Inflation refers to the sustained increase in the general price level of goods and services in an economy over a period of time. It is a key economic indicator that affects the purchasing power of money and can have significant implications for businesses, consumers, and governments. Understanding inflation is crucial for making informed financial decisions, formulating effective monetary and fiscal policies, and maintaining economic stability. A moderate level of inflation is generally considered healthy for an economy, while high or volatile inflation can have negative consequences. Demand-pull inflation occurs when aggregate demand for goods and services outpaces aggregate supply, leading to higher prices. This type of inflation can be driven by factors such as increased consumer spending, business investment, or government expenditure. Cost-push inflation results from rising production costs, such as wages or raw materials, that lead to higher prices for goods and services. This type of inflation can be triggered by supply-side factors like labor strikes, natural disasters, or geopolitical events. Built-in inflation arises from the expectation of future price increases, which can cause businesses to raise prices and workers to demand higher wages, perpetuating the inflationary cycle. This type of inflation can be influenced by historical inflation trends and psychological factors. Hyperinflation is an extreme form of inflation characterized by rapidly accelerating price increases, typically driven by the expansion of the money supply or a loss of confidence in a currency. Hyperinflation can have severe consequences for the economy and society, often leading to financial collapse. An increase in demand for goods and services can lead to inflation, as greater demand relative to supply drives up prices. Demand-side factors that can contribute to inflation include population growth, rising incomes, and increased consumer confidence. A decrease in the supply of goods and services can also cause inflation, as reduced availability of products leads to higher prices. Supply-side factors that can contribute to inflation include natural disasters, labor strikes, or geopolitical events that disrupt production. An expansion of the money supply can lead to inflation, as an increase in the amount of money circulating in the economy can drive up the demand for goods and services, resulting in higher prices. Central banks often control the money supply through monetary policy tools like interest rates and open market operations. Government policies can contribute to inflation through fiscal measures, such as increased government spending or tax cuts, which can stimulate demand and raise prices. Additionally, regulatory changes or trade policies can impact production costs and influence inflation rates. International factors, such as changes in global commodity prices, currency exchange rates, or geopolitical events, can affect domestic inflation rates by influencing the costs of imported goods and services, as well as the overall demand for domestic products. Psychological factors, such as expectations of future inflation, can influence pricing and wage-setting behavior, leading to self-fulfilling inflationary cycles. Public perception of inflation trends and economic conditions can play a role in shaping inflationary expectations. Inflation affects consumers by eroding the purchasing power of money, as higher prices mean that a given amount of money can buy fewer goods and services. This can lead to a decline in the standard of living, particularly for those on fixed incomes. Inflation can lead to income redistribution, as the impact of rising prices may not be felt evenly across the population. Those with fixed incomes or limited ability to adjust their spending may be disproportionately affected, while those with more flexible incomes or assets that appreciate with inflation may be better protected. Inflation can create uncertainty about future price levels, which may influence consumer saving and spending behavior. High or unpredictable inflation can discourage saving and encourage short-term spending, potentially contributing to further inflationary pressures. Inflation affects businesses by increasing the cost of production, as higher prices for raw materials, labor, and other inputs can erode profit margins. Companies may need to raise prices or find ways to cut costs to maintain profitability in the face of inflation. Inflation can influence business investment decisions, as it affects the cost of capital and the expected return on investments. Higher inflation can lead to higher interest rates, which may discourage borrowing and investment in capital projects. Inflation can impact business profitability and competitiveness, as companies may struggle to maintain margins in the face of rising costs. Additionally, uneven inflation rates between countries can affect the competitiveness of exports and imports, potentially impacting trade balances and economic growth. Inflation can influence economic growth, as moderate levels of inflation are generally considered conducive to growth, while high or volatile inflation can hinder growth by creating uncertainty and discouraging investment. Inflation can affect employment levels, as rising costs may lead businesses to cut back on hiring or lay off workers to reduce expenses. However, moderate inflation can also stimulate economic activity and job creation by encouraging spending and investment. Inflation can impact a country's balance of payments, as higher domestic inflation can make exports more expensive and imports cheaper, potentially leading to trade deficits and currency depreciation. Inflation can exacerbate income inequality, as those with fixed incomes or limited ability to adjust their spending may be disproportionately affected by rising