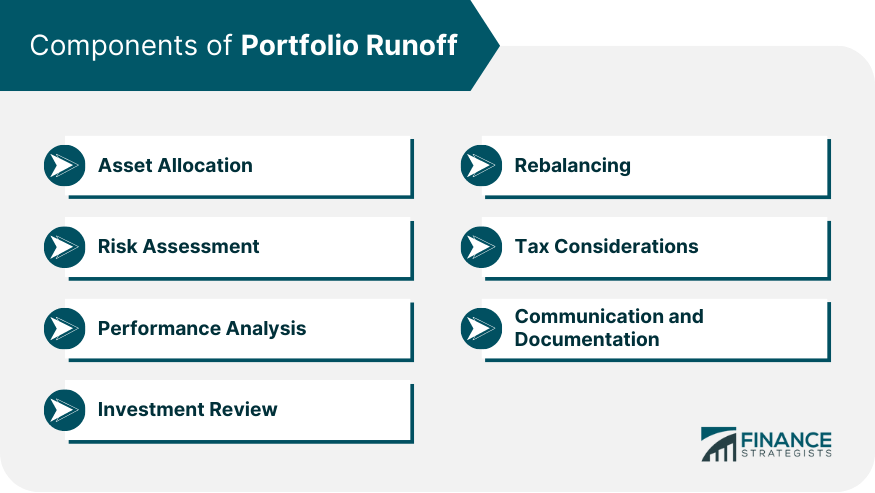

Portfolio runoff refers to the gradual reduction of assets in a portfolio over time due to the maturity, prepayment, or cancellation of contracts. It's a concept most commonly associated with fixed-income securities, mortgage-backed securities, and insurance policies. The term 'runoff' is also used to describe the phase where a company ceases new operations and lets existing obligations mature or be resolved. The portfolio runoff concept is rooted in the banking and insurance industries. With the advent of modern portfolio theory in the 1950s, financial institutions began to view their holdings as an aggregate portfolio of assets, and the concept of portfolio runoff became more relevant. Since then, it has been crucial in financial management, asset-liability management, and financial regulation. Understanding portfolio runoff is important as it can greatly influence investment strategies and decisions, potentially affecting your financial outcomes. The components of Portfolio Runoff typically include the following: The first component involves reviewing the current asset allocation within a portfolio. This includes assessing the distribution of investments across various asset classes such as stocks, bonds, real estate, and cash. The goal is to determine the existing mix and identify any overweight or underweight positions. The next component is a comprehensive risk assessment of the portfolio. This involves evaluating the level of risk exposure to factors such as market volatility, interest rate changes, credit risk, and geopolitical events. The aim is to understand the potential vulnerabilities and risks associated with the current holdings. Evaluating the performance of individual investments within the portfolio is another crucial component. This analysis includes assessing the historical returns, comparing them to relevant benchmarks, and identifying underperforming assets or strategies. It helps in identifying investments that may need to be reevaluated or replaced. Conducting a thorough review of each investment is an essential component of portfolio runoff. This involves analyzing the fundamentals, financial statements, and market conditions of each holding. The goal is to determine if the investment still aligns with the investor's objectives and if there are any specific concerns or changes that may warrant a reallocation. Rebalancing the portfolio is a critical component of managing the runoff process. This involves adjusting the asset allocation to bring it back in line with the desired targets. It may include selling overperforming assets, reducing exposure to certain sectors or regions, and reallocating funds to areas with more potential for growth. Taking into account tax implications is an important component, especially when liquidating assets. The impact of capital gains taxes or tax-efficient strategies should be considered to minimize the tax burden while implementing the portfolio runoff. Effective communication with clients or stakeholders is essential during the portfolio runoff process. Regular updates, reporting, and documentation of decisions made and rationale behind them are crucial for transparency and maintaining trust. By considering these components, investors can manage the portfolio runoff process more effectively, making informed decisions to achieve their financial goals. In fixed-income portfolios, runoff typically occurs as bonds mature and the principal is returned to the investor. This can lead to reinvestment risk if interest rates have fallen, making it difficult to find new investments with comparable yields. For mortgage-backed securities, runoff can happen when homeowners prepay their mortgages, often due to refinancing when interest rates decrease. This can reduce the yield for the investor, as prepayments usually occur when market rates are lower than the mortgage's original rate. In the insurance industry, portfolio runoff happens when policies expire or are canceled, and no new policies are issued to replace them. Policyholder behavior and broader economic factors can influence the runoff rate. Economic conditions can greatly impact the rate of portfolio runoff. There might be a slower runoff in economic growth and stability periods as policyholders are more likely to maintain their policies, and borrowers are less likely to default. Conversely, in times of economic downturns or increased interest rates, portfolio runoff may increase due to higher levels of prepayments, defaults, or policy cancellations. The health of the financial markets is another significant factor influencing portfolio runoff. There may be increased prepayments in a low-interest-rate environment as borrowers take advantage of lower rates, leading to faster portfolio runoff. On the other hand, in a high-interest-rate environment, policyholders might be more likely to let their policies lapse, also accelerating