Earnest money is a deposit made by a buyer to a seller in a real estate transaction, signaling the buyer's commitment to follow through on the purchase. It serves the purpose of reassuring the seller of the buyer's seriousness, prompting them to reserve the property for the buyer. The amount is typically 1% to 5% of the property's purchase price and is usually held in an escrow account until the transaction is complete. Understanding the concept of earnest money is crucial, particularly for those planning to buy or sell property, as it impacts their financial and legal obligations during a property sale. It is a key term in the broader context of real estate transactions, influencing the actions and decisions of both buyers and sellers. Knowledge about earnest money can help navigate real estate transactions more effectively, safeguarding their interests. In real estate transactions, earnest money is akin to a security deposit. Upon making an offer, the buyer will provide earnest money to demonstrate their genuine interest in purchasing the property. This reassures the seller that the buyer is serious, thus motivating the seller to take the property off the market. The specific amount of earnest money required can vary greatly based on local customs, the state of the real estate market, and the price of the property. However, it usually ranges from 1% to 5% of the purchase price. Higher amounts may be offered in particularly competitive markets to make the buyer's offer more appealing to the seller. Earnest money serves as a binding tool in real estate transactions. For buyers, the earnest money deposit shows they are committed to the purchase, which makes their offer more attractive. For sellers, accepting an earnest money deposit ensures that the buyer has a financial stake in the deal, reducing the likelihood of the buyer withdrawing. The Earnest Money Agreement, or EMA, is a legally binding document that outlines the details of the earnest money deposit. It includes specifics such as the amount of earnest money, how and when it will be paid, and conditions under which it might be returned to the buyer or retained by the seller. This document is crucial in providing legal protection for both parties. The terms and conditions surrounding earnest money are usually explicitly outlined in the purchase agreement. These terms can include contingencies such as the buyer securing financing, the property passing inspection, or the buyer selling their current home. If these conditions are not met, the buyer may be entitled to reclaim their earnest money. When an Earnest Money Agreement is breached, legal implications can be significant. If a buyer backs out of a deal without a valid reason outlined in the agreement, the seller is typically entitled to keep the earnest money. In some cases, legal disputes may arise that require litigation or arbitration to resolve. Earnest money can be paid in several forms, including personal checks, cashier's checks, wire transfers, or in some cases, even cash. It's important for buyers to verify with their real estate agent or attorney the most suitable form of payment. Once an offer has been accepted, the buyer will be required to submit the earnest money deposit. This is typically done by providing the agreed-upon funds to a neutral third party, often a real estate attorney or escrow company. To protect the earnest money deposit, it is typically held in an escrow account until the transaction is completed. This provides assurance for both parties - the buyer can be confident that the money will only be released according to the terms of the agreement, and the seller knows that the funds are secured. If a buyer decides to pull out of the deal without a valid reason, they generally forfeit their earnest money deposit, which then goes to the seller. However, most contracts have contingencies that allow the buyer to withdraw without losing their earnest money, such as a failed inspection or inability to secure financing. Should the seller back out of the agreement without a valid reason, they could be subject to legal action from the buyer. In most cases, the buyer would be entitled to