Private banking and wealth management are overlapping concepts associated with financial institutions. They mainly differ in the nature of their services and target clients. Typically, private banking services concentrate on the transactional aspects of banking. These services offer personalized banking to high-net-worth individuals through dedicated relationship managers. On the other hand, wealth management is a holistic approach that provides an array of financial services. This includes tax, estate, retirement, and legacy planning for affluent customers seeking long-term wealth growth and preservation.

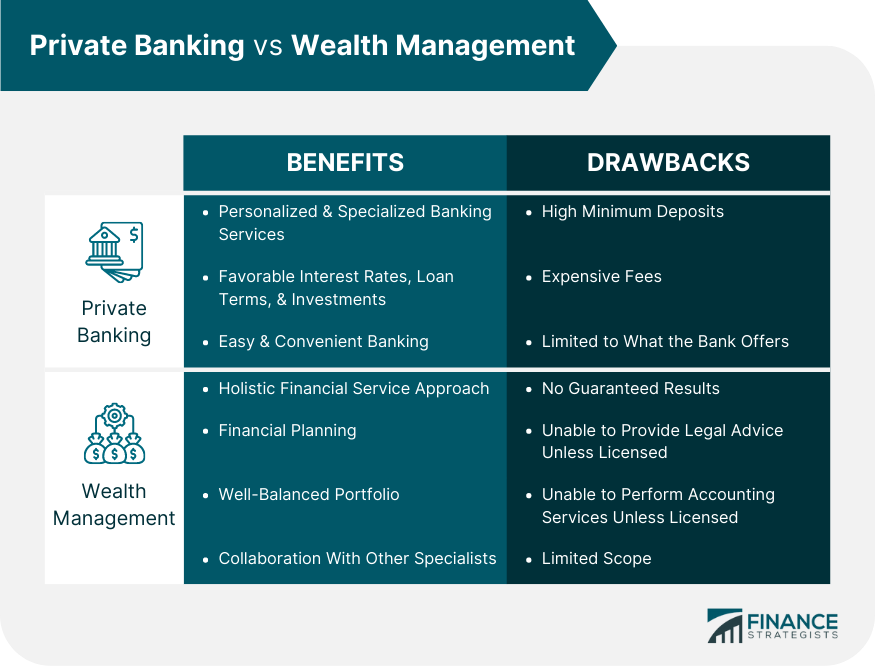

Private banking has become an increasingly popular option for high-net-worth individuals seeking to make the most of their financial resources. Some of its services include a dedicated relationship manager, customized loan terms and interest rates, access to premier investments and markets, private financial advisors, and tax planning. While this level of service is highly beneficial for those eligible, an individual typically must have at least $1 million in liquid assets to qualify for private banking services. Here are some reasons why private banking appeals to high-net-worth individuals: High-net-worth individuals can have confidence knowing their finances are in expert hands with a full suite of customized banking solutions. These services also give clients access to exclusive products, such as sophisticated derivatives and complex options in foreign exchange markets. Access to favorable interest rates, customized loan terms, and premier investments is usually unavailable to the general public. Other advantages of private banking include cheaper loan rates and higher savings or investment yield. Private banking clients have access to their accounts 24/7, allowing them to check balances, transfer funds, and make payments anytime. They may also conveniently contact their banker to discuss and manage their finances. However, there are some drawbacks to be aware of before engaging with private banking. Private banking services typically require a high minimum balance to open an account. This may be too costly and out of reach for many individuals, particularly since they would need considerable amounts of liquid assets to qualify. The fees associated with private banking services can be more expensive than conventional banking fees, which can quickly decrease your gains. Clients may have to pay management fees, as well as transaction fees, for each activity they make in their accounts. When using a private banking service, it is essential to note that their services are limited to the products and services the bank offers. You may not be able to access certain investments or specialized groups. Wealth management caters to wealthy clients and provides them with sophisticated financial management and investment advising services. This service creates and preserves wealth to achieve long-term generational financial success. Clients work with wealth managers to develop strategies. These plans are designed to be sustainable for long-term success. They involve a deep understanding of the client’s entire financial circumstances. Wealth management services cater to clients with any amount of investable assets. It is a good alternative for those who have a lot of money and want to ensure that their assets are managed and preserved constructively. This holistic approach includes asset management and diversification advice, tax planning, retirement planning, estate planning, philanthropy planning guidance, insurance review, and evaluation and consultation services. Wealth management services like those provided by Goldman Sachs help you develop a plan to achieve your financial objectives and build a varied and well-balanced portfolio. It also allows collaboration with other specialists who offer a comprehensive array of services. The cost associated with having a wealth manager can depend on the specific services you require. Generally, they charge an investment management fee based on a percentage of your total assets under their management, typically around 1% to 3% per year. Wealth management services have their own set of limitations. For instance, wealth managers cannot guarantee any