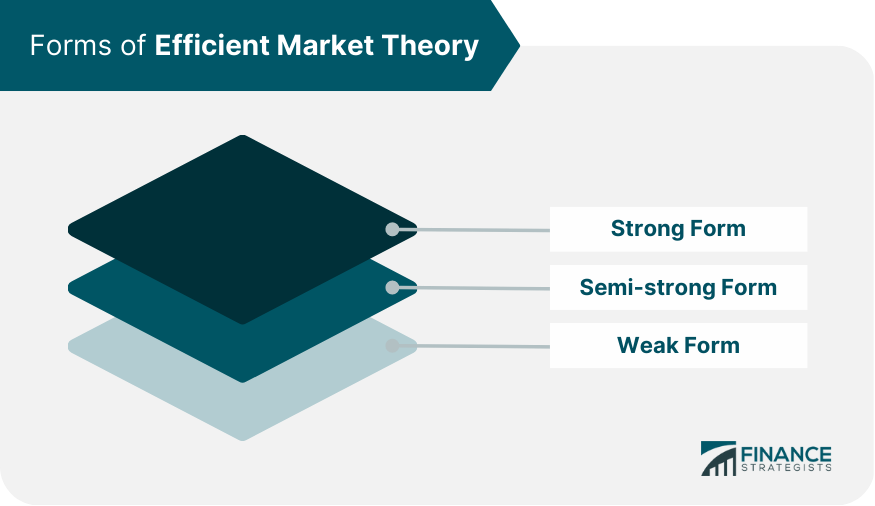

Efficient market theory (EMT) is a concept in finance that asserts that financial markets are highly efficient and that prices of assets fully reflect all available information. EMT has been a prominent topic of debate among finance academics and practitioners since its inception. It has been a widely studied and researched topic for decades, and its applications have had significant implications for investment decision-making, portfolio management, and market regulation. The concept of EMT has its roots in the works of Eugene Fama, who introduced it in 1965. EMT is grounded in the notion that market participants are rational and have access to all relevant information. Therefore, in an efficient market, prices of securities are determined by market forces, and any new information is immediately incorporated into prices. This implies that it is impossible to outperform the market consistently, as prices already reflect all available information. EMT is commonly categorized into three forms, which include the weak form, semi-strong form, and strong form. Weak Form: The weak form of EMT asserts that all past prices of securities are reflected in current prices, and it is impossible to use past prices to predict future prices. Semi-strong Form: The semi-strong form of EMT suggests that current prices reflect all publicly available information, including financial statements and other disclosures. Strong Form: The strong form of EMT suggests that current prices reflect all available information, including public and private information. In this case, insider trading would not be profitable, as prices already reflect all available information. Numerous empirical studies have been conducted to test the validity of EMT. One of the earliest and most influential studies was conducted by Fama himself. In his study, he found that stock prices in the United States followed a random walk pattern and were not predictable. Other studies have found similar results, suggesting that market prices are unpredictable and follow a random walk pattern. In addition, some studies have found that actively managed funds, which seek to outperform the market, often underperform the market after accounting for fees and transaction costs. Despite the empirical evidence in support of EMT, there are several criticisms of the theory. Another criticism is that EMT assumes that all market participants are rational and have access to all relevant information. In reality, investors may not be rational, and access to information may be limited or biased. This assumption implies that the market always incorporates all relevant information into prices, which critics argue may not be true due to behavioral biases and other external factors that can impact market prices. Prices can be influenced by irrational market behavior or by external factors such as political events or natural disasters. Behavioral finance is a field of study that seeks to understand how psychological factors influence investor behavior and market outcomes. Behavioral finance suggests that investors are not always rational and that market prices may not always reflect all available information. Therefore, behavioral finance challenges the underlying assumptions of EMT. Behavioral finance has identified several cognitive biases that can influence investor behavior, such as overconfidence, herd mentality, and loss aversion. These biases can lead to market inefficiencies and opportunities for skilled investors to outperform the market. The implications of EMT are far-reaching and have significant implications on the following: EMT suggests that it is impossible to outperform the market consistently, and as such, active portfolio management strategies, such as stock picking and market timing are unlikely to be successful in the long run. Instead, EMT suggests that investors should focus on passive investment strategies such as index funds that aim to replicate market performance. The implications of EMT for market regulation are also significant. If prices are always efficient, then it may not be necessary to regulate markets to ensure that prices are fair. However, some argue that regulation is still necessary to prevent fraud and market manipulation, which can lead to market inefficiencies and undermine investor confidence. There are several alternative theories and perspectives to EMT: A popular approach to investing that involves analyzing past market data, such as price and volume, to predict future price movements. This involves analyzing a company's financial statements, industry trends, and macroeconomic factors to determine its intrinsic value. This strategy involves identifying undervalued securities and investing in them with the expectation that their value will increase over time. Efficient Market Theory is a cornerstone of financial economics, positing that financial markets are efficient and that asset prices reflect all available information. The concept has significant implications for investment decision-making, portfolio management, and market regulation. However, the debate surrounding EMT remains ongoing, with some scholars pointing to empirical evidence that supports the theory while others criticize its underlying assumptions. Despite the criticisms, the concept of EMT continues to be relevant in financial markets today. Investors must carefully consider the underlying assumptions of the theory and alternative approaches to investing when making investment decisions. Understanding the implications of EMT for investment decision-making, portfolio management, and market regulation is critical to success in today's financial markets. While EMT has limitations, it remains a valuable tool for understanding the behavior of financial markets and the pricing of financial assets.What Is Efficient Market Theory (EMT)?

