Section 1231 property, as defined by the United States Internal Revenue Code, is a type of depreciable business property or real property used in trade or business held for over one year. Such assets include buildings, machinery, land, timber, and other natural resources. Section 1231 property plays a significant role in wealth management strategies, primarily due to its unique tax treatment. The potential for lower capital gains tax rates and offsetting ordinary income makes it a vital component for business owners and investors seeking to optimize their tax liabilities. Understanding the classification of assets under Section 1231 is crucial for taxpayers to optimize their tax planning strategies, maximize tax benefits, and comply with the Internal Revenue Service (IRS) regulations. Buildings that are used in a trade or business, such as offices, factories, or warehouses, and have been held for over a year, qualify as Section 1231 property. The sale of these buildings can result in Section 1231 gains or losses, subject to certain tax treatments. Machinery and equipment used in a trade or business and held for more than one year are also considered Section 1231 property. This could include manufacturing equipment, construction machinery, or other similar assets. Commercial vehicles used for business purposes and held for over a year are classified under Section 1231 property. These vehicles can include trucks, vans, and other motor vehicles that are instrumental in carrying out business operations. Intellectual properties such as patents and copyrights, when held for over a year, can also be classified as Section 1231 property. These are valuable business assets that can be sold or exchanged to generate Section 1231 gains or losses. Trademarks and trade names represent a business's identity in the market. When they have been in use for over a year, they become eligible as Section 1231 property. The transfer of these assets may lead to significant Section 1231 gains or losses. Goodwill, the intangible asset that arises when a buyer pays a premium price for a business above its fair market value, is another example of Section 1231 property. It's a representation of the business's reputation, customer relations, and other non-physical assets. The holding period is a critical factor for Section 1231 property. Assets must be held for more than one year to be eligible for this special tax treatment. Therefore, tracking the acquisition and disposal dates of these properties is crucial for tax purposes. If the net result of all Section 1231 transactions within a tax year is a gain, it's generally treated as a long-term capital gain. This could result in lower tax rates compared to ordinary income tax rates, providing a substantial tax advantage to taxpayers. On the contrary, if the net result is a loss, it's generally treated as an ordinary loss. This loss can offset other ordinary income, which can lower the overall tax liability for the taxpayer. To determine the tax treatment, Section 1231 requires netting gains and losses from all Section 1231 transactions during the year. This process can be complex, given the need to accurately track and categorize each transaction. Depreciation recapture is a tax provision that allows the IRS to collect taxes on the gain from the sale of depreciated capital property. When you sell a Section 1231 property, part or all of the gain may be subject to depreciation recapture rules. Section 1245 property primarily includes personal property that has been depreciated, such as machinery, equipment, and certain intangible property. Depreciation recapture rules under Section 1245 mandate that the amount of depreciation taken on the property is treated as ordinary income upon sale. Section 1250 covers depreciable real property, such as buildings or land improvements. Unlike Section 1245, only the portion of depreciation exceeding the straight-line method would be subject to recapture as ordinary income. The rest of the gain may be taxed as a Section 1231 gain. Depending on the net result of Section 1231 transactions, gains can be taxed at the lower capital gains rate, while losses can offset ordinary income, providing a versatile tool for tax planning. Holding Section 1231 property can also contribute to diversification and risk management in a portfolio. By including a mix of these assets in different sectors and industries, investors can mitigate risk and potentially enhance returns. The stepped-up basis rule allows heirs to inherit property with a basis equal to the fair market value at the time of the decedent's death, potentially minimizing future capital gains tax liability. Effective management of Section 1231 property involves strategic tax planning. Understanding the tax implications of these assets and timing their sale or exchange optimally can help reduce tax liabilities and enhance financial outcomes. Consideration of the timing of sales and exchanges can greatly influence the tax outcome. Delaying or advancing the sale of Section 1231 property could be instrumental in managing your taxable income and potential tax rate. Section 1031 provides another strategic tool for managing Section 1231 property. By using a like-kind exchange, investors can defer recognizing gains on the sale of property, postponing the payment of taxes and enabling their investments to continue growing. Section 1231 property is a classification of assets in the US tax code that encompasses depreciable and real property used in trade or business. This classification distinguishes property held for productive use from property held for sale. The tax treatment of Section 1231 property offers advantages, such as the eligibility for long-term capital gains rates on gains from the sale of these assets. Additionally, losses from the sale or exchange of Section 1231 property can be treated as ordinary losses, offsetting other ordinary income. Understanding the classification and tax implications of Section 1231 property is essential for taxpayers to optimize their tax planning strategies, minimize tax liabilities, and comply with IRS regulations. Strategies may include timing asset sales to maximize capital gains treatment, utilizing losses to offset taxable income, and carefully documenting the nature and use of the property to substantiate its classification. What Is Section 1231 Property?

