunities and mitigate risks.

While active management can offer the potential for higher returns, it typically involves higher fees and requires a more significant time commitment from the investor.

Passive Management

Passive management, on the other hand, involves creating a portfolio of short-term investments and allowing it to remain largely unchanged over time.

This approach typically involves lower fees and can be more suitable for investors who prefer a "buy-and-hold" strategy or have limited time to actively manage their investments.

Though passive management may result in lower returns compared to active management, it can still provide a stable source of income and capital preservation for investors with a lower risk tolerance or shorter time horizons.

Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy that involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions.

This approach can be applied to short-term investments, allowing investors to benefit from fluctuations in interest rates or asset prices.

By utilizing dollar-cost averaging, investors can mitigate the impact of market volatility and reduce the risk of making poorly timed investment decisions.

This strategy can be particularly effective for investors who wish to minimize risk while steadily growing their short-term investment portfolio.

Tax Implications of Short-Term Investments

Capital Gains Tax

Capital gains tax is levied on the profit made from selling an investment. Short-term capital gains, which result from investments held for one year or less, are generally taxed at a higher rate than long-term capital gains.

Investors should be aware of the tax implications of their short-term investments and plan accordingly to minimize their tax burden.

Dividend Tax

Dividends received from short-term investments may be subject to taxation. The tax rate on dividends varies depending on the investor's income level and the type of dividend received (qualified or non-qualified).

Investors should understand the tax treatment of dividends and consider the impact on their overall investment returns.

Interest Income Tax

Interest income earned from short-term investments, such as savings accounts, CDs, or bonds, is typically subject to federal and, in some cases, state income tax. The tax rate on interest income depends on the investor's income level.

It is essential for investors to factor in the tax implications of interest income when evaluating the potential returns on short-term investments.

Tax-Advantaged Accounts

Investors can consider utilizing tax-advantaged accounts, such as individual retirement accounts (IRAs) or 401(k)s, to hold their short-term investments.

These accounts offer tax-deferred growth, allowing investors to delay paying taxes on their investment earnings until they are withdrawn in retirement.

By holding short-term investments in tax-advantaged accounts, investors can potentially reduce their overall tax burden and enhance their investment returns.

Conclusion

Incorporating short-term investments into a diversified portfolio can help to balance risk and reward, providing stability during market volatility and generating income.

By carefully selecting investments that align with their financial goals, risk tolerance, and time horizon, investors can optimize their short-term investment strategy.

It is essential to consider the potential drawbacks and tax implications of short-term investments and adjust the portfolio as needed to ensure that it remains well-balanced and aligned with the investor's objectives.

Each investor's financial situation and goals are unique, and their short-term investment strategy should be tailored accordingly.

By considering factors such as investment goals, risk tolerance, time horizon, and fees, investors can create a customized short-term investment strategy that meets their specific needs.

Additionally, investors can choose from various investment strategies, such as laddering, active management, passive management, or dollar-cost averaging, to manage their short-term investments and optimize returns.

Regularly monitoring and adjusting short-term investments is crucial to ensure that they remain aligned with the investor's objectives and risk tolerance.

Market conditions, economic indicators, and personal financial circumstances may change over time, necessitating adjustments to the short-term investment portfolio.

By staying informed and proactively managing their short-term investments, investors can maximize their returns, minimize risk, and achieve their financial goals.

Short-Term Investments FAQs

Short-term investments are investments that are expected to yield returns in a short period, usually one year or less.

Short-term investments offer liquidity, low risk, and flexibility. They allow investors to access their funds quickly and can serve as a hedge against inflation.

Examples of short-term investments include money market funds, certificates of deposit (CDs), Treasury bills, and commercial paper.

Some strategies for investing in short-term investments include diversifying your portfolio, monitoring interest rates, and investing in a mix of short-term investments.

Short-term investments are investments that are expected to yield returns in a short period, usually one year or less, while long-term investments are investments that are held for an extended period, usually more than one year, and are typically higher risk with potentially higher returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.