Opportunity risk is a fundamental concept in economics and decision-making that refers to the potential loss or unfavorable outcome associated with choosing one option over another. This type of risk arises when a decision-maker selects a particular course of action, thereby forgoing the benefits that could have been gained from alternative options. In essence, opportunity risk represents the value of the next best alternative that is sacrificed as a result of making a specific choice. Understanding opportunity risk is crucial in decision-making as it helps individuals and organizations weigh the pros and cons of various options. By evaluating opportunity risk, one can make better-informed choices that optimize resources and maximize returns. Financial opportunity risk occurs when a decision leads to missed financial gains or increased financial losses. For instance, an investor may face financial opportunity risk when choosing between two investment options with different potential returns. Time-based opportunity risk refers to the potential loss of productivity or missed opportunities due to time spent on one activity over another. This type of risk is commonly encountered in project management when resources are allocated to one project at the expense of another. Human capital opportunity risk arises when an organization fails to capitalize on its workforce's skills and expertise. This can occur when a company invests in the wrong training programs or neglects to hire qualified individuals for key positions. Strategic opportunity risk is the potential loss that arises from choosing one business strategy over another. It can manifest when a company pursues a new product line or market expansion and misses out on other lucrative opportunities in the process. Reputational opportunity risk refers to the potential damage to a company's reputation and brand value when it fails to seize positive opportunities. This type of risk can occur when an organization neglects to address pressing issues or fails to capitalize on favorable market trends. The first step in identifying opportunity risk is to assess the current situation, including the organization's resources, strengths, and weaknesses. This process helps to clarify the available options and identify potential areas of risk. Once the current situation is understood, the next step is to identify potential alternatives. By considering a range of options, decision-makers can better understand the various opportunity risks associated with each choice. After identifying potential alternatives, it is crucial to evaluate the possible outcomes of each option. This involves examining the potential benefits and drawbacks associated with each choice and estimating the likelihood of each outcome occurring. The final step in identifying opportunity risk is to consider the opportunity cost of each option. Opportunity cost refers to the potential gains or benefits that are forfeited when one option is chosen over another. By considering this, decision-makers can better understand the trade-offs involved in their choices. Expected return calculations are a quantitative method used to measure opportunity risk by estimating the potential returns associated with various alternatives. This approach helps decision-makers compare options based on their potential financial outcomes. Scenario analysis involves creating multiple hypothetical scenarios for each alternative to evaluate their potential outcomes. This technique helps to assess the possible risks and rewards associated with each option under different circumstances. Sensitivity analysis is a quantitative method that measures the impact of changes in key variables on the outcomes of different alternatives. This approach helps decision-makers understand how vulnerable their choices are to fluctuations in external factors. A SWOT analysis is a qualitative method that assesses an organization's strengths, weaknesses, opportunities, and threats. By conducting a SWOT analysis, decision-makers can better understand the opportunity risks associated with their choices. Expert opinions can provide valuable insights into potential opportunity risks that may not be apparent through quantitative methods. Decision-makers can consult industry experts to gain a deeper understanding of the risks associated with their options. Industry benchmarking is a qualitative method that involves comparing an organization's performance and processes with those of its competitors. This can help identify potential opportunity risks by revealing areas where an organization may be underperforming or missing out on opportunities for growth. Diversification is a risk management strategy that involves spreading investments or resources across multiple options. This approach can help reduce opportunity risk by ensuring that potential losses or missed opportunities in one area are offset by gains in another. Contingency planning involves preparing for potential risks by developing alternative courses of action. By having a plan in place for various scenarios, decision-makers can minimize the impact of opportunity risks and adapt more quickly to changing circumstances. Regular monitoring and reassessment involve tracking the progress and outcomes of chosen options and adjusting strategies as needed. This process helps to identify emerging opportunity risks and ensure that resources are allocated effectively. Seeking expert advice can help mitigate opportunity risk by providing valuable insights and guidance. Experts can offer a fresh perspective and suggest alternative strategies that may reduce risk or enhance potential returns. Investing in skill development and innovation can help organizations mitigate opportunity risk by staying competitive and adaptable. By fostering a culture of learning and continuous improvement, organizations can better capitalize on emerging opportunities and navigate potential risks. Opportunity risk is an essential concept in decision-making that involves the potential loss or unfavorable outcome associated with selecting one option over another. There are different types of opportunity risks, including financial, time-based, human capital, strategic, and reputational. Identifying and measuring opportunity risk can be done through various quantitative and qualitative methods, such as expected return calculations, scenario analysis, SWOT analysis, and industry benchmarking. To mitigate opportunity risk, decision-makers can adopt strategies such as diversification, contingency planning, regular monitoring and reassessment, seeking expert advice, and investing in skill development and innovation. By understanding and managing opportunity risk, individuals and organizations can optimize their resources, make informed decisions, and minimize the potential for losses or missed opportunities.What Is Opportunity Risk?

