A Widely Held Fixed Investment Trust (WHFIT) is a type of investment vehicle that pools together funds from numerous investors and invests in a fixed, predetermined portfolio of securities. WHFITs are typically passively managed, with the primary objective of providing income and diversification to the investors. WHFITs serve as an alternative investment option for individuals looking for diversification and income generation. They offer exposure to various asset classes, including mortgages, commodities, and other income-producing securities, making them a suitable choice for investors seeking lower risk and predictable income streams. The portfolio composition of a WHFIT is fixed and determined at the time of the trust's creation. The trust invests in a specific selection of securities, which typically remain unchanged throughout its life. WHFITs are passively managed, meaning that the portfolio does not undergo active trading or adjustments by the trust manager. This passive management approach results in lower fees and expenses compared to actively managed investment funds. WHFITs invest in a diverse range of assets, including stocks, bonds, mortgages, and commodities. This wide range of underlying assets provides investors with exposure to multiple sectors and asset classes, reducing portfolio risk. Diversification is a key advantage of investing in WHFITs, as it helps to spread risk across various asset classes and securities. This reduces the potential impact of poor performance in any single security or asset class, thus contributing to the overall stability of the investment portfolio. The trustee of a WHFIT is responsible for collecting income and capital gains from the underlying securities and distributing them to the investors. The income and capital gains are passed through to investors on a pro-rata basis, reflecting their ownership in the trust. Since WHFITs pass-through income and capital gains directly to investors, the tax implications for individual investors depend on their personal tax situation. It is essential for investors to understand and comply with the tax reporting requirements associated with WHFITs. These trusts invest in mortgage-backed securities (MBS), which are financial instruments backed by a pool of mortgages. Mortgage-backed securities trusts provide investors with exposure to the residential and commercial mortgage markets, generating income from the interest payments on the underlying mortgages. UITs are a type of WHFIT that invests in a fixed portfolio of stocks, bonds, or other securities. The trust has a predetermined termination date, at which point the underlying securities are liquidated, and the proceeds are distributed to investors. UITs offer a predictable income stream and diversification benefits, making them an attractive option for long-term investors. Royalty trusts are a type of WHFIT that invests in the royalty interests of natural resource companies, such as oil, gas, and mineral producers. These trusts generate income from the royalties paid by the resource companies based on their production levels. Investors in royalty trusts can benefit from the income generated without directly participating in the extraction or production process. Commodity trusts invest in physical commodities, such as precious metals, agricultural products, or energy resources. These trusts aim to provide investors with exposure to the performance of the underlying commodities, without the need for direct investment in the physical assets themselves. By investing in commodity trusts, investors can benefit from potential price appreciation in the commodities market while avoiding the challenges and costs associated with storing, transporting, and insuring physical commodities. Investing in WHFITs can help investors reduce the overall risk of their investment portfolio by providing exposure to a diverse range of assets and sectors. This diversification can help mitigate the impact of poor performance in any single security or asset class, contributing to portfolio stability. WHFITs offer a high level of transparency, as the portfolio holdings are fixed and predetermined. Investors can easily access and review the trust's investments, making it simpler to evaluate the investment and understand the associated risks. Since WHFITs are passively managed, they generally have lower fees and expenses compared to actively managed investment funds. This cost advantage can result in higher net returns for investors, especially over the long term. Many WHFITs are designed to provide a steady income stream to investors, such as mortgage-backed securities trusts and royalty trusts. These income-generating assets can be attractive to investors seeking a predictable income source, particularly during periods of economic uncertainty or low-interest rates. Due to their fixed portfolio structure, WHFITs offer limited flexibility for adjusting investments in response to changing market conditions. Investors seeking a more dynamic approach to portfolio management may find WHFITs less suitable for their needs. While the passive management approach of WHFITs can result in lower fees and expenses, it may also lead to underperformance compared to actively managed funds, especially during periods of market volatility or rapid changes in the investment landscape. Investing in WHFITs can result in complex