A security becomes worthless when it loses all of its value, often due to the issuing company's financial distress or insolvency. Worthless securities can include stocks, bonds, mutual funds, and derivatives. For individuals and organizations involved in wealth management, understanding worthless securities is essential. It helps in identifying potential risks and adopting strategies to prevent financial losses. Some common causes include poor financial management, mismanagement of funds, excessive debt burden, declining market conditions, inadequate revenue generation, or adverse economic events. When dealing with worthless securities, individuals and organizations in the realm of wealth management must possess a comprehensive understanding of their nature and implications. One of the key indicators of a worthless security is a significant decline or complete cessation of trading activity. This can happen if there is no demand for the security in the market, or if it has been delisted from the stock exchange. The financial health of the company issuing the security can also indicate whether it is worthless. Companies facing financial distress or bankruptcy often have their securities rendered worthless as their ability to meet financial obligations becomes highly doubtful. Securities can become worthless when the issuing company is undergoing bankruptcy or insolvency proceedings. In such cases, the company’s ability to fulfill its obligations to security holders is significantly impaired, leading to a potential total loss of investment. If the issuing company is involved in fraudulent activities, this could also lead to its securities becoming worthless. This could occur if the company's reported financial performance and business operations are found to be inaccurate or misleading. Legal issues or violations of regulatory standards can render a security worthless. This can include non-compliance with financial regulations, legal judgments against the company, or failure to meet listing requirements. Finally, securities can become worthless if they are suspended or delisted from stock exchanges. This often happens if the issuing company fails to meet the exchange's listing requirements. Stocks represent shares in the ownership of a company and can become worthless if the company becomes insolvent or goes bankrupt. In such cases, shareholders may lose their entire investment. Bonds are debt securities issued by corporations or governments. If the issuer is unable to repay its debts, the bonds can become worthless, leading to a complete loss for bondholders. Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities. If the underlying securities in the fund become worthless, the value of the mutual fund units can decline significantly. Derivatives are financial instruments whose value is derived from underlying assets such as stocks, bonds, or commodities. Derivatives can become worthless if the underlying assets lose their value. Owning worthless securities can lead to a total loss of investment value. This can significantly affect an individual's or organization's financial health and long-term financial goals. There can also be tax implications related to worthless securities. In some jurisdictions, investors may be able to claim tax deductions for the losses incurred from worthless securities. The presence of worthless securities can impact portfolio risk management. It is critical to identify and manage these securities to ensure the portfolio is balanced and risk is adequately managed. One strategy for dealing with worthless securities is to write them off as a loss, which can offset gains elsewhere in your portfolio. Additionally, some jurisdictions allow tax deductions for such losses, which can reduce your overall tax liability. If the issuing company is in the process of liquidation, there may be a possibility to recover some of the investment value. Investors might receive the salvage value, which is the remaining value of the assets after all debts and other obligations have been paid. In some cases, legal action might be possible. For example, if the worthlessness of the security was due to fraudulent activities, investors may be able to seek legal remedies. The Securities and Exchange Commission (SEC) provides guidelines and regulations regarding the handling and reporting of worthless securities. Compliance with these regulations is essential for maintaining transparency and investor trust. The Financial Accounting Standards Board (FASB) offers guidelines for recognizing and measuring the impairment of securities. These rules guide how and when to write down the value of securities that have become worthless. Financial institutions have specific reporting obligations when it comes to worthless securities. This includes accurately reporting the value of these securities in their financial statements and disclosing relevant information to investors. Conducting thorough due diligence before investing in any security is a key preventive measure. This process involves analyzing the issuing company's financial health, business operations, and market trends. Diversification, which involves spreading investments across various asset classes and sectors, can help mitigate the risk of holding worthless securities. A well-diversified portfolio is less likely to be significantly affected by the failure of any single investment. Regular monitoring and review of investment portfolios is another crucial preventive measure. This helps in identifying potential risks early and taking appropriate action to minimize losses. Worthless securities are financial instruments that have lost their value or become essentially worthless due to various reasons, such as bankruptcy, fraud, or significant declines in the underlying assets. These securities hold no intrinsic value and are unlikely to generate any returns for investors. Investing in worthless securities can result in substantial financial losses and is generally considered highly risky and speculative. It is crucial for investors to exercise caution and conduct thorough due diligence before investing in any securities to minimize the risk of ending up with worthless holdings. Engaging the services of a qualified financial advisor, diversifying investments, and staying informed about market trends and company fundamentals can help investors avoid investing in securities that may become worthless. Ultimately, being aware of the risks associated with worthless securities is essential for making informed investment decisions and protecting one's financial well-being.What Are Worthless Securities?