runoff. Policyholder behavior is crucial in portfolio runoff, particularly for insurance companies. Policyholders might choose to cancel or not renew their policies based on their individual circumstances, such as changes in their health, financial status, or risk tolerance. These individual decisions can significantly affect the portfolio runoff rate when viewed in aggregate. One popular method for predicting portfolio runoff is time series analysis. This statistical technique uses historical data to forecast future trends. For example, an insurance company might use time series analysis to forecast policy renewals and cancellations based on historical trends. Survival analysis, another statistical technique, can also be useful for predicting portfolio runoff. Also known as event history analysis, this method can predict the "survival" of financial assets or contracts in a portfolio, helping institutions estimate the timing and likelihood of runoff. The advent of machine learning has provided new methods for predicting portfolio runoff. These techniques can process large amounts of data and identify complex patterns that traditional statistical methods might miss. Machine learning models can incorporate a variety of factors, including economic conditions, market trends, and policyholder behavior, making them particularly useful for forecasting runoff. Portfolio runoff can pose several risks for investors and financial institutions. For instance, if assets run off faster than expected, institutions may be forced to reinvest in a less favorable interest rate environment, reducing their returns. This is known as reinvestment risk. Similarly, there's the risk of early repayment or prepayment, particularly with mortgage-backed securities, which can also reduce the yield on these investments. Several strategies can help manage the risks associated with portfolio runoff. These may include diversification, which involves spreading investments across different types of assets and contracts to reduce exposure to any single type of runoff risk. Another strategy is laddering, where assets with different maturity dates are chosen to ensure that the entire portfolio doesn't run off at once. Maintaining a robust risk management framework can also help monitor and manage the effects of runoff. Regulatory bodies often view portfolio runoff as important in determining an institution's financial stability. Regulators may require institutions to maintain certain capital levels to absorb potential losses caused by unexpected runoff levels. Additionally, they may scrutinize institutions' strategies for managing runoff and their ability to predict future runoff levels accurately. Portfolio runoff also plays a critical role in stress testing, a simulation technique regulators use to assess financial institutions' ability to withstand adverse economic conditions. Stress tests often include scenarios with high levels of portfolio runoff to evaluate whether institutions have adequate capital to absorb the resulting losses. Portfolio runoff can have significant implications for liability management. As the assets in a portfolio runoff, institutions must carefully manage their liabilities to maintain their financial stability. This could involve adjusting the terms of their liabilities, hedging runoff risk, or acquiring new assets to replace those running off. As portfolio runoff occurs, financial institutions must reallocate assets strategically. This might involve reinvesting the funds received from matured or prepaid assets into new assets. The choice of new investments typically considers the current and predicted market conditions, the institution's risk tolerance, and the need to match the duration of assets and liabilities. Portfolio runoff is a crucial concept in investment management, asset-liability management, and financial regulation. Understanding its components, factors influencing it, and strategies for managing it is essential for investors and financial institutions. The components of portfolio runoff include asset allocation, risk assessment, performance analysis, investment review, rebalancing, tax considerations, and communication/documentation. These components help ensure that portfolios are well-diversified, risk-aware, and aligned with investment objectives. Factors such as economic conditions, financial market dynamics, and policyholder behavior influence the rate of portfolio runoff. Predictive models, including time series analysis, survival analysis, and machine learning, can help forecast runoff and aid in decision-making. Managing the risks associated with runoff is crucial. Strategies like diversification, laddering, and robust risk management frameworks help mitigate risks and optimize returns. Regulatory bodies consider portfolio runoff when assessing institutions' financial stability, and stress tests incorporate runoff scenarios to evaluate capital adequacy.What Is Portfolio Runoff?

