Definition of Supply and Demand

Supply and demand are two fundamental economic concepts that govern the behavior of buyers and sellers in a market.

Supply refers to the total amount of a product or service that producers are willing to provide at various prices, while demand represents the willingness of consumers to purchase a product or service at different prices.

Both supply and demand play a crucial role in determining the market price of goods and services.

Understanding the principles of supply and demand is critical for comprehending how markets function. These concepts enable businesses and consumers to predict how changes in the market might impact their decisions and behavior.

By mastering the principles of supply and demand, individuals can better understand market dynamics and make more informed choices.

Importance of Understanding Supply and Demand

A solid grasp of supply and demand is crucial for anyone involved in business, economics, or finance.

These concepts form the foundation of modern economic analysis and help explain the behavior of prices and quantities in a market.

By understanding supply and demand, businesses can optimize production levels, determine appropriate pricing strategies, and identify new opportunities for growth.

Moreover, an understanding of supply and demand is essential for policymakers who design and implement economic policies. These policies can significantly impact the overall health of an economy, as well as the well-being of individual citizens.

Thus, a thorough understanding of supply and demand is vital for making informed decisions that promote economic growth and stability.

Supply vs Demand

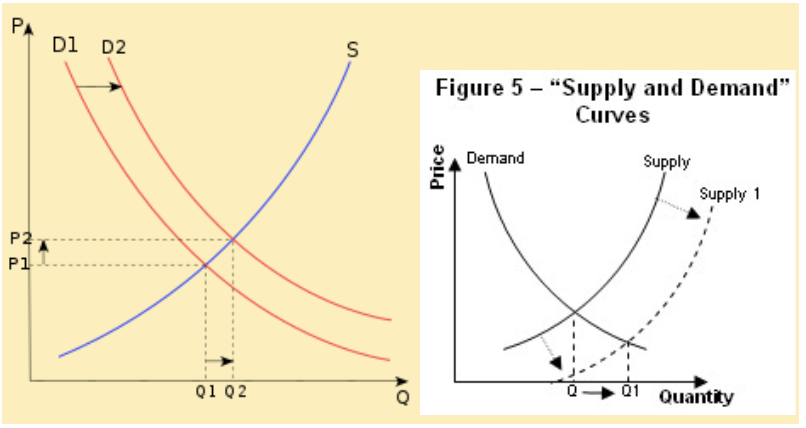

The relationship between supply and demand can be realized using a supply and demand curve graph.

In this graph, price is mapped to the vertical axis, and quantity is mapped to the horizontal axis. Demand is represented by a downward trending slope, and supply by an upward slope.

The first graph below shows how, supply being constant, an increase in demand (shown by an outward shift in the slope) leads to both an increase in quantity and price.

Inversely, a decrease in overall demand would lead to a decrease in both quantity and price.

The second graph shows how, demand being constant, an increase in supply leads to an increase in quantity but a decrease in overall price.

The Law of Supply

Definition of the Law of Supply

The Law of Supply is a fundamental economic principle that states that there is a direct relationship between the price of a good or service and the quantity supplied, all else being equal.

In other words, as the price of a product increases, producers are more willing and able to provide larger quantities of that product to the market.

This relationship is intuitive because higher prices generally lead to higher profits, which incentivize producers to supply more of the product.

Conversely, when the price of a good decreases, producers may be less willing to produce and supply that good, as their profits may decline.

Factors Affecting Supply

Several factors can influence the supply of a product or service, including production costs, technological advancements, supplier expectations, and the number of suppliers in the market.

Each of these factors can cause the supply curve to shift, which in turn, affects the market price and quantity.

Production costs, such as labor, raw materials, and energy, are a key determinant of supply. When production costs rise, it becomes more expensive for producers to supply their goods, which can lead to a decrease in supply.

Conversely, a decrease in production costs can lead to an increase in supply. Technological advancements can also impact supply by improving production efficiency and reducing costs, thereby increasing the quantity supplied.

The Relationship Between Price and Supply

The relationship between price and supply is a direct one. As the price of a product or service increases, producers are more willing to supply larger quantities of that product.

This occurs because higher prices generally lead to higher profits, incentivizing producers to increase their output.

Conversely, when the price of a product decreases, producers may be less inclined to produce and supply that product, as their profits may decline.

This relationship is illustrated by the upward-sloping supply curve in the supply and demand model. The curve demonstrates that, all else being equal, a higher price leads to a higher quantity supplied.

Understanding this relationship is vital for businesses when making production and pricing decisions, as it helps them predict the potential impact of price changes on their supply levels.

The Law of Demand

Definition of the Law of Demand

The Law of Demand is a fundamental economic principle that states that there is an inverse relationship between the price of a good or service and the quantity demanded, all else being equal.

This means that as the price of a product increases, consumers will generally demand less of it, and vice versa.