results. Neither can they provide legal services or advice without a license to practice law. They cannot perform accounting duties without a valid license. Neither can they act as a depository or deliver transactional banking services. Many financial instruments and investments are beyond the scope of most wealth managers. These can include complex derivatives and alternative asset classes like venture capital and private equity investments. Private banking and wealth management have their respective advantages and disadvantages. It is necessary to understand the differences between them so that you can make the best decision for your financial goals. Suppose you want a customized wealth-building experience with access to specialist advice and sophisticated investments. In that case, wealth management is the way to go. They offer security and reduce the stress associated with managing an extensive portfolio of investments. On the other hand, if you want specialized, personalized banking services and perks, then private banking may be right for you. These services offer convenience and easy access to clients who regularly conduct transactional banking activities. You should enlist a wealth management service if you require a comprehensive approach and a deep understanding of your financial circumstance. Such a service emphasizes the long-term success of your wealth journey. Private banking and wealth management are related services offered by financial institutions. Their primary distinctions are in the types of services they provide and their respective clientele. In some cases, clients who use private banking services are similar to ordinary clients. However, those HNWIs work directly with a dedicated banker, which allows them to have easier, more personalized, and expanded access to the bank’s financial and banking services. Clients who need wealth management seek to preserve, generate, and focus on the long-term growth and protection of their wealth. Before choosing between private banking and wealth management services, individuals should figure out how much their assets are worth and what services they need.Private Banking vs Wealth Management: Overview

What Is Private Banking?

Benefits of Private Banking

Personalized & Specialized Banking Services

Favorable Interest Rates, Loan Terms, & Investments

Easy & Convenient Banking

Drawbacks of Private Banking

High Minimum Deposits

Expensive Fees

Limited to What the Bank Offers

What Is Wealth Management?

Wealth Management Services

Limitations of Wealth Management

Private Banking vs Wealth Management: Which Is Best for You?

The Bottom Line

Private Banking vs Wealth Management FAQs

Private banking is ideal for high-net-worth individuals who need personalized banking services and access to specialized financial instruments. You should use private banking if you are worth more than $1,000,000 and you want convenient access to banking services, and are amenable to the fees involved.

Wealth management is ideal for individuals who need a comprehensive approach to managing their finances and want expertise in making critical financial decisions. Suppose you are looking for more of an all-inclusive service that covers complex investments, tax, estate, and retirement planning. In that case, wealth management might be the right choice.

Wealth management is a comprehensive strategic investment advisory service that focuses on the long-term financial success of affluent clients. It provides portfolio advice, investment management, risk management strategies, and tax, estate, retirement, and legacy planning.

Private banking services are typically reserved for high-net-worth individuals. HNWIs have a net worth of more than $1,000,000. Usually, they require specialized banking services or financial instruments to manage their wealth.

Private banking is a service that offers specialized banking services and access to specialized, personalized banking privileges and financial instruments to high-net-worth individuals with more than $1,000,000. Wealth management is an all-encompassing strategic approach for affluent clients with no required minimum investment, focusing on their wealth's long-term growth and protection.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.