A Real Estate Operating Company (REOC) is a firm that actively engages in real estate activities such as development, management, and sometimes leasing, in addition to owning its properties. Unlike Real Estate Investment Trusts (REITs), REOCs can reinvest their profits into business operations instead of distributing them to shareholders, allowing for potential growth and expansion. The major distinguishing factor between REOCs and other real estate structures, like REITs and Limited Partnerships (LPs), is the requirement for profit distribution. While REITs must distribute at least 90% of their taxable income to shareholders, REOCs are free from such obligation. This gives REOCs greater flexibility in terms of business development and expansion, allowing them to plow back their profits for growth. Understanding the distinct operational dynamics of REOCs may present savvy investors with unique growth opportunities, as these companies can reinvest their profits for expansion, potentially leading to higher long-term yields. REOCs have been central to the real estate industry for decades, pre-dating the introduction of Real Estate Investment Trusts (REITs) in 1960. The advent of REITs, designed to allow small investors access to large-scale, income-generating real estate, imposed income distribution obligations that REOCs did not have. This allowed REOCs to retain and reinvest profits for growth and development. The Financial Modernization Act of 1999 was another landmark event, enabling REOCs to diversify operations beyond real estate into areas like insurance and securities. In the 21st century, both REOCs and REITs continue to evolve, leveraging technological advancements like PropTech to improve operations and profitability. REOCs have evolved from being the standard model for real estate companies to one of several structures, each offering unique advantages and constraints based on specific business goals and strategies. In a typical REOC, the organizational structure is hierarchical, consisting of several key roles and departments. Here's a closer look: At the top of the hierarchy is the Board of Directors. They ensure the organization adheres to legal guidelines and maintains a strong corporate governance framework. The board makes high-level decisions about the company's direction, establishes policies, and oversees the CEO's and senior management's performance. Directly under the Board of Directors are the Chief Executive Officer (CEO), Chief Financial Officer (CFO), and other members of top management. The CEO is responsible for the company's overall strategic direction, while the CFO focuses on financial planning, risk management, and financial reporting. Other top management roles include the Chief Operating Officer (COO), responsible for day-to-day operations, and the Chief Investment Officer (CIO), responsible for the company's investment strategy. Below the top management are the departmental managers and operational teams responsible for executing the company's strategic plans. These departments can include: Property Management: This team manages the day-to-day operations of the properties, including maintenance, tenant relations, and lease administration. Leasing Team: This team ensures high occupancy rates by negotiating lease terms with current and prospective tenants. Development Team: This team identifies and oversees the development of new properties. Finance and Accounting: This team manages the company's finances, including budgeting, financial reporting, and ensuring financial compliance. REOCs' operations involve a mix of daily tasks and long-term strategic planning. Here's an overview: Daily, REOCs manage their properties, handle leasing activities, and conduct continuous market research. These tasks are essential to maintain high occupancy rates, ensure tenant satisfaction, and to stay informed about market trends and opportunities. Property Management: Includes activities like maintaining facilities, addressing tenant concerns, and collecting rent. Leasing Activities: REOCs continually work to attract and retain tenants. This involves marketing available spaces, negotiating lease terms, and renewing existing leases. Market Research: REOCs regularly analyze the real estate market to identify potential investment opportunities and stay ahead of industry trends. In addition to daily operations, REOCs also focus on long-term strategies to drive growth and increase shareholder value. These strategies typically involve property acquisition, development, and sometimes strategic divestment. Property Acquisition: This involves identifying and purchasing properties that align with the company's strategic goals. Property Development: REOCs often develop properties to increase their value. This can involve renovations, expansions, or even redevelopment. Strategic Divestment: At times, a REOC might sell a property if it no longer aligns with the company's strategy or if the potential sale price is particularly attractive. REOCs generate revenue through a combination of rental income and property sales. The mix between these two revenue streams can vary greatly depending on the company’s strategy and market conditions. The primary expenses for REOCs include operating costs, interest expenses, and capital expenditures. Operating costs cover property maintenance and management. Interest expenses arise from debt financing property acquisitions, and capital expenditures are for property improvements and acquisitions. Analyzing a REOC's cash flow involves evaluating operating cash flow (rental income minus operating expenses), investing cash flow (capital expenditures and property sales), and financing cash flow (borrowings and repayments, and equity issuances and buybacks). Unlike Real Estate Investment Trusts (REITs), REOCs are not mandated to distribute a significant portion of their income to shareholders. This gives them the liberty to reinvest their profits back into the business for expansion and development, potentially accelerating growth and increasing the company's value over time. Due to their ability to reinvest profits into new developments or renovations, REOCs may offer higher returns than REITs, particularly in the long term. This is dependent, however, on the success of their reinvestment strategies. REOCs can diversify their revenue streams by engaging in various aspects of real estate, from development to management and leasing. This diversification can reduce risk and improve financial stability. Like any other company operating in the real estate market, REOCs are exposed to market risks, such as fluctuations in property values, interest rates, and economic conditions. These can significantly impact the company's performance. While the ability to reinvest profits can be a benefit, it can also be a risk. If a REOC's reinvestments do not yield the expected returns, it could harm the company's financial health and the value of its shares. As REOCs are typically involved in various aspects of real estate operations, they may face operational risks such as project delays, cost overruns, and difficulties in property management. These can negatively impact profitability and returns. Several key financial indicators and ratios can be used to analyze a REOC, including: Return on Assets (ROA): Measures how efficiently a company uses its assets to generate profits. Debt-To-Equity Ratio (D/E): A company's financial leverage is assessed by comparing its total liabilities to shareholders' equity. Operating Margin: A profitability ratio showing the percentage of revenue that remains after deducting operating expenses. Price-To-Earnings (P/E) Ratio: A valuation ratio that indicates the dollar amount an investor can expect to invest in a company to receive one dollar of that company's earnings. Non-financial factors that can impact a REOC's performance include the quality of the management team, the company's strategic positioning, its competitive advantages, and the health of the real estate markets in which it operates. REOCs can have a significant impact on property prices. By actively developing and improving properties, they can help increase real estate values in their operating areas. REOCs can also influence market dynamics and trends. For example, a REOC's decision to invest heavily in a particular type of real estate (such as commercial properties or multifamily residential properties) can influence other investors and contribute to broader market trends. A REOC is a type of real estate company that actively engages in real estate activities such as development, management, and leasing and retains its profits for reinvestment and growth. REOCs contribute to economic development by improving properties, creating jobs, and contributing to local economies through property taxes and purchasing goods and services. While the REOC model has many advantages, it also carries risks. Investors should carefully consider both the potential benefits and risks when investing in REOCs. For investors looking to diversify their portfolio with real estate exposure, REOCs offer an attractive investment option. Consult with a wealth management advisor to discuss whether investing in REOCs aligns with your investment goals.What Is a Real Estate Operating Company (REOC)?

