The National Association of Real Estate Investment Trusts is a trade association that represents the interests of Real Estate Investment Trusts (REITs) and publicly-traded real estate companies. NAREIT's primary purpose is to advocate for policies that benefit the REIT industry, promote best practices, and provide educational resources for investors and industry professionals. NAREIT was established in 1960, shortly after the creation of the REIT structure by the United States Congress. Since then, NAREIT has played a crucial role in shaping the REIT industry, advocating for legislative and regulatory changes, and providing valuable information and resources to its members. NAREIT's mission is to advance the interests of REITs and real estate companies by fostering a business and regulatory environment that promotes responsible investment and growth. Its objectives include promoting the benefits of REITs, providing a platform for industry networking, and offering education and research resources to investors and professionals. The NAREIT Board of Directors is responsible for providing strategic direction and overseeing the organization's activities. The board is composed of senior executives from member companies, ensuring that a wide range of perspectives from the REIT industry is represented. The Executive Committee is a subset of the Board of Directors and is responsible for managing NAREIT's day-to-day operations. This committee ensures that the organization remains focused on its mission and objectives while efficiently allocating resources. NAREIT's advisory committees, composed of member company representatives, provide guidance on various aspects of the organization's activities. These committees help shape NAREIT's policies, educational programs, research initiatives, and advocacy efforts. NAREIT offers different types of memberships, including corporate, individual, and associate memberships. Corporate members are REITs and other real estate companies, while individual members are professionals in the industry. Associate members include service providers, such as law firms, accounting firms, and financial institutions. To become a NAREIT member, companies and individuals must meet specific eligibility criteria. For instance, corporate members must be publicly-traded REITs or real estate companies, while individual members must be employed by a NAREIT member company. NAREIT membership provides access to valuable resources, networking opportunities, and industry insights. Members benefit from exclusive events, research publications, educational programs, and the opportunity to influence industry policies and regulations. NAREIT's staff and management team are responsible for executing the organization's mission and objectives. The team includes professionals with expertise in various areas, including advocacy, research, education, and communications. A Real Estate Investment Trust is a company that owns, operates, or finances income-producing real estate. REITs allow individual investors to invest in large-scale, professionally-managed real estate portfolios, providing access to diversified assets and regular income streams. Equity REITs primarily invest in and own income-producing real estate properties, such as office buildings, shopping centers, and apartment complexes. These REITs generate income from rent collected from tenants, and their value is driven by property appreciation and rental income growth. Mortgage REITs invest in and own property mortgages, including mortgage-backed securities and mortgage loans. These REITs earn income from the interest on the mortgages they hold. Mortgage REITs can be more sensitive to interest rate changes and may have different risk-return profiles compared to equity REITs. Hybrid REITs combine the investment strategies of both equity and mortgage REITs, owning both income-producing properties and mortgage assets. This diversified approach can provide a balance between the income generated from property rents and interest on mortgage investments. Investing in REITs offers several advantages, including diversification, liquidity, and income potential. REITs provide exposure to various types of real estate assets, reducing the risk associated with investing in a single property. Additionally, REIT shares are publicly traded, offering investors liquidity not typically found in direct real estate investments. Finally, REITs are required to distribute at least 90% of their taxable income to shareholders, providing a steady stream of income. There are also potential disadvantages to investing in REITs, such as interest rate sensitivity, market risk, and management risk. REITs, particularly mortgage REITs, can be sensitive to changes in interest rates, which may impact their performance. Market risk refers to the potential for losses due to fluctuations in real estate markets. Management risk arises from the possibility that a REIT's management team may not make optimal investment or operational decisions, negatively impacting performance. NAREIT plays