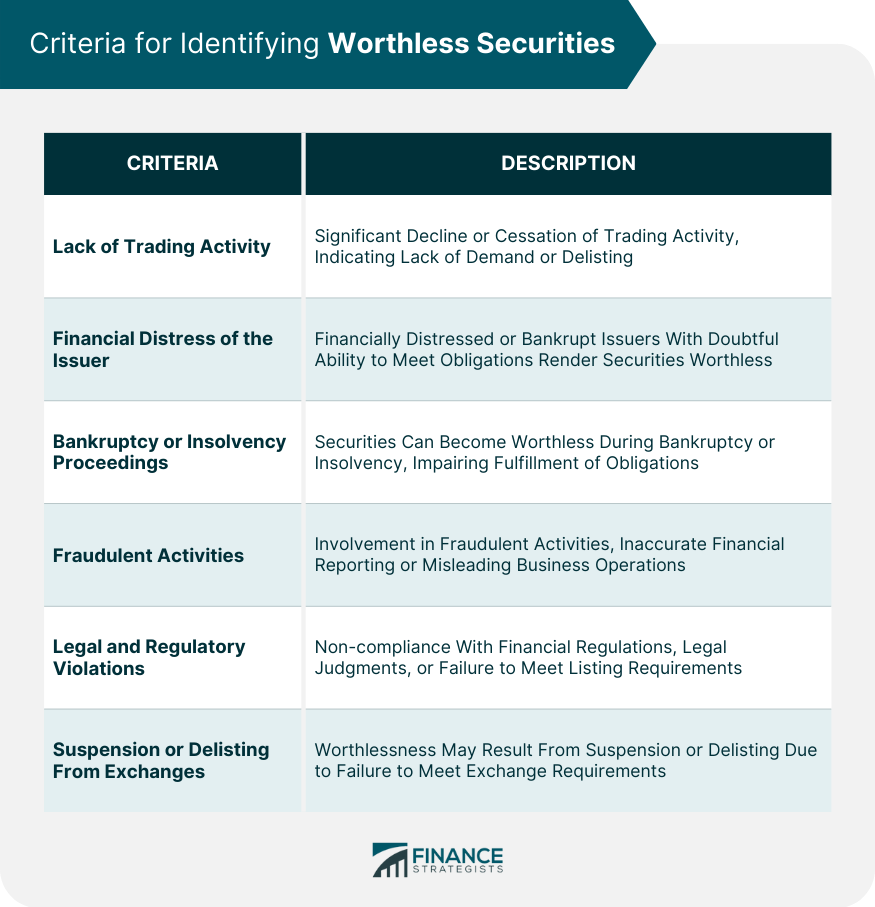

Criteria for Identifying Worthless Securities

Lack of Trading Activity

Financial Distress of the Issuer

Bankruptcy or Insolvency Proceedings

Fraudulent Activities

Legal and Regulatory Violations

Suspension or Delisting From Exchanges

Types of Worthless Securities

Stocks

Bonds

Mutual Funds

Derivatives

Implications of Owning Worthless Securities

Loss of Investment Value

Tax Implications

Portfolio Risk Management

Strategies for Dealing With Worthless Securities

Write-Offs and Tax Deductions

Liquidation and Salvage Value

Legal Actions and Remedies

Regulatory Framework and Reporting Requirements

Securities and Exchange Commission (SEC) Regulations

Financial Accounting Standards Board (FASB) Guidelines

Reporting Obligations for Financial Institutions

Risk Mitigation and Preventive Measures

Due Diligence in Investment Selection

Diversification and Asset Allocation

Regular Monitoring and Review of Investment Portfolios

The Bottom Line

Worthless Securities FAQs

A worthless security is a stock, bond, or other type of financial instrument that has lost all of its value. This typically happens when the company that issued the security goes bankrupt or is in severe financial distress.

In some jurisdictions, losses from worthless securities can be written off on your taxes, offsetting other capital gains. However, tax laws vary, so it's important to consult with a tax advisor or accountant to understand the specific implications in your case.

To avoid investing in worthless securities, thorough due diligence is crucial. This involves analyzing the issuing company's financial health, business operations, and industry trends. Diversification and regular portfolio review can also help in minimizing the risks.

If you own a worthless security, you might be able to write off the loss on your taxes, which can offset other capital gains. You might also consider legal action if the worthlessness of the security was due to fraudulent activities.

Worthless securities often show signs like a significant decline or cessation of trading activity, financial distress of the issuer, bankruptcy or insolvency proceedings, fraudulent activities, legal and regulatory violations, and suspension or delisting from exchanges. Conducting thorough research, monitoring market trends, and seeking professional advice can help in identifying potential worthless securities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.