Value Funds are a type of mutual fund or exchange-traded fund (ETF) that invests in stocks of companies that are deemed to be undervalued by the market. These funds are designed to follow a value investing strategy, which seeks to buy stocks of companies with strong fundamentals but low stock prices. The purpose of this article is to provide readers with an overview of Value Funds, how they work, their benefits, risks, and how to invest in them. Value Funds invest in companies that are considered undervalued by the market. This means that the stock price of the company is lower than its intrinsic value. Intrinsic value is the actual value of a company based on its assets, cash flow, and earnings potential. Value investors believe that the market tends to undervalue good companies, and therefore, they look for opportunities to buy these undervalued stocks at a discount. Value Funds typically have a portfolio of stocks that are chosen based on a set of criteria, such as low price-to-earnings (P/E) ratio, low price-to-book (P/B) ratio, high dividend yield, and other financial metrics that indicate undervaluation. The fund manager selects stocks that meet these criteria and creates a diversified portfolio of undervalued stocks. The goal is to hold these stocks for the long-term, allowing them to increase in value as the market eventually recognizes their true worth. One of the key benefits of investing in Value Funds is diversification. By investing in a portfolio of undervalued stocks across different sectors and industries, investors can reduce their overall portfolio risk. This is because different stocks and sectors have different risk profiles and tend to perform differently under different economic conditions. A well-diversified portfolio can help smooth out the ups and downs of individual stocks and provide more stable returns over the long-term. Value investing has a long track record of delivering consistent long-term returns. This is because undervalued stocks have the potential to outperform the market over time as their true value is recognized by the market. Value Funds can provide protection against market volatility because they invest in undervalued companies with strong fundamentals. These companies are often more stable and less prone to volatility compared to high-growth stocks, which can be more sensitive to market changes. As a result, Value Funds may provide a buffer against market volatility and provide a more stable source of returns over time. Value Funds have historically provided risk-adjusted returns, meaning that they have provided higher returns relative to their risk profile. This is because Value Funds invest in undervalued stocks that have already experienced a price decline, reducing their downside risk. Additionally, Value Funds often have a lower beta, or market risk, compared to the broader market, which can provide a more stable source of returns over time. One of the biggest risks of Value Funds is the value trap. This occurs when a stock appears undervalued but continues to decline in price, with no improvement in fundamentals. This can happen when a company is facing significant challenges, such as declining revenue or earnings, or increased competition. Investors need to be careful to avoid stocks that are value traps and focus on companies with strong fundamentals that are temporarily undervalued. Investing in Value Funds requires a long-term perspective, and investors need to be patient and wait for the market to recognize the true value of the underlying stocks. However, timing the market can be difficult, and there is a risk that the market may not recognize the true value of the stocks for an extended period. As a result, investors may miss out on potential gains or experience significant losses if they try to time their entry or exit from the market. Value Funds can be exposed to economic risk, as undervalued stocks may be more sensitive to changes in economic conditions. For example, if there is a recession, companies with weak fundamentals may experience a decline in earnings, leading to a decline in their stock price. Investors need to be aware of the economic environment and how it may impact the companies in the Value Fund's portfolio. Value Funds may also be exposed to interest rate risk, as changes in interest rates can impact the performance of the underlying stocks. For example, if interest rates rise, companies with high levels of debt may experience increased interest expense, leading to a decline in their earnings and stock price. Investors need to be aware of the interest rate environment and how it may impact the companies in the Value Fund's portfolio. Investors can choose from a variety of Value Funds, including mutual funds and ETFs. When selecting a Value Fund, investors should consider factors such as the fund's investment strategy, track record, fees, and management team. It is also important to consider the fund's diversification and risk management strategies, as well as the sectors and industries in which the fund invests. Investors can also build a Value Portfolio by selecting individual stocks that meet the criteria for value investing. This requires research and analysis of individual stocks and their financial metrics. Investors need to consider factors such as the company's financial strength, growth potential, and valuation metrics to identify undervalued stocks that have the potential to outperform the market over time. Investors should consider their investment objectives, risk tolerance, and time horizon when investing in Value Funds. Value investing is a long-term strategy that requires patience and discipline. Investors should avoid trying to time the market and focus on building a diversified portfolio of undervalued stocks that have the potential to outperform over the long-term. Investors can manage their risk by diversifying their portfolio and investing in Value Funds that have a diversified portfolio of undervalued stocks. They can also use stop-loss orders or other risk management strategies to limit their downside risk. Value Funds are a type of mutual fund or ETF that invests in undervalued stocks using a value investing strategy. Value investing involves buying stocks that are trading at a discount to their intrinsic value, with the expectation that they will eventually increase in value as the market recognizes their true worth. Investing in Value Funds can provide investors with diversification, consistent long-term returns, protection against market volatility, and risk-adjusted returns. However, investors need to be aware of the risks, such as the value trap, market timing risk, economic risk, and interest rate risk. By carefully selecting a Value Fund or building a Value Portfolio, investors can potentially achieve higher returns over the long-term while managing their risk.What Are Value Funds?