The reasoning behind this relationship is that consumers typically have limited budgets and must make choices about how to allocate their resources.

When the price of a product increases, consumers may choose to purchase less of that product, opting for alternatives or simply reducing consumption.

Factors Affecting Demand

Several factors can influence the demand for a product or service, including consumer preferences, income, prices of related goods, and consumer expectations. Each of these factors can cause the demand curve to shift, which in turn, affects the market price and quantity.

Consumer preferences play a significant role in determining demand. If a product becomes more popular or fashionable, demand for that product may increase.

Conversely, if a product loses favor with consumers, demand may decrease. Additionally, changes in consumer income can also impact demand.

As income increases, consumers may be more likely to purchase higher quantities of goods and services, and vice versa.

The Relationship Between Price and Demand

The relationship between price and demand is an inverse one. As the price of a product or service increases, consumers will generally demand less of it.

This is because higher prices make a product less attractive to buyers, who may choose to purchase alternative products or simply reduce their consumption.

This relationship is illustrated by the downward-sloping demand curve in the supply and demand model. The curve demonstrates that, all else being equal, a higher price leads to a lower quantity demanded.

Understanding this relationship is vital for businesses when setting prices and marketing strategies, as it helps them predict the potential impact of price changes on consumer demand.

Equilibrium

Definition of Market Equilibrium

Market equilibrium is a state in which the quantity of a product or service supplied by producers is equal to the quantity demanded by consumers at a specific price.

At this point, there is no excess supply or demand, and the market is considered to be in balance. In the supply and demand model, market equilibrium is represented by the point where the supply and demand curves intersect.

Market equilibrium is a desirable state for both producers and consumers, as it leads to a stable market environment with predictable prices and quantities.

When markets are in equilibrium, resources are allocated efficiently, and there is no pressure for prices to change.

Determining Market Equilibrium

Market equilibrium can be determined by examining the intersection of the supply and demand curves on a graph.

At this point, the price at which the quantity supplied equals the quantity demanded is known as the equilibrium price, and the corresponding quantity is the equilibrium quantity.

In practice, markets are continually adjusting to reach equilibrium. Changes in supply and demand factors can cause the curves to shift, leading to a new equilibrium price and quantity.

By understanding the dynamics of supply and demand, businesses and policymakers can make more informed decisions to maintain market stability and promote efficient resource allocation.

Effects of Market Imbalances

Market imbalances occur when the quantity supplied does not equal the quantity demanded at a specific price. These imbalances can result in surpluses or shortages, leading to price adjustments as the market seeks to reach equilibrium.

In the case of a surplus, the quantity supplied exceeds the quantity demanded. This typically occurs when the market price is above the equilibrium price.

As a result, producers may lower their prices to attract more buyers and reduce excess inventory. As prices fall, the quantity demanded increases, and the quantity supplied decreases until equilibrium is restored.

In the case of a shortage, the quantity demanded exceeds the quantity supplied. This usually happens when the market price is below the equilibrium price.

In response, producers may raise their prices to take advantage of the high demand, while consumers may reduce their purchases due to the increased cost.

As prices rise, the quantity demanded decreases, and the quantity supplied increases until equilibrium is reached.

Market Shocks

Definition of Market Shocks

Market shocks are sudden, unexpected events that significantly impact supply, demand, or both, leading to a shift in the equilibrium point.

These events can disrupt the stability of a market and create temporary imbalances that require adjustments to restore equilibrium.

Market shocks can result from various factors, including natural disasters, political events, technological advancements, or changes in consumer preferences.

The severity and duration of the shock's impact on the market depend on the nature of the event and the market's ability to adapt and adjust.

Types of Market Shocks

Market shocks can be broadly categorized into demand-side shocks and supply-side shocks. Demand-side shocks affect the demand for a product or service, while supply-side shocks impact the supply.

Demand-side shocks may arise from changes in consumer preferences, economic conditions, or government policies that influence consumer spending.

For example, a sudden increase in consumer confidence could lead to a spike in demand for luxury goods, while an economic downturn may result in decreased demand for non-essential products.

Supply-side shocks can result from events that disrupt the production or distribution of a product, such as natural disasters, labor strikes, or new regulations.

For instance, a severe drought could lead to a decrease in agricultural production, causing a sudden drop in the supply of certain commodities.

Effects of Market Shocks on Equilibrium

Market shocks can significantly impact the equilibrium point by causing shifts in the supply and demand curves.

Depending on the nature and duration of the shock, these shifts can lead to temporary or long-term changes in the market price and quantity.

When a market shock affects supply or demand, it creates an imbalance in the market that must be resolved to restore equilibrium. This process may involve price adjustments, changes in production levels, or shifts in consumer behavior.

Understanding the potential effects of market shocks on equilibrium is crucial for businesses and policymakers, as it allows them to develop strategies to mitigate the impact of these events and maintain market stability.