prices. Meanwhile, individuals with assets that appreciate with inflation or flexible incomes may be better protected. The CPI is a widely used measure of inflation, tracking the changes in prices of a representative basket of goods and services consumed by households. The CPI is calculated by comparing the cost of the basket at different points in time, providing an estimate of overall price changes. The PPI measures the changes in prices received by producers for their goods and services. This index helps track inflation at the wholesale level and can provide early signals of changes in consumer prices. The GDP deflator is a measure of inflation that compares the nominal GDP (GDP at current prices) with the real GDP (GDP adjusted for inflation). This index provides a broad measure of price changes across the entire economy, including consumer goods, investment goods, and government spending. The PCE index measures the changes in prices of goods and services purchased by consumers. This index is similar to the CPI but includes a broader range of expenditures and adjusts for changes in consumer spending patterns over time. Core inflation measures exclude volatile components, such as food and energy prices, to provide a more stable and reliable measure of underlying inflation trends. These measures can help policymakers and analysts better understand the long-term trajectory of inflation and its potential drivers. Central banks use interest rates as a tool to control inflation, as raising interest rates can help slow down economic activity and reduce inflationary pressures. Conversely, lowering interest rates can stimulate spending and investment, potentially leading to higher inflation. Open market operations involve the buying and selling of government securities by central banks to influence the money supply and interest rates. By adjusting the supply of money, central banks can affect the overall demand for goods and services, thereby influencing inflation. Central banks can control inflation by adjusting the reserve requirements for commercial banks, which affects the amount of money available for lending. Higher reserve requirements can reduce the money supply, helping to curb inflation, while lower requirements can increase the money supply and potentially contribute to inflation. Government spending can influence inflation by affecting the overall demand for goods and services. Increased government spending can stimulate demand and lead to higher inflation, while reduced spending can have the opposite effect. Changes in taxation policies can also affect inflation by influencing consumer spending and business investment. Tax cuts can increase disposable income, potentially leading to higher demand and inflation, while tax increases can reduce spending and curb inflationary pressures. Supply-side policies focus on increasing the productive capacity of the economy to help control inflation. These policies can include investments in infrastructure, education, and technology, as well as regulatory reforms to promote competition and efficiency. Wage and price controls involve government-imposed limits on price increases or wage growth to combat inflation. While these measures can provide short-term relief, they can also create distortions in the economy and may not address the underlying causes of inflation. Inflation targeting is a monetary policy framework in which central banks set a specific inflation rate as their primary goal. By adjusting monetary policy tools, such as interest rates and open market operations, central banks aim to maintain price stability and promote economic growth. Deflation is the opposite of inflation, referring to a sustained decrease in the general price level of goods and services in an economy over time. Deflation can have negative consequences, as falling prices can lead to reduced consumer spending, business investment, and economic growth. Deflation can be caused by factors such as a decline in aggregate demand, technological advancements that reduce production costs, or an increase in the supply of goods and services. Additionally, tight monetary policy and high levels of debt can contribute to deflationary pressures. Deflation can have negative effects on the economy, including reduced consumer spending, lower business investment, and increased unemployment. Furthermore, deflation can exacerbate debt burdens, as the real value of debt increases when prices fall. Inflation and deflation both have significant implications for the economy, consumers, and businesses. While moderate inflation is generally considered healthy for an economy, high or volatile inflation can be harmful. Deflation, on the other hand, is typically seen as a negative phenomenon that can lead to economic stagnation and financial instability. Inflation is an important economic concept that affects the purchasing power of money, business decisions, and overall economic growth. Understanding inflation's causes, effects, and measures is crucial for making informed financial decisions and managing the economy. Effectively managing inflation is essential for maintaining economic stability and promoting growth. Policymakers, businesses, and individuals need to be aware of inflationary trends and their potential consequences to make informed decisions and navigate economic challenges. As the global economy continues to evolve, managing inflation will remain a critical challenge for policymakers, businesses, and individuals. Factors such as technological advancements, demographic shifts, and global economic integration may influence inflation dynamics and require ongoing adaptation of policy tools and strategies. Given the complexities of inflation and its potential impact on financial well-being, seeking professional wealth management services can be a wise decision.What Is Inflation?

