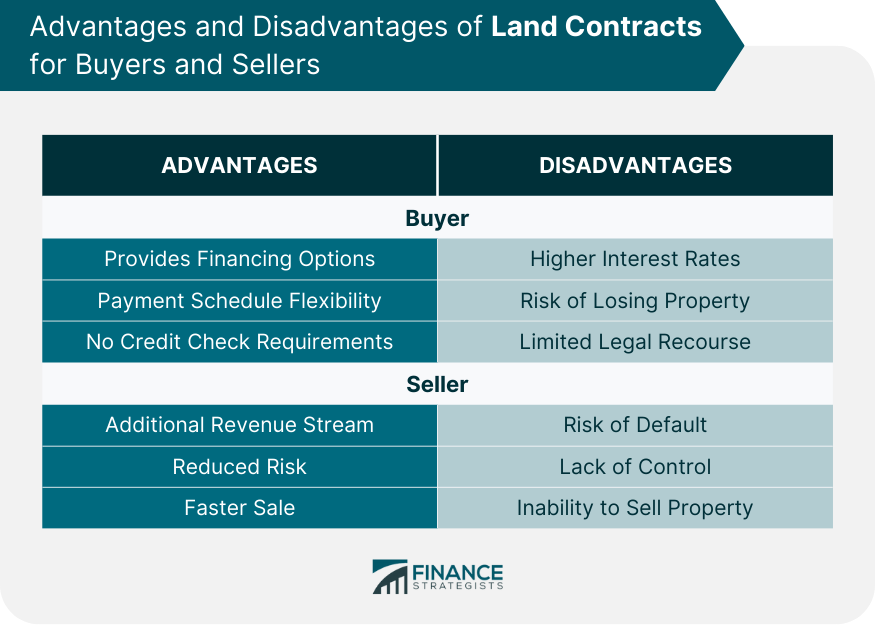

Land contracts, also known as installment sale agreements or contracts for deed, are a type of real estate transaction where the buyer makes payments directly to the seller over a period of time, instead of obtaining a mortgage from a bank or other financial institution. After the final payment is made, the seller transfers the title to the buyer. Land contracts serve as an alternative method of financing for homebuyers who may have difficulty securing a traditional mortgage due to poor credit history, limited down payment, or other financial challenges. They can also benefit sellers by providing a faster sale, a source of additional income, and a means to reduce risk. Some advantages of land contracts for buyers include easier access to financing, flexibility in negotiating terms, and the absence of a credit check. For sellers, land contracts can provide an additional revenue stream, reduced risk, and a faster sale process. However, there are also disadvantages to using land contracts. Buyers may face higher interest rates, the risk of losing the property, and limited legal recourse. Sellers, on the other hand, may encounter the risk of default, a lack of control over the property, and an inability to sell the property. The land contract must contain a detailed description of the property being sold, including its address, legal description, and any improvements or fixtures on the land. This ensures that both parties are clear about what is being transferred as part of the contract. The purchase price is the total amount the buyer agrees to pay for the property. The contract should clearly state this amount, as well as any adjustments that may be made due to prorated taxes, assessments, or other factors. In a land contract, the buyer typically makes a down payment to the seller at the beginning of the agreement. This amount should be clearly stated in the contract and may be negotiable between the parties. The payment schedule outlines the frequency and amount of the buyer's payments to the seller. This can include monthly, quarterly, or annual payments and should be clearly detailed in the contract. The interest rate is the percentage of the outstanding balance that the buyer pays to the seller as part of each payment. This rate should be specified in the contract and may be fixed or adjustable based on the terms agreed upon by the parties. The duration of the land contract refers to the length of time it takes for the buyer to pay off the property in full. This should be clearly outlined in the contract and may range from a few years to several decades, depending on the negotiated terms. Default provisions are the terms and conditions that apply if either party fails to meet their obligations under the land contract. This can include remedies for nonpayment, late payments, or other breaches of the contract. These provisions should be clearly defined to protect the interests of both parties. Under a land contract, the buyer has the right to possess and use the property as long as they fulfill their payment obligations. They are also responsible for property maintenance, taxes, and insurance. Failure to meet these obligations can result in default, potentially leading to the loss of the property and any payments made. The seller, in turn, has the obligation to transfer the title to the buyer once the full purchase price has been paid. Until then, the seller retains the legal title and has the right to reclaim the property in case of the buyer's default. The seller is also responsible for disclosing any material defects or issues with the property and ensuring that the property is free of liens and encumbrances that could affect the buyer's ownership rights. One of the main advantages of land contracts for buyers is the easier access to financing. Since the seller provides the financing, buyers who might not qualify for a traditional mortgage can still purchase a property. Land contracts offer flexibility in negotiating terms such as the down payment, interest rate, and payment schedule. This allows buyers to tailor the contract to their specific financial situation and needs. Since the seller provides the financing, buyers are not typically subject