Venture Capital (VC) funds are financial intermediaries that provide capital to startups and high-growth companies in exchange for equity or ownership stakes. These funds play a crucial role in financing innovative businesses that require significant resources to develop and commercialize new products, services, and technologies. Venture capital funds serve as a catalyst for economic growth, job creation, and innovation. They provide financial resources, strategic guidance, mentorship, and access to networks that help startups scale and succeed. VC funds enable entrepreneurs to pursue disruptive ideas and turn them into market-leading companies, fostering a competitive and dynamic business environment. The venture capital ecosystem comprises various stakeholders, including general partners (GPs), limited partners (LPs), entrepreneurs, angel investors, accelerators, incubators, and government entities. Seed-stage funds specialize in providing capital to startups at the earliest stage of their development. These funds invest in companies that often have a concept or prototype but have not yet generated significant revenues or launched their product in the market. Early-stage funds invest in companies that have developed their product or service and started generating revenues but are not yet profitable. These funds provide capital to help businesses scale and expand their operations. Growth-stage funds focus on investing in more mature companies that have demonstrated strong revenue growth and are approaching profitability. These funds typically invest larger amounts to support further expansion, acquisitions, or market penetration. Industry-specific funds concentrate their investments in a particular sector, such as technology, healthcare, or consumer products. These funds leverage their expertise and networks to identify and support promising companies within their target industries. Corporate venture capital funds are investment arms of large corporations that invest in startups to gain strategic advantages, such as access to new technologies or markets. These funds often provide startups with resources, industry knowledge, and distribution channels to help them grow. Governments or public entities establish government-backed funds to promote entrepreneurship, innovation, and economic development. These funds often invest in startups that align with national priorities or focus on specific industries or regions. Venture capital funds are typically structured as limited partnerships, with general partners responsible for managing the fund's investments and limited partners providing capital. GPs have fiduciary duties to LPs and are compensated through management fees and carried interest. VC funds vary in size, ranging from small seed-stage funds to large multi-billion-dollar funds. The fund size influences its investment focus, deal size, and portfolio diversification strategy. The investment process in VC funds involves deal sourcing, initial screening, due diligence, term negotiation, investment decision-making, and post-investment management. Due diligence is critical to this process, as it helps GPs assess the startup's potential risks and returns. A typical venture capital fund has a life cycle of 10-12 years, divided into an investment period (usually 3-5 years) and a harvesting period. The fund's term may be extended to allow portfolio companies to exit through initial public offerings (IPOs), mergers and acquisitions (M&As), or secondary sales. VC funds construct and manage their portfolios to diversify risks and maximize returns. They invest in a mix of startups across various industries, stages, and geographies to mitigate the impact of individual company failures and market fluctuations. The internal rate of return (IRR) is a key performance metric used by VC funds to measure the annualized rate of return on investments. It takes into account the timing and magnitude of cash flows generated by the fund's investments. Cash-on-cash return measures the total amount of cash distributions received by investors relative to their invested capital. This metric provides a simple and intuitive measure of the fund's performance, although it does not consider the time value of money. Total Value to Paid-in Capital (TVPI) is a performance metric that compares the total value of a VC fund's investments (including both realized and unrealized gains) to the amount of capital paid in by LPs. A TVPI greater than 1 indicates that the fund has generated a positive return on investment. Distribution to Paid-in Capital (DPI) measures the amount of cash distributions returned to LPs relative to their invested capital. It is a key metric for assessing a VC fund's liquidity and realized returns. Institutional investors, such