tax reporting requirements, as investors must account for their share of the trust's income and capital gains. Understanding and complying with these requirements can be time-consuming and may require the assistance of a tax professional. Investors can buy units of WHFITs through a brokerage account, just as they would purchase shares of a stock or other investment. The broker will facilitate the transaction, enabling the investor to acquire an ownership stake in the trust. Some WHFIT sponsors allow investors to purchase units directly from the trust without the need for a broker. This option can help investors avoid brokerage fees and commissions, potentially resulting in cost savings. Units of some WHFITs may be traded on the secondary market, similar to shares of publicly traded companies. Investors can buy and sell units through a brokerage account, providing a level of liquidity not always available with other types of investment trusts. Investors in WHFITs are subject to taxation on their share of the trust's income and capital gains. The tax treatment varies depending on the investor's personal tax situation and the specific type of WHFIT in which they have invested. Investors in WHFITs typically receive a Schedule K-1 form, which reports their share of the trust's income, deductions, and credits. This information is essential for accurately completing personal income tax returns and ensuring compliance with tax reporting requirements. Depending on the investor's state of residence and the trust's underlying investments, there may be additional state-specific tax implications. Investors should consult a tax professional to understand and address these potential state tax considerations. When evaluating WHFITs, investors should consider the trust's historical performance and compare it to relevant benchmarks or similar investment options. Performance metrics, such as total return, yield, and risk-adjusted returns, can help investors make informed decisions about the trust's suitability for their investment goals. Understanding the expenses and fees associated with a WHFIT is crucial for investors, as these costs can significantly impact the net returns. Comparing expense ratios and other fees across different WHFITs can help investors identify cost-efficient investment options. For WHFITs investing in fixed-income securities, such as mortgage-backed securities trusts, credit ratings can provide valuable insights into the creditworthiness of the underlying assets. Assessing credit ratings can help investors gauge the trust's risk profile and potential for default. Investors should also consider the duration and maturity profiles of WHFIT's underlying investments. These factors can influence the trust's sensitivity to interest rate fluctuations and overall risk profile. Understanding the duration and maturity profiles can help investors align their investment choices with their risk tolerance and investment horizon. Like all investments, WHFITs are subject to market risk – the possibility that the value of the underlying assets may decline due to market fluctuations. While diversification can help mitigate some of this risk, investors should be aware of the potential for losses in their investment. WHFITs that invest in fixed-income securities, such as mortgage-backed securities and bonds, are exposed to interest rate risk. Changes in interest rates can impact the value of these securities, potentially leading to capital losses for investors. Investing in WHFITs with underlying assets that carry credit risks, such as mortgage-backed securities or corporate bonds, exposes investors to the possibility of defaults or downgrades in credit ratings. These events can negatively impact the trust's performance and result in losses for investors. Some WHFITs may be less liquid than other investment options, making it more difficult for investors to buy or sell units in the trust. Limited liquidity can lead to wider bid-ask spreads and increased price volatility, which may impact the investor's ability to exit the investment when desired. A Widely Held Fixed Investment Trust (WHFIT) is an investment vehicle that offers a fixed, predetermined portfolio of securities, providing diversification and income generation for investors. Key features of WHFITs include their fixed portfolios, diversification benefits, and pass-through of income and capital gains. There are various types of WHFITs, such as mortgage-backed securities trusts, unit investment trusts, royalty trusts, and commodity trusts. Investing in WHFITs comes with both advantages and disadvantages. Pros include reduced risk through diversification, transparency in holdings, lower costs compared to actively managed funds, and predictable income streams. Cons, on the other hand, encompass limited flexibility for portfolio adjustments, the possibility of underperformance compared to actively managed funds, and complex tax reporting requirements. Investors interested in WHFITs can purchase units through a broker directly from the trust sponsor, or trade on the secondary market. Investors considering WHFITs should seek professional wealth management services to help them make well-informed decisions and ensure they are choosing an investment vehicle that aligns with their investment goals and risk tolerance. What Is Widely Held Fixed Investment Trust (WHFIT)?