a refund of their earnest money. If a property fails inspection or does not appraise for the agreed-upon purchase price, the buyer usually has the option to back out of the deal and reclaim their earnest money. This is why having inspection and appraisal contingencies in the agreement is essential. There are several conditions under which earnest money may be refunded to the buyer. These generally include contingencies outlined in the agreement, such as securing financing, passing inspections, or selling the buyer's current home. It's important for buyers to understand these conditions to protect their earnest money. Disputes over earnest money can be complex and stressful. Mediation is often the first step in resolving these conflicts, with both parties meeting with a neutral third party to find a resolution. If mediation is unsuccessful, arbitration or litigation may be necessary. Mediation and arbitration are valuable tools in resolving earnest money disputes. In mediation, a neutral third party helps the conflicting parties reach an agreement. If this fails, arbitration involves a neutral third party making a binding decision based on the evidence presented. Earnest money can be forfeited if the buyer breaches the terms of the purchase agreement without a valid reason. Examples might include the buyer simply changing their mind about the purchase, failing to secure financing if the contract didn't have a financing contingency, or not selling their current home if the agreement did not include a home sale contingency. Forfeiting earnest money can have substantial financial consequences for the buyer, as they stand to lose the deposit amount. Additionally, it may harm their reputation within the real estate community, potentially affecting future transactions. Earnest money and down payment are both upfront payments made by the buyer, but they serve different purposes. While earnest money shows the buyer's serious intent, the down payment represents a portion of the purchase price that the buyer pays upfront when the sale closes. Earnest money is typically applied toward the down payment or closing costs. Earnest money itself doesn't directly impact the mortgage approval process. However, lenders look favorably upon buyers who show serious intent to purchase, which can indirectly influence the lender's decision. Contingency clauses in a real estate contract provide protection for the buyer and their earnest money. They set specific conditions that must be met for the transaction to proceed, and if these conditions are not met, the buyer may be able to recover their earnest money. Real estate professionals play a significant role in protecting earnest money. They can help in drafting a solid purchase agreement with proper contingencies, advising on how much earnest money to offer, and guiding buyers through the process of depositing and safeguarding the earnest money. Buyers should be well aware of the terms of their agreement and should work closely with their real estate agent or attorney to ensure they are protected. Sellers should confirm that the earnest money has been deposited into an escrow account before taking their property off the market. Earnest money is a vital part of real estate transactions, acting as a security deposit to demonstrate a buyer's genuine interest in a property. This deposit, ranging typically from 1% to 5% of the purchase price, is governed by an Earnest Money Agreement providing legal protection to both parties. It's paid in a variety of forms and placed in an escrow account until the transaction completes. Various circumstances can impact the fate of earnest money, such as the buyer or seller withdrawing or if the property fails inspection. Disputes over earnest money often require mediation or arbitration. To avoid the forfeiture of earnest money, buyers should ensure contingency clauses are included in the contract. Real estate professionals play a critical role in safeguarding earnest money and guiding both buyers and sellers through the process. Understanding earnest money and its nuances can help make real estate transactions smoother and more secure.Earnest Money Overview

