A modified gross lease is a type of real estate agreement in which the tenant pays a base rent, and the landlord and tenant share responsibility for certain operating expenses. The specific expenses shared vary by contract, but common ones include utilities, property taxes, and maintenance costs. This kind of arrangement offers a middle ground between a gross lease, where the landlord assumes all costs, and a triple net lease, where the tenant bears all expenses. Modified gross leases play a significant role in the real estate industry, especially in commercial and industrial sectors. They provide a flexible structure that can be adjusted to fit the needs of the landlord and tenant. This flexibility is crucial in the ever-changing commercial and industrial real estate landscape, where each business has unique needs and financial capacities. Base rent is the fixed amount a tenant pays for property use, exclusive of utilities, maintenance, taxes, or insurance. These additional costs are negotiated separately, differentiating them from Triple Net or Full-Service Leases. The base rent represents the minimum payable amount. In a modified gross lease, specified expenses refer to operating costs that are agreed upon in the contract to be shared between the landlord and tenant. These include building insurance, common area maintenance, or utilities. Unspecified expenses are those not explicitly listed in the lease agreement. In the context of a modified gross lease, these are typically expenses incurred unexpectedly or beyond regular operations. The responsibility for such expenses depends on the specific terms of the contract. Modified gross leases can vary significantly based on the specific expenses they cover and the industry or property type. Understanding these differences can help both landlords and tenants negotiate terms that best suit their needs. Different modified gross leases can be differentiated based on the operating costs shared between the landlord and tenant. Here are some common examples: Utility-Based Leases: In some cases, a modified gross lease might only involve the sharing of utility costs. This could include electricity, water, heating, or cooling expenses. The tenant pays a base rent and shares the utility expenses with the landlord. Maintenance-Inclusive Leases: Certain modified gross leases may involve sharing maintenance costs. This could cover everything from basic cleaning and repairs to more substantial maintenance work, such as landscaping or structural repairs. Tax-Inclusive Leases: Some modified gross leases might include sharing property taxes. In this case, the tenant contributes to the property tax and pays the base rent. Insurance-Inclusive Leases: A modified gross lease could include a provision for sharing building insurance costs in certain scenarios. This would mean the tenant contributes to the insurance premium and base rent. The specifics of which expenses are shared and how they're divided are typically a matter of negotiation between the landlord and tenant, and the final arrangement should be clearly outlined in the lease agreement. Modified gross leases can also vary depending on the industry and property type. These variations often reflect the unique needs and characteristics of different business sectors and property categories. Retail: A modified gross lease might include provisions for sharing advertising or signage costs in a retail setting. This could be particularly relevant for businesses in shopping centers or malls where coordinated marketing efforts are common. Industrial: A modified gross lease could include stipulations about sharing equipment maintenance or warehousing expenses for industrial properties. This would reflect these spaces' specialized nature and their unique expenses. Office: In office buildings, a modified gross lease could involve shared costs for amenities such as shared conference rooms, restrooms, or building security. A full-service lease, often seen in commercial real estate, includes all operating expenses in the rent, making it more predictable for tenants but potentially less flexible. In contrast, a modified gross lease separates base rent from certain operating expenses, providing more transparency and adaptability to changing business conditions. A triple net lease places the burden of all operating expenses on the tenant, offering the landlord more financial security but potentially making the lease less attractive to potential tenants. A modified gross lease, with its shared expenses, can strike a balance that's appealing to both parties. Each lease type has its advantages and disadvantages. Full-service leases offer simplicity and predictability but may come with higher base rent. Triple net leases can be cost-effective for landlords but risky for tenants. Modified gross leases offer a balanced approach but require clear communication and negotiation to ensure fairness. Base rent in a modified gross lease is typically determined by market conditions, the property's location and quality, and the lease term's length. It's a fixed cost that the tenant must pay regularly. Operational expenses in a modified gross lease are usually allocated based on the proportion of the property the tenant occupies or based on a negotiated agreement. These expenses can vary monthly, making the total cost less predictable than with a full-service lease. Different methods can be used to calculate the allocation of operational expenses, often depending on the specifics of the property and the nature of the tenant's business. These variations underline the importance of clarity and transparency in the lease agreement. A modified gross lease agreement should clearly stipulate the terms of rent, the specific expenses to be shared, and the method for calculating and paying these costs. It should also include provisions for changes in expenses, lease renewal terms, and dispute resolution mechanisms. The lease should define the rights and obligations of both parties. This includes the tenant's right to use the property and the landlord's responsibility for ensuring its suitability for use. Obligations might include the tenant's duty to maintain the premises and the landlord's duty to provide necessary services. Conflicts can arise in any lease agreement, but the potential for disputes can be higher in a modified gross lease due to the sharing of expenses. The lease should therefore include mechanisms for resolving disputes through negotiation, mediation, or legal action. A modified gross lease offers a flexible middle ground between a gross lease and a triple net lease, sharing certain operating expenses between landlord and tenant. Components include base rent, specified expenses, and unspecified expenses. Types vary based on expenses covered and industry/property type. Compared to full-service leases and triple net leases, modified gross leases provide balance and adaptability. Calculating payments involves determining base rent and allocating operational expenses based on occupancy or agreement. Legal considerations include clear lease terms, rights and obligations, and conflict resolution mechanisms. Understanding and negotiating a well-defined modified gross lease can benefit both landlords and tenants, promoting transparency, fairness, and successful real estate arrangements.What Is a Modified Gross Lease?

