Private wealth advisors are financial professionals who offer specialized financial planning services to high-net-worth individuals and families. These professionals are experts in managing complex and large financial portfolios and provide a wide range of financial services such as investment management, tax planning, estate planning, risk management, and wealth transfer. They work closely with their clients to understand their financial goals and develop customized strategies to help them achieve these goals. Private wealth advisors are different from traditional financial advisors in that they typically work with clients who have a minimum of $1 million in investable assets. The minimum threshold is necessary because managing such large portfolios requires specialized knowledge and expertise. Private wealth advisors have an in-depth understanding of the unique needs and challenges of high-net-worth individuals, making them well-positioned to offer tailored financial solutions that are aligned with their clients' goals and objectives. Have a financial question? Click here.

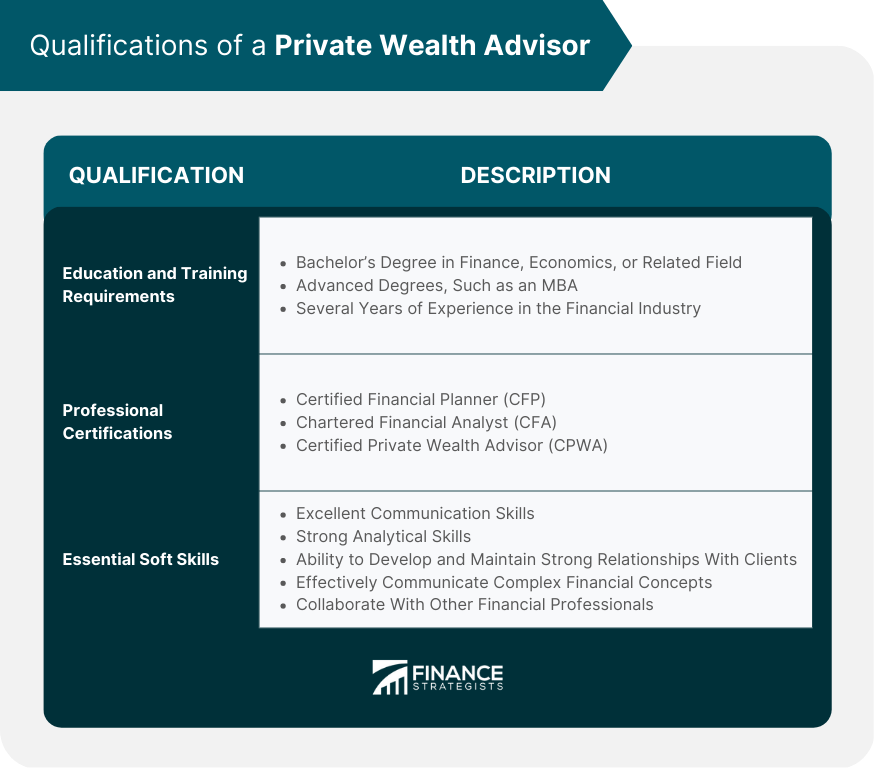

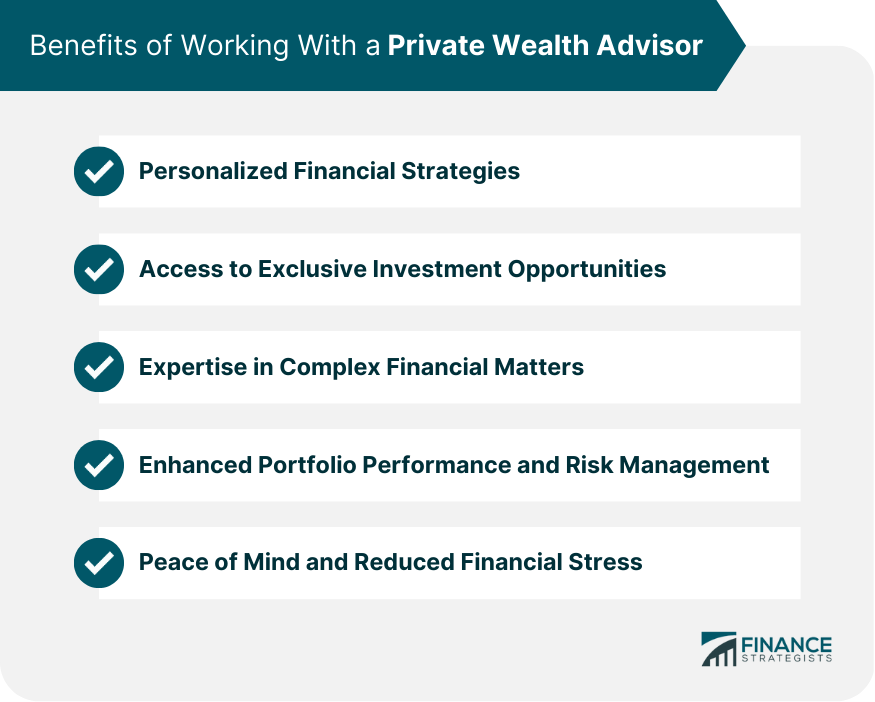

The primary role of a private wealth advisor is to provide comprehensive financial planning and investment management services to high-net-worth individuals and families. They are responsible for managing their clients' assets, including stocks, bonds, mutual funds, and alternative investments. Private wealth advisors also work closely with their clients to develop customized financial plans that take into account their unique goals and objectives. In addition to investment management, private wealth advisors are responsible for providing tax planning, estate planning, risk management, and wealth transfer services. They work closely with their clients' other advisors, such as tax attorneys and estate planning attorneys, to ensure that their clients' financial plans are comprehensive and integrated. The following are the common services offered by private wealth advisors: They work closely with their clients to understand their risk tolerance, investment goals, and overall financial objectives, and develop customized investment strategies that help them achieve those goals while minimizing risk. Private wealth advisors provide tax planning services to help their clients minimize their tax liability. This includes developing strategies to minimize capital gains taxes, optimizing retirement account contributions, and identifying tax-efficient investment opportunities. They work closely with their clients' estate planning attorneys to develop comprehensive estate plans. This includes developing strategies to minimize estate taxes, creating trusts to protect assets, and ensuring that their clients' assets are distributed according to their wishes. It is common for private wealth advisors to provide risk management services to help their clients protect their assets from unforeseen events, such as market downturns or lawsuits. This includes developing strategies to diversify investments, protect against market volatility, and minimize exposure to risk. Private wealth advisors provide wealth transfer services to help their clients transfer their assets to the next generation in a tax-efficient manner. This includes developing strategies to minimize gift and estate taxes, creating trusts, and ensuring that their clients' assets are distributed according to their wishes. The following are the qualifications and skills required for private wealth advisors: Private wealth advisors must have a combination of education, training, and experience to be successful in their roles. They typically have a bachelor's degree in finance, economics, or a related field, and many have advanced degrees such as a Master of Business Administration (MBA). In addition to formal education, private wealth advisors typically have several years of experience working in the financial industry before becoming private wealth advisors. These certifications demonstrate that the advisor has met certain educational and experience requirements and has passed rigorous exams to demonstrate their knowledge and expertise. The most common certifications for private wealth advisors are the Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Private Wealth Advisor (CPWA) designations. Soft skills are also crucial for private wealth advisors. These skills include excellent communication skills, strong analytical skills, and the ability to develop and maintain strong relationships with clients. Private wealth advisors must be able to effectively communicate complex