The Quantitative Easing definition, commonly referred to as QE, is an unconventional monetary policy tool of central banks where the central bank buys securities from the open market to inject cash into the economy. Increasing the cash supply encourages banks to lend and potential borrowers to borrow. By increasing the money supply, central banks purchase longer-term securities, such as government bonds and mortgage-backed securities, from the open market. This act, in essence, pumps money directly into the economy. The intriguing facet of QE lies in its distinction from traditional monetary policies. Rather than just targeting short-term interest rates, QE broadens the scope, directly influencing longer-term rates and liquidity conditions. Quantitative Easing aims to reinvigorate an economy grappling with sluggish growth. When conventional tools, like slashing short-term interest rates, seem insufficient or are already maxed out (think zero or negative rates), QE emerges as a potent alternative. By increasing the money supply and driving up the prices of bonds, QE pushes down long-term interest rates, nudging businesses and consumers towards borrowing and spending. This chain reaction is hoped to steer economies towards healthier growth trajectories and away from deflationary abysses. The central bank's monetary tools often focus on adjusting interest rates. Lower interest rates are expansionary because they lower the cost of money and encourage economic growth, and higher interest rates are contractionary because they increase the cost of money and slow growth. Central banks use quantitative easing after they've exhausted conventional tools, such as lowering the interest rate. For example, after announcing a new interest rate target of 0 to 0.25%, on March 15, 2020, the Federal Reserve announced a $700 billion quantitative easing program. $500 billion of Treasury securities and $200 billion of mortgage-backed securities. QE, with its aggressive approach, can jolt economies out of slumbers. By making money cheaper and more accessible, QE encourages spending and investment, crucial drivers for growth. Additionally, a stimulated economy often sees improved employment rates, creating a positive feedback loop of consumption and growth. QE has a knack for pushing interest rates downward, particularly the long-term ones. When central banks buy securities, they increase their demand, causing their prices to rise and yields (or interest rates) to decline. Lower interest rates can act as a catalyst for businesses to invest in expansion or for consumers to purchase homes or other big-ticket items. Here's an often-overlooked nuance: QE tends to elevate asset prices. Whether it's equities, real estate, or other assets, a surge in liquidity and reduced interest rates make them more appealing. Higher asset prices can usher in a wealth effect. As individuals see their holdings grow in value, they feel richer and are more inclined to spend, fueling the economy further. Deflation, a persistent drop in prices, can trap economies in vicious cycles. As consumers anticipate further price drops, they delay spending, leading to reduced demand and, ironically, even lower prices. QE, by pumping money and slashing interest rates, can counteract these deflationary spirals, ensuring prices remain stable or grow modestly. Quantitative easing has the following shortcomings: 1.) While QE puts money into the hands of investors, it does not force them to spend it. For example, in the 2009 financial crisis, the US Federal Reserve bought $4 trillion in securities from banks, but because of the poor economic outlook, banks mostly held the extra cash in reserves instead of putting it back into the economy. 2.) More cash in the market increases inflationary pressure and devalues a currency against its global peers. Inflation without economic growth is known as stagflation. 3.) The central bank's large-scale purchasing of securities often results in a country's national debt growing substantially. Tapering, or gradually reducing asset purchases, emerges as a preferred first step. Rather than a sudden halt, central banks can methodically reduce their monthly or quarterly purchases, allowing markets to adjust slowly. Once tapering is underway, central banks face the colossal task of unwinding their bloated balance sheets. This could involve selling off assets or, more commonly, letting them mature without reinvesting the proceeds. This gradual approach mitigates the risk of market disruptions. With the economy back on its feet, central banks can start normalizing interest rates. Moving away from near-zero rates, they can incrementally hike rates, signaling economic strength and curbing excessive risk-taking. Quantitative Easing can impact international trade by influencing currency exchange rates and relative competitiveness of exporting nations, potentially leading to trade imbalances and adjustments in trade flows. QE implemented by major economies can cause capital inflows into emerging markets, affecting their asset prices and financial stability. It may lead to currency appreciation, making exports less competitive, while increased foreign investment can pose challenges for monetary policy management. QE measures can lead to currency depreciation as central banks increase money supply, affecting exchange rates and trade dynamics between countries. The resulting weaker currency can boost exports but also increase import costs and inflation. Quantitative Easing is an unconventional monetary policy tool utilized by central banks to inject cash into the economy through securities purchases. Its broad scope and aggressive approach aim to stimulate economic growth, lower interest rates, boost asset prices, and address deflationary pressures. However, QE is not without its shortcomings, including potential impacts on investor spending, inflationary pressure, and the growth of national debt. As economies stabilize and recover, central banks must devise appropriate exit strategies for QE. Gradual tapering, unwinding measures, and interest rate normalization are key elements in the process. By carefully managing these strategies, central banks can ensure a smooth transition to a more conventional monetary policy, safeguarding economic stability and preventing adverse market disruptions. Overall, while QE has proven to be a powerful tool in combating economic downturns, its success lies in meticulous implementation and a timely transition to more sustainable policies as the economy regains strength.Quantitative Easing Explained

Purpose and Objectives of QE

How Does Quantitative Easing Work?