as pension funds, endowments, and insurance companies, are significant sources of capital for VC funds. They invest in venture capital to diversify their portfolios and seek higher returns compared to traditional asset classes. High-net-worth individuals (HNWIs) invest in VC funds to gain exposure to high-growth startups and potentially achieve outsized returns. They may invest directly in funds or through wealth management platforms and family offices. Family offices manage the wealth and investments of wealthy families and often allocate a portion of their assets to venture capital funds. They may invest in VC funds directly or through fund-of-fund structures. Crowdfunding platforms enable individual and institutional investors to invest online in startups and venture capital funds. These platforms democratize access to venture capital by lowering the barriers to entry for smaller investors. Angel groups are networks of individual angel investors who pool their resources and expertise to invest in startups collectively. These groups may also invest in VC funds to access broader investment opportunities. Accelerators and incubators support early-stage startups by providing mentorship, resources, and sometimes capital. They may invest in or partner with VC funds to co-invest in promising startups. Venture capital funds must comply with various legal and regulatory requirements, including fund formation, registration, and reporting obligations. These requirements vary by jurisdiction and may involve complex legal, tax, and compliance considerations. VC funds are subject to investor protection and compliance rules designed to safeguard the interests of LPs. These rules may include disclosure requirements, anti-money laundering (AML) regulations, and fiduciary duties owed by GPs to LPs. Tax considerations play a critical role in structuring VC funds and investments. GPs and LPs must navigate complex tax laws and regulations that may impact fund returns and investor returns. These considerations may include capital gains tax, income tax, withholding tax, and tax treaties between different jurisdictions. Investing in startups entails significant risks, as a large percentage of startups fail due to various reasons, such as insufficient funding, poor product-market fit, or intense competition. VC funds must carefully select and manage their investments to mitigate these risks. Venture capital investments are typically illiquid, as they cannot be easily sold or exchanged for cash. Investors in VC funds need to have a long-term investment horizon and be prepared to hold their investments until exit opportunities arise. VC funds are exposed to market and economic risks, such as market downturns, regulatory changes, and macroeconomic shocks. These factors can negatively impact portfolio companies' performance and the fund's overall returns. Venture capital funds must navigate a complex regulatory landscape, which may impact their operations, investments, and returns. Changes in regulations can create uncertainties and pose challenges for both GPs and LPs. The competitive landscape for venture capital is constantly evolving, with new funds, investors, and technologies entering the market. VC funds must continually adapt their strategies and networks to source attractive investment opportunities and stay ahead of the competition. An increasing number of VC funds are incorporating environmental, social, and governance (ESG) considerations into their investment strategies. This trend reflects growing investor demand for responsible and sustainable investments that generate both financial returns and positive social and environmental impacts. Artificial intelligence (AI) and data analytics are becoming increasingly important tools for VC funds to identify, evaluate, and manage investments. By leveraging these technologies, VC funds can gain deeper insights, improve decision-making, and enhance their overall performance. Venture capital funds play a crucial role in financing innovative businesses that require significant resources to develop and commercialize new products, services, and technologies. VC funds vary in size and investment focus, from small seed-stage funds to large multi-billion-dollar funds that concentrate their investments in specific sectors or industries. VC funds must comply with various legal and regulatory requirements, including fund formation, registration, and reporting obligations, and they are subject to investor protection and compliance rules. A wealth management professional can provide valuable insights and advice tailored to the investor's unique financial goals and risk tolerance, ensuring a well-diversified portfolio that balances risk and return. What Are Venture Capital Funds?