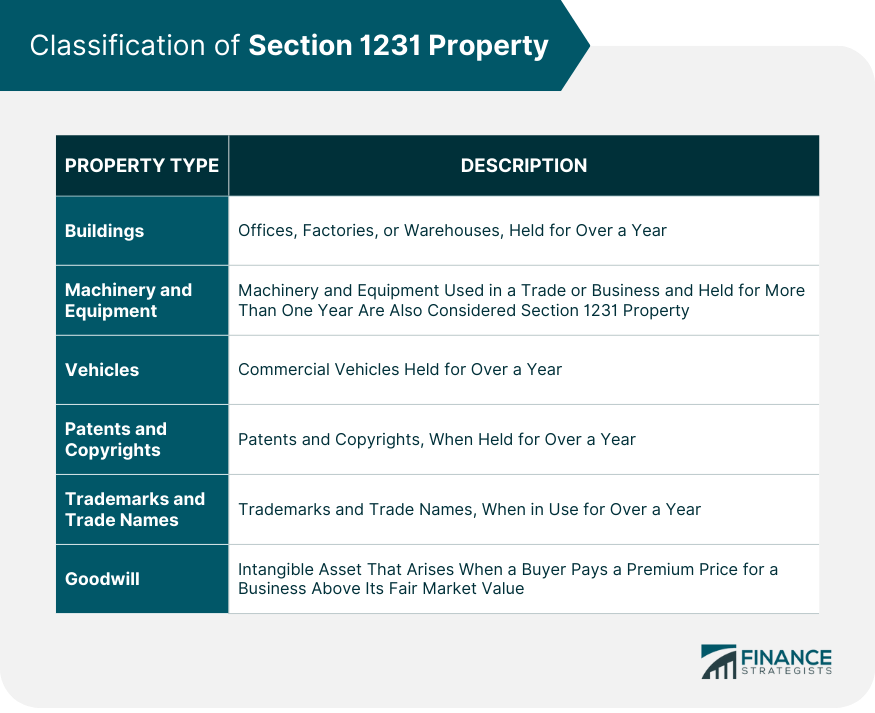

Classification of Section 1231 Property

Buildings

Machinery and Equipment

Vehicles

Patents and Copyrights

Trademarks and Trade Names

Goodwill

Tax Treatment of Section 1231 Property

Determining the Holding Period

Capital Gain Treatment

Ordinary Income Treatment

Netting of Section 1231 Gains and Losses

Depreciation Recapture Rules

Explanation of Depreciation Recapture

Section 1245 Property

Section 1250 Property

Benefits of Section 1231 Property

Tax Advantages

Risk Management and Diversification

Estate Planning Opportunities

Strategies for Managing Section 1231 Property

Tax Planning Considerations

Timing of Sales and Exchanges

Utilizing Like-Kind Exchanges (Section 1031)

Conclusion

Section 1231 Property FAQs

Section 1231 property includes depreciable business property and real property used in a trade or business and held for over one year.

If the net result of all Section 1231 transactions within a tax year is a gain, it's generally treated as a long-term capital gain, potentially lowering your tax rate. If the net result is a loss, it's treated as an ordinary loss, which can offset other ordinary income.

Upon the sale of a Section 1231 property, any depreciation taken on the property could be subject to depreciation recapture rules, meaning that part or all of the gain may be treated as ordinary income, depending on whether it's Section 1245 or 1250 property.

Yes, Section 1231 property can be included in a Section 1031 like-kind exchange. This strategy allows investors to defer recognizing gains on the sale of property, postponing the tax liability.

Section 1231 property can contribute to wealth management by providing potential tax benefits, diversification, risk management, and estate planning opportunities. Effective management of these assets can play a significant role in enhancing financial outcomes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.