How it Works

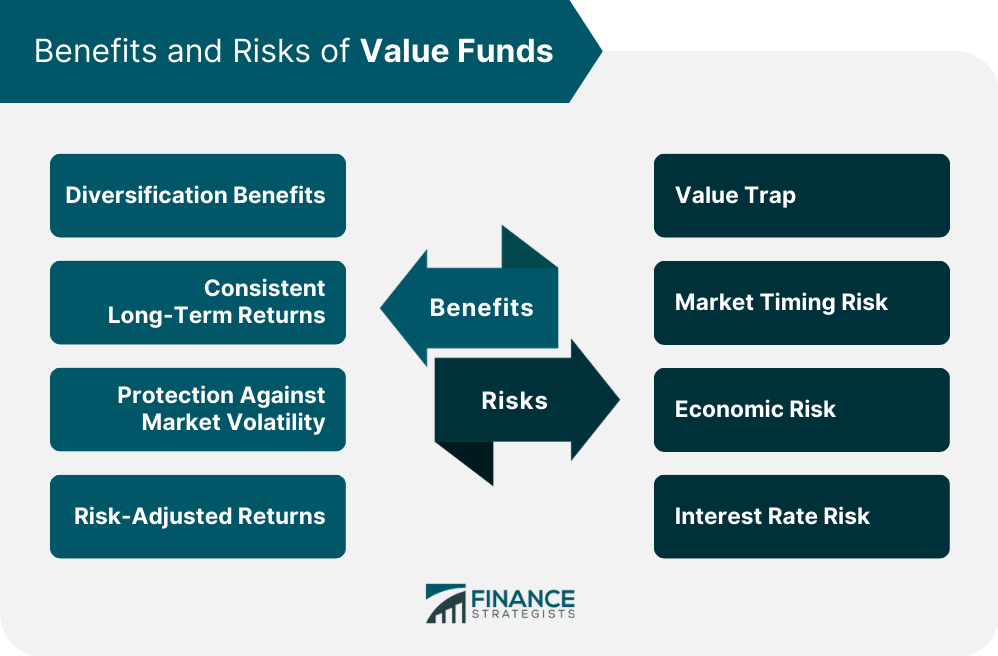

Benefits of Value Funds

Diversification Benefits

Consistent Long-Term Returns

While there may be short-term volatility, value stocks have historically provided higher returns over the long-term compared to growth stocks.Protection Against Market Volatility

Risk-Adjusted Returns

Risks of Value Funds

Value Trap

Market Timing Risk

Economic Risk

Interest Rate Risk

How to Invest in Value Funds

Choosing a Value Fund

Building a Value Portfolio

Investment Strategy Considerations

Risk Management Strategies

Conclusion

Value Funds FAQs

Value Funds are mutual funds or exchange-traded funds that invest in stocks of companies that are believed to be undervalued by the market.

Value Funds invest in companies that are believed to be trading at a discount to their intrinsic value. The fund managers look for stocks that have low price-to-earnings ratios, low price-to-book ratios, or high dividend yields.

Investing in Value Funds may provide potential benefits such as higher returns over the long term, lower volatility than growth funds, and a margin of safety due to the discounted valuation of the companies.

The potential risks of investing in Value Funds include the possibility of value traps (stocks that are cheap for a reason), market volatility, and underperformance during growth market cycles.

Investors can invest in Value Funds through a broker or financial advisor who can help them select the appropriate fund(s) based on their investment goals, risk tolerance, and overall financial situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.