a crucial role in representing the interests of REITs and real estate companies in Congress. By advocating for favorable legislation and policies, NAREIT helps ensure that the REIT industry can thrive and contribute to economic growth. NAREIT addresses key policy issues that impact the REIT industry, such as taxation, financial regulations, and housing policies. By taking informed positions on these issues, NAREIT aims to shape policy debates and influence decision-making in ways that benefit its members and the broader real estate sector. NAREIT works closely with regulatory agencies, such as the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), to promote regulations that support the growth and stability of the REIT industry while protecting investors. NAREIT helps its members stay compliant with industry standards and regulations by providing guidance, resources, and best practices. This ensures that REITs maintain high levels of transparency, governance, and operational efficiency. NAREIT provides legal representation and support for its members when necessary, protecting their interests in the courts. This includes defending against potential lawsuits, navigating complex legal issues, and advocating for the rights of REITs. NAREIT's judicial advocacy efforts also focus on protecting the interests of REITs in legal disputes and regulatory challenges. By leveraging its expertise and resources, NAREIT can influence court decisions that may have significant implications for the industry. The annual REITWeek conference is a flagship event organized by NAREIT, bringing together REIT executives, investors, and industry professionals to share insights, network, and discuss industry trends. This event offers valuable learning opportunities and helps shape the future of the REIT industry. NAREIT also participates in and sponsors other industry events throughout the year, such as regional conferences, workshops, and seminars. These events provide additional opportunities for members to connect, learn, and exchange ideas with their peers. NAREIT regularly publishes performance reports that provide insights into the REIT industry's performance, trends, and outlook. These reports offer valuable information for investors, analysts, and industry professionals to make informed decisions and evaluate market conditions. NAREIT produces whitepapers and policy briefs that address key regulatory and legislative issues affecting the REIT industry. These publications help inform policymakers, regulators, and industry stakeholders about the implications of various policy proposals and potential regulatory changes. NAREIT offers educational programs and resources designed to help investors and industry professionals better understand the REIT industry, investment strategies, and risk management. These programs include online courses, workshops, and training sessions. NAREIT regularly hosts webinars featuring industry experts who discuss current trends, challenges, and opportunities in the REIT industry. These webinars provide valuable insights and analysis for members, helping them stay informed and make strategic decisions. NAREIT plays a significant role in promoting transparency and best practices in the REIT industry. By providing guidance and resources on governance, financial reporting, and risk management, NAREIT helps its members maintain high standards of corporate responsibility and investor confidence. The REIT industry, represented by NAREIT, contributes to economic growth and development by facilitating investment in real estate assets. This investment helps drive job creation, supports local communities, and fuels economic expansion across various sectors. NAREIT's advocacy, education, and research initiatives have a profound influence on the real estate investment landscape. Through its efforts, NAREIT has helped shape policies and regulations that encourage investment in REITs, foster industry growth, and provide individual investors with access to diversified real estate portfolios. The National Association of Real Estate Investment Trusts (NAREIT) serves as a leading advocate for the REIT industry, promoting its growth, advocating for favorable legislation and policies, and providing valuable resources for investors and professionals. NAREIT's educational initiatives, such as conferences, research publications, and educational programs, offer members opportunities to learn, network, and stay informed about industry trends. The association's advocacy efforts encompass legislative, regulatory, and judicial arenas, ensuring that the interests of REITs are represented and protected. NAREIT's impact on the real estate industry extends to promoting transparency and best practices, contributing to economic growth and development, and influencing the real estate investment landscape. Through its comprehensive approach, NAREIT continues to shape the future of the REIT industry and support its members in achieving their goals.What Is the National Association of Real Estate Investment Trusts (NAREIT)?

