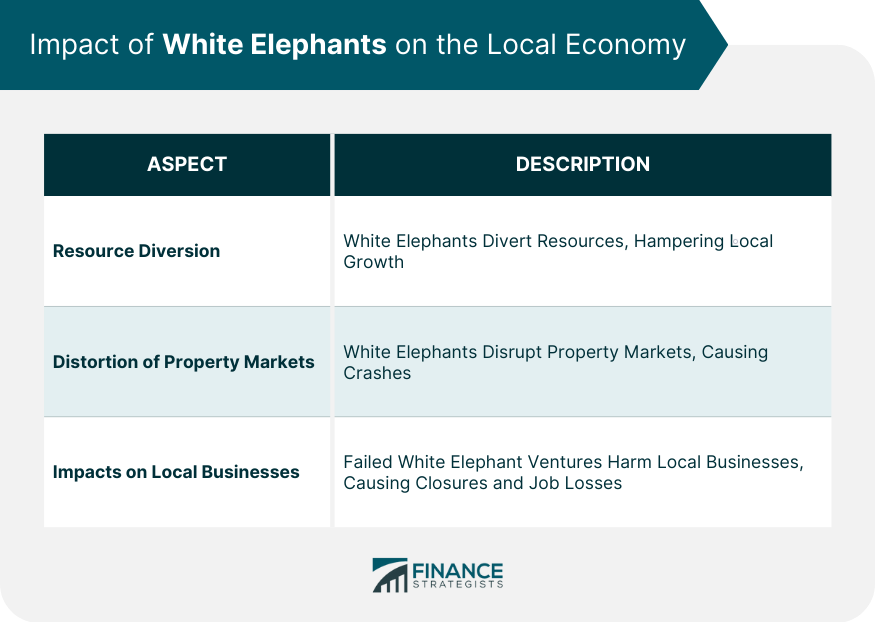

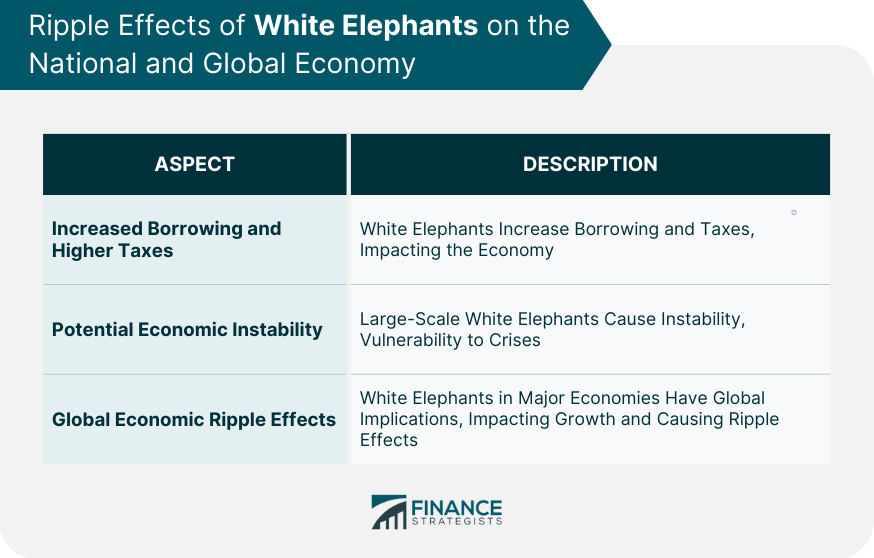

The term "white elephant" originates from ancient Asian cultures where the rare and sacred white elephant symbolized royal power and prestige. However, despite their auspicious nature, these elephants were incredibly costly to maintain and, being sacred, could not be put to labor. Thus, owning a white elephant was a double-edged sword — it brought prestige but also considerable expense and inconvenience. In modern times, the term "white elephant" has adopted a similar financial connotation, signifying an investment, asset, or venture that is costly to maintain or difficult to dispose of, despite its apparent value. A financial "white elephant" is typically an investment, project, or asset initially perceived as valuable but has since become a drain on resources. Key characteristics include high maintenance costs, underperformance, and difficulties in divestment or disposal. Often these are tied to a significant initial investment that cannot be readily recouped. While similar to the concept of a "sunk cost" — money already spent that cannot be recovered — a white elephant goes further. It requires spending, and its disposal might be difficult because of regulatory constraints, contractual commitments, or a lack of potential buyers. In the corporate world, a white elephant might be an underperforming business unit, an expensive but outdated piece of machinery, or a costly and unproductive real estate investment. Identifying such ventures requires vigilant financial monitoring, where expenses, revenues, and the asset's value are frequently and rigorously assessed. The presence of a white elephant can lead to serious cash flow problems within a corporation. These assets or investments often require significant resources for upkeep, renovations, and other necessary expenses. If these costs exceed the revenue the asset generates, it becomes a financial burden. The diversion of resources towards this maintenance can inhibit a company's ability to invest in other profitable ventures or meet its other financial obligations, resulting in a potential financial shortfall. Moreover, the inability to liquidate or sell the asset due to a lack of market interest further exacerbates the financial strain as the initial capital investment becomes tied up. Beyond its direct impact on cash flow, the presence of a white elephant can also have psychological and strategic implications on a corporation's investment decisions. The experience of having such a burdensome asset can make company decision-makers more cautious, thereby potentially missing out on valuable opportunities due to fear of repeating past mistakes. On the flip side, the pressure to counterbalance the losses from the white elephant may push the company to undertake riskier investments in the hope of higher returns, potentially leading to further financial problems. White elephants are not exclusive to corporations or public finance; they can also manifest in personal finance. Often, these take the form of expensive assets with high maintenance costs. Examples could be a luxury vehicle that constantly needs repairs or a piece of real estate that, instead of appreciating over time, is stagnant or decreasing in value. Despite their perceived worth, these assets can slowly drain an individual's resources due to their upkeep costs and the inability to dispose of them fairly. Owning a white elephant can significantly impact an individual's financial health. The costs associated with maintaining the asset can disrupt personal financial planning. Instead of using resources towards investments, savings, or reducing debt, funds get diverted to support the white elephant. In extreme cases, the financial burden may lead to increased debt levels, causing further financial distress and potentially impacting the person's credit score. Public finance is another sector where white elephants commonly occur, often in the form of large infrastructure projects. Public funds typically finance these projects with the expectation that they will boost local economies, provide public services, or stimulate tourism. However, these projects can fail to deliver the promised benefits due to factors like poor planning, inadequate feasibility studies, or changing economic circumstances. A city might invest in a colossal sports stadium expecting it to bring in significant revenue through tourism and local spending, only to discover that the maintenance costs and other expenses far outweigh the revenue. These public white elephants can create significant burdens on state or municipal finances. The resources spent on maintaining these projects divert funds away from other essential public services such as healthcare, education, and public transportation. Furthermore, they can contribute to the public debt if the government borrows funds to finance the project. Therefore, the impact of white elephants in public finance can have far-reaching implications, affecting the provision of public services and the state's or municipality's financial health. White elephants can have significant implications for the local economy, manifesting in several ways: Resource Diversion: White elephants often consume considerable financial resources for their maintenance and upkeep. This diversion of funds means less investment in other sectors of the economy that could provide higher returns or more employment. This could stifle local economic growth and development. Distortion of Property Markets: White elephants, especially