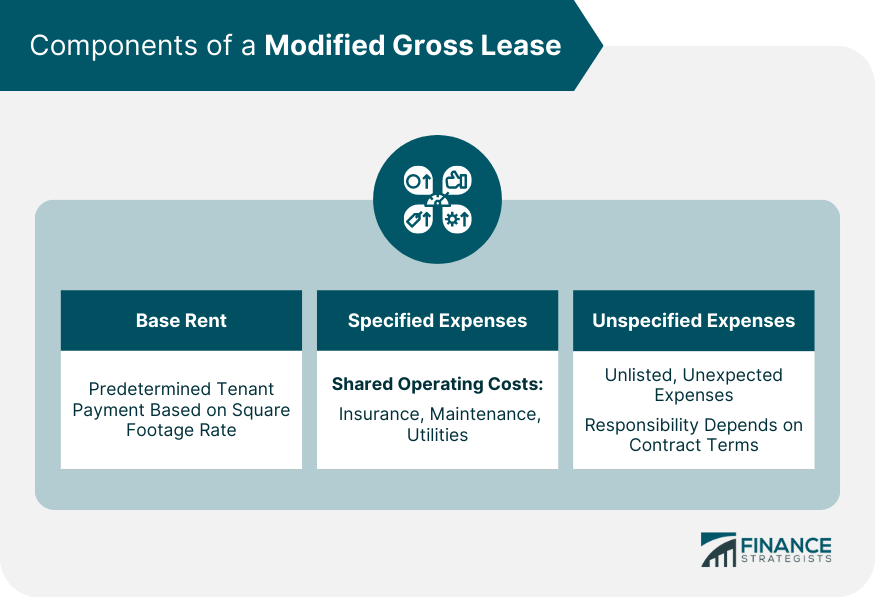

Components of a Modified Gross Lease

Base Rent

Specified Expenses

Unspecified Expenses

Types of Modified Gross Leases

Types Based on Expenses Covered

Variations by Industry and Property Type

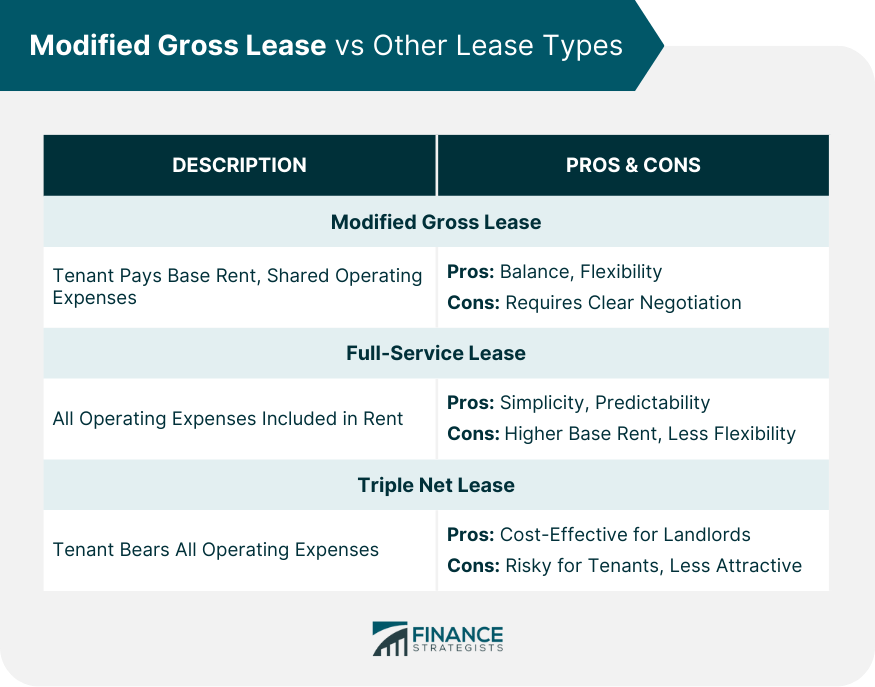

Modified Gross Lease vs Other Lease Types

Full-Service Lease

Triple Net Lease

Pros and Cons of Each Lease Type

Calculating Payments Under a Modified Gross Lease

Determination of Base Rent

Allocation of Operational Expenses

Variations in Calculation Methods

Legal Considerations in Modified Gross Leases

Lease Agreement Terms

Rights and Obligations of the Parties

Conflict Resolution Mechanisms

Final Thoughts

Modified Gross Lease FAQs

A modified gross lease is a type of lease where the tenant pays base rent and shares some of the operating expenses with the landlord. These expenses can include utilities, maintenance costs, and property taxes.

In a full-service lease, the landlord assumes all operating expenses, while in a triple net lease, the tenant bears all these costs. A modified gross lease offers a middle ground where certain expenses are shared between the landlord and the tenant.

A modified gross lease payment includes a base rent plus a share of specified operating expenses. The base rent is typically fixed, while the shared expenses vary.

Modified gross leases are commonly used in commercial and industrial real estate. Examples include an office building where the landlord and tenants share utility costs or a retail store where advertising costs are shared.

Economic conditions, technological advancements, and sustainability considerations could influence future trends in modified gross leases. These affect the types of expenses shared and the methods used to calculate them.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.