Types of Opportunity Risks

Financial Opportunity Risk

Time-Based Opportunity Risk

Human Capital Opportunity Risk

Strategic Opportunity Risk

Reputational Opportunity Risk

How to Identify Opportunity Risk

Assess the Current Situation

Identify Potential Alternatives

Evaluate Potential Outcomes

Consider the Opportunity Cost

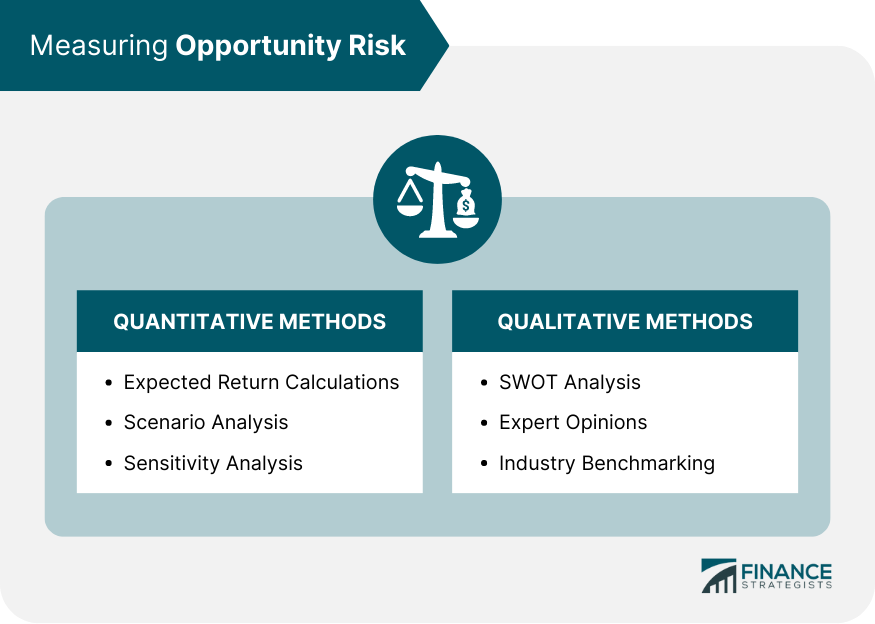

Measuring Opportunity Risk

Quantitative Methods

Expected Return Calculations

Scenario Analysis

Sensitivity Analysis

Qualitative Methods

SWOT Analysis

Expert Opinions

Industry Benchmarking

Mitigating Opportunity Risk

Diversification

Contingency Planning

Regular Monitoring and Reassessment

Seeking Expert Advice

Investing in Skill Development and Innovation

Final Thoughts

Opportunity Risk FAQs

Opportunity risk is the potential loss or unfavorable outcome that may occur when one option is chosen over another. Understanding opportunity risk is crucial in decision-making because it helps individuals and organizations weigh the pros and cons of various options, make better-informed choices, optimize resources, and maximize returns.

To identify opportunity risk, follow these steps: assess the current situation to understand the available options, identify potential alternatives, evaluate the potential outcomes of each option, and consider the opportunity cost associated with each choice. This process helps decision-makers better understand the trade-offs involved in their decisions.

Some strategies for mitigating opportunity risk include diversification, contingency planning, regular monitoring and reassessment, seeking expert advice, and investing in skill development and innovation. These approaches can help reduce opportunity risk by spreading investments or resources across multiple options, preparing for potential risks, staying competitive and adaptable, and gaining valuable insights from experts.

Measuring opportunity risk can be challenging due to uncertainties in estimating potential outcomes, difficulty in quantifying qualitative factors, and the dynamic nature of external factors that influence decision-making. Additionally, accurately assessing the value of foregone alternatives can be complex, especially when dealing with multiple options and scenarios.

Wealth management services can help individuals and organizations effectively manage opportunity risk by providing expert advice, insights, and financial strategies. Professional wealth managers can help clients identify and mitigate opportunity risk, balance risk and reward, and optimize their financial decisions. Partnering with a wealth management expert ensures better positioning to capitalize on opportunities and navigate potential risks.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.