in the form of large real estate projects or infrastructure, can distort local property markets. If a significant real estate project turns into a white elephant, it could lead to an oversupply of properties in the market, driving down prices and potentially leading to a property market crash. Impacts on Local Businesses: If the white elephant is a commercial venture that fails to attract the expected footfall, local businesses that rely on this footfall could suffer. This could lead to business closures and job losses, further impacting the local economy. The economic impact of white elephants isn't confined to local economies. They can have far-reaching implications at both the national and global levels: Increased Borrowing and Higher Taxes: If a government has multiple white elephants to care for nationally, it might need to resort to increased borrowing to fund these projects. This increase in public debt could lead to higher taxes or cuts in public services, affecting the overall economy. Potential Economic Instability: Large-scale white elephants can cause economic instability. For instance, if a significant portion of a country's economy is tied up in white elephants, it could weaken the economy, making it more vulnerable to shocks and potentially leading to economic crises. Global Economic Ripple Effects: When white elephants occur in significant economies, they can have global implications. For example, if a major economy like the United States or China has many white elephants, it could impact their economic growth. Given the interconnectedness of the global economy, a slowdown in these economies could have ripple effects worldwide. Preventing white elephants often involves thorough due diligence before investing. Feasibility studies, risk assessments, financial projections, and market analysis can all help identify potential white elephants before resources are committed. For existing white elephants, it is essential to develop exit strategies. These could involve selling the asset, repurposing it, or even shutting down the project if these costs are less than the continued maintenance. Proactive management is crucial in minimizing the impact of white elephants in a business context. Regular financial reviews, rigorous performance monitoring, and flexible strategic planning can help identify and address issues before they become significant problems. At the public level, transparency, public consultation, and strong project management practices can help avoid white elephants in public spending and infrastructure projects. In finance, a "White Elephant" refers to an investment, asset, or project that, despite its apparent value, is expensive to maintain, unprofitable, or difficult to sell or dispose of, thereby becoming a financial burden. Though initially appearing valuable, white elephants in finance can become a significant burden, draining resources and causing financial strain for individuals, corporations, and governments. Identifying and managing these white elephants is critical in maintaining financial health. Understanding the concept of white elephants in finance is crucial, as it can have significant implications on financial health and economic stability. It allows for proactive management and making informed decisions to prevent financial burdens. It is essential to consult financial advisors and wealth management professionals to make informed decisions about large-scale investments to avoid potential white elephants.What Is a White Elephant?

Understanding the Financial White Elephant

Definition and Characteristics

Differentiation From Other Financial Concepts

White Elephant in Corporate Finance

Identifying a White Elephant in Business Ventures

Financial Implications for Corporations

Impact on Cash Flow

Influence on Investment Decisions

White Elephant in Personal Finance

White Elephant as Personal Assets

Effect on Individual Financial Health

White Elephant in Public Finance

Identification and Effect on Public Infrastructure Projects

Financial Burden for the State

The Economic Impact of White Elephants

Impact on the Local Economy

Ripple Effects on the National and Global Economy

Strategies to Avoid Financial White Elephants

Pre-investment Evaluation Methods

Exit Strategies for Existing White Elephants

White Elephant Risk Management

Managing White Elephants in Business

Mitigating Risks at the Public Finance Level

Conclusion

White Elephant FAQs

In finance, a white elephant is an investment or asset that, despite its perceived value, is costly to maintain or difficult to dispose of, making it a financial burden.

Yes, a white elephant can become profitable if it is restructured, repurposed, or managed in a way that decreases its costs or increases its revenue. However, this requires careful planning and strategic decision-making.

Avoiding white elephants requires careful due diligence before making an investment. Regularly reviewing and monitoring financial performance can also help identify and address issues early on.

An example is the telecommunications company WorldCom, which accumulated an unsustainable debt level through numerous acquisitions. Despite initial growth, these acquisitions needed to generate more cash flow, leading to the company's bankruptcy in 2002.

White elephants can have significant economic impacts, diverting resources away from more productive uses. They can distort local property markets, impact national fiscal health, and potentially cause economic instability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.