A target-date fund is an investment vehicle that automatically adjusts the asset allocation mix as the investor approaches retirement. These funds are designed to provide a simple and convenient way for individuals to save for retirement without the need to constantly monitor and adjust their investments. Target-date funds are often identified by the year of the investor's expected retirement and typically include a mix of stocks, bonds, and other assets. The primary objective of a target-date fund is to help investors achieve their retirement savings goals. The asset allocation mix is designed to gradually become more conservative as the investor approaches the target retirement date. This gradual shift is intended to help minimize risk as the investor gets closer to retirement age. The asset allocation mix in a target-date fund is determined by the fund manager based on the target retirement date. The fund's asset allocation mix is typically more aggressive when the target retirement date is further in the future, with a higher percentage of stocks and other growth-oriented assets. As the target retirement date approaches, the asset allocation mix gradually becomes more conservative, with a higher percentage of bonds and other fixed-income investments. The investment strategy of a target-date fund is based on the principle of diversification. The fund is invested in a mix of stocks, bonds, and other assets to spread out the risk and minimize the impact of market volatility. Target-date funds are designed to automatically rebalance the asset allocation mix based on the target retirement date. As the investor gets closer to retirement age, the asset allocation mix becomes more conservative. This automatic rebalancing ensures that the investor's portfolio is in line with their retirement goals and risk tolerance. Active target-date funds are managed by professional fund managers who actively make investment decisions based on market conditions and other factors. These funds typically have higher fees compared to passive target-date funds. Passive target-date funds are designed to track a specific index or benchmark and do not involve active management by a professional fund manager. These funds typically have lower fees compared to active target-date funds. Custom target-date funds are designed for institutional investors, such as pension plans or endowments. These funds are typically managed by investment firms or consultants and are customized based on the specific needs and goals of the institution. One of the primary advantages of target-date funds is their simplicity. Investors can simply choose a fund based on their expected retirement date and leave the asset allocation and investment decisions to the fund manager. This eliminates the need for investors to constantly monitor and adjust their investments. Target-date funds are designed to provide investors with a diversified portfolio of stocks, bonds, and other assets. This diversification helps to spread out risk and minimize the impact of market volatility. Target-date funds are managed by professional fund managers who have expertise in selecting and managing investments. This professional management helps to ensure that the fund is invested in a diversified mix of assets that are appropriate for the investor's retirement goals and risk tolerance. Target-date funds are designed to automatically rebalance the asset allocation mix based on the target retirement date. This automatic rebalancing ensures that the investor's portfolio remains in line with their retirement goals and risk tolerance, without the need for constant monitoring and adjustment. Target-date funds provide exposure to multiple asset classes, including stocks, bonds, and other assets. This exposure helps to spread out risk and minimize the impact of market volatility. One of the primary disadvantages of target-date funds is their limited customization. The asset allocation mix is determined by the fund manager based on the target retirement date, and investors do not have the ability to customize the mix based on their individual goals and risk tolerance. Target-date funds typically have higher fees compared to other investment products, such as index funds. These fees can eat into the investor's returns over time. Investors who choose target-date funds relinquish control over their investments to the fund manager. This lack of control can be a disadvantage for investors who prefer to be more involved in the investment process. Investors should consider their retirement goals when choosing a target-date fund. The fund's asset allocation mix should be aligned with the investor's expected retirement age and retirement income needs. Investors should also consider their risk tolerance when choosing a target-date fund. The fund's asset allocation mix should be appropriate for the investor's risk tolerance, and investors should be comfortable with the level of risk associated with the fund. Investors should consider the fees associated with the target-date fund, as these fees can impact the investor's returns over time. Investors should also consider the asset allocation mix of the target-date fund and ensure that it is appropriate for their individual retirement goals and risk tolerance. Investors can combine target-date funds with other investments, such as individual stocks or bonds, to further diversify their portfolio and customize their asset allocation mix. Investors who start investing in target-date funds early in their career can take advantage of the power of compounding and potentially achieve greater returns over time. While target-date funds are designed to be a hands-off investment product, investors should still regularly monitor their investments and ensure that the asset allocation mix is appropriate for their retirement goals and risk tolerance. Target-date funds are an investment option that can simplify the retirement planning process for investors. They offer a diversified portfolio of stocks, bonds, and other assets that are rebalanced over time, making them a popular choice for many investors. It is important to understand the different types of target-date funds available and the pros and cons of each. Active target-date funds may offer the potential for higher returns but can come with higher fees and risks. Passive target-date funds have lower fees and are more predictable but may not outperform the market. Custom target-date funds allow for more flexibility but require more effort and knowledge to manage. When choosing a target-date fund, it is important to consider your retirement goals, risk tolerance, fees, and asset allocation needs. Starting early and regularly monitoring your investments can help ensure that you stay on track to reach your retirement goals.What Is a Target-Date Fund?

