The Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act) is a United States federal law that requires parties involved in certain large mergers and acquisitions to notify the Federal Trade Commission (FTC) and the Department of Justice (DOJ) before completing the transaction. The purpose of this notification is to allow regulatory authorities to review the transaction for potential antitrust concerns. The primary purpose of the HSR Act is to protect consumers and competition by ensuring that the relevant antitrust authorities have the opportunity to review and potentially challenge proposed mergers and acquisitions before they are finalized. The Act aims to prevent the creation of monopolies and maintain a competitive marketplace. The HSR Act establishes a premerger notification process, sets thresholds for reporting, and imposes waiting periods to give antitrust authorities time to review proposed transactions. The Act also provides for civil penalties for non-compliance and outlines the steps for parties seeking an exemption from the notification requirement. Companies involved in certain large mergers, acquisitions, or other transactions that meet specified size thresholds are required to comply with the HSR Act. This applies to both domestic and foreign firms, as well as private and public companies, if the transaction has the potential to impact competition within the United States. The HSR Act is triggered when a proposed transaction meets or exceeds the specified monetary thresholds, which are adjusted annually for inflation. The Act applies to transactions involving the acquisition of voting securities, assets, or non-corporate interests, as well as certain other types of transactions that may affect competition. The HSR Act establishes monetary thresholds for reporting, which determine whether a transaction is subject to the premerger notification requirement. There are two primary thresholds: the size-of-transaction threshold and the size-of-persons threshold. Both of these thresholds are adjusted annually based on changes in the gross national product. The premerger notification process is designed to provide the FTC and DOJ with information about proposed transactions that may have an impact on competition. This enables antitrust authorities to review and, if necessary, challenge or block transactions that could result in a substantial lessening of competition or the creation of a monopoly. Parties to a transaction that triggers the HSR Act must submit a premerger notification form to the FTC and DOJ, which includes detailed information about the transaction and the parties involved. This form, known as the HSR Form, must be completed and submitted by both the acquiring and the acquired parties, along with the required filing fee. Once the HSR Form is submitted, a waiting period is imposed to allow the antitrust authorities to review the proposed transaction. The initial waiting period is typically 30 days for most transactions or 15 days for cash tender offers and bankruptcy sales. The waiting period may be extended if the antitrust authorities require additional information or decide to investigate further. The HSR Act requires parties to provide detailed information about the proposed transaction and the businesses involved. This information is necessary to help the antitrust authorities assess the potential impact of the transaction on competition in the relevant market. The HSR Form is the primary document used to submit the required information to the FTC and DOJ. The form includes instructions on what information to provide, such as details about the parties, the transaction structure, the acquired and acquiring entities, and financial data. Foreign entities involved in transactions that trigger the HSR Act must also comply with the premerger notification requirements. Special rules apply to foreign entities, including additional reporting requirements and exemptions for certain types of transactions that have minimal impact on U.S. commerce. Parties that fail to comply with the HSR Act may face significant civil penalties. The FTC is authorized to seek penalties for each day of non-compliance, and the maximum daily penalty is adjusted annually for inflation. Compliance with the HSR Act is crucial to avoid potential penalties and ensure that transactions are not delayed or blocked due to antitrust concerns. Early detection of potential antitrust issues allows parties to address them proactively, reducing the risk of enforcement actions and penalties. The FTC and DOJ have taken enforcement actions against parties that fail to comply with the HSR Act, resulting in substantial penalties. These actions serve as a reminder of the importance of compliance and the potential consequences of non-compliance. The HSR Act provides several exemptions and special rules that may apply to certain transactions, allowing parties to avoid the premerger notification process. Understanding these exemptions can help parties determine whether their transaction is subject to the HSR Act's requirements. The HSR Act includes special rules for acquisitions of voting securities, such as the aggregation of holdings and the acquisition of convertible securities. These rules can impact whether a transaction triggers the reporting requirements under the Act. The HSR Act also provides exemptions for certain acquisitions of assets and interests in non-corporate entities, such as partnerships and limited liability companies. These exemptions may apply when the transaction has minimal impact on U.S. commerce or when the acquired assets are used solely for investment purposes. Engaging experienced legal counsel is essential for navigating the complexities of HSR Act compliance. Legal counsel can help parties determine whether their transaction is subject to the Act, complete the HSR Form accurately, and navigate the premerger notification process efficiently. Parties can adopt several strategies to minimize the burden of HSR Act compliance, such as preparing for the premerger notification process early, using technology to streamline the collection and submission of required information, and maintaining open communication with antitrust authorities throughout the process. Avoiding common mistakes in HSR Act compliance can help parties reduce the risk of penalties and delays. These mistakes include underestimating the complexity of the HSR Form, failing to consult with legal counsel early in the process, and not providing complete and accurate information in the premerger notification. This article has provided an overview of the Hart-Scott-Rodino Antitrust Improvements Act of 1976, including its purpose, key provisions, reporting requirements, and compliance strategies. Understanding these aspects of the HSR Act is essential for parties involved in large mergers and acquisitions to ensure compliance and avoid potential penalties. Compliance with the HSR Act is crucial for businesses involved in significant transactions that may affect competition. Adhering to the Act's requirements helps maintain a competitive marketplace, protect consumer interests, and prevent the formation of monopolies. Given the complexities of the HSR Act and the potential consequences of non-compliance, parties involved in transactions that may trigger the Act should seek legal guidance from experienced counsel. This will help ensure that they navigate the premerger notification process effectively and avoid potential penalties or delays. Estate planning is an essential step in securing your family's future and preserving your legacy. Don't leave these critical decisions to chance. Reach out to an experienced estate planning lawyer today to guide you through the process, ensuring your assets are distributed according to your wishes and minimizing the burden on your loved ones.What Is the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act)?

