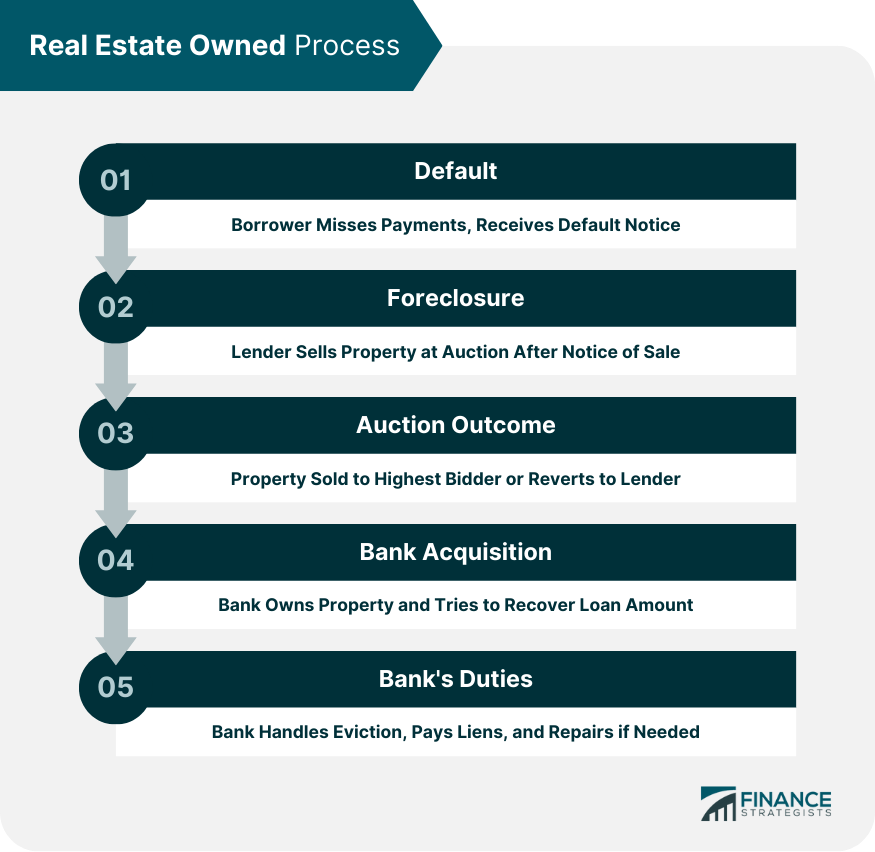

Real Estate Owned (REO) is a term in the US denoting property owned by a lender—frequently a bank, government agency, or government loan insurer—after a failed foreclosure auction. This transition happens when a homeowner defaults on a loan, and the lender unsuccessfully attempts to sell the property at auction to recover the loan amount. The progression to REO status typically occurs via a series of steps, starting with the homeowner's loan default, often due to missed mortgage payments over a period. If the homeowner doesn't clear the outstanding debt or sell the property via a short sale, the lender begins a foreclosure process, culminating in an auction. If the property doesn't sell, the lender repossesses it, becoming an REO property. As potential homeowners or investors, it's crucial to understand this process. REO properties can present unique buying opportunities but also bear potential risks. The REO process begins when a borrower defaults on their mortgage loan. This typically happens after the borrower has missed multiple consecutive mortgage payments. The borrower receives a notice of default from the lender, which initiates the pre-foreclosure period. During this time, the borrower can still avoid foreclosure by paying off the outstanding debt or selling the property through a short sale. If the borrower fails to remedy the default, the lender will start foreclosure. Foreclosure laws vary by state, but generally, the lender will issue a notice of sale and then sell the property at a public auction. The highest bidder at the auction becomes the new owner of the property. If the property is not sold at the auction, usually due to a lack of high enough bids to cover the outstanding loan, the ownership of the property is transferred back to the lender. This is when the property officially becomes real estate owned. The bank or lender now owns the property and will typically attempt to sell the property to recover the outstanding loan amount. The bank will handle the eviction, pay off tax liens, and may even do some repairs if necessary. REO properties are often sold 'as is', meaning that the lender makes no guarantees about the property's condition. Because these homes have typically gone through a period of vacancy, they may require significant repairs or maintenance. It is, therefore, highly recommended that potential buyers arrange for a professional inspection before purchasing an REO property. REO properties can entice buyers because they often have lower prices than comparable properties in the market. The lender usually prices the property below market value to encourage a quick sale. However, potential buyers should consider the cost of repairs and renovations when assessing the overall value and investment potential. When a bank takes ownership of a property, it will typically clear any previous liens on the property. This means that buyers of REO properties usually receive a clean title, simplifying the buying process. Nonetheless, it is wise for buyers to conduct a title search to ensure everything runs smoothly. The foreclosure process, and thus the transition to REO status, is governed by state laws. These laws determine how foreclosures are processed, how long borrowers have to remedy a default, and what notices lenders must provide. Understanding these laws can be critical for both lenders and potential REO buyers. Once a property becomes REO, the lender has certain legal responsibilities, including maintaining the property and paying associated taxes and HOA fees. Lenders are also responsible for selling the property non-discriminately and ensuring that the property's title is clear of any liens. REO properties are often sold below their market value, allowing buyers to acquire a property at a discounted price. This can result in immediate equity gains for investors or cost savings for homebuyers. Lenders are motivated to sell REO properties quickly, so buyers may have more room to negotiate favorable terms. This can include negotiating the purchase price, closing costs, or other aspects of the transaction, potentially saving the buyer additional money. If buyers can acquire an REO property below market value and make necessary improvements or renovations, they can earn a significant profit when selling the property in the future. REO properties are typically sold "as is," meaning the buyer accepts the property in its current condition. This can present risks, as buyers may discover hidden issues or costly repairs after purchasing the property. It's important to thoroughly inspect the property or enlist the help of a professional home inspector before making an offer. Buying an REO property often involves more paperwork and bureaucracy than purchasing a traditional home. Lenders may have specific requirements or