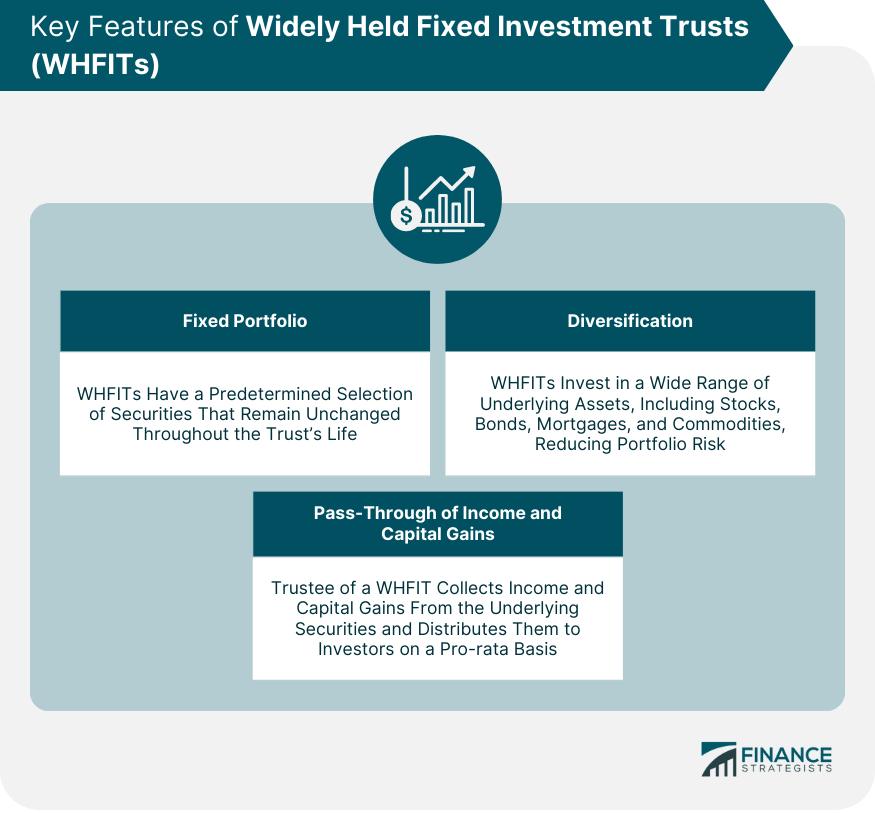

Key Features of WHFITs

Fixed Portfolio

Predetermined Selection of Securities

No Active Management

Diversification

Wide Range of Underlying Assets

Benefits for Investors

Pass-Through of Income and Capital Gains

Trustee Responsibilities

Tax Implications for Investors

Types of WHFITs

Mortgage-Backed Securities Trusts

Unit Investment Trusts (UITs)