financial concepts to their clients and collaborate with other financial professionals such as estate planning attorneys and tax accountants. Below are some benefits of working with a private wealth advisor: Private wealth advisors provide customized financial strategies that are tailored to their clients' unique goals and objectives. This personalized approach ensures that their clients' financial plans are aligned with their individual needs and circumstances. Private wealth advisors have access to exclusive investment opportunities that are not available to the general public. This includes access to private equity funds, hedge funds, and other alternative investments that can provide greater diversification and potentially higher returns than traditional investment options. Private wealth advisors have a deep understanding of complex financial matters, such as tax planning, estate planning, and risk management. This expertise ensures that their clients' financial plans are comprehensive and integrated, and that they are taking advantage of all available opportunities to optimize their financial outcomes. Private wealth advisors have a track record of achieving strong investment performance while minimizing risk exposure. This is achieved through a combination of customized investment strategies, diversification, and ongoing monitoring and analysis of market trends and conditions. By working with a private wealth advisor, high-net-worth individuals can enjoy peace of mind knowing that their financial affairs are being managed by an expert. This can help to reduce financial stress and anxiety, allowing clients to focus on other important areas of their lives. Listed below are some of the steps in choosing the right private wealth advisor: Before choosing a private wealth advisor, it is essential to identify your financial goals and objectives. This will help you to find an advisor who has experience and expertise in the areas that are most important to you. Use online resources and professional networks to identify potential advisors who have experience working with clients with similar financial needs and goals. Compile a list of potential advisors and review their credentials, experience, and qualifications. Reach out to potential advisors to schedule initial consultations. During these consultations, ask questions about the advisor's experience, investment philosophy, and approach to risk management. Ask potential advisors for references and review their track record of investment performance. This will help you to assess the advisor's ability to deliver results over the long term. Conduct due diligence and perform background checks on potential advisors to ensure that they are reputable and trustworthy. This includes checking the advisor's regulatory history, references, and professional affiliations. Review the advisor's fee structure to ensure that it is aligned with your interests. Look for advisors who are transparent about their fees and who are willing to work with you to develop a fee structure that meets your needs. A private wealth advisor is a financial professional who provides specialized financial planning and wealth management services to high-net-worth individuals and families. These advisors have the expertise and knowledge necessary to manage complex financial portfolios. Private wealth advisors are differentiated from traditional financial advisors by their experience working with clients who have a minimum of $1 million in investable assets. The role and responsibilities of a private wealth advisor include investment management, tax planning, estate planning, risk management, and wealth transfer. To excel in their roles, private wealth advisors require a combination of education, training, and experience. They must have a bachelor's degree in finance, economics, or a related field, along with professional certifications such as the CFP or CFA designation. Soft skills such as excellent communication skills, strong analytical skills, and the ability to develop and maintain strong relationships with clients are also critical. The benefits of working with a private wealth advisor include personalized financial strategies, access to exclusive investment opportunities, expertise in complex financial matters, enhanced portfolio performance and risk management. When selecting a private wealth advisor, it is important to consider factors such as experience, qualifications, and professional certifications, and to conduct due diligence and perform background checks to ensure that the advisor is reputable and trustworthy.Definition of Private Wealth Advisor