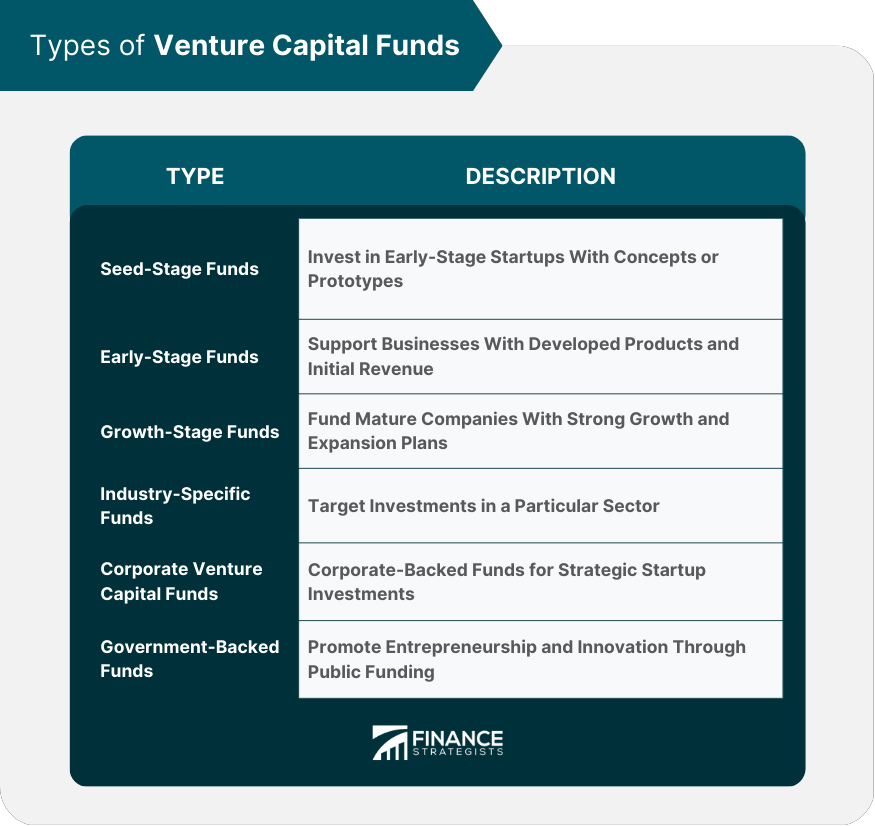

Types of Venture Capital Funds

Seed-Stage Funds

Early-Stage Funds

Growth-Stage Funds

Industry-Specific Funds

Corporate Venture Capital Funds

Government-Backed Funds

Structure of Venture Capital Funds

General Partners (GPs) and Limited Partners (LPs)

Fund Size and Investment Focus

Investment Process and Due Diligence

Term and Life Cycle of a VC Fund

Portfolio Management and Diversification

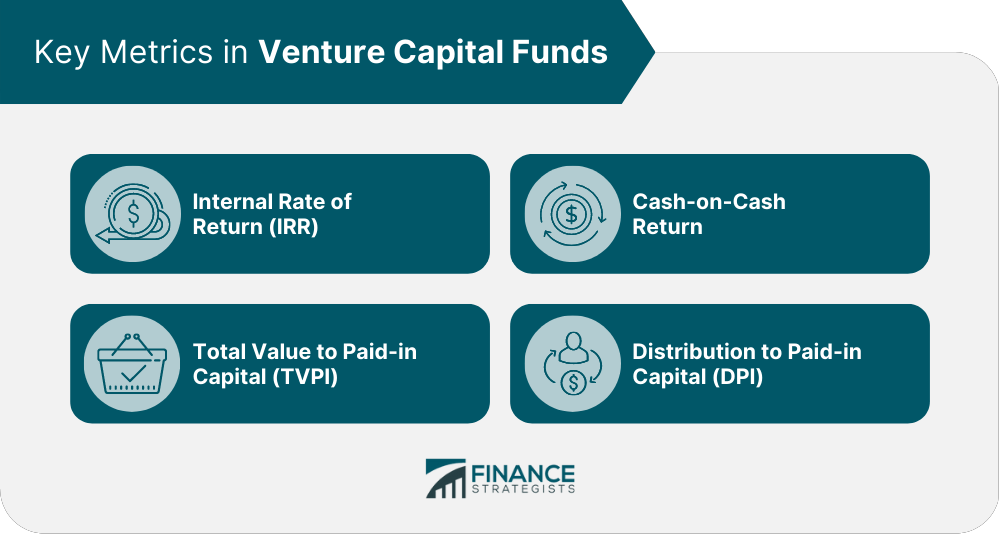

Key Metrics in Venture Capital Funds

Internal Rate of Return (IRR)

Cash-on-Cash Return

Total Value to Paid-in Capital (TVPI)

Distribution to Paid-in Capital (DPI)