to a credit check, making it easier for those with poor credit history or no credit history to purchase a property. Buyers may face higher interest rates in a land contract compared to a traditional mortgage, as sellers often charge a premium for the increased risk they assume by providing financing. If a buyer defaults on their payments, they risk losing the property and any payments made up to that point. This is because the seller retains legal title to the property until the full purchase price is paid. Buyers may have limited legal recourse in the event of disputes or issues with the property, as their rights are not as clearly defined as they would be under a traditional mortgage. By providing financing, sellers can create an additional revenue stream in the form of interest payments from the buyer. In the event of the buyer's default, the seller can reclaim the property and retain any payments made up to that point, reducing their risk in the transaction. Land contracts can attract a wider pool of potential buyers, including those who may not qualify for a traditional mortgage, potentially leading to a faster sale process. Sellers face the risk of the buyer defaulting on their payments, which can result in the need to reclaim the property and potentially find a new buyer. Until the full purchase price is paid, sellers have limited control over the property, as they are unable to sell it or use it as collateral for other loans. If a seller decides they want to sell the property before the buyer has paid the full purchase price, they may face challenges in finding a buyer willing to assume the land contract or obtaining a release from the original buyer. Land contracts offer an alternative method of financing for both buyers and sellers in real estate transactions. They have distinct advantages and disadvantages for each party, depending on their individual circumstances and financial situations. Land contracts can be a viable option for buyers who are unable to secure traditional financing and for sellers who are looking for a faster sale or an additional revenue stream. However, both parties should carefully consider the potential risks and disadvantages before entering into a land contract agreement. Land contracts may become an increasingly popular financing option for buyers and sellers. However, it is essential that both parties understand their rights and obligations under a land contract and seek professional advice to ensure a successful and fair transaction.What Are Land Contracts?

Essential Elements of Land Contracts

Property Description

Purchase Price

Down Payment

Payment Schedule

Interest Rate

Duration of Contract

Default Provisions

Rights and Obligations of Parties in Land Contracts

Buyer's Rights and Obligations

Seller's Rights and Obligations

Advantages of Land Contracts for Buyers

Provides Financing Options

Payment Schedule Flexibility

No Credit Check Requirements

Disadvantages of Land Contracts for Buyers

Higher Interest Rates

Risk of Losing Property

Limited Legal Recourse

Advantages of Land Contracts for Sellers

Additional Revenue Stream

Reduced Risk

Faster Sale

Disadvantages of Land Contracts for Sellers

Risk of Default

Lack of Control

Inability to Sell Property

Bottom Line

Land Contracts FAQs

A land contract is a legal agreement where a buyer makes payments to a seller in exchange for the right to occupy and use the seller's property.

Land contracts provide financing for buyers who may not qualify for traditional financing, flexible payment schedules, and no credit check requirements.

Disadvantages of land contracts for buyers include higher interest rates, risk of losing the property, and limited legal recourse. For sellers, risks include default and lack of control.

The essential elements of a land contract include a property description, purchase price, down payment, payment schedule, interest rate, duration of contract, and default provisions.

Buyers have the right to occupy and use the property, make payments according to the contract, and maintain the property. Sellers have the right to receive payments, enforce the contract, and take legal action in case of default.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.