Private Wealth Management is a specialized form of investment and financial planning for high-net-worth individuals (HNWIs). Private wealth management services range from recommending a budget to diversifying investments. It offers HNWIs a holistic approach to managing taxes, estate planning, portfolio management, and other financial matters. Individuals or families with liquid assets valued between $1 to $5 million are considered HNWIs. The definition of liquid assets, or money maintained in banks or brokerage accounts, is widely considered to exclude assets like principal residence, collectibles, or durable goods.

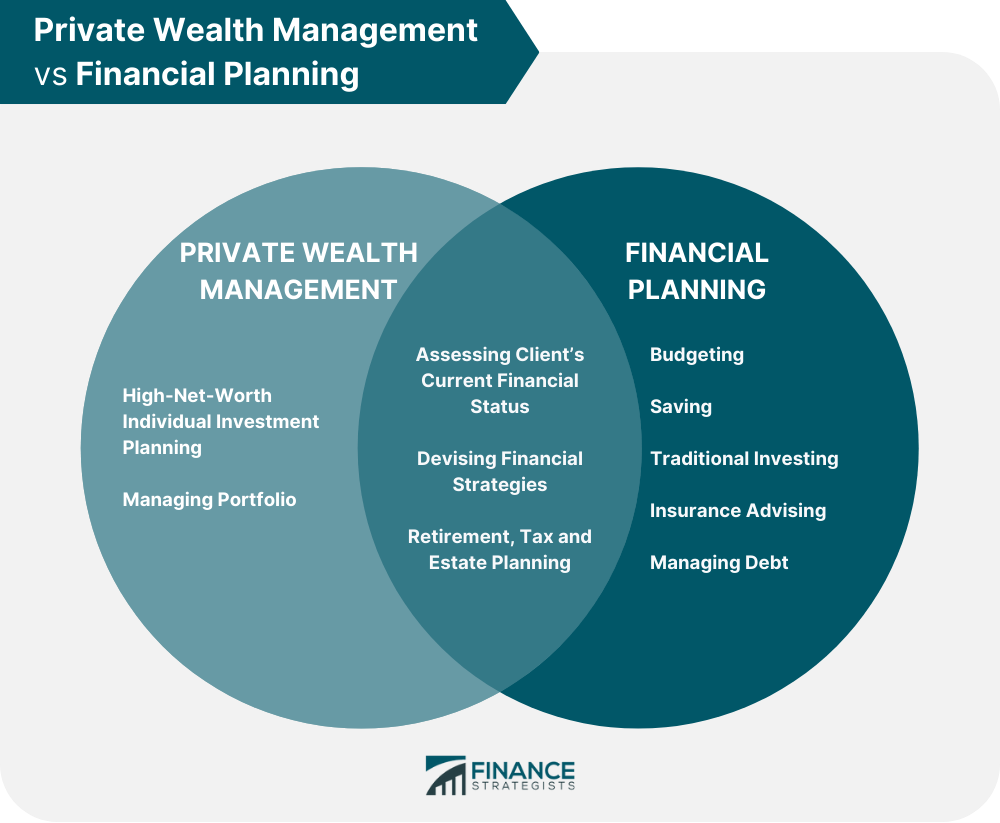

Generally, there are two types of wealth managers: those working independently and those hired by a bank or another financial institution. Wealth managers employed with smaller firms, not connected to banks or financial institutions, are called independent private wealth managers. They can take advantage of a broader range of strategies and resources than banks, granting them an edge in investing. Yet, they cannot access quick loans or other commercial banking organizations' services. Private wealth managers associated with large banks offer a unique service directly tied to the bank. These big firms have an expansive reach, and private wealth management serves as one specific department within the larger structure. Unlike independent private wealth managers, bank-affiliated private wealth managers can offer limited investment options. Private wealth management provides a wide range of financial planning services, from financial planning, asset protection, tax planning and management, retirement planning, risk management, and charitable donations. Private wealth managers craft a comprehensive financial plan by evaluating the client's circumstances and financial objectives. Private wealth management is essential for protecting affluent clients from potential legal action, governmental seizures, inheritance disputes, marital conflicts, property disagreements, and other similar challenges. The lawsuits may lead to hefty financial penalties if they fail in court. A private wealth manager's task is to find the most tax-efficient alternatives for high-net-worth individuals while remaining compliant with the government's requirements. Private wealth managers are immensely knowledgeable about inheritance tax regulations and other tax services. Retirement planning for high-net-worth individuals entails acquiring knowledge about the various financial options, selecting the most suitable strategies, and executing them properly. Their clients can have adequate and a strong sense of security upon retirement. High-net-worth individuals are more exposed to financial risks. A private wealth manager reviews the potential risks and ensures their client’s investments are aligned with their goals and risk tolerance level. Giving to charity is an essential component of wealth management. Both the tax benefits and the social contributions are significant. Charitable giving entitles donors to a generous income tax benefit while donating assets like stocks or real estate. Private wealth management firms typically take a portion of their client's assets as fees. These costs are often tiered, ranging from 1% to 3%. It is essential to remember that when the amount of assets under management rises, the advisory fee percentage is frequently scaled and eventually drops. Some establishments demand additional charges for yearly services or hourly rates on special projects. Private wealth management fees can be expensive. However, for HNWIs, the personalized investment solutions available through their services outweigh the costs involved. Such investment approaches are not provided by traditional investment vehicles. Financial Planning involves managing finances, assessing current circumstances, and developing strategies to ensure prosperity and financial stability. On the other hand, private wealth management is a specialized form of investment and financial planning for HNWI. Here are the shared features and differences between private wealth management and financial planning: Private wealth management and financial planning involve assessing the client's current financial status and devising strategies for the future. Both services encompass retirement, tax preparation, and estate planning, among other areas of expertise. Financial planning involves a comprehensive plan for individuals to achieve their long-term financial goals. It typically includes budgeting, saving, investing, debt management, insurance, retirement, estate, and tax planning. On the other hand, private wealth management is typically focused on providing personalized advice and investments tailored to an investor's specific goals, risk tolerance, and situation. Private wealth management mainly concentrates on