Role and Responsibilities of a Private Wealth Advisor

Services Offered by Private Wealth Advisors

Investment Management

Tax Planning

Estate Planning

Risk Management

Wealth Transfer

Qualifications of a Private Wealth Advisor

Education and Training Requirements

Professional Certifications

Essential Soft Skills

Benefits of Working With a Private Wealth Advisor

Personalized Financial Strategies

Access to Exclusive Investment Opportunities

Expertise in Complex Financial Matters

Enhanced Portfolio Performance and Risk Management

Peace of Mind and Reduced Financial Stress

Choosing the Right Private Wealth Advisor

Determine Your Financial Goals

Research Potential Advisors

Conduct Initial Interviews

Review the Advisor’s Track Record

Evaluate the Advisor’s Fee Structure

Bottom Line

Private Wealth Advisor FAQs

A private wealth advisor is a financial professional who specializes in managing the financial affairs of high-net-worth individuals, families, and organizations.

Private wealth advisors offer a range of services, including investment management, tax planning, estate planning, risk management, and wealth transfer.

Private wealth advisors typically have a Bachelor's degree in Finance, Economics, or related fields, several years of experience working in the financial industry, and hold certifications such as Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Private Wealth Advisor (CPWA).

Working with a private wealth advisor offers numerous benefits, such as personalized financial strategies, access to exclusive investment opportunities, expertise in complex financial matters, enhanced portfolio performance and risk management, and peace of mind knowing that their financial affairs are being managed by an expert.

When choosing a private wealth advisor, it is important to consider factors such as qualifications, experience, certifications, and approach to wealth management. Additionally, you can ask questions during the selection process, perform due diligence, and conduct background checks to ensure you choose the right advisor for your needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.