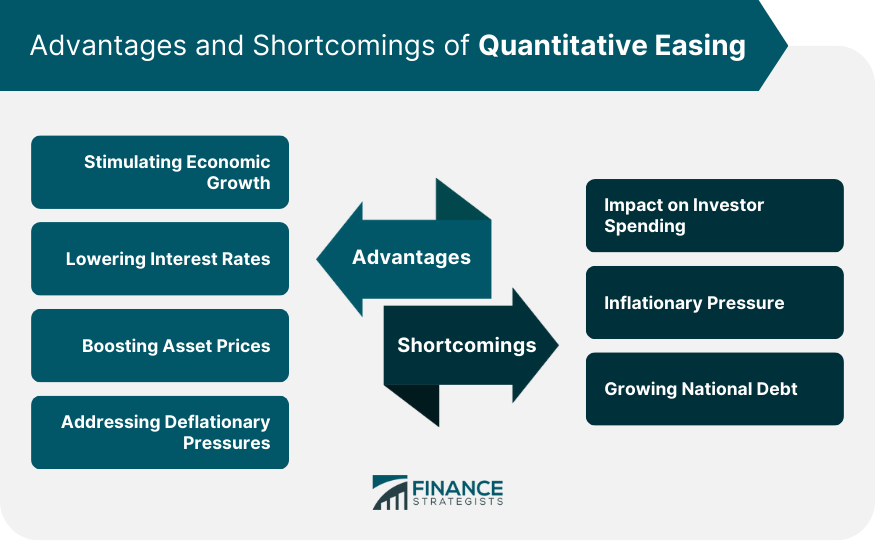

Advantages of Quantitative Easing (QE)

Stimulating Economic Growth

Lowering Interest Rates

Boosting Asset Prices

Addressing Deflationary Pressures

Is There a Shortcoming With QE?

Impact on Investor Spending

Inflationary Pressure

Growing National Debt

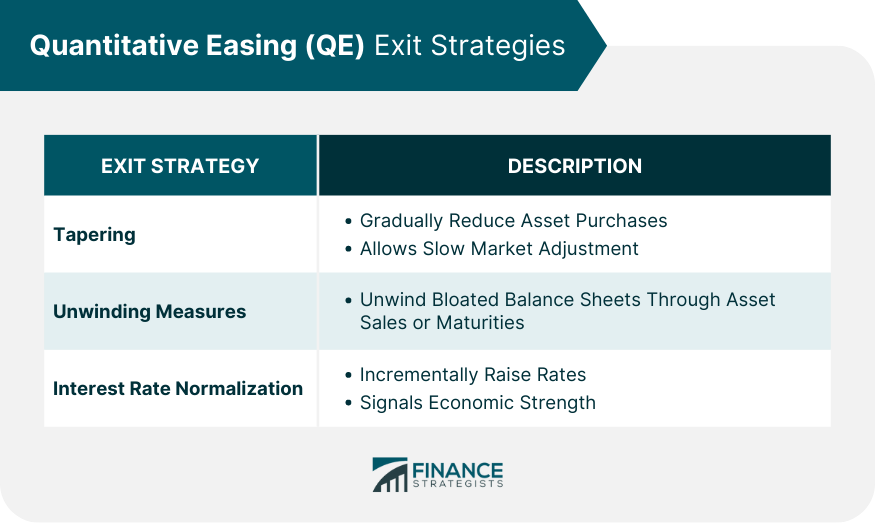

Quantitative Easing (QE) Exit Strategies

Tapering

Unwinding Measures

Interest Rate Normalization

QE's Impact on the Global Economy

International Trade

Emerging Markets

Exchange Rates

Conclusion

Quantitative Easing (QE) FAQs

QE stands for quantitative easing.

Quantitative easing is a monetary policy tool of central banks where the central bank buys securities from the open market to inject cash into the economy.

The central bank’s monetary tools often focus on adjusting interest rates.

Central banks use quantitative easing after they’ve exhausted conventional tools, such as lowering the interest rate.

Some shortcomings of the Quantitative Easing strategy are: more cash in the market increases inflationary pressure and devalues a currency against its global peers; the central bank’s large-scale purchasing of securities often results in a country’s national debt growing substantially; while QE puts money into the hands of investors, it does not force them to spend it.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.