Historical Evolution of REOCs

REOC Structure and Operation

Overview of Organizational Structure

Board of Directors

CEO, CFO, and Other Top Management

Departmental Managers and Operational Teams

How a REOC Operates: Daily Operations and Long-Term Strategies

Daily Operations

Long-Term Strategies

Financial Aspects of a REOC

Revenue Generation

Cost Structure and Expense Management

Cash Flow Analysis

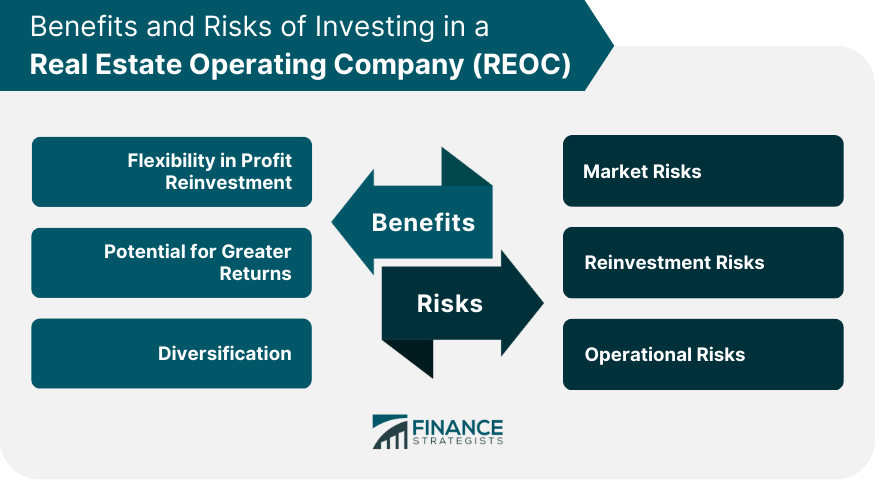

Benefits of Investing in a REOC

Flexibility in Profit Reinvestment

Potential for Greater Returns

Diversification

Risks and Challenges of Investing in a REOC

Market Risks

Reinvestment Risks

Operational Risks

Analyzing a REOC for Investment Purposes

Key Financial Indicators and Ratios

Non-financial Factors to Consider

Impact of REOCs on the Real Estate Market

Influence on Property Prices

Effect on Market Dynamics and Trends

Final Thoughts

Real Estate Operating Company (REOC) FAQs

A REOC is a type of real estate company that engages in property development, management, and leasing. Unlike REITs, REOCs can reinvest their profits into business operations instead of distributing them to shareholders.

The primary difference between a REOC and a REIT lies in the profit distribution. While REITs are required to distribute at least 90% of their taxable income to shareholders, REOCs have no such obligation and can reinvest profits back into the business.

REOCs generate revenue primarily through rental income and property sales. The mix of these revenue streams may vary based on the company's strategy and market conditions.

Investing in a REOC comes with several risks, including market, operational, and financial risks. These risks pertain to the potential for a decline in property values, poor management, and financial instability due to excessive debt, respectively.

Emerging technologies are expected to have a significant impact on REOCs. Digital platforms can improve property management and tenant services, while AI and Big Data can provide valuable insights for strategic decision-making and operational efficiency.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.