Structure of NAREIT

Organizational Structure

Board of Directors

Executive Committee

Advisory Committees

Membership

Types of Members

Eligibility Criteria

Benefits of Membership

Staff and Management

Real Estate Investment Trusts (REITs)

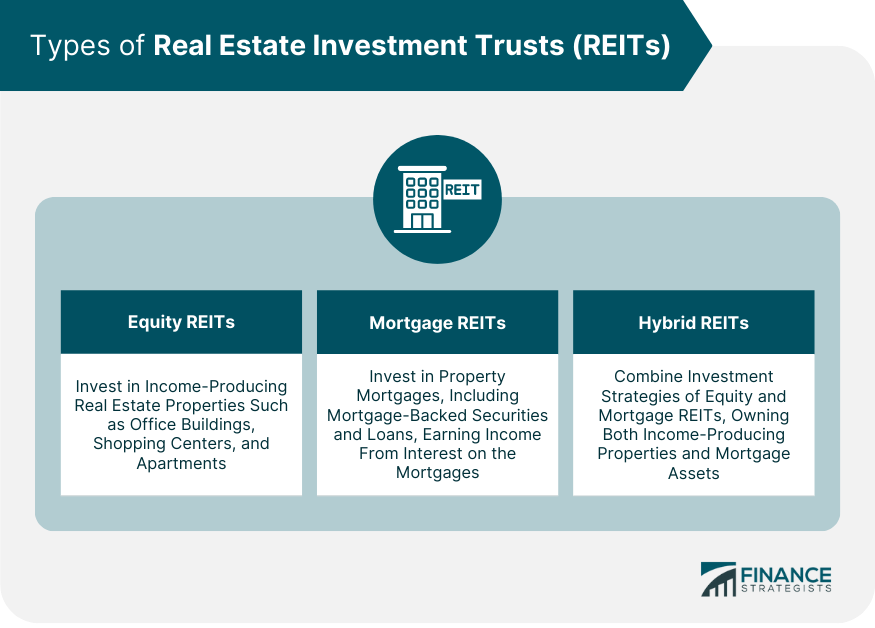

Types of REITs

Equity REITs

Mortgage REITs

Hybrid REITs

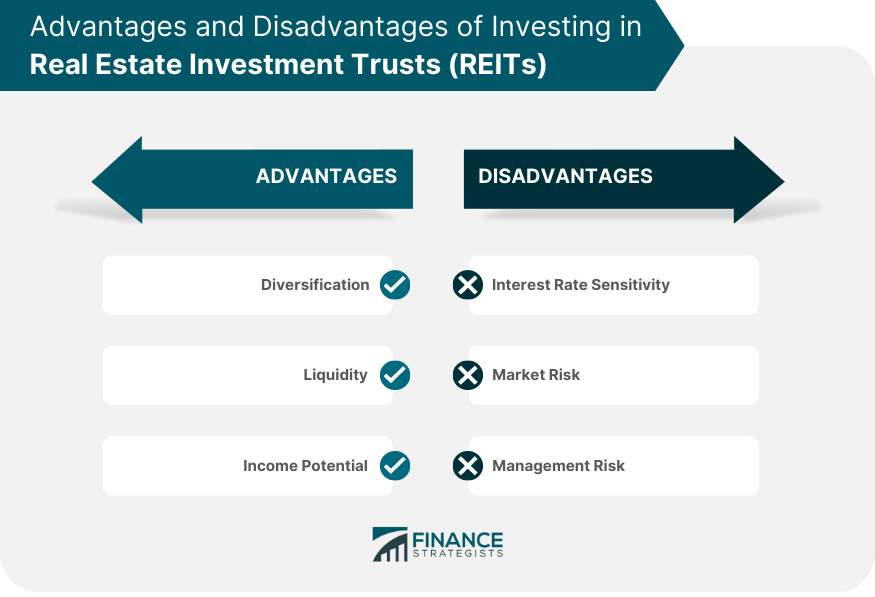

Advantages and Disadvantages of Investing in REITs

Advantages

Disadvantages

NAREIT's Role in Advocacy and Policy

Legislative Advocacy

Representing REITs in Congress

Key Policy Issues and Positions

Regulatory Advocacy

Collaborating With Regulatory Agencies

Ensuring Compliance With Industry Standards

Judicial Advocacy

Legal Representation for REITs

Protecting REIT Interests in the Courts

NAREIT's Educational and Research Initiatives

Conferences and Events

Annual REITWeek Conference

Other Industry Events

Research Publications and Resources

REIT Industry Performance Reports

Whitepapers on Policy and Regulation

Educational Programs and Webinars

REIT Education for Investors and Professionals

Webinars on Industry Trends and Analysis

NAREIT's Impact on the Real Estate Industry

Promoting Transparency and Best Practices

Contributions to Economic Growth and Development

Influence on Real Estate Investment Landscape

Final Thoughts

National Association of Real Estate Investment Trusts (NAREIT) FAQs

The National Association of Real Estate Investment Trusts (NAREIT) is the leading trade association representing REITs and publicly traded real estate companies in the United States. NAREIT's mission is to advocate for favorable policies, promote industry best practices, and provide valuable resources to its members.

NAREIT engages in legislative, regulatory, and judicial advocacy on behalf of the REIT industry. This includes representing REITs in Congress, collaborating with regulatory agencies, and providing legal representation to protect the interests of REITs in the courts.

NAREIT offers various educational and research initiatives, including conferences and events, research publications and resources, and educational programs and webinars. These initiatives help investors, industry professionals, and policymakers better understand the REIT industry and make informed decisions.

NAREIT has a significant impact on the real estate industry by promoting transparency and best practices, contributing to economic growth and development, and influencing the real estate investment landscape through its advocacy, education, and research initiatives.

NAREIT will continue to play a vital role in shaping the future of the REIT industry by advocating for favorable policies, promoting best practices, and providing valuable resources to its members. As the industry evolves and faces challenges, NAREIT will adapt and respond to ensure the industry remains a vital part of the broader real estate investment landscape.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.