processes that buyers need to navigate, which can lengthen the overall purchasing timeline and add complexity to the transaction. In some cases, lenders may need more complete information about the property's history, condition, or any existing liens or encumbrances. Buyers may need to conduct their own research or hire professionals to gather all the necessary information, which can add time and expense to the purchasing process. Since REO properties can offer attractive opportunities, there may be competition from other buyers, including investors and experienced homebuyers. This can lead to bidding wars or a higher level of competition, making it more challenging to secure the property at a favorable price. The lender plays a pivotal role in the REO process, initiating the foreclosure process upon the borrower's default, taking possession of the property if it fails to sell at auction, and finally, selling the REO property to recover the loan amount. Once the lender takes ownership, it becomes responsible for maintaining the property. This includes handling any necessary eviction processes, making basic repairs, paying property taxes, and listing the property for sale. Some lenders have in-house REO departments, while others outsource these tasks to real estate agents. Foreclosure and ownership of REO properties can be costly for lenders. They lose the income from the defaulted loan and incur legal fees, property maintenance, and sales costs. Therefore, lenders are often motivated to sell REO properties quickly, sometimes leading to below-market listing prices. Real estate agents play a crucial role in selling REO properties. Lenders often hire real estate agents to list and manage REO properties. These agents handle tasks such as listing the property, managing offers, and coordinating the closing process. Real estate agents also assist buyers interested in REO properties. They help navigate the complex buying process, provide access to property listings, advise on offer strategies, and help with paperwork. The next sections of this article will cover the impact of REO properties on the economy, alternatives to REO, the legal aspects of REO, and the future of REO properties. Please let me know if you'd like me to continue with these sections or if any changes to the current content are needed. The presence of REO properties in a local real estate market can have various effects. In some cases, these properties can lower the values of surrounding homes because they may be sold at prices below market value. However, they can also provide affordable housing opportunities and investment possibilities. For investors, REO properties can be purchased, improved, and resold or rented, contributing to neighborhood revitalization. At the national level, the volume of REO properties can reflect broader economic and housing market trends. High numbers of REOs suggest economic downturns, job losses, or lax lending practices. Conversely, decreasing REO inventories can indicate an improved economy and stabilize the housing market. Two primary alternatives to the REO process are short sales and deeds instead of foreclosure. A short sale is a transaction where the lender allows the homeowner to sell the property for less than the outstanding mortgage balance. A deed instead of foreclosure, on the other hand, involves the homeowner voluntarily transferring the property title to the lender to avoid the foreclosure process. These alternatives can provide benefits to both lenders and borrowers. For lenders, they can reduce the time and expense of the foreclosure process. For borrowers, they can lessen the negative impact on credit scores. However, both options require the lender's agreement and have potential tax implications for the homeowner. Real Estate Owned (REO) properties are those owned by lenders—commonly banks, government agencies, or government loan insurers—usually due to failed foreclosure auction sales. Understanding the REO process, stakeholder roles, legal factors, potential benefits, and risks can guide informed decisions about buying these properties. The economy and housing market trends greatly affect the current state of REO properties. Technological advances and shifts in the economic and regulatory landscape will shape future trends in REO properties. Therefore, being informed about these changes is crucial for potential investors, buyers, and real estate professionals. Whether you're considering buying an REO property as a primary residence, an investment, or a wealth management strategy, consultation with financial and real estate professionals is essential to understand the entire process. This approach ensures informed decisions align with your financial objectives. Collaborating with seasoned professionals can facilitate this understanding.What Is Real Estate Owned (REO)?