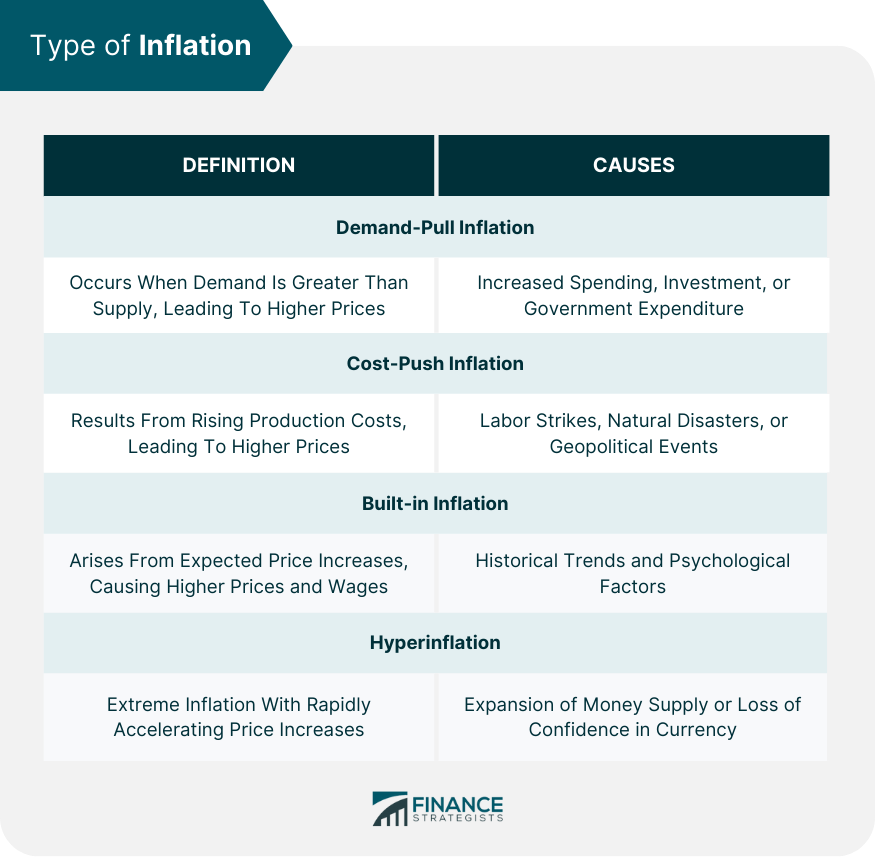

Types of Inflation

Demand-Pull Inflation

Cost-Push Inflation

Built-in Inflation

Hyperinflation

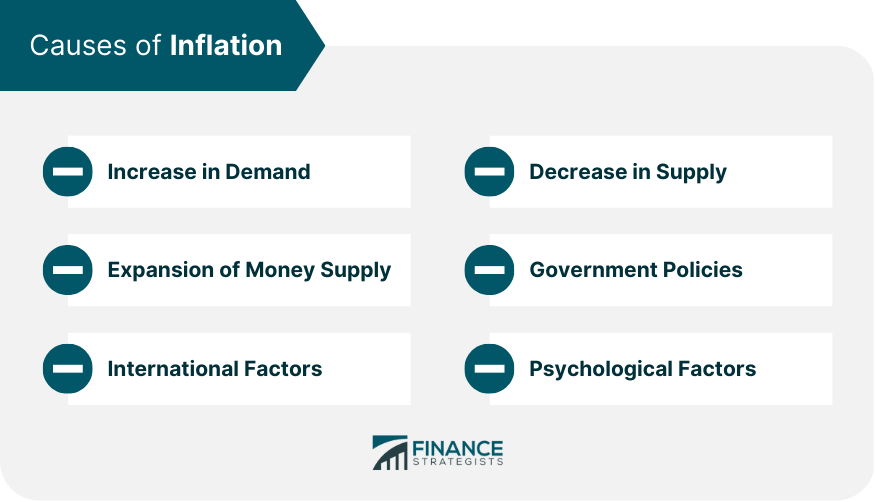

Causes of Inflation

Increase in Demand

Decrease in Supply

Expansion of Money Supply

Government Policies

International Factors

Psychological Factors

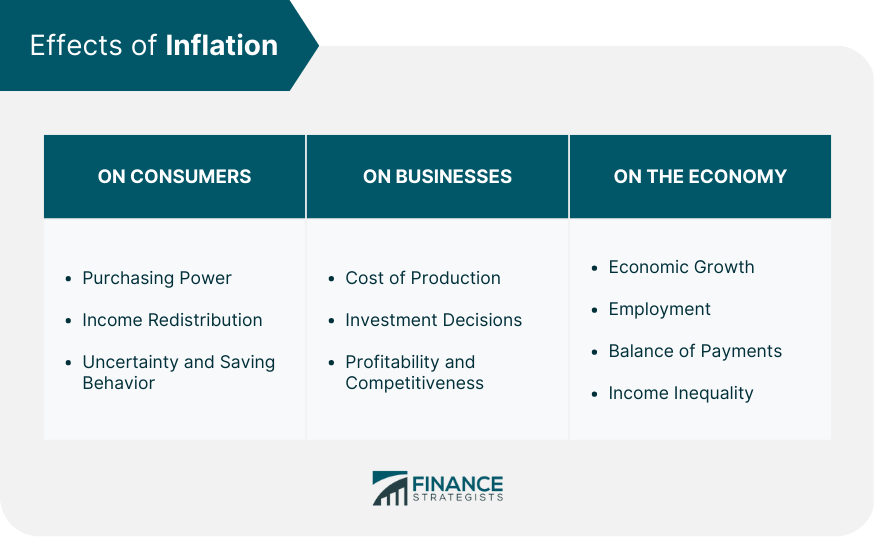

Effects of Inflation

On Consumers

Purchasing Power

Income Redistribution

Uncertainty and Saving Behavior

On Businesses

Cost of Production

Investment Decisions

Profitability and Competitiveness

On the Economy

Economic Growth

Employment

Balance of Payments

Income Inequality

Measuring Inflation

Consumer Price Index (CPI)

Producer Price Index (PPI)

Gross Domestic Product (GDP) Deflator

Personal Consumption Expenditures (PCE)

Core Inflation Measures

Controlling Inflation

Monetary Policy

Interest Rates

Open Market Operations

Reserve Requirements

Fiscal Policy

Government Spending

Taxation

Supply-Side Policies

Wage and Price Controls

Inflation Targeting

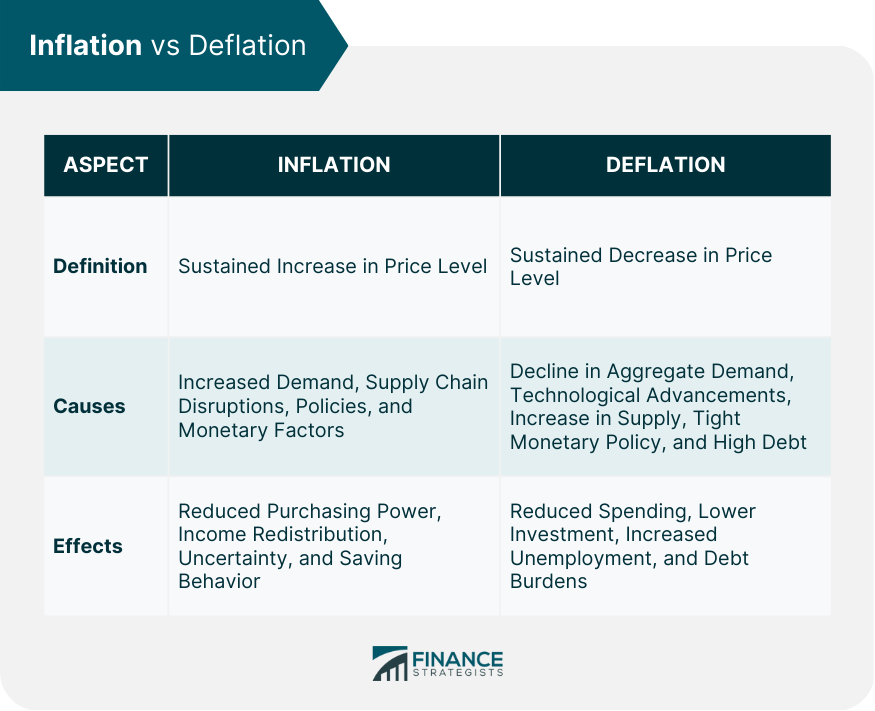

Inflation vs Deflation

Definition of Deflation

Causes of Deflation

Effects of Deflation

Inflation and Deflation Comparison

Final Thoughts

Inflation FAQs

Inflation is the sustained increase in the general price level of goods and services in an economy over time. It is important because it affects the purchasing power of money, influences business decisions, and impacts overall economic growth.

The main causes of inflation include increases in demand, decreases in supply, expansion of the money supply, government policies, international factors, and psychological factors. These factors can contribute to various types of inflation, such as demand-pull, cost-push, and built-in inflation.

Inflation affects consumers by reducing their purchasing power, redistributing income, and creating uncertainty in saving behavior. For businesses, inflation can influence the cost of production, investment decisions, and profitability, as well as overall competitiveness.

The primary methods used to measure inflation include the Consumer Price Index (CPI), Producer Price Index (PPI), Gross Domestic Product (GDP) Deflator, Personal Consumption Expenditures (PCE), and core inflation measures, which exclude volatile components such as food and energy prices.

Policymakers can control inflation through a combination of monetary policy (interest rates, open market operations, and reserve requirements), fiscal policy (government spending and taxation), supply-side policies, wage and price controls, and inflation targeting to maintain price stability and promote economic growth.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.