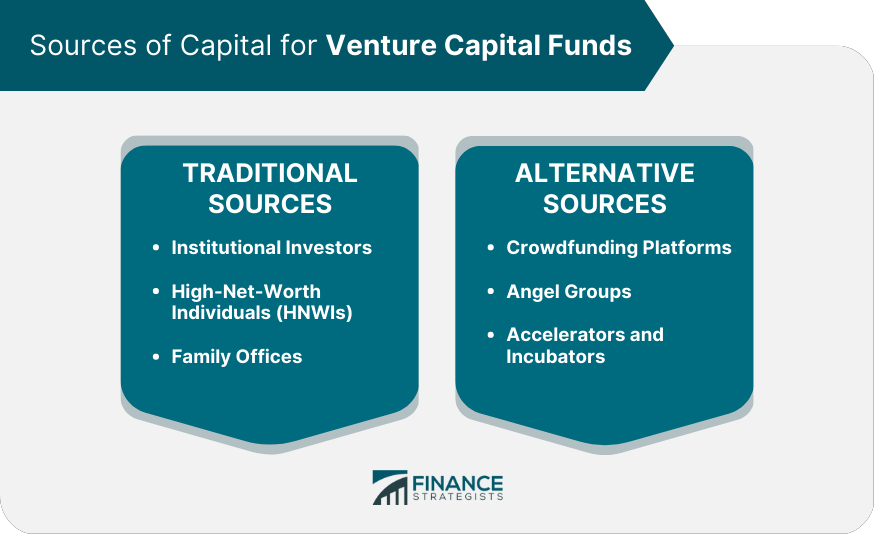

Fundraising and Sources of Capital

Traditional Sources of Capital for VC Funds

Institutional Investors

High-Net-Worth Individuals (HNWIs)

Family Offices

Alternative Sources of Capital

Crowdfunding Platforms

Angel Groups

Accelerators and Incubators

Legal and Regulatory Considerations for Venture Capital Funds

Fund Formation and Registration Requirements

Investor Protection and Compliance

Tax Considerations for VC Funds and Investors

Challenges and Risks in Venture Capital Investing

High Failure Rate of Startups

Illiquidity of Investments

Market and Economic Risks

Regulatory Risks

Competitive Landscape and Deal Sourcing

Trends and Future Outlook in Venture Capital

Focus on Sustainability and Social Impact Investing

The Role of Artificial Intelligence and Data Analytics in VC Investing

Conclusion

They construct and manage their portfolios to diversify risks and maximize returns, using key performance metrics such as internal rate of return, cash-on-cash return, total value to paid-in capital, and distribution to paid-in capital.

Investing in startups entails significant risks, such as the high failure rate of startups, illiquidity of investments, market and economic risks, regulatory risks, and the competitive landscape for deal sourcing.

Given the complexities and opportunities in venture capital investing, investors must work with experienced wealth management professionals who can help them access, evaluate, and manage their venture capital investments.

Venture Capital Funds FAQs

Venture capital funds are financial intermediaries that provide capital to startups and high-growth companies in exchange for equity or ownership stakes. They are crucial for startups as they offer financial resources, strategic guidance, mentorship, and access to networks, enabling entrepreneurs to scale and succeed.

Venture capital funds can be classified into several types, such as seed-stage funds, early-stage funds, growth-stage funds, industry-specific funds, corporate venture capital funds, and government-backed funds. Each type focuses on investing in companies at different stages of development or within specific industries.

Key metrics used to assess venture capital funds' performance include the internal rate of return (IRR), cash-on-cash return, the total value to paid-in capital (TVPI), and distribution to paid-in capital (DPI). These metrics help measure the fund's returns, liquidity, and overall performance.

Venture capital funds mitigate risks by diversifying their investments across various startups, industries, stages, and geographies. They also rely on thorough due diligence, portfolio management, and collaboration with other stakeholders in the startup ecosystem to minimize risks and maximize returns.

Some trends influencing the future of venture capital funds include the impact of technology on the VC landscape, geographical expansion of venture capital, the emergence of new industries and sectors, focus on sustainability and social impact investing, and the role of artificial intelligence and data analytics in VC investing. These trends present both challenges and opportunities for venture capital funds to adapt and succeed in a dynamic environment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.