Real Estate Owned Process

Default by the Borrower

Foreclosure Process

Auction and Its Outcome

Acquisition by the Bank

Features of REO Properties

Condition of the Property

Pricing and Value

Title Status

Legal Aspects of REO

State Foreclosure Laws

Legal Responsibilities of REO Lenders

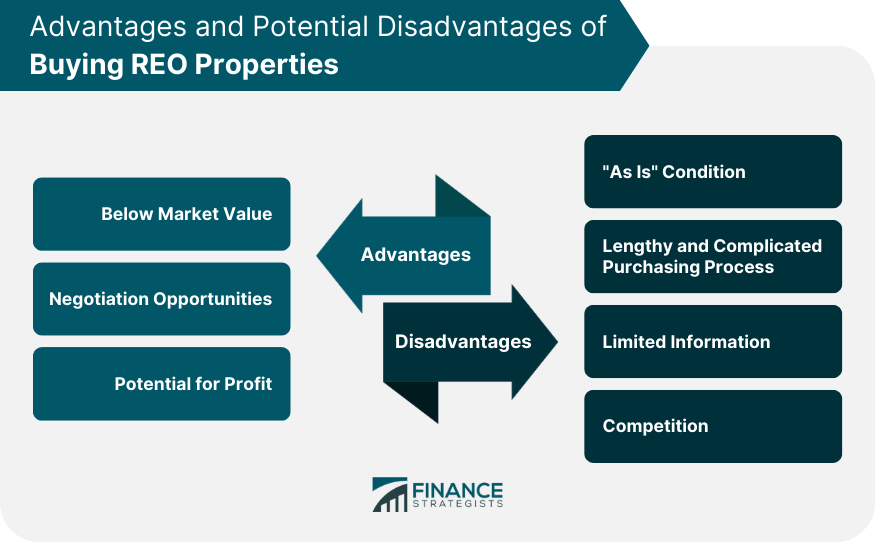

Potential Advantages of Buying REO Properties

Below Market Value

Negotiation Opportunities

Potential for Profit

Potential Disadvantages of Buying REO Properties

"As Is" Condition

Lengthy and Complicated Purchasing Process

Limited Information

Competition

REO and the Mortgage Lender

Role of the Lender in the REO Process

How Lenders Manage REO Properties

Financial Impact on the Lender

Role of Real Estate Agents in REO Transactions

Listing REO Properties

Helping Buyers Navigate the Process

REO Properties and the Economy

Impact on Local Real Estate Markets

Influence on National Housing Trends

Alternatives to REO: Short Sales and Deeds Instead of Foreclosure

Overview and Definitions

Comparison With REO

Final Thoughts

What Is Real Estate Owned (REO)? FAQs

Real Estate Owned (REO) is a term used to describe a class of property owned by a lender—typically a bank, government agency, or government loan insurer—after an unsuccessful sale at a foreclosure auction.

A property typically becomes an REO after a borrower defaults on their mortgage, the lender fails to sell the property at a foreclosure auction, and the lender then reclaims it.

REO properties can often be bought below market value, and buyers usually receive a clean title from the lender, simplifying the buying process. However, potential buyers should also consider the potential risks and challenges.

Alternatives to REO properties include short sales and deeds instead of foreclosure. In a short sale, the lender allows the homeowner to sell the property for less than the outstanding mortgage balance. A deed instead of foreclosure involves the homeowner voluntarily transferring the property title to the lender to avoid foreclosure.

Foreclosure and ownership of REO properties can be costly for lenders. They lose the income from the defaulted loan and incur legal fees, property maintenance, and sales costs. Therefore, lenders are often motivated to sell REO properties quickly.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.