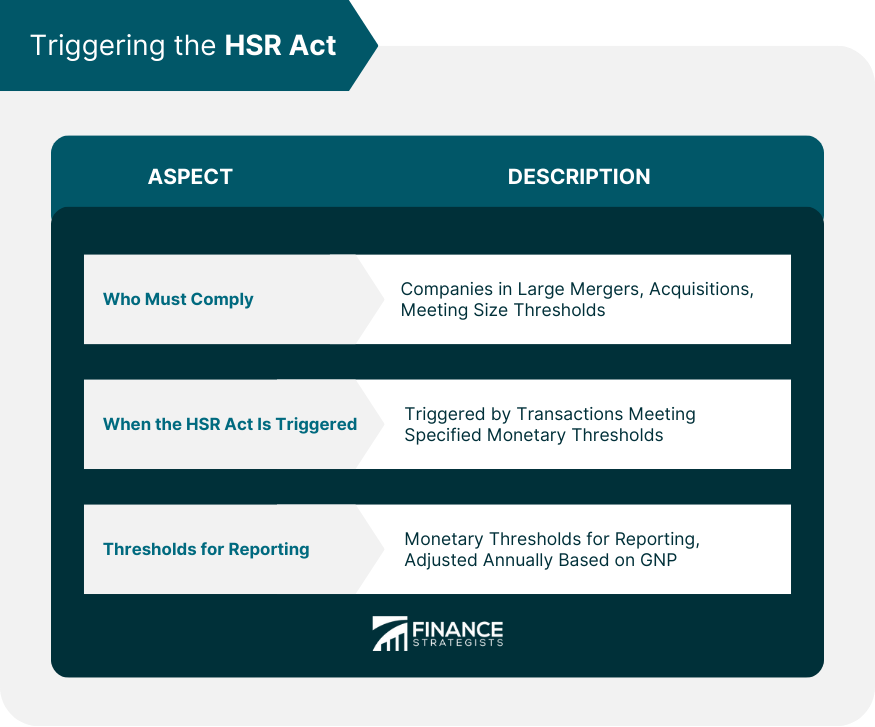

Triggering the HSR Act

Who Must Comply With the HSR Act

When the HSR Act is Triggered

Thresholds for Reporting Under the HSR Act

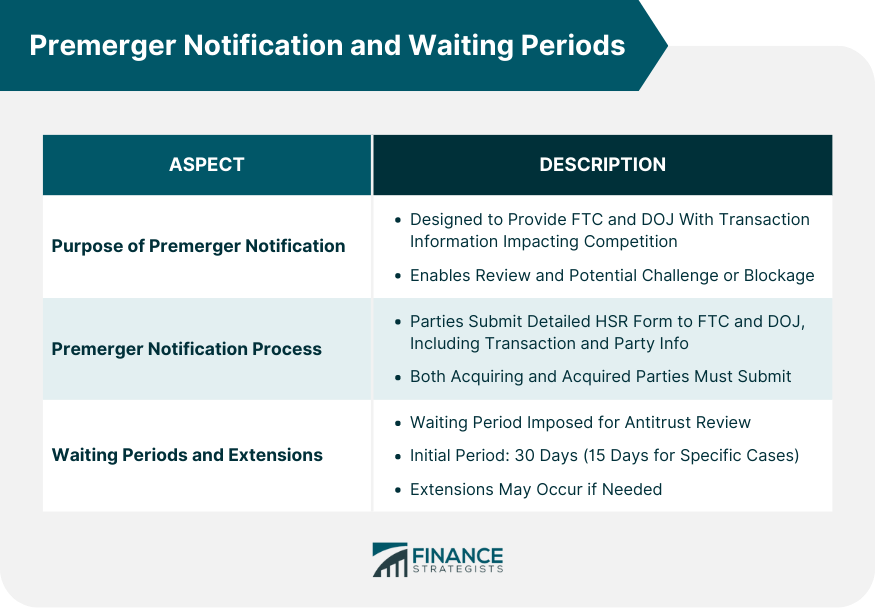

Premerger Notification and Waiting Periods

The Purpose of Premerger Notification

The Premerger Notification Process

Waiting Periods and Extensions

Information Required for HSR Act Compliance

Overview of the Required Information

The HSR Form and Instructions

Special Rules for Foreign Entities

Penalties for Violating the HSR Act

Civil Penalties for HSR Act Violations

The Importance of Compliance

Recent Enforcement Actions and Penalties

Exemptions and Special Rules

Overview of Exemptions and Special Rules

Special Rules for Acquisitions of Voting Securities

Exemptions for Acquisitions of Assets and Interests in Non-corporate Entities

HSR Act Compliance Strategies

The Role of Legal Counsel in HSR Act Compliance

Strategies for Minimizing the Burden of HSR Act Compliance

Common Mistakes to Avoid in HSR Act Compliance

Final Thoughts

Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act) FAQs

The HSR Act aims to protect consumers and maintain competition by requiring parties involved in certain large mergers and acquisitions to notify the Federal Trade Commission (FTC) and the Department of Justice (DOJ) before completing the transaction. This allows authorities to review and potentially challenge or block transactions that may negatively impact competition.

A transaction is subject to the HSR Act if it meets or exceeds the specified monetary thresholds, which are adjusted annually for inflation. These thresholds include the size-of-transaction threshold and the size-of-persons threshold, and the Act applies to transactions involving the acquisition of voting securities, assets, or non-corporate interests.

Violations of the HSR Act can result in significant civil penalties, with the FTC authorized to seek penalties for each day of non-compliance. The maximum daily penalty is adjusted annually for inflation, emphasizing the importance of complying with the Act's requirements.

The HSR Act provides several exemptions and special rules for certain transactions, including special rules for acquisitions of voting securities and exemptions for acquisitions of assets and interests in non-corporate entities. Understanding these exemptions can help parties determine whether their transaction is subject to the HSR Act's requirements.

An experienced attorney can guide parties through the complexities of HSR Act compliance, helping them determine if their transaction is subject to the Act, accurately complete the HSR Form, and efficiently navigate the premerger notification process. Legal counsel can also assist in developing strategies for minimizing the burden of HSR Act compliance and avoiding common mistakes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.