Understanding Earnest Money in Real Estate Transactions

Role of Earnest Money in Real Estate

Typical Amounts for Earnest Money

How Earnest Money Influences Buyer and Seller Actions

Legal Aspects of Earnest Money

Earnest Money Agreement (EMA)

Terms and Conditions Surrounding Earnest Money

Legal Implications of Breaching Earnest Money Agreements

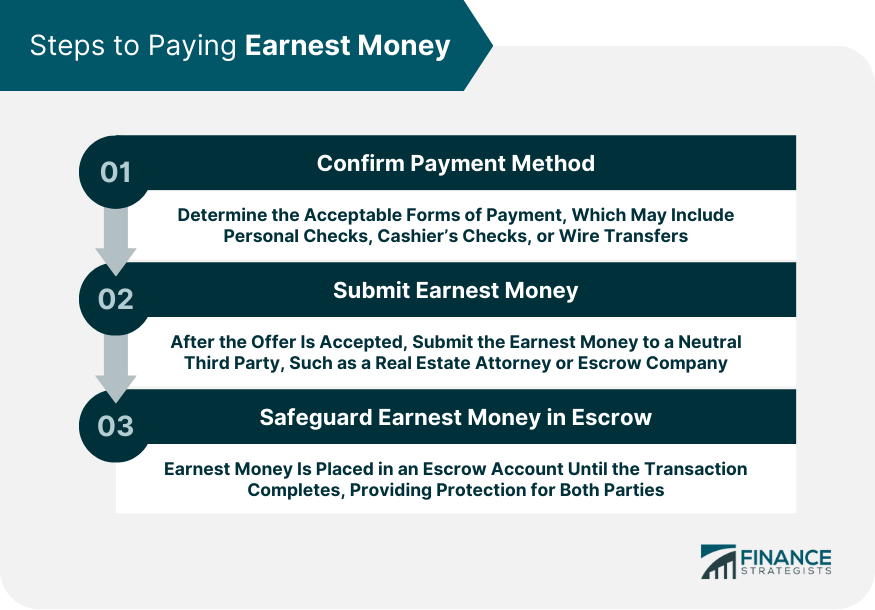

How to Pay Earnest Money

Accepted Forms of Payment

Process of Submitting Earnest Money

Safeguarding Earnest Money: Escrow Accounts

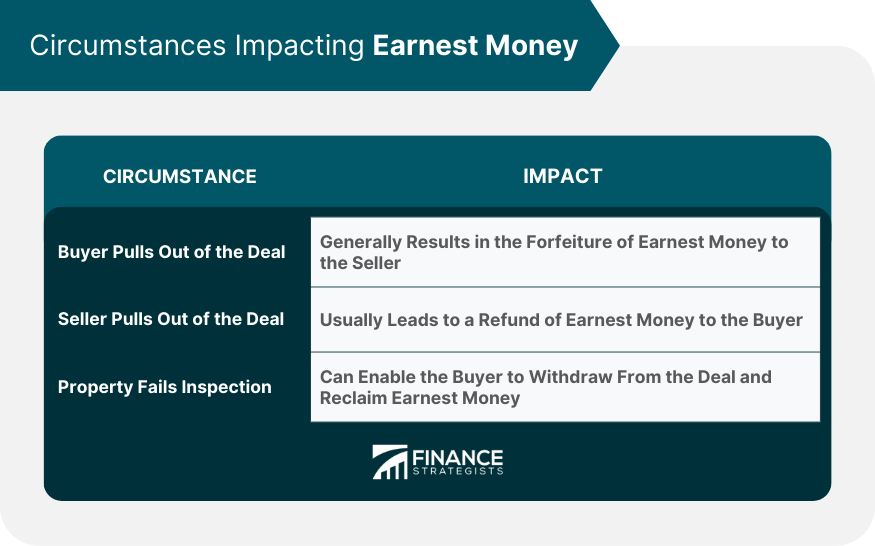

Circumstances Impacting Earnest Money

Buyer Pulls Out of the Deal

Seller Pulls Out of the Deal

Property Fails Inspection or Appraisal

Refunds and Disputes Over Earnest Money

Conditions Under Which Earnest Money is Refundable

Dispute Resolution in Case of Earnest Money Conflicts

Role of Mediation and Arbitration in Earnest Money Disputes

How Earnest Money Can Be Forfeited

Cases Where Earnest Money Can Be Forfeited

Consequences of Forfeiting Earnest Money

Earnest Money and Mortgage Process

Relationship Between Earnest Money and Down Payment

Impact of Earnest Money on Mortgage Approval Process

Strategies to Protect Earnest Money

Importance of Contingency Clauses

Role of Real Estate Professionals in Protecting Earnest Money

Advice for Buyers and Sellers

Final Thoughts

Earnest Money FAQs

Earnest money is a good faith deposit from a buyer to a seller, showing their serious intent to complete the transaction. It reassures the seller to remove the property from the market and negotiate exclusively with the buyer.

The amount of earnest money varies but is typically between 1% to 5% of the purchase price of the property. The specific amount can be influenced by factors such as local market conditions, property prices, and buyer interest.

If the buyer pulls out of the deal without a valid reason, as outlined in the purchase agreement, they typically forfeit their earnest money. However, if the agreement includes contingencies, such as passing an inspection or securing financing, the buyer might be entitled to get their earnest money back.

Buyers can protect their earnest money by ensuring that the purchase agreement includes necessary contingencies, such as passing a property inspection, appraising for the agreed-upon price, or securing financing. Also, working with experienced real estate professionals can offer guidance and protection.

Both earnest money and down payment are upfront payments made by the buyer, but they serve different purposes. Earnest money demonstrates the buyer's intent to purchase, while the down payment is a portion of the purchase price paid at closing. Typically, earnest money is applied toward the down payment or closing costs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.