Components of Portfolio Runoff

Asset Allocation

Risk Assessment

Performance Analysis

Investment Review

Rebalancing

Tax Considerations

Communication and Documentation

Portfolio Runoff in Different Types of Financial Instruments

Fixed-Income Securities

Mortgage-Backed Securities

Insurance Policies

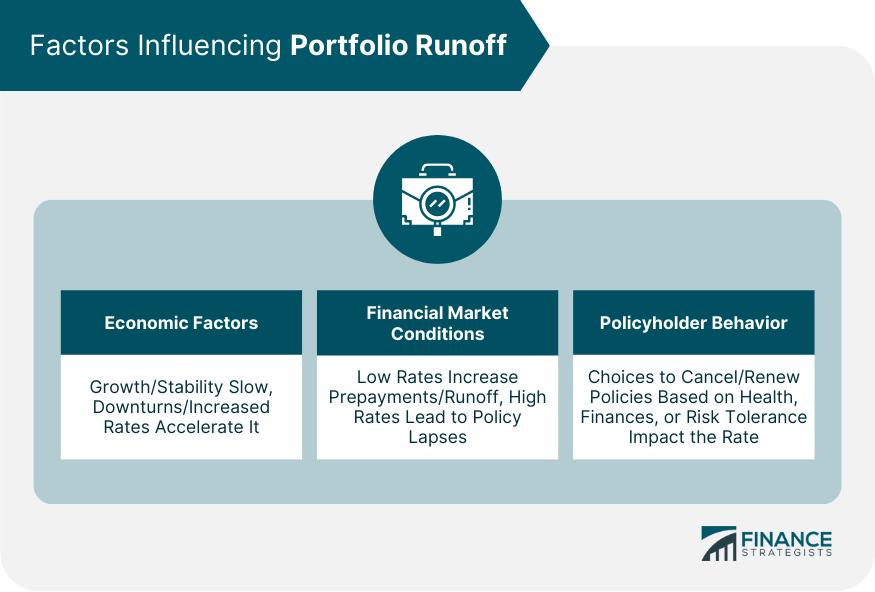

Factors Influencing Portfolio Runoff

Economic Factors

Financial Market Conditions

Policyholder Behavior

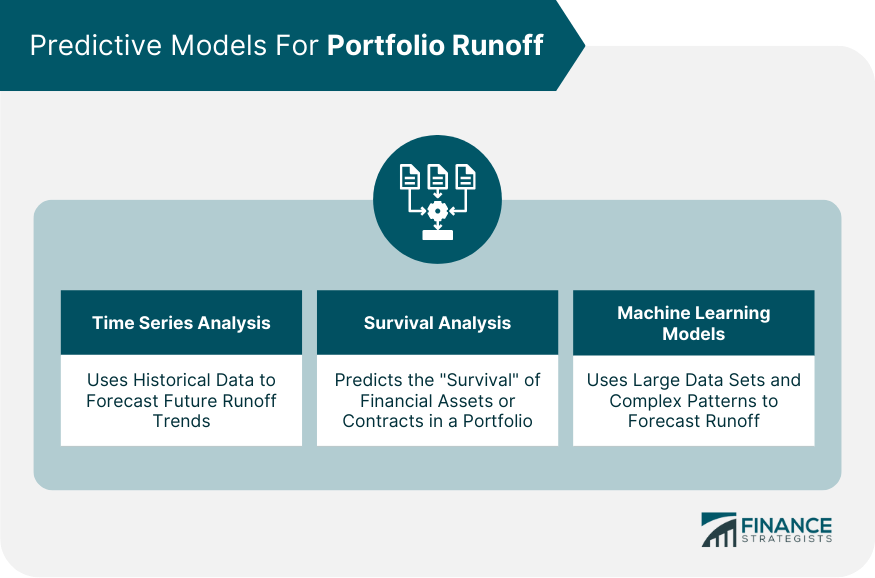

Mathematical and Statistical Models for Predicting Portfolio Runoff

Time Series Analysis for Runoff Prediction

Survival Analysis and Its Applications in Runoff Forecasting

Machine Learning Models for Runoff Prediction

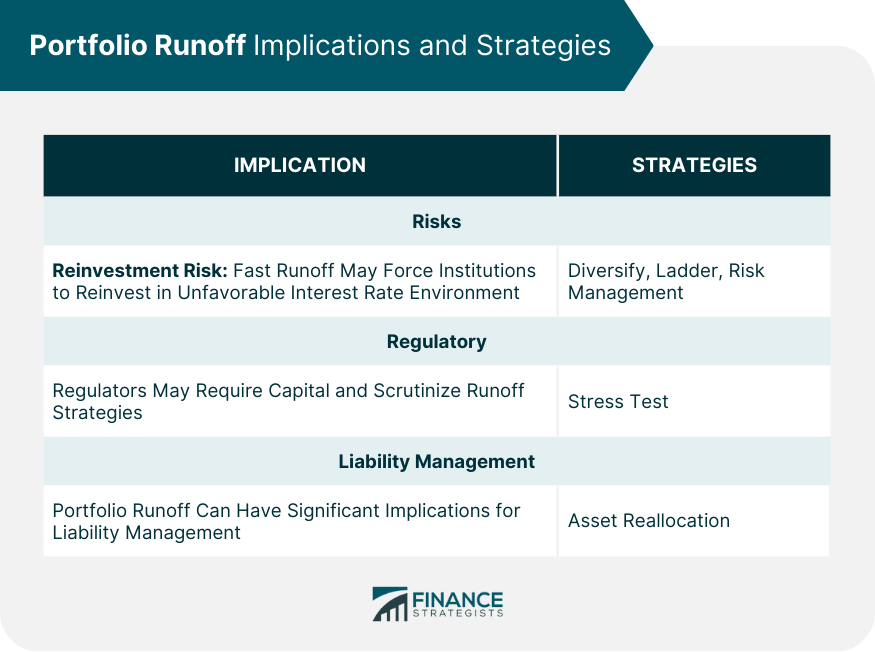

Portfolio Runoff for Investors and Financial Institutions

Risks Associated With Runoff

Strategies for Managing Runoff

Portfolio Runoff in Financial Regulation

Regulatory Views on Runoff

Role of Runoff in Stress Testing and Capital Adequacy

Portfolio Runoff and Asset-Liability Management

Implications for Liability Management

Strategies for Asset Reallocation

Conclusion

Portfolio Runoff FAQs

Portfolio runoff refers to the gradual reduction of assets in a portfolio over time due to the maturity, prepayment, or cancellation of contracts.

Several factors can influence portfolio runoff, including economic conditions, financial market trends, and policyholder behavior.

Several statistical and machine learning methods can be used to predict portfolio runoff, including time series analysis, survival analysis, and various machine learning models.

Portfolio runoff can pose several risks, including reinvestment risk, where assets run off and are replaced by new investments at lower interest rates, and prepayment risk, where borrowers repay loans earlier than expected.

Strategies for managing the risks of portfolio runoff can include diversification, laddering, and maintaining a robust risk management framework.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.