Price Elasticity of Demand

Definition of Price Elasticity of Demand

Price elasticity of demand is an economic measure that quantifies the sensitivity of consumer demand for a product or service to changes in its price.

It is calculated as the percentage change in quantity demanded divided by the percentage change in price.

A higher price elasticity of demand indicates that consumers are more sensitive to price changes, while a lower elasticity suggests that demand is relatively insensitive to price fluctuations.

Determining Price Elasticity of Demand

The price elasticity of demand can be determined using historical data on price and quantity demanded or through economic models that estimate consumer behavior.

Factors that influence the price elasticity of demand include the availability of substitute products, the necessity of the product, and the proportion of a consumer's budget spent on the item.

Products with many close substitutes typically have higher price elasticities, as consumers can easily switch to alternative products when prices change. In contrast, products with few or no substitutes, or those considered necessities, tend to have lower price elasticities, as consumers are less likely to change their consumption in response to price fluctuations. Additionally, products that represent a small portion of a consumer's budget are likely to have lower price elasticities, as the impact of price changes on overall spending is minimal.

Implications of Price Elasticity of Demand

Understanding the price elasticity of demand is essential for businesses when making pricing and marketing decisions.

Firms operating in markets with more elastic demand must be cautious when raising prices, as significant price increases could lead to a substantial decline in demand.

Conversely, businesses in markets with inelastic demand may have more flexibility to adjust prices without significantly affecting demand.

Price elasticity of demand also has implications for government policies, particularly when it comes to taxation.

For instance, taxing goods with inelastic demand, such as gasoline or cigarettes, can generate significant revenue with relatively small changes in consumption.

However, taxing goods with elastic demand can lead to more significant changes in consumer behavior and potentially lower tax revenues.

Price Elasticity of Supply

Definition of Price Elasticity of Supply

Price elasticity of supply is an economic measure that quantifies the responsiveness of the quantity supplied of a product or service to changes in its price.

It is calculated as the percentage change in quantity supplied divided by the percentage change in price.

A higher price elasticity of supply indicates that producers are more sensitive to price changes, while a lower elasticity suggests that supply is relatively insensitive to price fluctuations.

Determining Price Elasticity of Supply

The price elasticity of supply can be determined using historical data on price and quantity supplied or through economic models that estimate producer behavior.

Factors that influence the price elasticity of supply include production costs, the availability of inputs, and the degree of competition in the market.

Products with low production costs and readily available inputs typically have higher price elasticities of supply, as producers can quickly adjust their production levels in response to price changes.

In contrast, products with high production costs, limited inputs, or those produced in highly competitive markets may have lower price elasticities of supply, as producers are less able to respond rapidly to price fluctuations.

Implications of Price Elasticity of Supply

Understanding the price elasticity of supply is essential for businesses when making production and pricing decisions.

In markets with more elastic supply, producers must be prepared to quickly adjust their production levels in response to price changes, which can have significant implications for inventory management and resource allocation.

Conversely, businesses operating in markets with inelastic supply may have less flexibility to adjust production in response to price fluctuations, which can lead to challenges in maintaining market equilibrium.

Price elasticity of supply also has implications for government policies, particularly those related to regulation and taxation.

Policies that impact production costs, such as environmental regulations or taxes on inputs, can influence the price elasticity of supply and affect market dynamics.

Policymakers must consider these effects when designing policies to ensure that they promote economic stability and efficient resource allocation.

Conclusion

In conclusion, the principles of supply and demand are foundational to the study of economics and the functioning of markets.

These concepts provide a framework for understanding the forces that drive prices, production, and consumption in a market economy.

By mastering the principles of supply and demand, individuals, businesses, and governments can make better-informed decisions, promote efficient resource allocation, and contribute to a more stable and prosperous economic environment.

Supply and Demand FAQs

Demand is an economic principle that refers to the willingness and ability of consumers to make discretionary purchases at a given price.

Supply and demand is a fundamental concept in economics that describes how prices and quantities of goods and services are determined in a market economy. The law of supply and demand states that the price of a good or service will vary based on the availability of the product (supply) and the level of consumer interest in purchasing the product (demand). When demand for a good or service is high and the supply is low, the price will increase, whereas when demand is low and supply is high, the price will decrease.

Demand is closely related to supply, which is the number of goods available to be sold in an economic market.

A decrease in overall demand would lead to a decrease in both quantity and price.

In economics, supply refers to the amount of a good or service that producers are willing and able to sell at a given price, within a specific period of time, and under certain conditions. The supply of a product is affected by various factors such as the cost of production, technology, availability of resources, government policies, and the level of competition. Generally, when the price of a product increases, producers will be motivated to supply more of that product to the market, because they can earn higher profits. Conversely, when the price decreases, producers may reduce their supply, as it becomes less profitable to produce and sell that product. Thus, supply is an important determinant of the price of a product in the market.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.