Royalty Trusts

Commodity Trusts

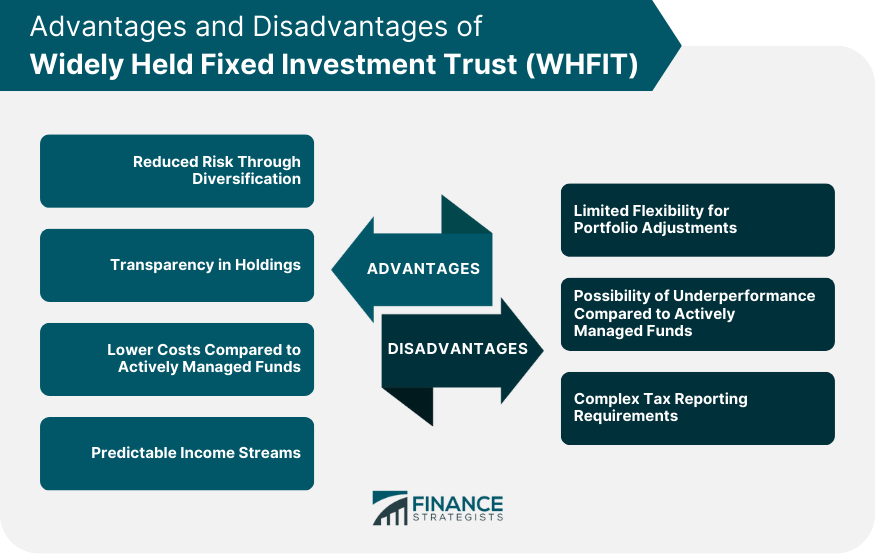

Advantages of WHFITs

Reduced Risk Through Diversification

Transparency in Holdings

Lower Costs Compared to Actively Managed Funds

Predictable Income Streams

Disadvantages of WHFITs

Limited Flexibility for Portfolio Adjustments

Possibility of Underperformance Compared to Actively Managed Funds

Complex Tax Reporting Requirements

How to Invest in WHFITs

Purchasing Units through a Broker

Direct Investment From the Trust Sponsor

Secondary Market Trading

Tax Implications and Reporting Requirements

Taxation of Income and Capital Gains

Importance of the Schedule K-1 Form

State-Specific Tax Considerations

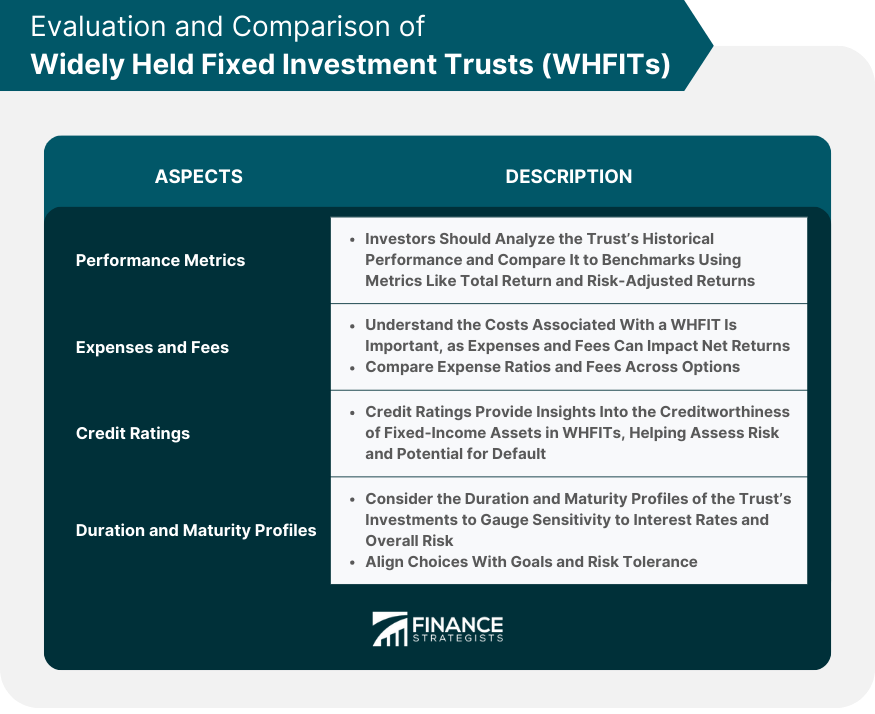

Evaluating and Comparing WHFITs

Performance Metrics

Expenses and Fees

Credit Ratings

Duration and Maturity Profiles

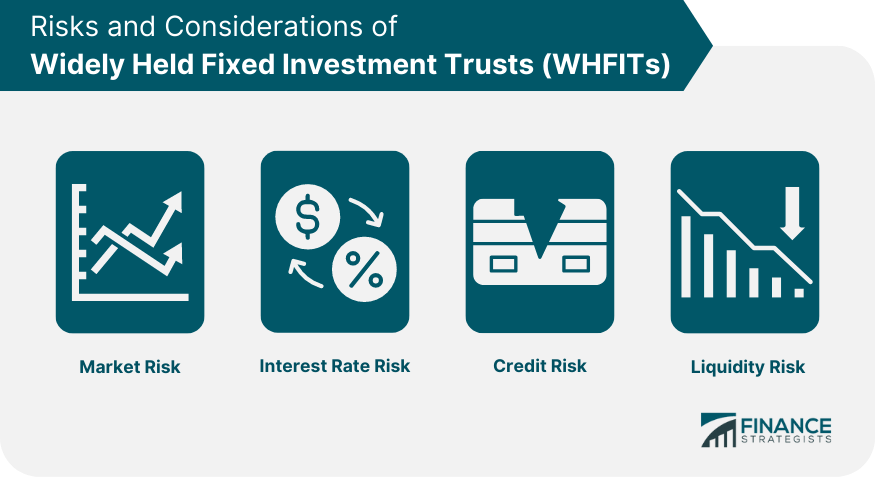

Risks and Considerations of WHFITs

Market Risk

Interest Rate Risk

Credit Risk

Liquidity Risk

Final Thoughts

Widely Held Fixed Investment Trust (WHFIT) FAQs

A Widely Held Fixed Investment Trust (WHFIT) is a type of investment vehicle that pools together funds from numerous investors and invests in a fixed, predetermined portfolio of securities. WHFITs are passively managed and aim to provide income and diversification for investors.

The key features of a WHFIT include a fixed, predetermined portfolio of securities, diversification across a wide range of underlying assets, and pass-through of income and capital gains to investors. WHFITs are also passively managed, which generally results in lower fees and expenses compared to actively managed funds.

There are several types of WHFITs, such as mortgage-backed securities trusts, unit investment trusts (UITs), royalty trusts, and commodity trusts. These trusts invest in various asset classes, including mortgages, stocks, bonds, natural resource royalties, and physical commodities, providing investors with diverse investment options.

Advantages of investing in a WHFIT include reduced risk through diversification, transparency in holdings, lower costs compared to actively managed funds, and predictable income streams. Disadvantages encompass limited flexibility for portfolio adjustments, the possibility of underperformance compared to actively managed funds, and complex tax reporting requirements.

To invest in a WHFIT, you can purchase units through a brokerage account directly from the trust sponsor, or trade on the secondary market. Before investing, it's essential to carefully evaluate the trust's performance, expenses, credit quality, and duration/maturity profiles, and consult with a financial advisor or tax professional to ensure the investment aligns with your investment goals and risk tolerance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.