investments and portfolio oversight, while financial planning considers all aspects of an individual's finances. Private wealth management could be the perfect solution for individuals looking for a professional to help manage their wealth. Whether or not to use private wealth management services should be based on various factors such as resources available, the complexity of the financial situation, and comfort level with handling money. This service is particularly beneficial for high-net-worth individuals with a $1 to $5 million net worth. A considerable net worth often creates complex tax and estate planning needs, which can be challenging to manage without the help of a professional. Individuals who are too busy, lack the expertise, or need more experience to take care of their money can also greatly benefit from private wealth management services. Investors considering entrusting their investment portfolio may consider hiring a wealth management firm. It is vital to choose an organization that is invested in the client’s financial well-being and intends to protect their investments. To determine if a wealth management firm is worth the cost, consider the value it provides. Suppose the firm offers a lower price, but the value of its services or products differs from those of the other firms. In that case, choosing them may not be worth it. The financial advisor's background and qualifications must be checked. Details like previous employment and whether they possess a Certified Financial Planner (CFP) designation or any other relevant title should be considered. You can check an advisor’s background through the SEC IAPD website or FINRA's BrokerCheck. Do your due diligence before making a decision. There are various methods of paying these professionals. Some charge a commission based on the products you purchase from them, while others charge a fixed rate based on the portfolio size. Make sure to compare fees with other professionals or firms. Private wealth managers can prove invaluable to individual investors by helping them capitalize on opportunities while navigating the complexities of financial markets. The two main types of private wealth managers are those working independently and those hired by a bank or another financial institution. Private wealth management offers a wide range of financial planning services. Among these are financial planning, asset protection, tax planning and management, retirement planning, risk management, and charitable donations. High-net-worth individuals who are too busy and need more expertise or experience may consult with a private wealth manager. In choosing one, consider the value of their services, check the financial advisor’s fees and professional credentials. Take advantage of the services offered by a financial advisor to reach your short-term and long-term financial goals.What Is Private Wealth Management?

Types of Private Wealth Managers

Independent Private Wealth Managers

Bank-Affiliated Private Wealth Managers

Private Wealth Management Services

Financial Planning

Asset Protection

Tax Planning and Management

Retirement Planning

Risk Management

Charitable Giving

Cost of Private Wealth Management Services

Private Wealth Management vs Financial Planning

Similarities Between Private Wealth Management and Financial Planning

Differences Between Private Wealth Management and Financial Planning

Is Private Wealth Management Right For You?

How to Find a Private Wealth Manager

Check the Value of Their Services

Check Professional Credentials

Consider Compensation Methods

Final Thoughts

Private Wealth Management FAQs

Yes. Private wealth management is specially tailored for those with considerable wealth. The practice pays attention to the struggles and managerial issues of having a high net worth. Certified Private Wealth Advisors (CPWAs) are exceptionally prepared to work alongside individuals with $1 to $5 million.

Private wealth management services range from recommending a budget to diversifying investments. It offers HNWIs a holistic approach to managing taxes, estate planning, portfolio management, and other financial matters.

Private wealth manager offers a wide range of financial planning services. Among these are financial planning, asset protection, tax planning and management, retirement planning, risk management, and charitable donations.

Private wealth management mainly concentrates on investments and portfolio oversight, while financial planning considers all aspects of an individual's finances.

Yes. Financial planners will provide advice on budgeting, retirement planning, and taxes. However, the expertise of a private wealth manager in complex investments and financial products may be necessary for a high-net-worth individual to maximize wealth and minimize the risk of loss.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.