How It Works

Asset Allocation

Investment Strategy

The investment strategy is based on the investor's target retirement date and risk tolerance.Rebalancing

Types of Target-Date Funds

Active Target-Date Funds

Passive Target-Date Funds

Custom Target-Date Funds

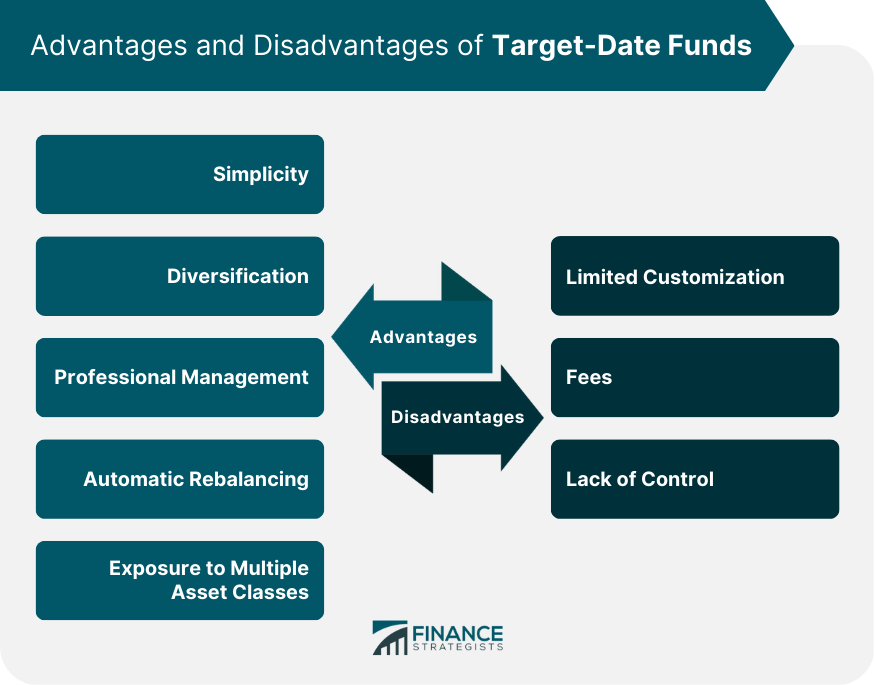

Advantages of Target-Date Funds

Simplicity

Diversification

Professional Management

Automatic Rebalancing

Exposure to Multiple Asset Classes

Disadvantages of Target-Date Funds

Limited Customization

Fees

Lack of Control

Factors to Consider When Choosing a Target-Date Fund

Retirement Goals

Risk Tolerance

Fees

Asset Allocation

Strategies for Using Target-Date Funds

Combining Target-Date Funds With Other Investments

Starting Early

Regularly Monitoring Investments

Final Thoughts

Target-Date Fund FAQs

A Target-Date Fund is a type of mutual fund that adjusts its investment portfolio over time to become more conservative as the target date approaches.

Target-Date Funds invest in a diversified portfolio of stocks, bonds, and other assets. The asset allocation becomes more conservative as the target date approaches, reducing the risk.

Target-Date Funds offer a simple, hands-off investment option that requires little knowledge or time. They also automatically adjust to become more conservative as the target date approaches.

Target-Date Funds may not be suitable for all investors, as they offer limited customization options. Additionally, fees may be higher than other investment options.

Target-Date Funds can be categorized by the year in which the target date occurs, such as 2030, 2040, or 2050. They can also be categorized by the level of risk, such as aggressive, moderate, or conservative.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.