Forms of Efficient Market Theory

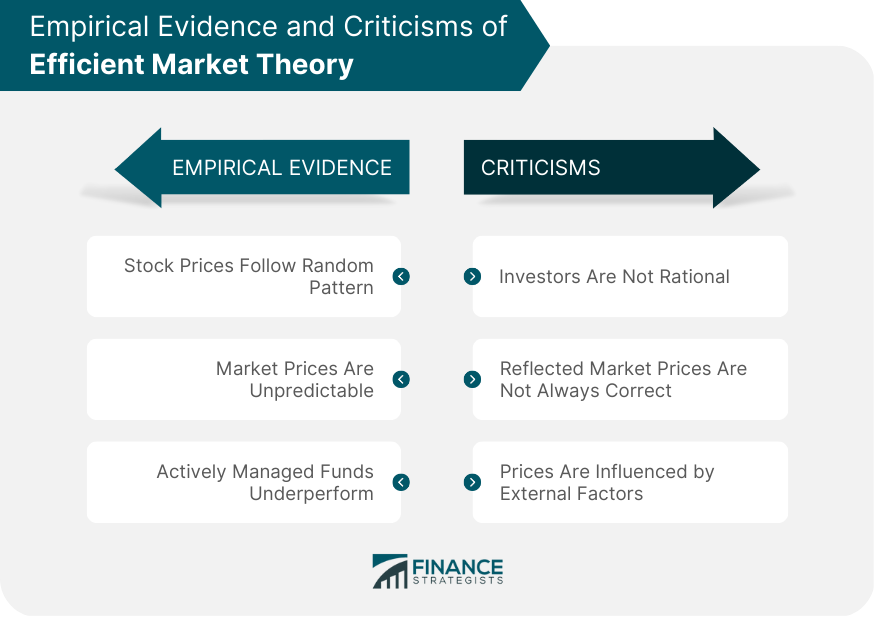

Empirical Evidence in Support of Efficient Market Theory

Stock Prices Follow Random Pattern

Market Prices Are Unpredictable

Actively Managed Funds Underperform

Criticisms of Efficient Market Theory

Investors Are Not Rational

Reflected Market Prices Are Not Always Correct

Prices Are Influenced by External Factors

Behavioral Finance and Efficient Market Theory

Implications of Efficient Market Theory

Portfolio Management

Market Regulation

Alternatives to Efficient Market Theory

Technical Analysis

Fundamental Analysis

Value Investing

Final Thoughts

For more information on efficient market theory and support in applying it to your circumstances, you may consult a wealth management professional.

Efficient Market Theory FAQs

Efficient market theory is a concept in finance that asserts that financial markets are highly efficient and that prices of assets fully reflect all available information.

EMT is commonly categorized into three forms, which include the weak form, semi-strong form, and strong form.

Numerous empirical studies have been conducted to test the validity of EMT. Some studies have found evidence in support of EMT, while others have found evidence that contradicts the theory.

The criticisms of EMT center around the difficulty in defining what constitutes relevant information, the assumption that all market participants are rational and have access to all relevant information, and the assumption that market prices are always correct.

EMT suggests that it is impossible to outperform the market consistently, and as such, active portfolio management strategies such as stock picking and market timing are unlikely to be successful in the long run. Instead, EMT suggests that investors should focus on passive investment strategies, such as index funds that aim to replicate market performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.